In the age of digital, where screens have become the dominant feature of our lives The appeal of tangible printed materials isn't diminishing. Whether it's for educational purposes and creative work, or simply adding an element of personalization to your home, printables for free have become a valuable source. With this guide, you'll take a dive deep into the realm of "Do You Pay Taxes On Employer 401k Contributions," exploring the benefits of them, where they can be found, and how they can enrich various aspects of your daily life.

Get Latest Do You Pay Taxes On Employer 401k Contributions Below

Do You Pay Taxes On Employer 401k Contributions

Do You Pay Taxes On Employer 401k Contributions - Do You Pay Taxes On Employer 401k Contributions, Do You Pay Taxes On Employer Roth 401 K Contributions, Do You Have To Pay Taxes On Employer 401k Match, Do You Pay Taxes On Company Match 401k, Do I Pay Taxes On Employer 401k Contributions, Do You Pay Self Employment Tax On 401k Contributions, Do I Pay Taxes On Employer Roth 401 K Contributions, Are 401k Employer Contributions Taxed, Do You Pay Payroll Taxes On 401k Contributions

Employees and employers can contribute to a 401 k plan offering both an opportunity to save on taxes Deferred contributions can be made on a pre tax basis and are taxable only when the employee makes a withdrawal typically at retirement

Traditional 401 k contributions are automatically deducted from your tax statements received from your employer You ll have to pay taxes on what you

Do You Pay Taxes On Employer 401k Contributions include a broad range of printable, free content that can be downloaded from the internet at no cost. These resources come in many types, like worksheets, coloring pages, templates and many more. The great thing about Do You Pay Taxes On Employer 401k Contributions is in their variety and accessibility.

More of Do You Pay Taxes On Employer 401k Contributions

Paying Taxes The Pros And Cons Of Doing It With A Credit Card

Paying Taxes The Pros And Cons Of Doing It With A Credit Card

You may be eligible for a 401 k tax deduction if you have a retirement account Read about contribution limits employer contributions and tax deferred options

Employers receive tax benefits for contributing to 401 k accounts What Are the Benefits of a 401 k to Employees These days most private sector employers prefer defined

Printables that are free have gained enormous popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Modifications: They can make the design to meet your needs for invitations, whether that's creating them for your guests, organizing your schedule or even decorating your home.

-

Educational Value These Do You Pay Taxes On Employer 401k Contributions can be used by students from all ages, making them a useful tool for teachers and parents.

-

Easy to use: Access to various designs and templates cuts down on time and efforts.

Where to Find more Do You Pay Taxes On Employer 401k Contributions

401k Reduce Taxable Income Calculator ArmaanHakeem

401k Reduce Taxable Income Calculator ArmaanHakeem

Key Points 401 k s offer an upfront tax break or a tax break in retirement depending on whether you have a traditional 401 k or a Roth 401 k Under the Secure Act 2 0 rules employers

Traditional 401 k plans are tax deferred You don t have to pay income taxes on your contributions though you will have to pay other payroll taxes like Social Security and Medicare taxes You won t pay income tax

After we've peaked your curiosity about Do You Pay Taxes On Employer 401k Contributions Let's look into where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of printables that are free for a variety of purposes.

- Explore categories like decorating your home, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free with flashcards and other teaching tools.

- This is a great resource for parents, teachers or students in search of additional sources.

3. Creative Blogs

- Many bloggers share their creative designs as well as templates for free.

- The blogs covered cover a wide array of topics, ranging that includes DIY projects to planning a party.

Maximizing Do You Pay Taxes On Employer 401k Contributions

Here are some innovative ways how you could make the most of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes or seasonal decorations that will adorn your living areas.

2. Education

- Use printable worksheets from the internet to enhance your learning at home or in the classroom.

3. Event Planning

- Design invitations for banners, invitations and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Keep track of your schedule with printable calendars or to-do lists. meal planners.

Conclusion

Do You Pay Taxes On Employer 401k Contributions are an abundance of practical and imaginative resources for a variety of needs and interest. Their availability and versatility make them an essential part of both professional and personal lives. Explore the world of Do You Pay Taxes On Employer 401k Contributions and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly available for download?

- Yes they are! You can print and download these files for free.

-

Can I use the free printouts for commercial usage?

- It's contingent upon the specific usage guidelines. Always check the creator's guidelines prior to using the printables in commercial projects.

-

Are there any copyright concerns with printables that are free?

- Some printables may come with restrictions in their usage. You should read the terms and regulations provided by the creator.

-

How do I print printables for free?

- Print them at home with either a printer or go to an area print shop for superior prints.

-

What software do I require to open printables free of charge?

- Most PDF-based printables are available in PDF format. They can be opened with free programs like Adobe Reader.

Taxes You ll Pay Cashing In A 401k Traditional Or ROTH IRA YouTube

What Happens If You Don t Pay Your Taxes A Complete Guide All

Check more sample of Do You Pay Taxes On Employer 401k Contributions below

Tax Payment Which States Have No Income Tax Marca

Everything You Need To Know About Employer Match 401k Plans

What Is The Maximum Employer 401k Contribution For 2020 401kInfoClub

What Are Payroll Taxes An Employer s Guide Wrapbook

How To Increase The Value Of A Business By Paying More Taxes

The Maximum 401k Contribution Limit Harry Point

https://www. investopedia.com /ask/answers/112515/...

Traditional 401 k contributions are automatically deducted from your tax statements received from your employer You ll have to pay taxes on what you

https://www. forbes.com /advisor/retirement/what-is-401k-match

You don t have to pay any income taxes on employer 401 k matching contributions until you start making withdrawals Gross income includes wages salaries bonuses tips sick

Traditional 401 k contributions are automatically deducted from your tax statements received from your employer You ll have to pay taxes on what you

You don t have to pay any income taxes on employer 401 k matching contributions until you start making withdrawals Gross income includes wages salaries bonuses tips sick

What Are Payroll Taxes An Employer s Guide Wrapbook

Everything You Need To Know About Employer Match 401k Plans

How To Increase The Value Of A Business By Paying More Taxes

The Maximum 401k Contribution Limit Harry Point

Social Security Cost Of Living Adjustments 2023

How Much Does An Employer Pay In Payroll Taxes Tax Rate

How Much Does An Employer Pay In Payroll Taxes Tax Rate

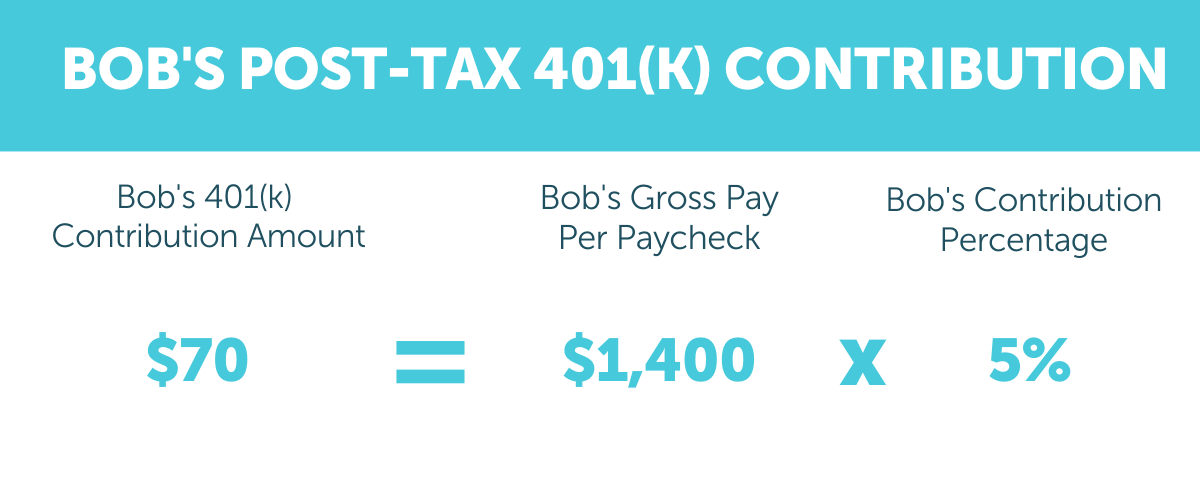

After Tax 401 k Contribution Definition Pros Cons Rollover