In the digital age, where screens dominate our lives and our lives are dominated by screens, the appeal of tangible, printed materials hasn't diminished. Whatever the reason, whether for education in creative or artistic projects, or simply to add some personal flair to your space, Do I Pay Taxes On Employer 401k Contributions can be an excellent resource. In this article, we'll dive into the world "Do I Pay Taxes On Employer 401k Contributions," exploring the benefits of them, where they are, and how they can add value to various aspects of your daily life.

Get Latest Do I Pay Taxes On Employer 401k Contributions Below

Do I Pay Taxes On Employer 401k Contributions

Do I Pay Taxes On Employer 401k Contributions -

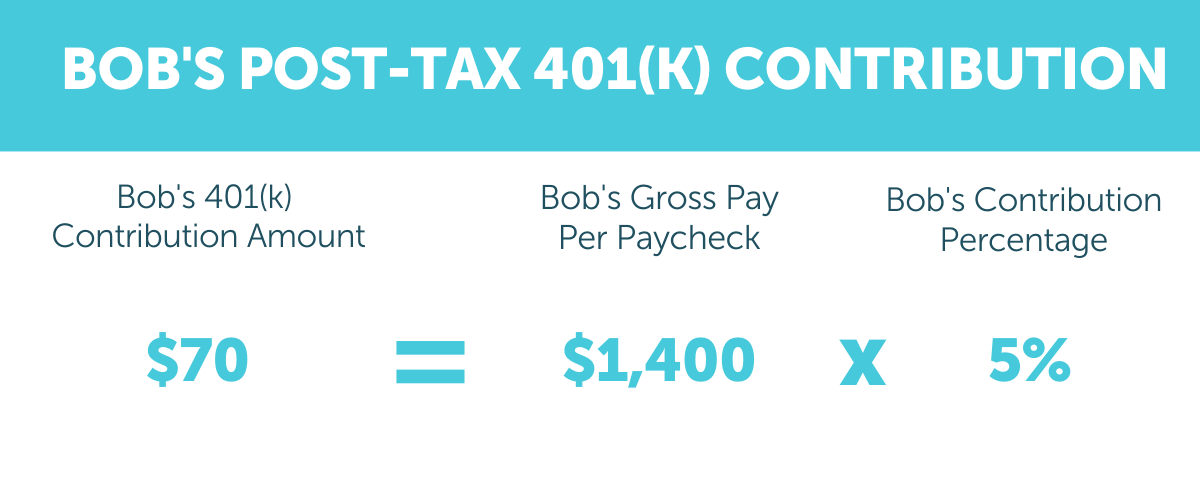

Employees can build financial security through tax advantaged savings Companies match 401 k plan contributions to attract talent encourage employee enrollment in the plan and get a tax

You won t need to claim your 401 k contributions as tax deductible when filing your taxes While contributions to qualified retirement plans such as traditional 401

Do I Pay Taxes On Employer 401k Contributions offer a wide range of printable, free materials available online at no cost. These printables come in different formats, such as worksheets, coloring pages, templates and more. The benefit of Do I Pay Taxes On Employer 401k Contributions lies in their versatility and accessibility.

More of Do I Pay Taxes On Employer 401k Contributions

Tax Savings For Non Itemizers Appletree Business

Tax Savings For Non Itemizers Appletree Business

Employers can contribute to employees accounts Distributions including earnings are includible in taxable income at retirement except for qualified distributions of

Key Points 401 k s offer an upfront tax break or a tax break in retirement depending on whether you have a traditional 401 k or a Roth 401 k Under the Secure Act 2 0 rules

The Do I Pay Taxes On Employer 401k Contributions have gained huge appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or expensive software.

-

Individualization There is the possibility of tailoring designs to suit your personal needs be it designing invitations or arranging your schedule or even decorating your house.

-

Educational Worth: Educational printables that can be downloaded for free are designed to appeal to students from all ages, making them an invaluable source for educators and parents.

-

It's easy: Access to various designs and templates is time-saving and saves effort.

Where to Find more Do I Pay Taxes On Employer 401k Contributions

How Much Does The Average American Pay In Taxes It Depends

How Much Does The Average American Pay In Taxes It Depends

Employees and employers can contribute to a 401 k plan offering both an opportunity to save on taxes Deferred contributions can be made on a pre tax basis and are taxable

Changes to federal law governing retirement savings plans allow employers to make matching contributions to employees 401 k accounts using after tax dollars as with a Roth 401 k Employees get to choose whether

Since we've got your curiosity about Do I Pay Taxes On Employer 401k Contributions Let's take a look at where they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of printables that are free for a variety of purposes.

- Explore categories like home decor, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free, flashcards, and learning materials.

- Perfect for teachers, parents and students looking for additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs or templates for download.

- These blogs cover a wide array of topics, ranging ranging from DIY projects to party planning.

Maximizing Do I Pay Taxes On Employer 401k Contributions

Here are some innovative ways that you can make use of Do I Pay Taxes On Employer 401k Contributions:

1. Home Decor

- Print and frame stunning artwork, quotes and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Use free printable worksheets to enhance your learning at home for the classroom.

3. Event Planning

- Designs invitations, banners and decorations for special events like birthdays and weddings.

4. Organization

- Make sure you are organized with printable calendars or to-do lists. meal planners.

Conclusion

Do I Pay Taxes On Employer 401k Contributions are a treasure trove of innovative and useful resources catering to different needs and preferences. Their accessibility and flexibility make them an essential part of each day life. Explore the world of Do I Pay Taxes On Employer 401k Contributions right now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Do I Pay Taxes On Employer 401k Contributions truly absolutely free?

- Yes they are! You can print and download the resources for free.

-

Can I utilize free templates for commercial use?

- It's contingent upon the specific rules of usage. Always read the guidelines of the creator before using any printables on commercial projects.

-

Do you have any copyright issues with printables that are free?

- Some printables may contain restrictions on use. Make sure you read the terms and condition of use as provided by the creator.

-

How do I print printables for free?

- You can print them at home with either a printer or go to a print shop in your area for premium prints.

-

What program is required to open printables free of charge?

- Many printables are offered in PDF format. These is open with no cost software, such as Adobe Reader.

Everything You Need To Know About Employer Match 401k Plans

Cu nto Paga Un Empleador En Impuestos Sobre La N mina Tasa De

Check more sample of Do I Pay Taxes On Employer 401k Contributions below

Taxes You ll Pay Cashing In A 401k Traditional Or ROTH IRA YouTube

What Happens If You Don t Pay Your Taxes A Complete Guide All

8 Ways To Pay Less In Taxes And Save Money Business Tax Tax

What Is A 401 k Match OnPlane Financial Advisors

What Is The Maximum Employer 401k Contribution For 2020 401kInfoClub

How To Pay Payroll Taxes A Step by step Guide

https://www.investopedia.com/ask/answers/112515/...

You won t need to claim your 401 k contributions as tax deductible when filing your taxes While contributions to qualified retirement plans such as traditional 401

https://smartasset.com/retirement/401k-tax

Do You Pay Tax on 401 k Contributions A 401 k is a tax deferred account That means you do not pay income taxes when you contribute money Instead your employer withholds your contribution

You won t need to claim your 401 k contributions as tax deductible when filing your taxes While contributions to qualified retirement plans such as traditional 401

Do You Pay Tax on 401 k Contributions A 401 k is a tax deferred account That means you do not pay income taxes when you contribute money Instead your employer withholds your contribution

What Is A 401 k Match OnPlane Financial Advisors

What Happens If You Don t Pay Your Taxes A Complete Guide All

What Is The Maximum Employer 401k Contribution For 2020 401kInfoClub

How To Pay Payroll Taxes A Step by step Guide

How To Legally Never Pay Taxes Again YouTube

Social Security Cost Of Living Adjustments 2023

Social Security Cost Of Living Adjustments 2023

The Maximum 401k Contribution Limit Harry Point