In this day and age with screens dominating our lives, the charm of tangible, printed materials hasn't diminished. No matter whether it's for educational uses, creative projects, or just adding a personal touch to your home, printables for free are now an essential source. The following article is a dive into the sphere of "Do You Pay Federal Income Tax On Pension Benefits," exploring the different types of printables, where to find them and ways they can help you improve many aspects of your lives.

Get Latest Do You Pay Federal Income Tax On Pension Benefits Below

Do You Pay Federal Income Tax On Pension Benefits

Do You Pay Federal Income Tax On Pension Benefits - Do You Pay Federal Income Tax On Pension Benefits, Do You Pay Federal Income Tax On Social Security Retirement Benefits, Do I Have To Pay Federal Taxes On My Pension, Do You Have To Pay Taxes On Pension Benefits, Do I Pay Taxes On Pension Payments, Do U Have To Pay Taxes On A Pension

Page Last Reviewed or Updated 16 Jan 2024 Determine if your pension or annuity payment from an employer sponsored retirement plan or nonqualified annuity is taxable

The taxable part of your pension or annuity payments is generally subject to federal income tax withholding You may be able to choose not to have income tax withheld from your pension or annuity payments or may want to

Do You Pay Federal Income Tax On Pension Benefits offer a wide selection of printable and downloadable documents that can be downloaded online at no cost. They are available in a variety of kinds, including worksheets templates, coloring pages and more. The appeal of printables for free is their flexibility and accessibility.

More of Do You Pay Federal Income Tax On Pension Benefits

Ca Tax Brackets Chart Jokeragri

Ca Tax Brackets Chart Jokeragri

Our tax law provides for a pay as you go system which requires taxes to be paid on income as it is received There are two ways which taxes are typically paid ax T Withholding You can request federal tax be withheld from your pension social security unemployment

Up to 85 of your Social Security benefits may be taxable depending on your total income and your filing status Distributions from 401 k and traditional IRA accounts are generally taxable

Printables for free have gained immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

Flexible: We can customize printing templates to your own specific requirements be it designing invitations planning your schedule or decorating your home.

-

Educational Value Education-related printables at no charge provide for students of all ages, which makes these printables a powerful resource for educators and parents.

-

It's easy: immediate access a variety of designs and templates saves time and effort.

Where to Find more Do You Pay Federal Income Tax On Pension Benefits

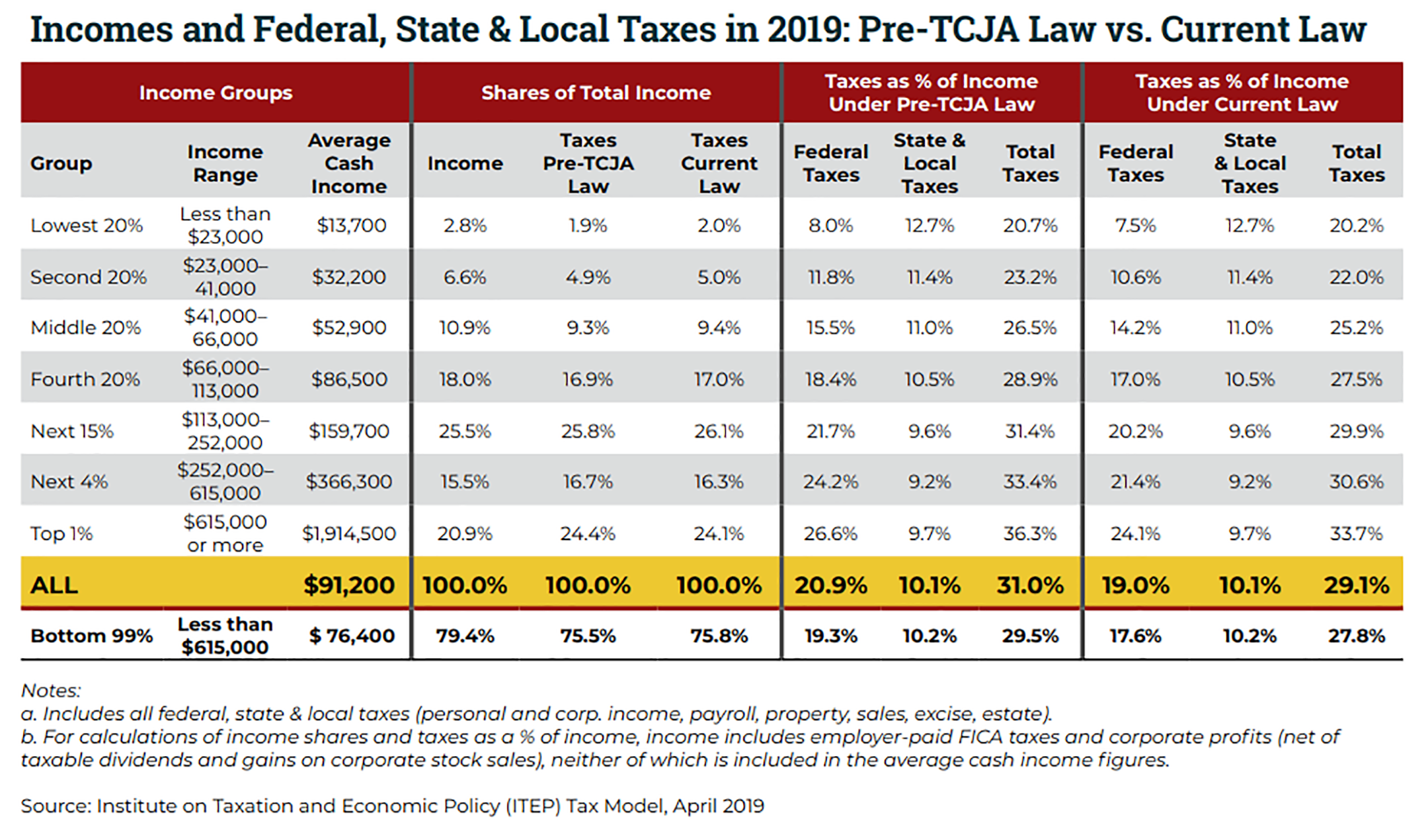

Top 1 Pay Nearly Half Of Federal Income Taxes

Top 1 Pay Nearly Half Of Federal Income Taxes

Once you start receiving your pension the IRS regards it as income and you ll pay taxes on it accordingly on the federal level Check the tax laws in your state to see how it handles pension income because it can vary widely Pretax and post tax contributions to your pension make a difference

Social Security Benefits Depending on provisional income up to 85 of Social Security benefits can be taxed by the IRS at ordinary income tax rates Pensions Pension payments are

Now that we've piqued your interest in printables for free We'll take a look around to see where you can get these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of printables that are free for a variety of purposes.

- Explore categories like decoration for your home, education, organisation, as well as crafts.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing along with flashcards, as well as other learning materials.

- Ideal for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates free of charge.

- The blogs covered cover a wide variety of topics, including DIY projects to planning a party.

Maximizing Do You Pay Federal Income Tax On Pension Benefits

Here are some fresh ways in order to maximize the use use of Do You Pay Federal Income Tax On Pension Benefits:

1. Home Decor

- Print and frame gorgeous images, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Use printable worksheets for free to reinforce learning at home also in the classes.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Make sure you are organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Do You Pay Federal Income Tax On Pension Benefits are a treasure trove of practical and innovative resources that meet a variety of needs and needs and. Their availability and versatility make them an invaluable addition to every aspect of your life, both professional and personal. Explore the many options of Do You Pay Federal Income Tax On Pension Benefits today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually for free?

- Yes you can! You can print and download these items for free.

-

Do I have the right to use free printing templates for commercial purposes?

- It's based on specific terms of use. Make sure you read the guidelines for the creator before using any printables on commercial projects.

-

Do you have any copyright issues in Do You Pay Federal Income Tax On Pension Benefits?

- Certain printables might have limitations on their use. Make sure to read the terms of service and conditions provided by the author.

-

How do I print Do You Pay Federal Income Tax On Pension Benefits?

- You can print them at home with printing equipment or visit a local print shop to purchase the highest quality prints.

-

What program do I need to open Do You Pay Federal Income Tax On Pension Benefits?

- Most PDF-based printables are available with PDF formats, which can be opened using free software such as Adobe Reader.

Tax Tip 24 Federal Income Tax On SS Benefits Rushton

The Union Role In Our Growing Taxocracy California Policy Center

Check more sample of Do You Pay Federal Income Tax On Pension Benefits below

CARPE DIEM Average Federal Income Tax Rates By Income Group Are Highly

How Federal Income Tax Rates Work Full Report Tax Policy Center

2021 Nc Standard Deduction Standard Deduction 2021

Social Security Wage Base 2021 Updated For 2023 UZIO Inc

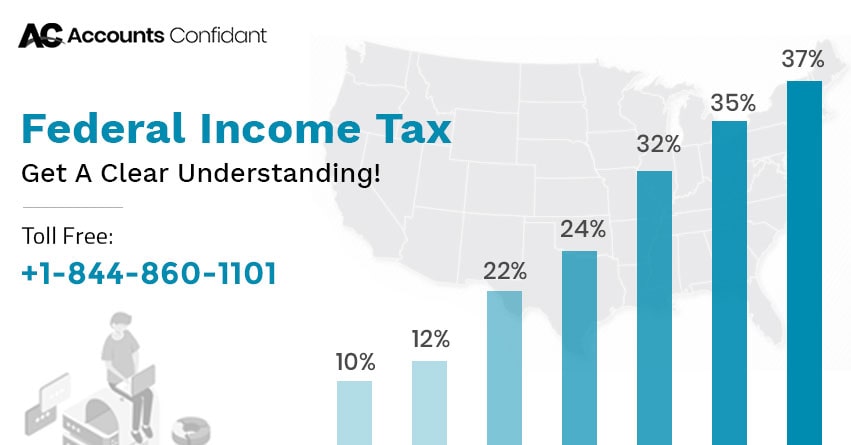

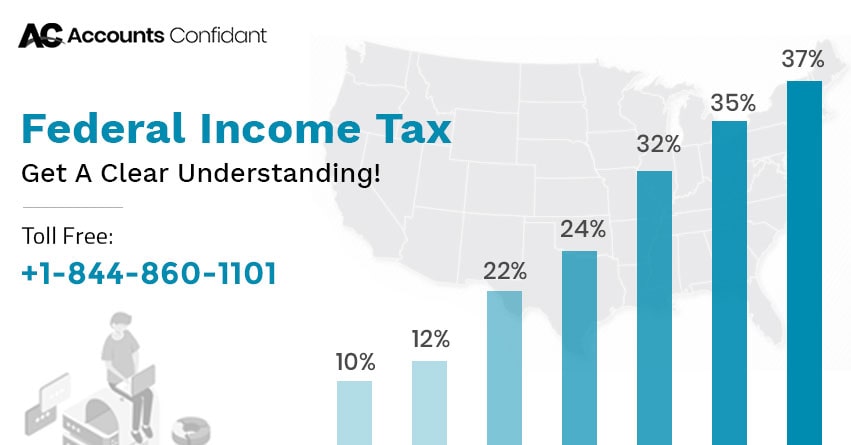

Federal Income Tax Get A Clear Understanding Accounts Confidant

2024 Retirement Plan Withdrawals Calculator Calculate Early Withdrawal

https://www.irs.gov/taxtopics/tc410

The taxable part of your pension or annuity payments is generally subject to federal income tax withholding You may be able to choose not to have income tax withheld from your pension or annuity payments or may want to

https://www.nerdwallet.com/article/investing/...

Retirement income from tax deferred accounts such as 401 k s 403 b s or Traditional IRAs is taxable as is income from pensions annuities and Social Security Roth IRA retirement

The taxable part of your pension or annuity payments is generally subject to federal income tax withholding You may be able to choose not to have income tax withheld from your pension or annuity payments or may want to

Retirement income from tax deferred accounts such as 401 k s 403 b s or Traditional IRAs is taxable as is income from pensions annuities and Social Security Roth IRA retirement

Social Security Wage Base 2021 Updated For 2023 UZIO Inc

How Federal Income Tax Rates Work Full Report Tax Policy Center

Federal Income Tax Get A Clear Understanding Accounts Confidant

2024 Retirement Plan Withdrawals Calculator Calculate Early Withdrawal

2022 Income Tax Rate Tables Printable Forms Free Online

Top 10 Federal Income Tax Prep Tips For The 2019 Filing Year The

Top 10 Federal Income Tax Prep Tips For The 2019 Filing Year The

What Do They Pay What Do You Pay Federal Income Tax Income Tax