In the digital age, where screens have become the dominant feature of our lives however, the attraction of tangible printed items hasn't gone away. For educational purposes and creative work, or just adding an extra personal touch to your area, Do Roth Ira Distributions Count As Income can be an excellent resource. This article will take a dive to the depths of "Do Roth Ira Distributions Count As Income," exploring the benefits of them, where they can be found, and the ways that they can benefit different aspects of your lives.

Get Latest Do Roth Ira Distributions Count As Income Below

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)

Do Roth Ira Distributions Count As Income

Do Roth Ira Distributions Count As Income - Do Roth Ira Distributions Count As Income, Do Roth Ira Distributions Count As Income For Obamacare, Do Roth Ira Distributions Count As Income For Medicaid, Do Roth Ira Distributions Count As Income For Social Security, Do Roth Ira Distributions Count As Income For Medicare Premiums, Do Roth Ira Distributions Count As Income For Medicare, Do Roth Ira Withdrawals Count As Income For Social Security, Do Roth Ira Withdrawals Count As Income For Medicare, Do Inherited Roth Ira Distributions Count As Income, Do Roth Ira Withdrawals Count As Provisional Income

All an individual s Roth IRAs not including beneficiary Roth IRAs are aggregated and treated as one to determine an individual s total amount in Layer 1 Distributions from

When it comes to IRA distributions here s how it works Roth IRA distributions are not included in your combined income so they have no impact on whether your Social Security is

Do Roth Ira Distributions Count As Income cover a large array of printable materials available online at no cost. They are available in numerous forms, like worksheets templates, coloring pages, and more. The beauty of Do Roth Ira Distributions Count As Income is their flexibility and accessibility.

More of Do Roth Ira Distributions Count As Income

What Is A Roth IRA And Do You Really Need One Roth Ira Investing

What Is A Roth IRA And Do You Really Need One Roth Ira Investing

This interview will help you determine if your distribution from a Roth IRA or designated Roth account is taxable This topic doesn t address either the return of a Roth IRA

With the Roth IRA the money you contribute isn t tax deductible That means you don t report Roth IRA contributions on your tax return and you can t deduct them from your taxable income

Printables for free have gained immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or expensive software.

-

Individualization We can customize printing templates to your own specific requirements whether it's making invitations or arranging your schedule or decorating your home.

-

Education Value Free educational printables can be used by students from all ages, making them a vital aid for parents as well as educators.

-

The convenience of Instant access to a myriad of designs as well as templates saves time and effort.

Where to Find more Do Roth Ira Distributions Count As Income

Isolating IRA Basis For Tax Efficient Roth IRA Conversions

Isolating IRA Basis For Tax Efficient Roth IRA Conversions

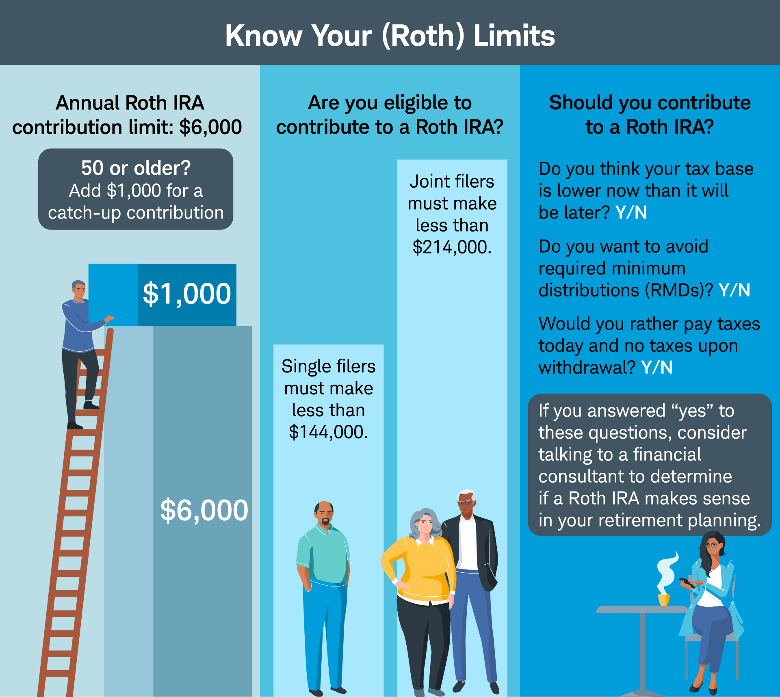

You must have earned income to qualify to contribute to a Roth IRA Individuals who qualify to make maximum contributions to Roth IRAs can contribute up to 6 500 in the 2023 tax year or 7 500 if they re age 50 or older

Earnings from a Roth IRA don t count as income as long as withdrawals are considered qualified If you take a non qualified distribution it counts as taxable income and you might

We've now piqued your interest in printables for free we'll explore the places you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection and Do Roth Ira Distributions Count As Income for a variety uses.

- Explore categories such as design, home decor, the arts, and more.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free including flashcards, learning materials.

- It is ideal for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for free.

- These blogs cover a broad range of interests, including DIY projects to party planning.

Maximizing Do Roth Ira Distributions Count As Income

Here are some unique ways create the maximum value use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes or festive decorations to decorate your living spaces.

2. Education

- Use these printable worksheets free of charge for teaching at-home either in the schoolroom or at home.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars, to-do lists, and meal planners.

Conclusion

Do Roth Ira Distributions Count As Income are an abundance of innovative and useful resources for a variety of needs and interest. Their availability and versatility make them an essential part of the professional and personal lives of both. Explore the endless world of printables for free today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Do Roth Ira Distributions Count As Income truly for free?

- Yes, they are! You can print and download these materials for free.

-

Does it allow me to use free printables to make commercial products?

- It's based on specific conditions of use. Always verify the guidelines of the creator before utilizing their templates for commercial projects.

-

Do you have any copyright issues with printables that are free?

- Certain printables may be subject to restrictions on use. Be sure to check the terms and regulations provided by the author.

-

How can I print Do Roth Ira Distributions Count As Income?

- You can print them at home using the printer, or go to a local print shop to purchase more high-quality prints.

-

What program do I need in order to open printables that are free?

- The majority of printables are in PDF format. They can be opened with free software like Adobe Reader.

Roth IRA Distribution Rules Taxation Tax Diversification

Roth IRA Withdrawal Rules Oblivious Investor

Check more sample of Do Roth Ira Distributions Count As Income below

Qualified Vs Non Qualified Roth IRA Distributions

Roth IRA Distributions Qualified Vs Non Qualified Definition

2022 Roth Ira Income Limits Choosing Your Gold IRA

Understanding Non Qualified Roth IRA Distributions

/shutterstock_240823573.Roth.IRA.cropped-fd86349be2cd4f42a0ea35dd6956813d.jpg)

Traditional Vs Roth IRAs What s The Difference Fi3 Advisors

Do Roth Conversions Count Towards Roth IRA Income Limits David McKnight

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png?w=186)

https://www.fool.com › retirement › plan…

When it comes to IRA distributions here s how it works Roth IRA distributions are not included in your combined income so they have no impact on whether your Social Security is

https://www.investopedia.com

While there s no deduction for Roth IRA contributions qualified distributions from a Roth account are tax free Savers can also withdraw their original contributions on a tax free

When it comes to IRA distributions here s how it works Roth IRA distributions are not included in your combined income so they have no impact on whether your Social Security is

While there s no deduction for Roth IRA contributions qualified distributions from a Roth account are tax free Savers can also withdraw their original contributions on a tax free

/shutterstock_240823573.Roth.IRA.cropped-fd86349be2cd4f42a0ea35dd6956813d.jpg)

Understanding Non Qualified Roth IRA Distributions

Roth IRA Distributions Qualified Vs Non Qualified Definition

Traditional Vs Roth IRAs What s The Difference Fi3 Advisors

Do Roth Conversions Count Towards Roth IRA Income Limits David McKnight

Why Most Pharmacists Should Do A Backdoor Roth IRA

What Is A Roth IRA The Fancy Accountant

What Is A Roth IRA The Fancy Accountant

Roth IRA Explained A Simple Explanation Of The Roth IRA YouTube