In this age of technology, where screens rule our lives and the appeal of physical printed objects hasn't waned. If it's to aid in education and creative work, or simply to add a personal touch to your space, Do Roth Ira Withdrawals Count As Income For Medicare have proven to be a valuable resource. In this article, we'll dive in the world of "Do Roth Ira Withdrawals Count As Income For Medicare," exploring the benefits of them, where to find them and ways they can help you improve many aspects of your life.

Get Latest Do Roth Ira Withdrawals Count As Income For Medicare Below

Do Roth Ira Withdrawals Count As Income For Medicare

Do Roth Ira Withdrawals Count As Income For Medicare -

Just as important for retirees who are trying to avoid the IRMAA surcharge is understanding what types of income does not contribute to IRMAA The big one is withdrawals from Roth IRAs Regardless of how much you take out from Roth IRAs it is not taxable

Earnings that you withdraw from a Roth IRA don t count as income as long as you meet the rules for qualified distributions Typically you will need to have had a Roth IRA for at

Do Roth Ira Withdrawals Count As Income For Medicare provide a diverse range of downloadable, printable documents that can be downloaded online at no cost. The resources are offered in a variety kinds, including worksheets templates, coloring pages, and much more. One of the advantages of Do Roth Ira Withdrawals Count As Income For Medicare is their versatility and accessibility.

More of Do Roth Ira Withdrawals Count As Income For Medicare

What Is A Roth IRA And Do You Really Need One Roth Ira Investing

What Is A Roth IRA And Do You Really Need One Roth Ira Investing

David Kindness Fact checked by Hans Daniel Jasperson The Roth IRA has many benefits compared to the traditional IRA Distributions from traditional IRAs for example are generally

Roth IRA withdrawals do not count as income for Medicare Unlike traditional IRAs contributions to Roth IRAs are made with after tax dollars and withdrawals are tax free Therefore Roth IRA withdrawals do not affect your Medicare premiums or eligibility

Printables for free have gained immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

customization: The Customization feature lets you tailor print-ready templates to your specific requirements, whether it's designing invitations, organizing your schedule, or even decorating your home.

-

Educational Worth: Educational printables that can be downloaded for free cater to learners of all ages. This makes them an invaluable source for educators and parents.

-

Easy to use: You have instant access various designs and templates can save you time and energy.

Where to Find more Do Roth Ira Withdrawals Count As Income For Medicare

Do Roth IRA Withdrawals Count As Income For The Senior Freeze New

Do Roth IRA Withdrawals Count As Income For The Senior Freeze New

Roth IRA distributions and qualified health savings account HSA withdrawals are not included in gross income and therefore do not generate IRMAAs People in pre retirement years but not within two years of Medicare coverage may want to consider contributing to Roth retirement plans and HSAs Individuals in this time frame

June 29 2021 Do Roth IRA conversions increase Medicare premiums How can you convert to Roth and stay below the IRMAA threshold that is Medicare s Income Related Monthly Adjustment Amount

After we've peaked your interest in printables for free We'll take a look around to see where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of Do Roth Ira Withdrawals Count As Income For Medicare suitable for many motives.

- Explore categories such as decorations for the home, education and crafting, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets as well as flashcards and other learning materials.

- Ideal for teachers, parents and students looking for additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates, which are free.

- These blogs cover a broad range of interests, ranging from DIY projects to party planning.

Maximizing Do Roth Ira Withdrawals Count As Income For Medicare

Here are some unique ways ensure you get the very most of printables for free:

1. Home Decor

- Print and frame stunning art, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Print worksheets that are free to reinforce learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations and banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable planners along with lists of tasks, and meal planners.

Conclusion

Do Roth Ira Withdrawals Count As Income For Medicare are a treasure trove with useful and creative ideas catering to different needs and desires. Their accessibility and flexibility make they a beneficial addition to both personal and professional life. Explore the wide world of Do Roth Ira Withdrawals Count As Income For Medicare right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really are they free?

- Yes you can! You can download and print these materials for free.

-

Can I download free printables for commercial use?

- It's dependent on the particular conditions of use. Always consult the author's guidelines before using their printables for commercial projects.

-

Are there any copyright problems with Do Roth Ira Withdrawals Count As Income For Medicare?

- Certain printables could be restricted concerning their use. You should read the terms and regulations provided by the designer.

-

How can I print Do Roth Ira Withdrawals Count As Income For Medicare?

- Print them at home with the printer, or go to an in-store print shop to get superior prints.

-

What software do I require to open printables for free?

- The majority are printed in PDF format. They can be opened using free programs like Adobe Reader.

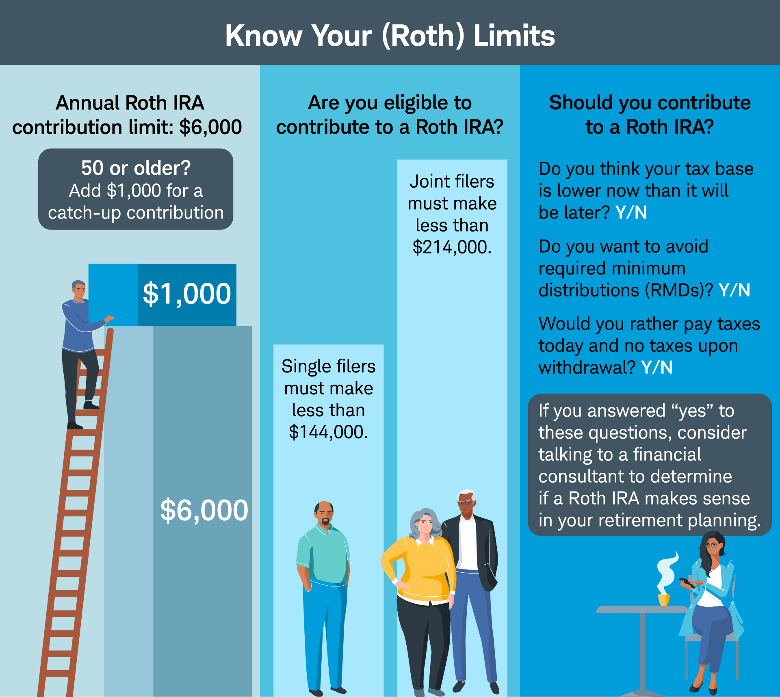

2022 Roth Ira Income Limits Choosing Your Gold IRA

Roth IRA Withdrawal Rules And Penalties The TurboTax Blog

Check more sample of Do Roth Ira Withdrawals Count As Income For Medicare below

Roth IRA Strategies For Physicians WealthKeel

Do You Pay Taxes On Stocks Sold In Roth Ira Choosing Your Gold IRA

Does A Roth IRA Account Make Sense For You Gorfine Schiller Gardyn

Roth Ira Withdrawal Tax Calculator TaniyaSuphi

Roth IRA Withdrawal Rules Oblivious Investor

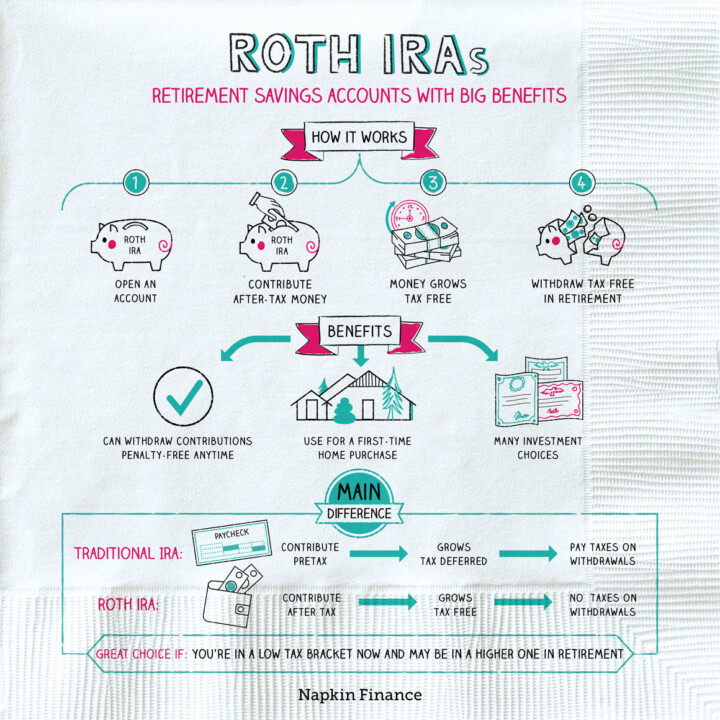

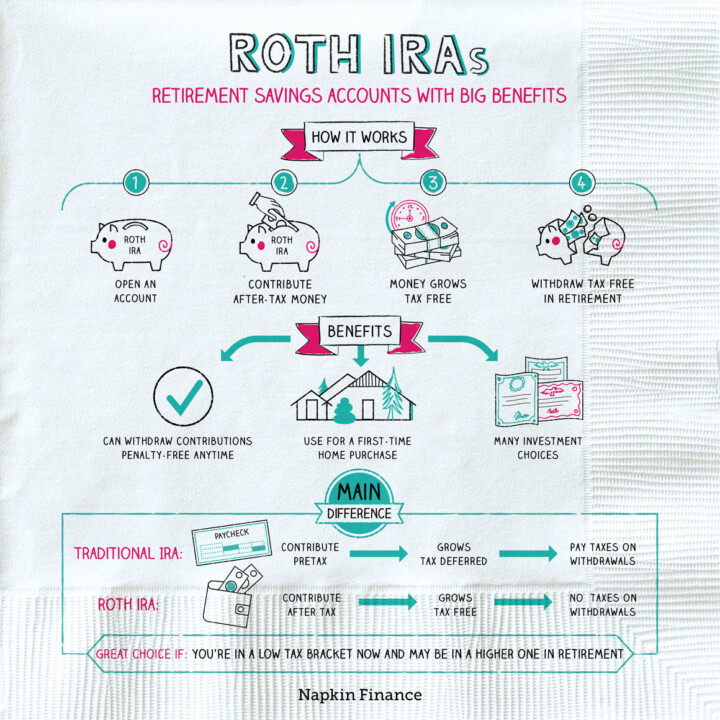

Roth IRAs Benefits Napkin Finance

https://www.investopedia.com/ask/answers/05/iraearningsmagi.asp

Earnings that you withdraw from a Roth IRA don t count as income as long as you meet the rules for qualified distributions Typically you will need to have had a Roth IRA for at

https://over65insuranceoptions.com/do-ira...

No Roth IRA withdrawals do not count as income for Medicare Roth IRAs are funded with after tax dollars so the withdrawals are generally tax free As a result Roth IRA withdrawals are not considered as income for determining Medicare eligibility or for calculating income based premiums

Earnings that you withdraw from a Roth IRA don t count as income as long as you meet the rules for qualified distributions Typically you will need to have had a Roth IRA for at

No Roth IRA withdrawals do not count as income for Medicare Roth IRAs are funded with after tax dollars so the withdrawals are generally tax free As a result Roth IRA withdrawals are not considered as income for determining Medicare eligibility or for calculating income based premiums

Roth Ira Withdrawal Tax Calculator TaniyaSuphi

Do You Pay Taxes On Stocks Sold In Roth Ira Choosing Your Gold IRA

Roth IRA Withdrawal Rules Oblivious Investor

Roth IRAs Benefits Napkin Finance

Roth Vs Traditional IRA Retirement Basics Budget Like A Lady Roth

Is Your Bank Account Ready For 2014 CreativeLive Blog Roth Ira

Is Your Bank Account Ready For 2014 CreativeLive Blog Roth Ira

The Roth IRA What It Is And How It Works Personal Financial Strategies