In the age of digital, with screens dominating our lives however, the attraction of tangible printed products hasn't decreased. Whatever the reason, whether for education or creative projects, or simply to add personal touches to your space, Can I Deduct Social Security And Medicare Taxes are now a vital resource. Through this post, we'll dive through the vast world of "Can I Deduct Social Security And Medicare Taxes," exploring what they are, how to locate them, and how they can enrich various aspects of your daily life.

Get Latest Can I Deduct Social Security And Medicare Taxes Below

Can I Deduct Social Security And Medicare Taxes

Can I Deduct Social Security And Medicare Taxes - Can I Deduct Social Security And Medicare Taxes, Can An Employer Deduct Social Security And Medicare Taxes, Do You Get To Deduct Social Security And Medicare Taxes, Do Pretax Deductions Affect Social Security And Medicare Taxes, Deduct Social Security And Medicare Tax, How Do I Claim Exempt From Social Security And Medicare Taxes, Does Social Security And Medicare Count Towards Taxes Paid, Is Social Security And Medicare Deducted From Taxable Income, Do I Have To Pay Social Security And Medicare Taxes, Does Social Security And Medicare Count As Federal Tax

FICA is a payroll tax that goes toward funding Social Security and Medicare Employees and employers split the total cost By Sabrina Parys and Tina Orem Updated Nov 15 2023 Edited by

In some cases your premiums can be automatically deducted If you receive Social Security Disability Insurance SSDI or Social Security retirement benefits

Can I Deduct Social Security And Medicare Taxes include a broad variety of printable, downloadable content that can be downloaded from the internet at no cost. They come in many forms, including worksheets, templates, coloring pages, and more. The appeal of printables for free lies in their versatility as well as accessibility.

More of Can I Deduct Social Security And Medicare Taxes

Learn About FICA Social Security And Medicare Taxes

/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

Learn About FICA Social Security And Medicare Taxes

They do not impact your self employment taxes which include taxes to fund the Medicare and Social Security programs So you ll still pay the same amount in

Medicare premiums are tax deductible if you itemize deductions although there may be restrictions Part A premiums are tax deductible if you meet certain requirements Most people don t pay

Can I Deduct Social Security And Medicare Taxes have garnered immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Modifications: The Customization feature lets you tailor print-ready templates to your specific requirements, whether it's designing invitations for your guests, organizing your schedule or decorating your home.

-

Educational Use: Printables for education that are free provide for students of all ages, which makes these printables a powerful tool for parents and educators.

-

Accessibility: Fast access various designs and templates can save you time and energy.

Where to Find more Can I Deduct Social Security And Medicare Taxes

Can I Deduct Health Insurance Premiums HealthQuoteInfo

Can I Deduct Health Insurance Premiums HealthQuoteInfo

The Social Security tax rate for 2024 is 15 3 percent on self employment income up to 168 600 You do not pay Social Security taxes on earnings above that

In fact if you are signed up for both Social Security and Medicare Part B the portion of Medicare that provides standard health insurance the Social Security

In the event that we've stirred your curiosity about Can I Deduct Social Security And Medicare Taxes we'll explore the places you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection and Can I Deduct Social Security And Medicare Taxes for a variety applications.

- Explore categories such as decorating your home, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free for flashcards, lessons, and worksheets. tools.

- Ideal for teachers, parents and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for free.

- The blogs covered cover a wide spectrum of interests, that range from DIY projects to planning a party.

Maximizing Can I Deduct Social Security And Medicare Taxes

Here are some new ways in order to maximize the use use of printables that are free:

1. Home Decor

- Print and frame stunning images, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Use these printable worksheets free of charge to aid in learning at your home either in the schoolroom or at home.

3. Event Planning

- Invitations, banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

Can I Deduct Social Security And Medicare Taxes are a treasure trove filled with creative and practical information for a variety of needs and desires. Their access and versatility makes them a fantastic addition to every aspect of your life, both professional and personal. Explore the endless world of Can I Deduct Social Security And Medicare Taxes today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually gratis?

- Yes they are! You can print and download these resources at no cost.

-

Do I have the right to use free templates for commercial use?

- It's based on specific conditions of use. Always review the terms of use for the creator before utilizing their templates for commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Certain printables may be subject to restrictions in use. Be sure to review the terms and conditions provided by the creator.

-

How do I print printables for free?

- Print them at home using the printer, or go to any local print store for superior prints.

-

What program will I need to access printables free of charge?

- Many printables are offered in PDF format, which is open with no cost software, such as Adobe Reader.

You Need To Deduct Social Security Tax From Wages On Workers In Your

Do You Have To Withhold Taxes For Housekeeper

Check more sample of Can I Deduct Social Security And Medicare Taxes below

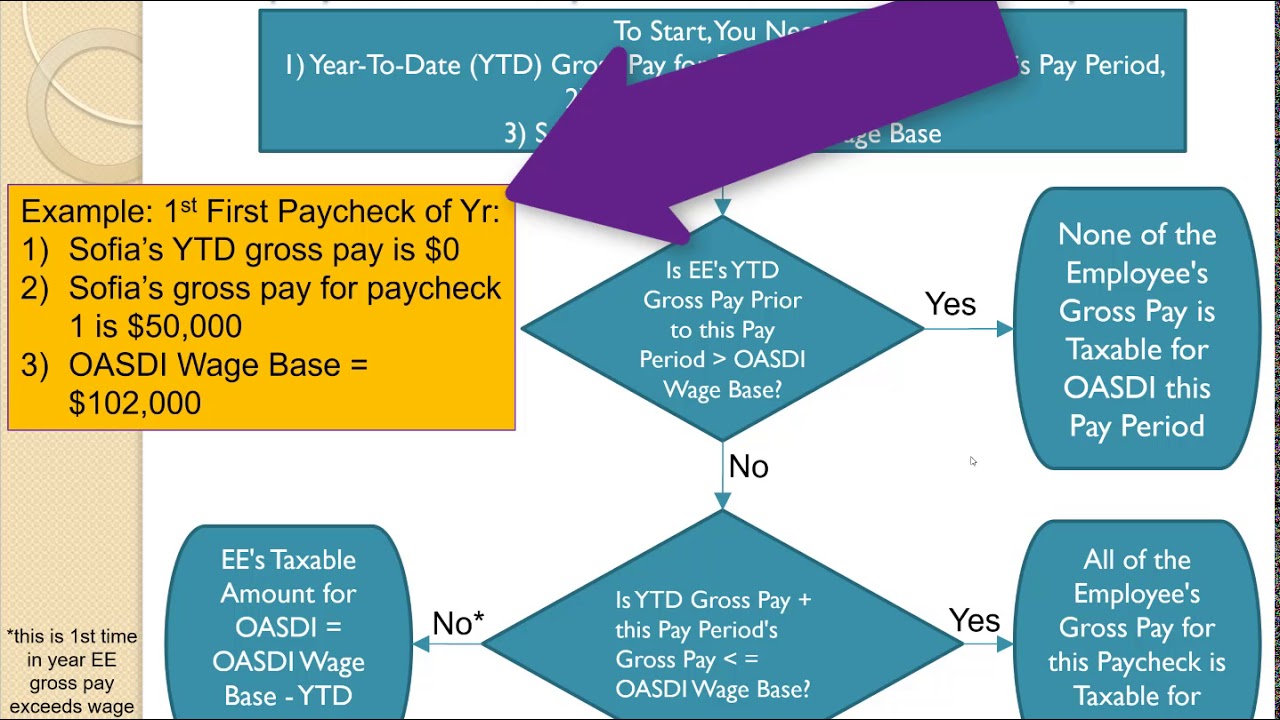

Calculating OASDI Social Security Deduction Medicare Deduction

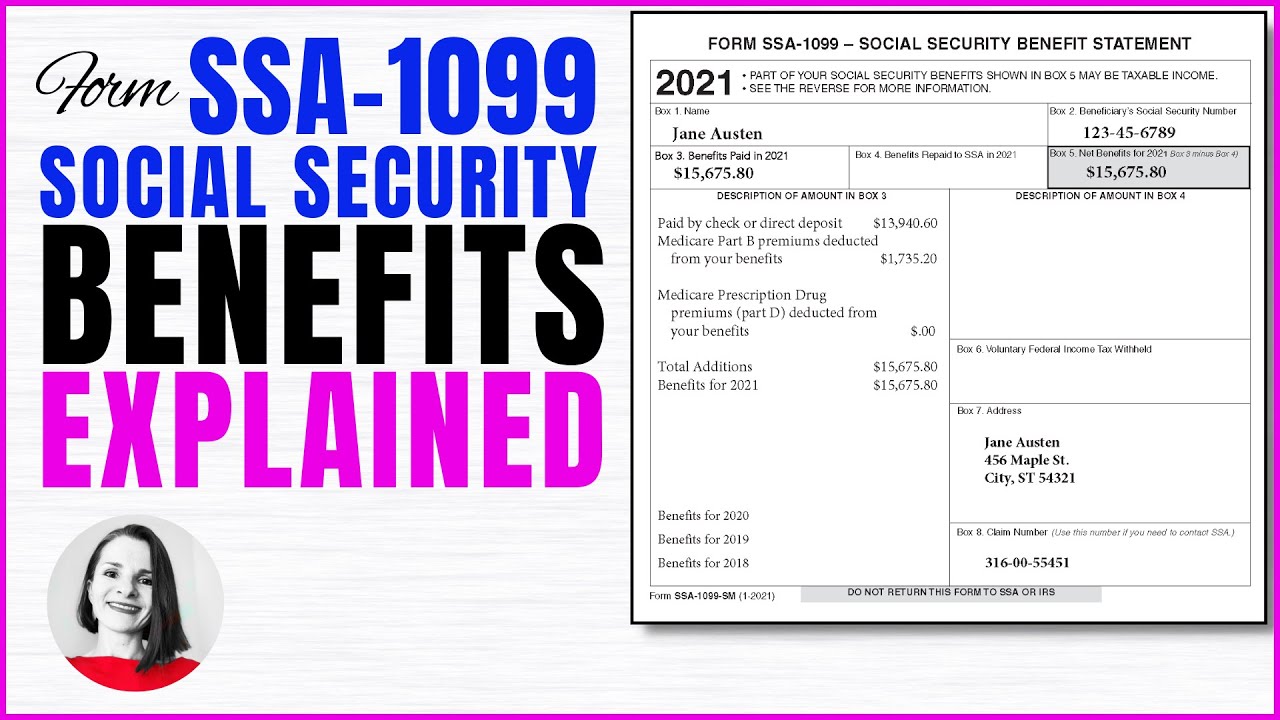

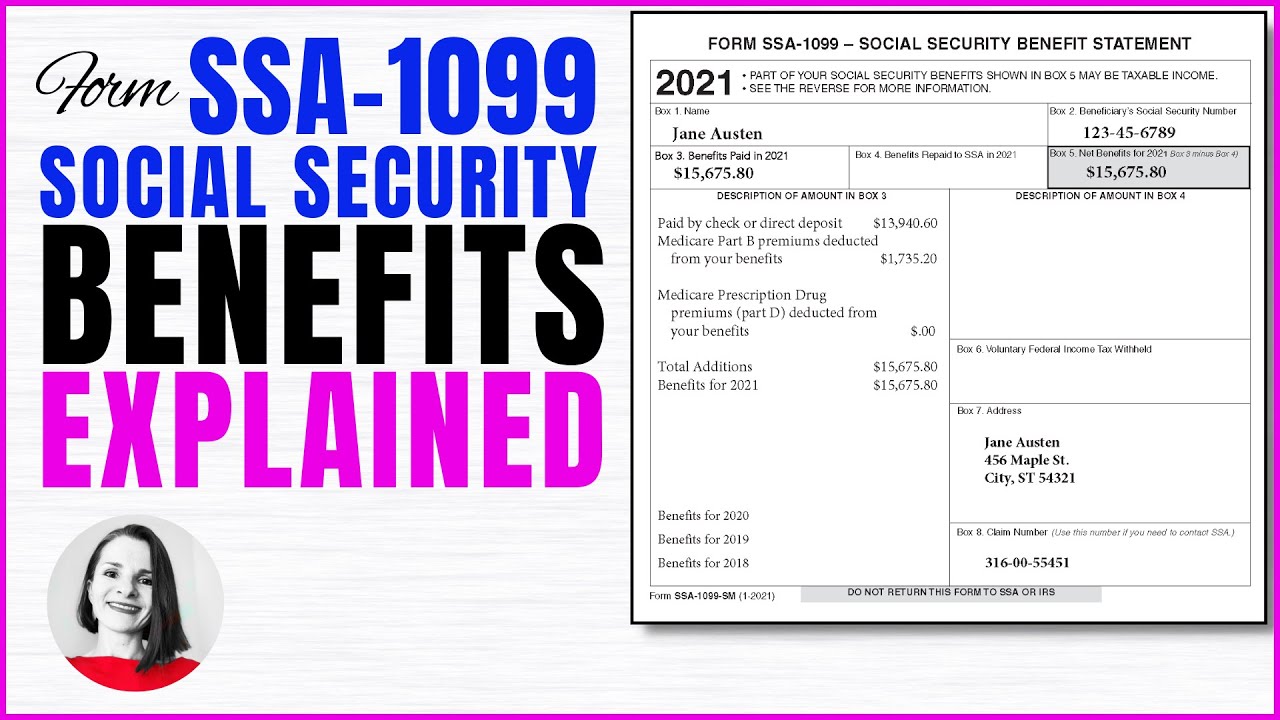

Tax Form SSA 1099 Social Security Benefit Explained Is My Social

Can You Deduct Medicare Costs On Your Taxes

Is Medicare Part B Automatically Deducted From Social Security

Medicare Lapses Caused By Missed Deductions From Social Security Checks

What Can I Deduct From My Taxes Hylen CPA Inc

https://www.healthline.com/health/medicare/...

In some cases your premiums can be automatically deducted If you receive Social Security Disability Insurance SSDI or Social Security retirement benefits

/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png?w=186)

https://www.thebalancemoney.com/tax-withho…

Most taxpayers will have 6 2 withheld for Social Security 1 45 for Medicare and federal income taxes withheld from their taxable incomes This is your income that remains after any pre tax deductions

In some cases your premiums can be automatically deducted If you receive Social Security Disability Insurance SSDI or Social Security retirement benefits

Most taxpayers will have 6 2 withheld for Social Security 1 45 for Medicare and federal income taxes withheld from their taxable incomes This is your income that remains after any pre tax deductions

Is Medicare Part B Automatically Deducted From Social Security

Tax Form SSA 1099 Social Security Benefit Explained Is My Social

Medicare Lapses Caused By Missed Deductions From Social Security Checks

What Can I Deduct From My Taxes Hylen CPA Inc

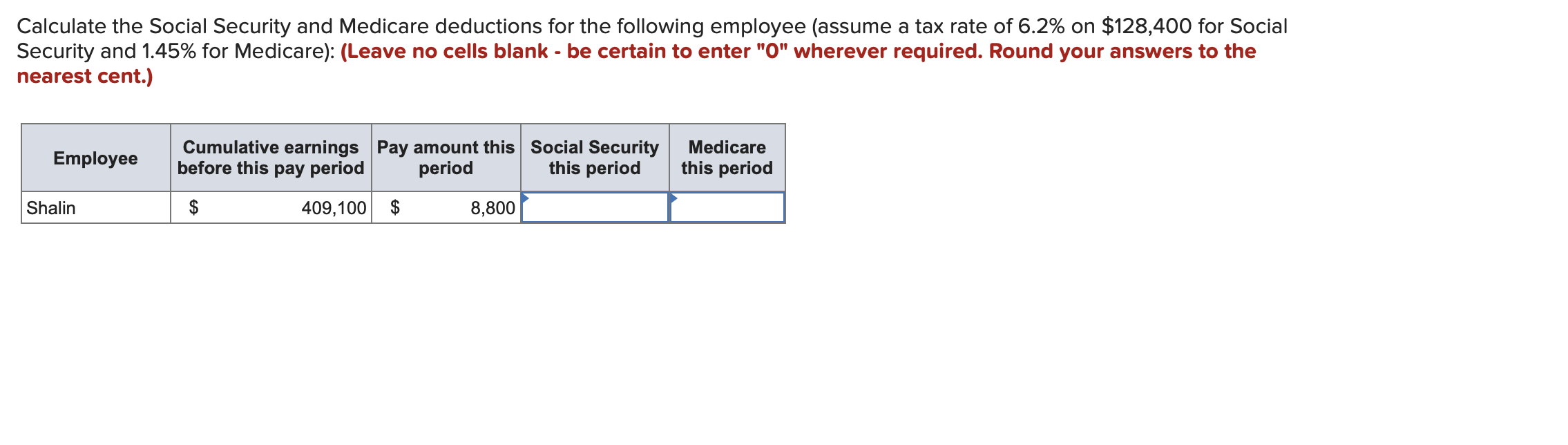

Solved Calculate The Social Security And Medicare Deductions Chegg

Social Security And Household Workers Advancing Smartly

Social Security And Household Workers Advancing Smartly

What Income Is Used For Medicare Part B Premiums MedicareTalk