In this age of electronic devices, when screens dominate our lives however, the attraction of tangible, printed materials hasn't diminished. It doesn't matter if it's for educational reasons project ideas, artistic or just adding an element of personalization to your home, printables for free have become an invaluable resource. Through this post, we'll take a dive into the world "Can An Employer Deduct Social Security And Medicare Taxes," exploring what they are, how to get them, as well as how they can be used to enhance different aspects of your lives.

Get Latest Can An Employer Deduct Social Security And Medicare Taxes Below

Can An Employer Deduct Social Security And Medicare Taxes

Can An Employer Deduct Social Security And Medicare Taxes -

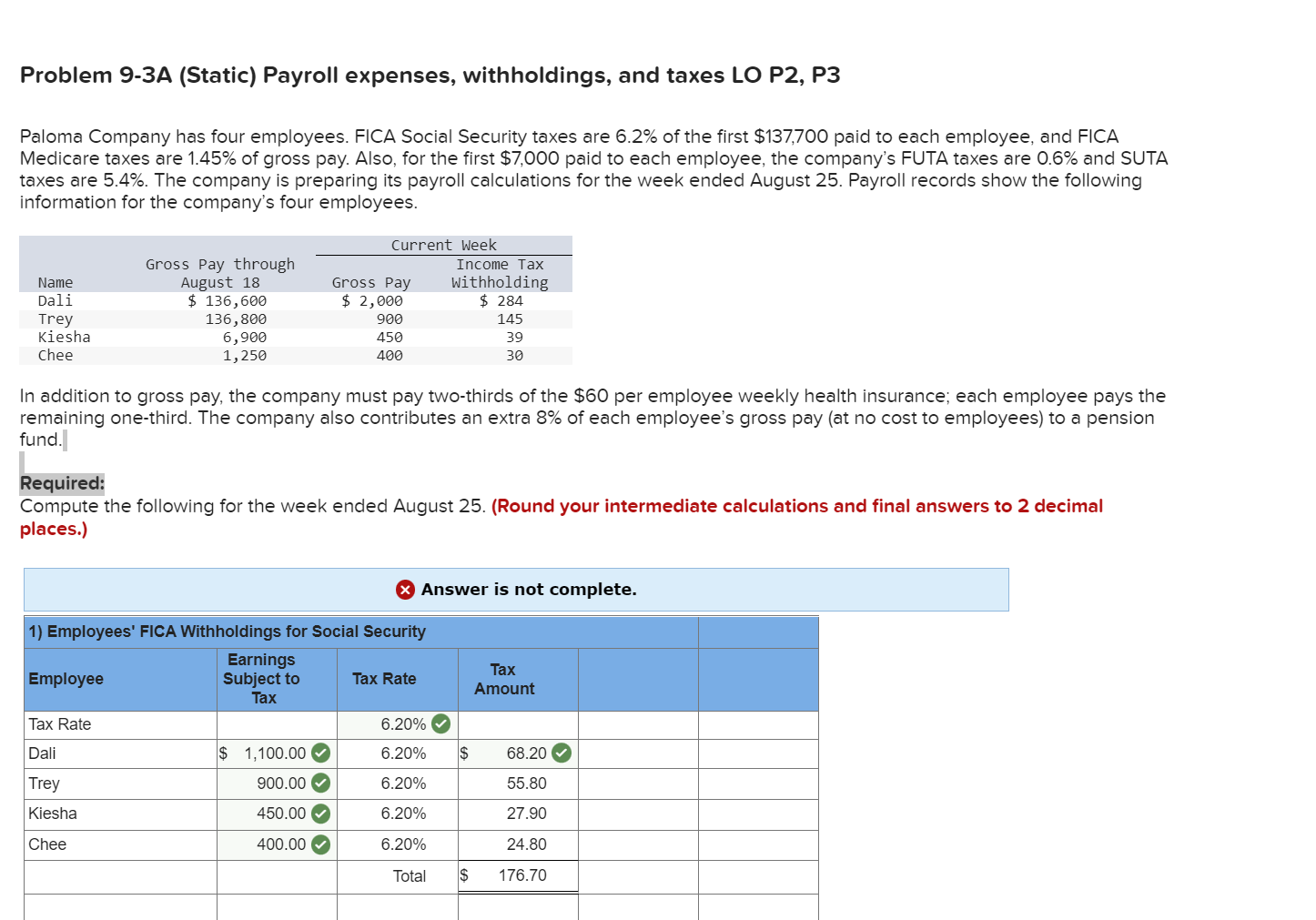

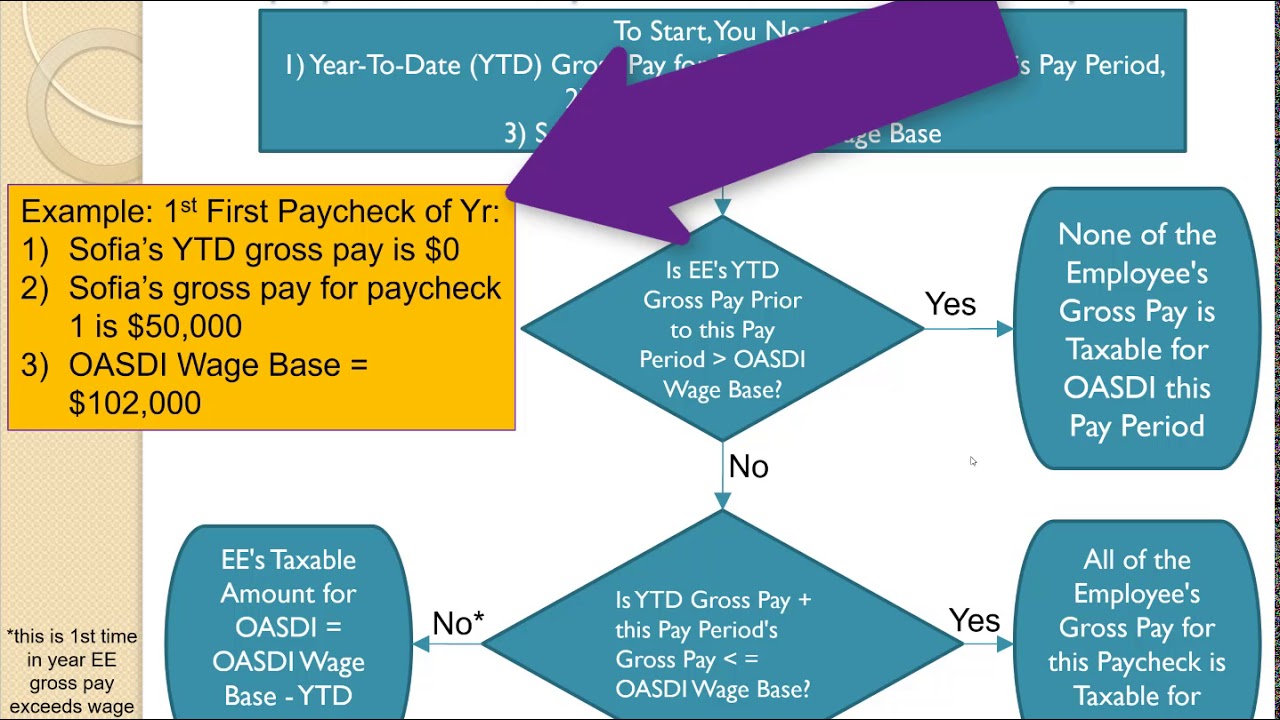

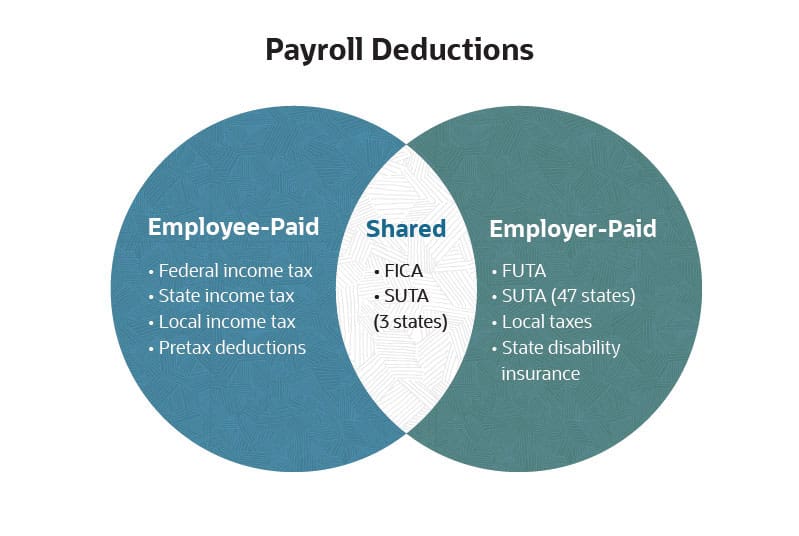

Federal payroll tax rates for 2024 are Social Security tax rate 6 2 for the employee plus 6 2 for the employer Medicare tax rate 1 45 for the employee plus 1 45 for the

An employer is required to begin withholding Additional Medicare tax in the pay period in which it pays wages in excess of 200 000 to an employee and

Printables for free include a vast range of downloadable, printable materials that are accessible online for free cost. They are available in a variety of kinds, including worksheets templates, coloring pages and more. The beauty of Can An Employer Deduct Social Security And Medicare Taxes is their versatility and accessibility.

More of Can An Employer Deduct Social Security And Medicare Taxes

Do You Have To Withhold Taxes For Housekeeper

Do You Have To Withhold Taxes For Housekeeper

The law requires employers to withhold a certain percentage of an employee s wages to help fund Social Security and Medicare The total bill is split

The law requires employers to withhold taxes from employee earnings to fund the Social Security and Medicare programs These are called Federal Insurance Contributions

Can An Employer Deduct Social Security And Medicare Taxes have gained a lot of popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

Customization: This allows you to modify printables to fit your particular needs, whether it's designing invitations to organize your schedule or even decorating your house.

-

Educational Benefits: These Can An Employer Deduct Social Security And Medicare Taxes can be used by students of all ages, making them an essential tool for teachers and parents.

-

Convenience: Quick access to various designs and templates helps save time and effort.

Where to Find more Can An Employer Deduct Social Security And Medicare Taxes

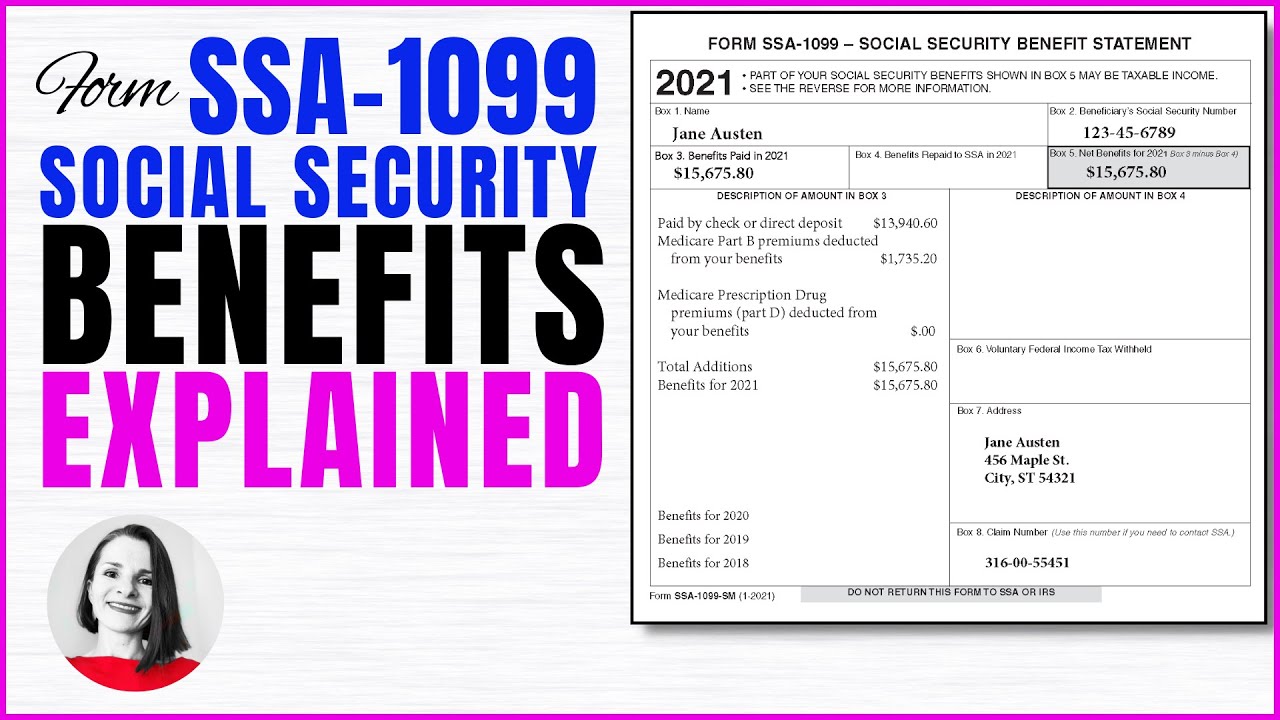

Tax Form SSA 1099 Social Security Benefit Explained Is My Social

Tax Form SSA 1099 Social Security Benefit Explained Is My Social

At least three taxes are withheld from an employee s wages income tax Social Security and Medicare Federal income tax withholdings are separate from Social Security and Medicare

The employer will deduct the overpayment of Social Security taxes from your payroll tax record The W 2 Form for an employee who earns more than the income cap should show the total amount of pay

Now that we've piqued your interest in printables for free We'll take a look around to see where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of Can An Employer Deduct Social Security And Medicare Taxes for various needs.

- Explore categories such as design, home decor, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets as well as flashcards and other learning tools.

- It is ideal for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their innovative designs as well as templates for free.

- The blogs covered cover a wide range of topics, that range from DIY projects to planning a party.

Maximizing Can An Employer Deduct Social Security And Medicare Taxes

Here are some ideas that you can make use use of printables for free:

1. Home Decor

- Print and frame stunning art, quotes, or festive decorations to decorate your living spaces.

2. Education

- Use free printable worksheets to help reinforce your learning at home and in class.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars, to-do lists, and meal planners.

Conclusion

Can An Employer Deduct Social Security And Medicare Taxes are an abundance of useful and creative resources that cater to various needs and interests. Their accessibility and flexibility make them a fantastic addition to both professional and personal lives. Explore the vast array of Can An Employer Deduct Social Security And Medicare Taxes now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really for free?

- Yes you can! You can print and download these materials for free.

-

Can I use the free printouts for commercial usage?

- It's dependent on the particular terms of use. Always consult the author's guidelines before utilizing printables for commercial projects.

-

Do you have any copyright issues in Can An Employer Deduct Social Security And Medicare Taxes?

- Some printables may come with restrictions on usage. You should read the terms and regulations provided by the designer.

-

How can I print Can An Employer Deduct Social Security And Medicare Taxes?

- You can print them at home using a printer or visit a print shop in your area for the highest quality prints.

-

What program do I need to run Can An Employer Deduct Social Security And Medicare Taxes?

- Most printables come in the format PDF. This is open with no cost software, such as Adobe Reader.

Calculating OASDI Social Security Deduction Medicare Deduction

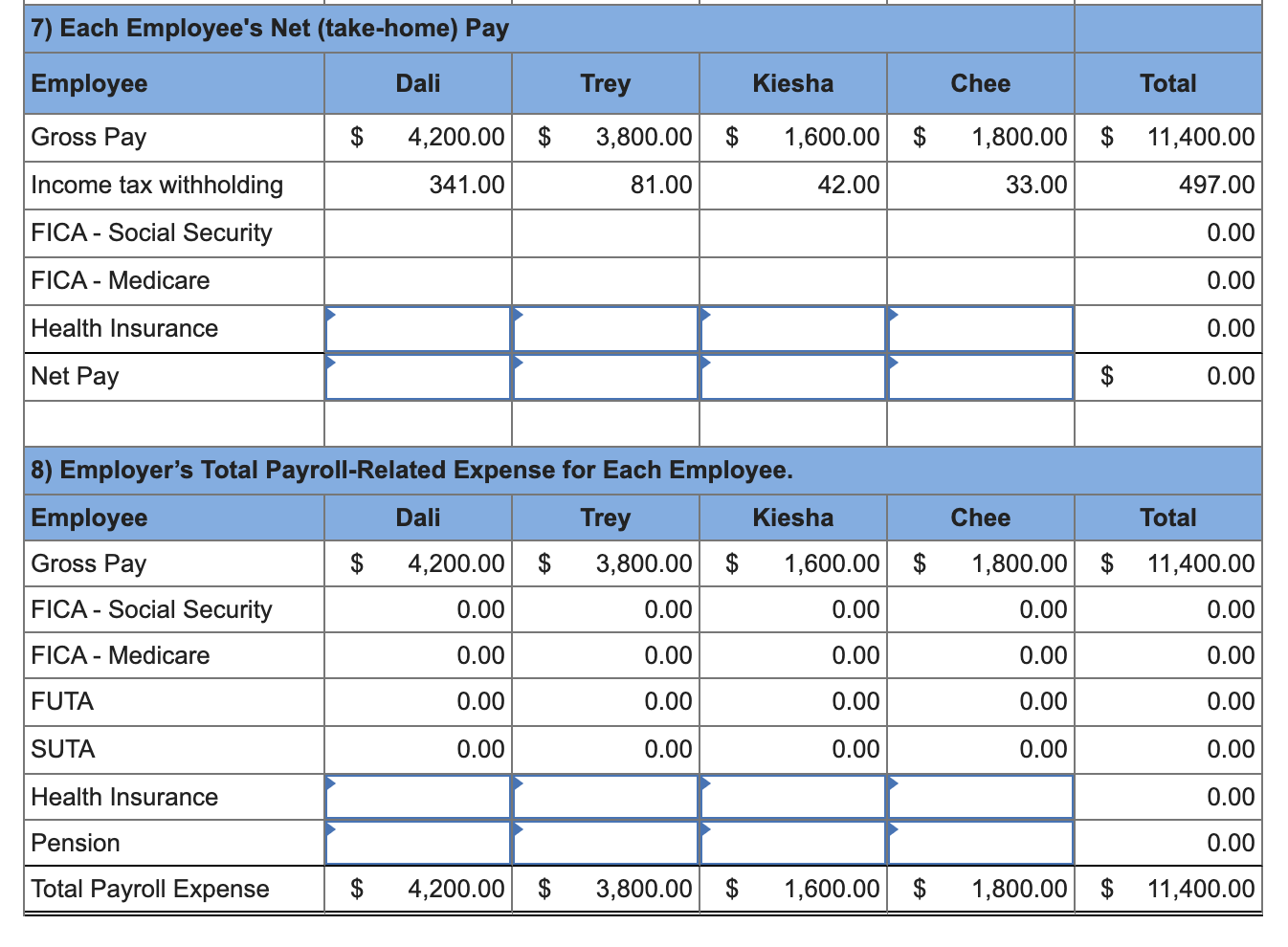

Solved Paloma Company Has Four Employees FICA Social Chegg

Check more sample of Can An Employer Deduct Social Security And Medicare Taxes below

Is Medicare Part B Automatically Deducted From Social Security

Can You Deduct Medicare Costs On Your Taxes

Payroll Tax What It Is How To Calculate It NetSuite

Medicare Lapses Caused By Missed Deductions From Social Security Checks

Social Security And Household Workers Advancing Smartly

Solved Paloma Company Has Four Employees FICA Social Chegg

https://www.irs.gov/taxtopics/tc751

An employer is required to begin withholding Additional Medicare tax in the pay period in which it pays wages in excess of 200 000 to an employee and

https://www.irs.gov/businesses/small-businesses...

You can deduct the employer equivalent portion of your self employment tax in figuring your adjusted gross income This deduction only affects your income tax

An employer is required to begin withholding Additional Medicare tax in the pay period in which it pays wages in excess of 200 000 to an employee and

You can deduct the employer equivalent portion of your self employment tax in figuring your adjusted gross income This deduction only affects your income tax

Medicare Lapses Caused By Missed Deductions From Social Security Checks

Can You Deduct Medicare Costs On Your Taxes

Social Security And Household Workers Advancing Smartly

Solved Paloma Company Has Four Employees FICA Social Chegg

What Is The Employee Medicare Tax

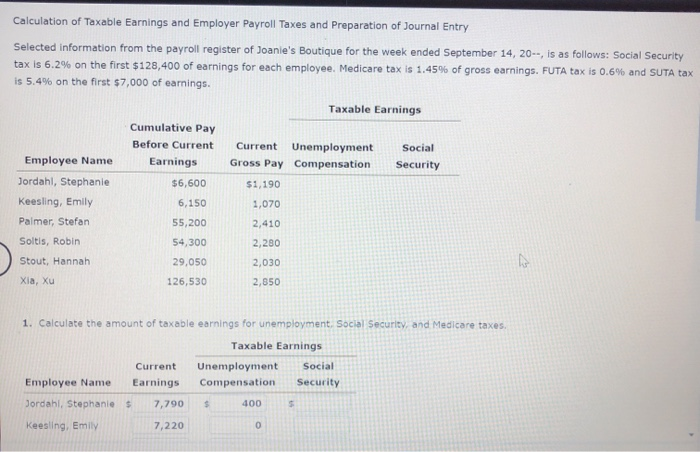

Solved Problem 3 401K For The Data Below Calculate The Amount Of

Solved Problem 3 401K For The Data Below Calculate The Amount Of

Solved Calculation Of Taxable Earnings And Employer Payroll Chegg