In this age of electronic devices, with screens dominating our lives yet the appeal of tangible printed products hasn't decreased. Whatever the reason, whether for education for creative projects, just adding an individual touch to the area, Are Roth Ira Contributions Tax Deductible have become an invaluable resource. Through this post, we'll take a dive into the world of "Are Roth Ira Contributions Tax Deductible," exploring their purpose, where they can be found, and how they can add value to various aspects of your daily life.

What Are Are Roth Ira Contributions Tax Deductible?

Are Roth Ira Contributions Tax Deductible offer a wide range of printable, free materials that are accessible online for free cost. They are available in a variety of forms, including worksheets, templates, coloring pages and much more. The value of Are Roth Ira Contributions Tax Deductible is in their variety and accessibility.

Are Roth Ira Contributions Tax Deductible

Are Roth Ira Contributions Tax Deductible

Are Roth Ira Contributions Tax Deductible - Are Roth Ira Contributions Tax Deductible, Are Roth Ira Contributions Tax Deductible For Self Employed, Are Roth Ira Contributions Tax Deductible In 2022, Are Roth Ira Contributions Tax Free, Are My Roth Ira Contributions Tax Deductible, Why Are Roth Ira Contributions Not Tax Deductible, Roth Ira Contributions Tax Credit, Contributions To A Roth Ira Are Not Tax-deductible. True False, Are Roth Contributions Tax Deductible

[desc-5]

[desc-1]

Roth IRA Contribution Roth Ira Contributions Roth Ira Ira

Roth IRA Contribution Roth Ira Contributions Roth Ira Ira

[desc-4]

[desc-6]

Is A Roth IRA Pre Tax Are Roth IRA Contributions Tax Deductible

Is A Roth IRA Pre Tax Are Roth IRA Contributions Tax Deductible

[desc-9]

[desc-7]

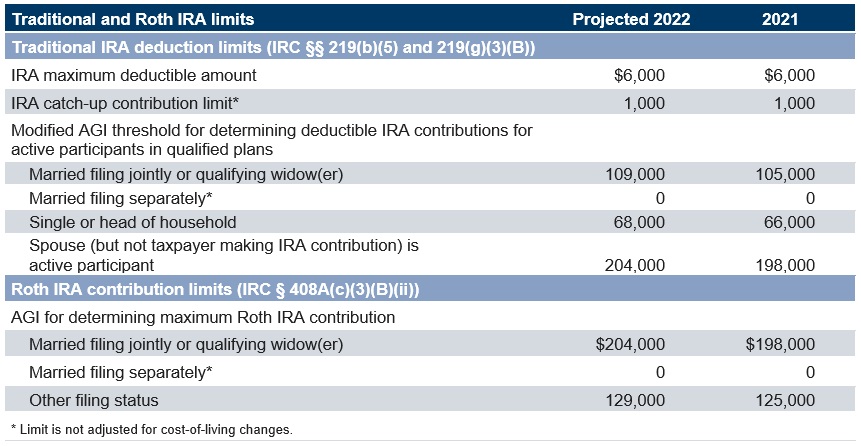

RE403 IRA Account Fundamentals

Entering IRA Contributions In A 1040 Return In ProSeries

Max Roth Ira Contribution 2022 Choosing Your Gold IRA

Are Roth IRA Contributions Tax Deductible

IRA Contributions Tax Deductible Mullooly Asset Management

Are IRA Contributions Tax Deductible Alto

Are IRA Contributions Tax Deductible Alto

Roth IRA Rules What You Need To Know In 2019 Roth Ira Rules Roth