In this digital age, where screens rule our lives but the value of tangible printed objects hasn't waned. Whatever the reason, whether for education, creative projects, or simply to add personal touches to your home, printables for free have become a valuable resource. This article will take a dive into the world of "Roth Ira Contributions Tax Credit," exploring what they are, where you can find them, and how they can enhance various aspects of your daily life.

Get Latest Roth Ira Contributions Tax Credit Below

Roth Ira Contributions Tax Credit

Roth Ira Contributions Tax Credit -

The primary benefit of a Roth IRA is that your contributions and the earnings on those contributions can grow tax free and be withdrawn tax free after age 59 assuming the account has

What is the saver s credit The retirement savings contribution credit the saver s credit for short is a nonrefundable tax credit worth up to 1 000 2 000 if married filing

Printables for free include a vast array of printable materials available online at no cost. They come in many designs, including worksheets templates, coloring pages, and much more. The appealingness of Roth Ira Contributions Tax Credit lies in their versatility as well as accessibility.

More of Roth Ira Contributions Tax Credit

Roth IRA Rules What You Need To Know In 2019 Roth Ira Rules Roth

Roth IRA Rules What You Need To Know In 2019 Roth Ira Rules Roth

While you can withdraw your contributions at any time without tax or penalty you need to leave your investment earnings in the account until at least age 59 or face a fairly steep 10

The maximum annual contribution for 2023 is 6 500 or 7 500 if you re age 50 or older and you can make those contributions through April of 2024 For 2024 the maximum contribution rises to

The Roth Ira Contributions Tax Credit have gained huge appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

Personalization It is possible to tailor the templates to meet your individual needs, whether it's designing invitations to organize your schedule or decorating your home.

-

Education Value Downloads of educational content for free provide for students of all ages, which makes these printables a powerful resource for educators and parents.

-

Simple: Quick access to a myriad of designs as well as templates will save you time and effort.

Where to Find more Roth Ira Contributions Tax Credit

Is A Roth IRA Pre Tax Are Roth IRA Contributions Tax Deductible

Is A Roth IRA Pre Tax Are Roth IRA Contributions Tax Deductible

By contributing to a Roth IRA you can earn a nonrefundable tax credit that lowers or eliminates your tax bill The good news is that you are not required to contribute a certain amount

Contributions to a Roth IRA are made in after tax dollars which means that you pay the taxes upfront You can withdraw your contributions at any time for any reason without tax or

In the event that we've stirred your interest in printables for free Let's see where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection with Roth Ira Contributions Tax Credit for all objectives.

- Explore categories such as home decor, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free with flashcards and other teaching materials.

- Great for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for no cost.

- The blogs covered cover a wide selection of subjects, everything from DIY projects to party planning.

Maximizing Roth Ira Contributions Tax Credit

Here are some ideas ensure you get the very most use of printables that are free:

1. Home Decor

- Print and frame stunning art, quotes, or festive decorations to decorate your living spaces.

2. Education

- Print free worksheets to reinforce learning at home either in the schoolroom or at home.

3. Event Planning

- Make invitations, banners and decorations for special events such as weddings and birthdays.

4. Organization

- Stay organized by using printable calendars as well as to-do lists and meal planners.

Conclusion

Roth Ira Contributions Tax Credit are an abundance of practical and imaginative resources that can meet the needs of a variety of people and interests. Their access and versatility makes them a wonderful addition to the professional and personal lives of both. Explore the endless world that is Roth Ira Contributions Tax Credit today, and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really free?

- Yes you can! You can print and download these free resources for no cost.

-

Can I download free printouts for commercial usage?

- It's dependent on the particular conditions of use. Always verify the guidelines provided by the creator before using their printables for commercial projects.

-

Are there any copyright rights issues with Roth Ira Contributions Tax Credit?

- Some printables could have limitations regarding their use. Be sure to check the terms and conditions provided by the author.

-

How do I print Roth Ira Contributions Tax Credit?

- Print them at home with the printer, or go to an in-store print shop to get the highest quality prints.

-

What software will I need to access printables at no cost?

- The majority of printed documents are in the format PDF. This is open with no cost software like Adobe Reader.

SEP IRA Vs Roth IRA Definition How To Set Up Major Differences

Does A Roth IRA Account Make Sense For You Gorfine Schiller Gardyn

Check more sample of Roth Ira Contributions Tax Credit below

Roth IRA Contribution Roth Ira Contributions Roth Ira Ira

Max Ira Contribution 2022 Over 50 Choosing Your Gold IRA

2023 Irs Contribution Limits And Tax Rates By Kristin Mckenna Harvest

Roth Ira Growth Calculator GarveenIndia

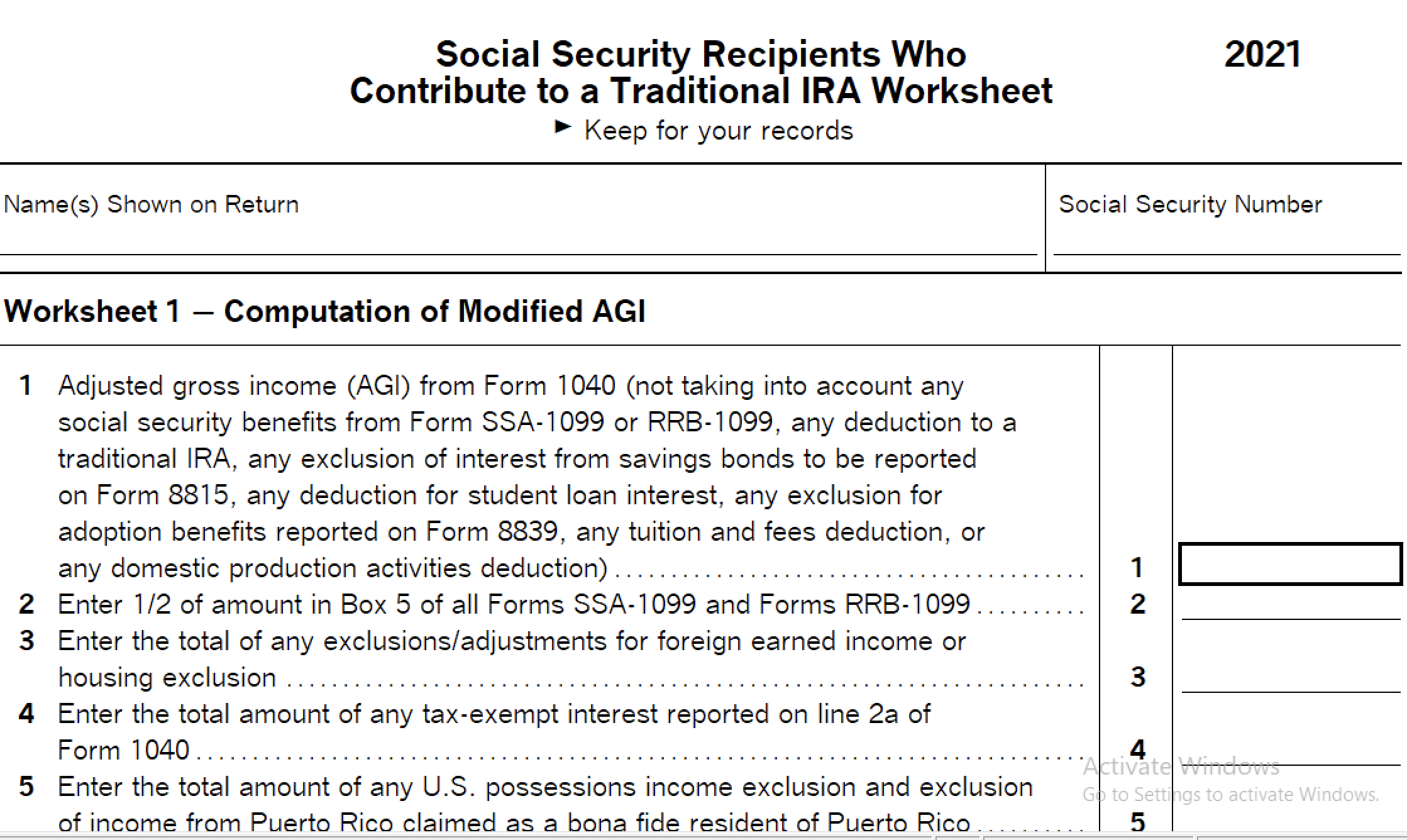

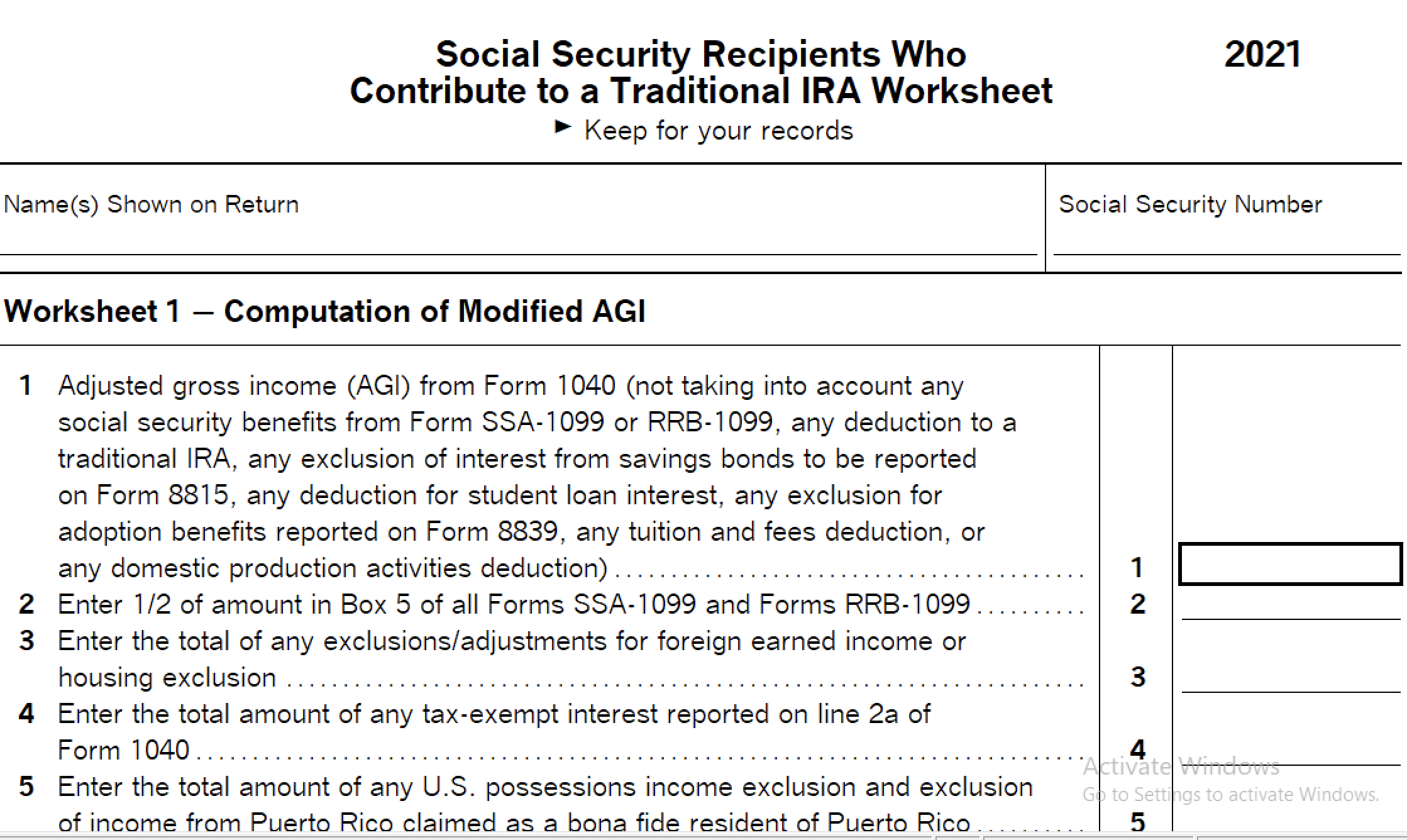

Entering IRA Contributions In A 1040 Return In ProSeries

IRS Announces IRA And Plan Limits For 2023 The New Retirement Dictionary

https://www.nerdwallet.com/article/taxes/can-you...

What is the saver s credit The retirement savings contribution credit the saver s credit for short is a nonrefundable tax credit worth up to 1 000 2 000 if married filing

https://www.investopedia.com/irs-form-8880-credit...

Eligible plans to which you can make contributions and claim the credit include traditional and Roth IRAs and 401 k 457 b and 403 b plans To be eligible for the credit you must

What is the saver s credit The retirement savings contribution credit the saver s credit for short is a nonrefundable tax credit worth up to 1 000 2 000 if married filing

Eligible plans to which you can make contributions and claim the credit include traditional and Roth IRAs and 401 k 457 b and 403 b plans To be eligible for the credit you must

Roth Ira Growth Calculator GarveenIndia

Max Ira Contribution 2022 Over 50 Choosing Your Gold IRA

Entering IRA Contributions In A 1040 Return In ProSeries

IRS Announces IRA And Plan Limits For 2023 The New Retirement Dictionary

Do You Pay Taxes On Stocks Sold In Roth Ira Choosing Your Gold IRA

2023 Roth Ira Limits W2023G

2023 Roth Ira Limits W2023G

Historical Roth IRA Contribution Limits Since The Beginning