In this age of electronic devices, with screens dominating our lives it's no wonder that the appeal of tangible printed items hasn't gone away. Be it for educational use in creative or artistic projects, or just adding an element of personalization to your area, Are Railroad Retirement Benefits Taxable In California are a great resource. We'll dive into the world of "Are Railroad Retirement Benefits Taxable In California," exploring what they are, how to locate them, and what they can do to improve different aspects of your daily life.

Get Latest Are Railroad Retirement Benefits Taxable In California Below

Are Railroad Retirement Benefits Taxable In California

Are Railroad Retirement Benefits Taxable In California - Are Railroad Retirement Benefits Taxable In California, Are Tier 1 And Tier 2 Railroad Retirement Benefits Taxed In California, Do I Have To Pay Taxes On My Railroad Retirement, Is Railroad Retirement Taxable

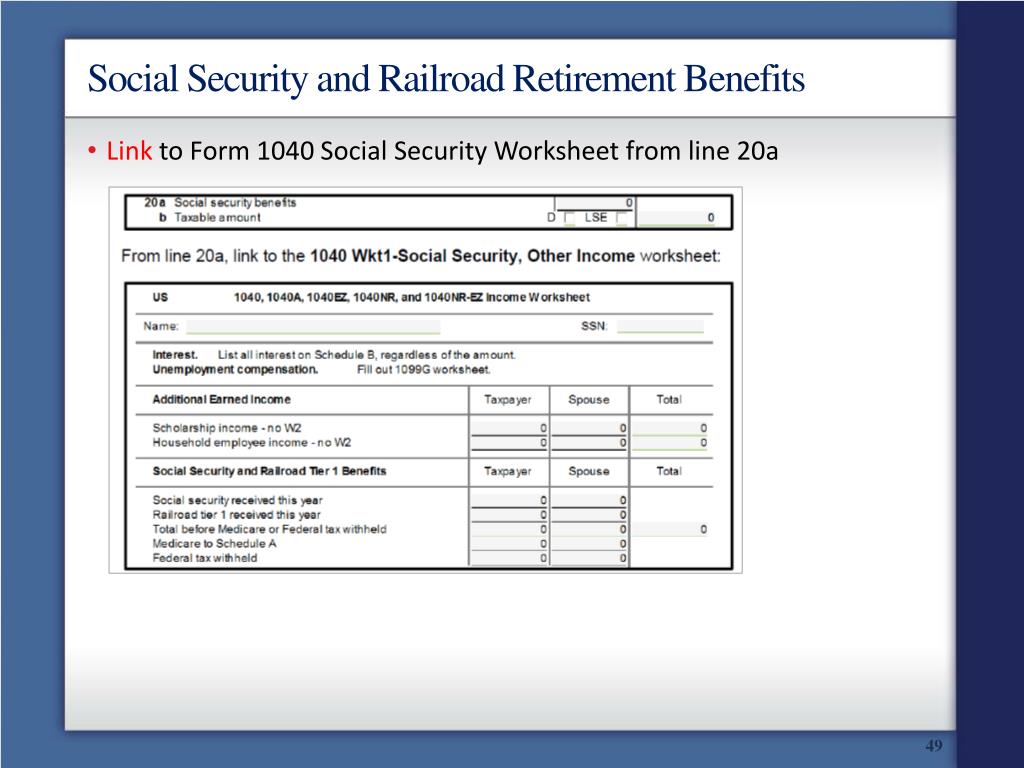

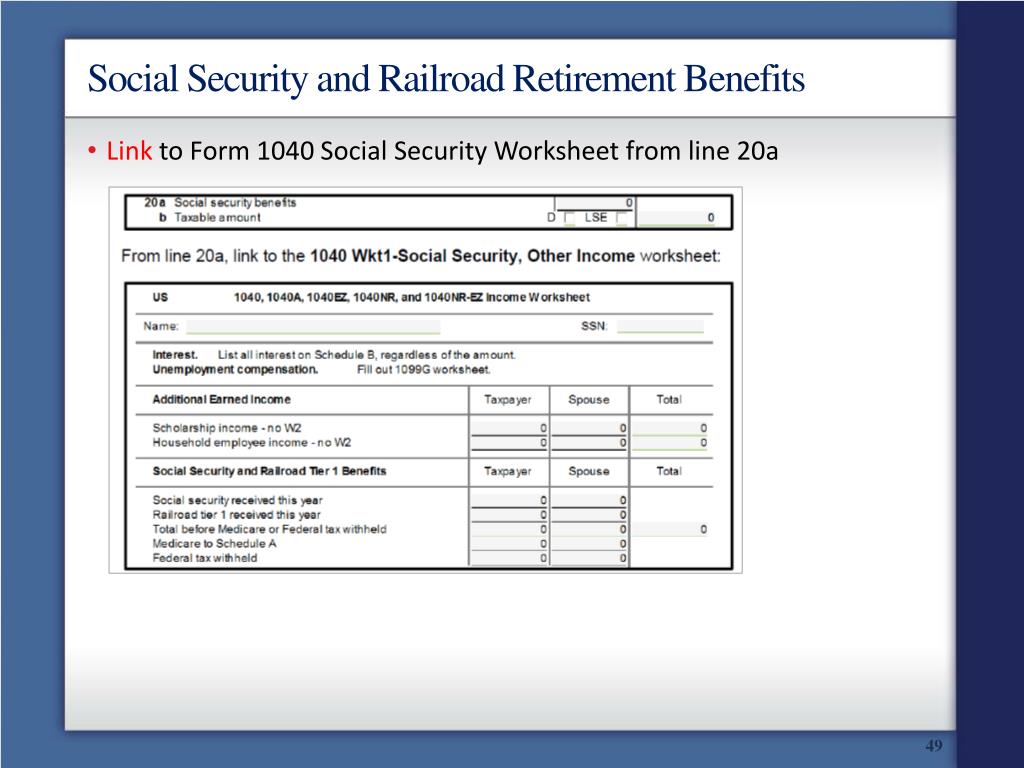

If the only income you received during the tax year was your Social Security or equivalent railroad retirement benefits your benefits may not be taxable and you

Railroad retirement benefits are not taxable by any state so state tax withholding from railroad retirement payments is not possible Annuitants that wish to add or change

Are Railroad Retirement Benefits Taxable In California include a broad collection of printable materials that are accessible online for free cost. They are available in a variety of formats, such as worksheets, coloring pages, templates and much more. The appealingness of Are Railroad Retirement Benefits Taxable In California lies in their versatility and accessibility.

More of Are Railroad Retirement Benefits Taxable In California

Are My Retirement Benefits Taxable

Are My Retirement Benefits Taxable

Taxes on Railroad Retirement benefits can significantly affect your retirement income and understanding your potential tax obligation can help you better

For railroad retirees with provisional incomes above 44 000 for married individuals filing jointly 0 for married individuals filing separately and 34 000 for unmarried individuals gross income will

Printables that are free have gained enormous recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

Individualization Your HTML0 customization options allow you to customize printed materials to meet your requirements for invitations, whether that's creating them as well as organizing your calendar, or even decorating your house.

-

Educational Worth: The free educational worksheets can be used by students of all ages, making them a great tool for parents and teachers.

-

It's easy: Instant access to various designs and templates can save you time and energy.

Where to Find more Are Railroad Retirement Benefits Taxable In California

What You Need To Know About Spouse Benefits For Railroad Retirement

What You Need To Know About Spouse Benefits For Railroad Retirement

Railroad retiree benefits are a special retirement pension paid to former railroad industry workers Depending on the state where the retired worker lives they

California Achieving a Better Life Experience ABLE accounts Differences between California and federal law There are differences between California and federal law

If we've already piqued your interest in Are Railroad Retirement Benefits Taxable In California we'll explore the places you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of printables that are free for a variety of applications.

- Explore categories like the home, decor, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational tools.

- Perfect for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for free.

- The blogs covered cover a wide range of topics, that includes DIY projects to planning a party.

Maximizing Are Railroad Retirement Benefits Taxable In California

Here are some ideas ensure you get the very most of printables for free:

1. Home Decor

- Print and frame beautiful art, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Print free worksheets to enhance learning at home either in the schoolroom or at home.

3. Event Planning

- Make invitations, banners and decorations for special events such as weddings and birthdays.

4. Organization

- Stay organized by using printable calendars or to-do lists. meal planners.

Conclusion

Are Railroad Retirement Benefits Taxable In California are an abundance of fun and practical tools catering to different needs and interest. Their access and versatility makes them a wonderful addition to the professional and personal lives of both. Explore the vast collection of Are Railroad Retirement Benefits Taxable In California to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Are Railroad Retirement Benefits Taxable In California truly are they free?

- Yes they are! You can download and print the resources for free.

-

Can I use the free printables in commercial projects?

- It's dependent on the particular rules of usage. Always verify the guidelines provided by the creator prior to using the printables in commercial projects.

-

Are there any copyright concerns when using Are Railroad Retirement Benefits Taxable In California?

- Certain printables might have limitations regarding usage. Always read the terms of service and conditions provided by the designer.

-

How do I print Are Railroad Retirement Benefits Taxable In California?

- You can print them at home with printing equipment or visit the local print shops for top quality prints.

-

What software do I need to open printables free of charge?

- Most PDF-based printables are available in PDF format. These is open with no cost software such as Adobe Reader.

Railroad Retirement Disability Benefits Disability Attorneys In New York

Railroad Stock In Railroad Retirement Highball Advisors Railroad

Check more sample of Are Railroad Retirement Benefits Taxable In California below

Quick Reference Guide For Railroad Disability Medicare

Foreign Social Security Taxable In Us TaxableSocialSecurity

Railroad Sickness Benefits And How They Pertain To You My Railroad

How Medicare Enrollment Works With Railroad Retirement Benefits

How Railroaders Prepare For Railroad Retirement Highball Advisors

Railroad Retirement Taxable Income Worksheet Printable Word Searches

https://www.rrb.gov/sites/default/files/2021-12/QA2112.pdf

Railroad retirement benefits are not taxable by any state so state tax withholding from railroad retirement payments is not possible Annuitants that wish to add or change

https://www.rrb.gov/sites/default/files/2018-02/QA1802.pdf

In most cases part of a railroad retirement annuity is treated like a social security benefit for Federal income tax purposes while other parts of the annuity are treated like private

Railroad retirement benefits are not taxable by any state so state tax withholding from railroad retirement payments is not possible Annuitants that wish to add or change

In most cases part of a railroad retirement annuity is treated like a social security benefit for Federal income tax purposes while other parts of the annuity are treated like private

How Medicare Enrollment Works With Railroad Retirement Benefits

Foreign Social Security Taxable In Us TaxableSocialSecurity

How Railroaders Prepare For Railroad Retirement Highball Advisors

Railroad Retirement Taxable Income Worksheet Printable Word Searches

Are Railroad Retirement Tier I Benefits Taxable

Are Tier 2 Railroad Benefits Taxable

Are Tier 2 Railroad Benefits Taxable

56 Of Social Security Households Pay Tax On Their Benefits Will You