In this age of electronic devices, where screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed materials hasn't faded away. Whether it's for educational purposes and creative work, or simply adding an individual touch to the home, printables for free can be an excellent resource. For this piece, we'll dive in the world of "Do I Have To Pay Taxes On My Railroad Retirement," exploring their purpose, where they are available, and how they can add value to various aspects of your life.

Get Latest Do I Have To Pay Taxes On My Railroad Retirement Below

Do I Have To Pay Taxes On My Railroad Retirement

Do I Have To Pay Taxes On My Railroad Retirement - Do I Have To Pay Taxes On My Railroad Retirement, Do You Pay State Taxes On Railroad Retirement

If you re a retiree enjoying the benefits of the Railroad Retirement Act RRA or soon to be retired you may have questions about how your annuities are taxed under

Social security benefits that may be taxable to you include monthly retirement survivor and disability benefits They don t include supplemental security

Printables for free cover a broad range of printable, free items that are available online at no cost. They are available in numerous designs, including worksheets coloring pages, templates and more. The great thing about Do I Have To Pay Taxes On My Railroad Retirement lies in their versatility and accessibility.

More of Do I Have To Pay Taxes On My Railroad Retirement

Common Financial Myths Don t Give Away Too Much Money Or You ll Owe

Common Financial Myths Don t Give Away Too Much Money Or You ll Owe

If the only income you received during 2023 was your social security or the SSEB portion of tier 1 railroad retirement benefits your benefits generally aren t taxable and you probably don t have to file a return

If the only income you received during the tax year was your Social Security or equivalent railroad retirement benefits your benefits may not be taxable and you

Printables for free have gained immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Customization: Your HTML0 customization options allow you to customize printables to fit your particular needs whether it's making invitations planning your schedule or decorating your home.

-

Educational Impact: Downloads of educational content for free can be used by students of all ages, which makes them a vital tool for parents and teachers.

-

Affordability: immediate access a myriad of designs as well as templates is time-saving and saves effort.

Where to Find more Do I Have To Pay Taxes On My Railroad Retirement

2022 Year End Tax Tips Richard Russell Law

2022 Year End Tax Tips Richard Russell Law

If that Provisional Income EXCEEDS your base number then some of your benefits may be taxable Those benefits like Social Security can be taxed up to 85

Earnings subject to railroad retirement taxes are assessed annually aligned with national wage levels Railroad employees also covered by social security may claim tax credits

In the event that we've stirred your curiosity about Do I Have To Pay Taxes On My Railroad Retirement Let's find out where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of Do I Have To Pay Taxes On My Railroad Retirement to suit a variety of uses.

- Explore categories like the home, decor, organizational, and arts and crafts.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free or flashcards as well as learning materials.

- Ideal for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for no cost.

- The blogs covered cover a wide range of topics, all the way from DIY projects to party planning.

Maximizing Do I Have To Pay Taxes On My Railroad Retirement

Here are some ways to make the most use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes or other seasonal decorations to fill your living spaces.

2. Education

- Use printable worksheets from the internet to aid in learning at your home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Do I Have To Pay Taxes On My Railroad Retirement are an abundance of fun and practical tools that can meet the needs of a variety of people and desires. Their availability and versatility make them an essential part of the professional and personal lives of both. Explore the world of Do I Have To Pay Taxes On My Railroad Retirement today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Do I Have To Pay Taxes On My Railroad Retirement really completely free?

- Yes they are! You can print and download the resources for free.

-

Do I have the right to use free printables for commercial purposes?

- It's based on specific conditions of use. Always verify the guidelines of the creator prior to printing printables for commercial projects.

-

Do you have any copyright issues with printables that are free?

- Some printables could have limitations concerning their use. Be sure to read the conditions and terms of use provided by the designer.

-

How can I print printables for free?

- Print them at home with either a printer or go to an in-store print shop to get top quality prints.

-

What program do I require to view Do I Have To Pay Taxes On My Railroad Retirement?

- The majority of PDF documents are provided in the PDF format, and is open with no cost software like Adobe Reader.

Where Do My Hard Earned Railroad Retirement Taxes Go Highball

Do You Have To Pay Taxes On The Sale Of A Cottage Financial Post

Check more sample of Do I Have To Pay Taxes On My Railroad Retirement below

Do I Need To Pay Taxes The Minimum Income To File Taxes

Changes To Compensation Levels Subject To Railroad Retirement Taxes

6 Tips For Keeping Your Retirement On Track At Age 50 Clever Finance

Railroad Retirement Calculated On Highest Earning Months Or Years Of

Do I Have To Pay Taxes On My Weekly Workers Compensation Benefits Or

Income Tax TDS Deducted But ITR Not Filed Here s What Professionals

https://www.irs.gov › help › ita › are-my-social...

Social security benefits that may be taxable to you include monthly retirement survivor and disability benefits They don t include supplemental security

https://www.rrb.gov › sites › default › files

Railroad retirement benefits are not taxable by any state so state tax withholding from railroad retirement payments is not possible Annuitants that wish to add or change

Social security benefits that may be taxable to you include monthly retirement survivor and disability benefits They don t include supplemental security

Railroad retirement benefits are not taxable by any state so state tax withholding from railroad retirement payments is not possible Annuitants that wish to add or change

Railroad Retirement Calculated On Highest Earning Months Or Years Of

Changes To Compensation Levels Subject To Railroad Retirement Taxes

Do I Have To Pay Taxes On My Weekly Workers Compensation Benefits Or

Income Tax TDS Deducted But ITR Not Filed Here s What Professionals

How To Increase The Value Of A Business By Paying More Taxes

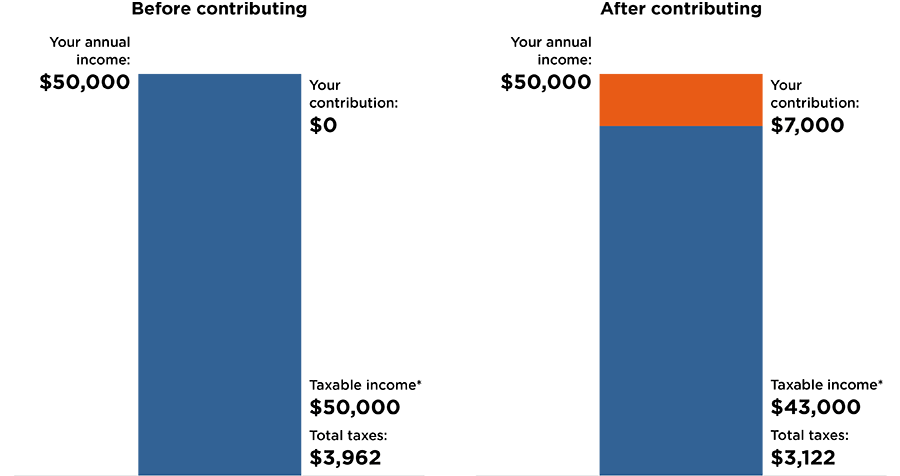

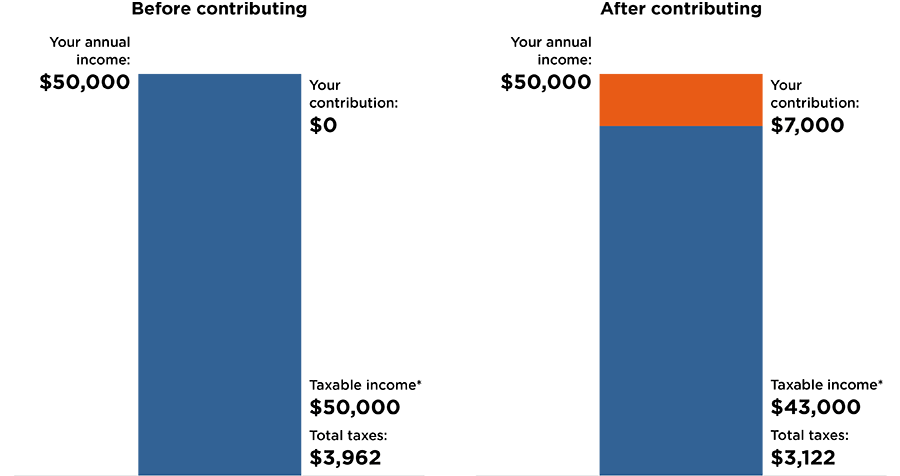

Retirement Plans Ways To Reduce Your Income Taxes

Retirement Plans Ways To Reduce Your Income Taxes

Who Pays Federal Taxes Source