In the age of digital, where screens rule our lives and the appeal of physical printed objects hasn't waned. If it's to aid in education as well as creative projects or just adding some personal flair to your space, Are Ira Withdrawals Taxable In Georgia are a great resource. Through this post, we'll dive to the depths of "Are Ira Withdrawals Taxable In Georgia," exploring what they are, how to get them, as well as how they can add value to various aspects of your life.

Get Latest Are Ira Withdrawals Taxable In Georgia Below

Are Ira Withdrawals Taxable In Georgia

Are Ira Withdrawals Taxable In Georgia - Are Ira Withdrawals Taxable In Georgia, Are Ira Distributions Taxable In Georgia, Are Ira Distributions Taxed In Georgia, Are Ira Distributions Taxable In Ga, Are Roth Ira Distributions Taxable In Georgia, Are Ira Withdrawals Taxable, Do I Have To Pay Taxes On Ira Withdrawal, Are Ira Withdrawals Taxed

Is my retirement income taxable to Georgia Georgia allows for taxpayers to subtract a portion of their retirement income on their Georgia return The maximum retirement

The federal government considers distributions from pensions 401 k s and traditional Individual Retirement Accounts IRAs as income the same as it does the income you get from work

The Are Ira Withdrawals Taxable In Georgia are a huge array of printable materials that are accessible online for free cost. They are available in a variety of designs, including worksheets templates, coloring pages, and much more. The great thing about Are Ira Withdrawals Taxable In Georgia lies in their versatility and accessibility.

More of Are Ira Withdrawals Taxable In Georgia

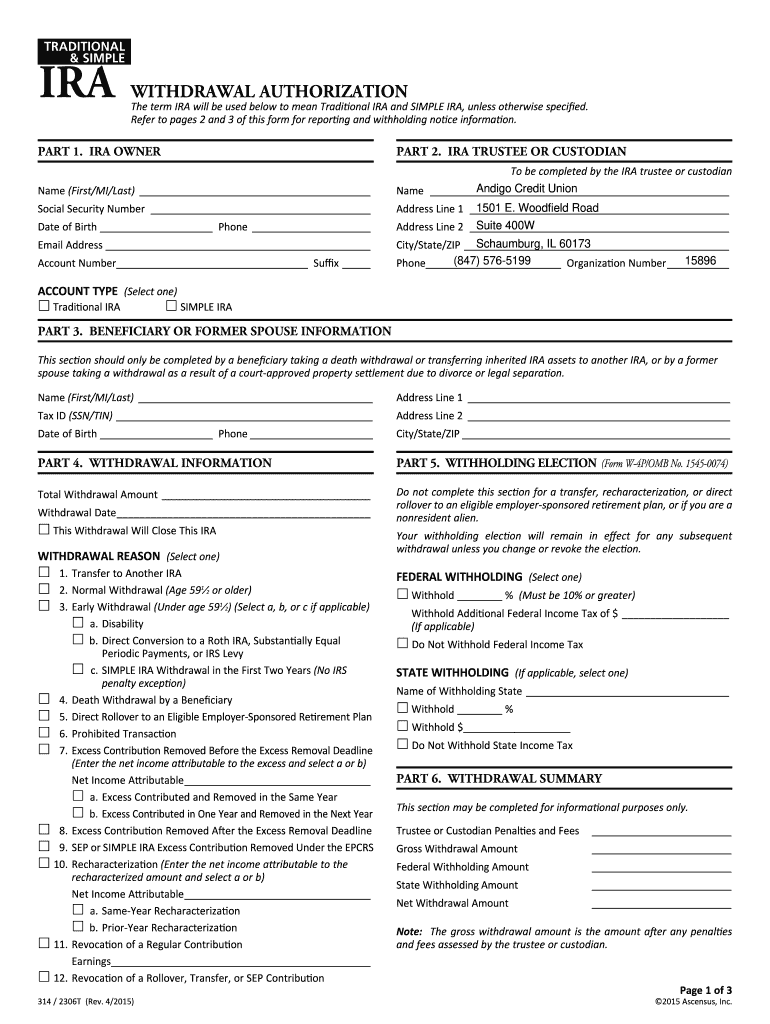

Mandatory Withdrawals From A TIRA While The Owner Is Living

Mandatory Withdrawals From A TIRA While The Owner Is Living

The way individual retirement account IRA withdrawals are taxed depends on the type of IRA For example you ll always pay taxes on traditional IRA withdrawals But with a Roth IRA there

Taxpayers age 62 and older may exclude up to 35 000 of their retirement income and those age 65 and older can exclude up to 65 000 of retirement income Social Security Not taxable Pensions

Printables that are free have gained enormous appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

Customization: The Customization feature lets you tailor designs to suit your personal needs be it designing invitations, organizing your schedule, or even decorating your home.

-

Education Value The free educational worksheets can be used by students from all ages, making them a valuable device for teachers and parents.

-

Simple: Instant access to a plethora of designs and templates is time-saving and saves effort.

Where to Find more Are Ira Withdrawals Taxable In Georgia

Axos Bank Ira Withdrawal Form Fill Out And Sign Printable PDF

Axos Bank Ira Withdrawal Form Fill Out And Sign Printable PDF

From the ages of 62 to 64 Georgia taxpayers can exclude up to 35 000 of their retirement income on their state return Taxpayers who re 65 or older can exclude up to 65 000 on their return If you are

IRA 401k Rollovers Annuities Pensions Retirement Planning Financial Planning Annuities IRAs CDs Bonds 401 k s Mutual Funds Estate Pensions Georgia Retirement Most forms of retirement income are

We hope we've stimulated your interest in printables for free Let's see where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of printables that are free for a variety of needs.

- Explore categories like home decor, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free with flashcards and other teaching tools.

- This is a great resource for parents, teachers or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for free.

- The blogs covered cover a wide range of topics, ranging from DIY projects to party planning.

Maximizing Are Ira Withdrawals Taxable In Georgia

Here are some inventive ways ensure you get the very most use of printables for free:

1. Home Decor

- Print and frame stunning art, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print free worksheets to enhance your learning at home or in the classroom.

3. Event Planning

- Invitations, banners as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Keep track of your schedule with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Are Ira Withdrawals Taxable In Georgia are an abundance of creative and practical resources that can meet the needs of a variety of people and desires. Their availability and versatility make these printables a useful addition to both professional and personal life. Explore the world of Are Ira Withdrawals Taxable In Georgia and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Are Ira Withdrawals Taxable In Georgia really for free?

- Yes you can! You can download and print the resources for free.

-

Do I have the right to use free printables to make commercial products?

- It's based on the rules of usage. Always verify the guidelines provided by the creator prior to printing printables for commercial projects.

-

Are there any copyright violations with Are Ira Withdrawals Taxable In Georgia?

- Some printables may contain restrictions on usage. You should read the conditions and terms of use provided by the creator.

-

How can I print printables for free?

- Print them at home using any printer or head to any local print store for premium prints.

-

What software do I require to view printables for free?

- The majority of printed documents are in PDF format. They can be opened with free software such as Adobe Reader.

Are IRA Withdrawals Subject To Social Security Tax YouTube

Traditional IRA Withdrawal Rules Blue Co LLC

Check more sample of Are Ira Withdrawals Taxable In Georgia below

How To Make Penalty Free Pre Age 59 5 Traditional IRA Withdrawals

Roth Ira Withdrawal Tax Calculator TaniyaSuphi

Budget 2016 PF Withdrawals Taxable From April 2016 IBTimes India

5 Things To Know About Required Minimum Distributions AZ IRA Real Estate

Do You Pay State Income Tax On Ira Withdrawals Tax Walls

How Are IRA Withdrawals Taxed YouTube

https://www.aarp.org/money/taxes/info …

The federal government considers distributions from pensions 401 k s and traditional Individual Retirement Accounts IRAs as income the same as it does the income you get from work

https://dor.georgia.gov/retirees-faq

No Taxable Social Security and Railroad Retirement on the Federal return are exempt from Georgia Income Tax The taxable portion is subtracted on schedule 1 of Form 500

The federal government considers distributions from pensions 401 k s and traditional Individual Retirement Accounts IRAs as income the same as it does the income you get from work

No Taxable Social Security and Railroad Retirement on the Federal return are exempt from Georgia Income Tax The taxable portion is subtracted on schedule 1 of Form 500

5 Things To Know About Required Minimum Distributions AZ IRA Real Estate

Roth Ira Withdrawal Tax Calculator TaniyaSuphi

Do You Pay State Income Tax On Ira Withdrawals Tax Walls

How Are IRA Withdrawals Taxed YouTube

Saturday School Why The Roth IRA Is Great For Savers And Spenders Ira

7 Photos Inherited Ira Rmd Table 2018 And Description Alqu Blog

7 Photos Inherited Ira Rmd Table 2018 And Description Alqu Blog

IRA Withdrawal Rules