In the age of digital, where screens dominate our lives it's no wonder that the appeal of tangible printed objects isn't diminished. For educational purposes project ideas, artistic or simply adding some personal flair to your home, printables for free are now a vital source. Here, we'll take a dive in the world of "Are Ira Distributions Taxable In Georgia," exploring the different types of printables, where to get them, as well as how they can enhance various aspects of your lives.

Get Latest Are Ira Distributions Taxable In Georgia Below

Are Ira Distributions Taxable In Georgia

Are Ira Distributions Taxable In Georgia - Are Ira Distributions Taxable In Georgia, Are Ira Distributions Taxed In Georgia, Are Ira Withdrawals Taxable In Georgia, Are Ira Distributions Taxable In Ga, Are Roth Ira Distributions Taxable In Georgia, Does Georgia Tax Ira Distributions, Are All Ira Distributions Taxable

Is my retirement income taxable to Georgia Georgia allows for taxpayers to subtract a portion of their retirement income on their Georgia return The maximum retirement

Georgia does not tax Social Security retirement benefits and provides a maximum deduction of 65 000 per person on all types of retirement income for anyone 65 or older The state s sales tax rates and property tax rates

Printables for free include a vast variety of printable, downloadable materials that are accessible online for free cost. The resources are offered in a variety types, such as worksheets templates, coloring pages and more. The appeal of printables for free is in their variety and accessibility.

More of Are Ira Distributions Taxable In Georgia

Qualified Vs Non Qualified Roth IRA Distributions

Qualified Vs Non Qualified Roth IRA Distributions

Understanding Georgia s Retirement Income Exclusion By Stacey Nickens In Georgia retirees and older individuals can shelter some of their income from state taxation This retirement income exclusion is

The Individual Estimated Income tax rate for a married couple filing jointly would be 1 for the 1 000 of taxable income 2 for 1 000 3 000 of taxable income 3 for 3 000 5 000 of taxable income 4 for 5 000

Printables that are free have gained enormous popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Modifications: You can tailor printing templates to your own specific requirements whether it's making invitations and schedules, or even decorating your home.

-

Educational Use: Free educational printables cater to learners of all ages. This makes them a vital aid for parents as well as educators.

-

An easy way to access HTML0: Fast access a variety of designs and templates saves time and effort.

Where to Find more Are Ira Distributions Taxable In Georgia

Are IRA Distributions Taxable If You Are Disabled YouTube

Are IRA Distributions Taxable If You Are Disabled YouTube

The state is moving to a flat tax rate of 5 49 percent in 2024 Property tax 92 percent of a home s assessed value average Real estate taxes vary widely by county

These are not traditional IRAs 4 The taxable portion of your payment will be taxed later when you take it out of the traditional IRA GA 30318 404 350 6300 800 805 4609

We've now piqued your interest in Are Ira Distributions Taxable In Georgia and other printables, let's discover where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection with Are Ira Distributions Taxable In Georgia for all applications.

- Explore categories like decorating your home, education, crafting, and organization.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing as well as flashcards and other learning materials.

- Perfect for teachers, parents and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for free.

- The blogs are a vast spectrum of interests, all the way from DIY projects to party planning.

Maximizing Are Ira Distributions Taxable In Georgia

Here are some ideas for you to get the best of Are Ira Distributions Taxable In Georgia:

1. Home Decor

- Print and frame beautiful artwork, quotes or seasonal decorations to adorn your living spaces.

2. Education

- Use printable worksheets for free to reinforce learning at home, or even in the classroom.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable planners as well as to-do lists and meal planners.

Conclusion

Are Ira Distributions Taxable In Georgia are an abundance of practical and imaginative resources that cater to various needs and interests. Their availability and versatility make them a wonderful addition to both professional and personal life. Explore the plethora of Are Ira Distributions Taxable In Georgia today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Are Ira Distributions Taxable In Georgia truly free?

- Yes, they are! You can print and download these free resources for no cost.

-

Does it allow me to use free printables for commercial uses?

- It's all dependent on the usage guidelines. Make sure you read the guidelines for the creator prior to printing printables for commercial projects.

-

Do you have any copyright issues with Are Ira Distributions Taxable In Georgia?

- Some printables could have limitations regarding usage. Make sure you read the terms and conditions offered by the designer.

-

How can I print printables for free?

- Print them at home using printing equipment or visit a print shop in your area for more high-quality prints.

-

What program do I need in order to open printables for free?

- The majority are printed in the format of PDF, which can be opened using free programs like Adobe Reader.

5 Things To Know About Required Minimum Distributions AZ IRA Real Estate

Roth IRA Withdrawal Rules Oblivious Investor

Check more sample of Are Ira Distributions Taxable In Georgia below

Isolating IRA Basis For Tax Efficient Roth IRA Conversions

7 Photos Inherited Ira Rmd Table 2018 And Description Alqu Blog

Chart Of IRA Distributions

Form 1040 Line 4 And Line 5 IRA Distributions Pensions And Annuities

Is SaaS Taxable In Georgia The SaaS Sales Tax Index

Are Electric Bikes Worth Buying

https://smartasset.com/retirement/georgia...

Georgia does not tax Social Security retirement benefits and provides a maximum deduction of 65 000 per person on all types of retirement income for anyone 65 or older The state s sales tax rates and property tax rates

https://www.actsretirement.org/.../georgia

Tax Benefits of Retiring in Georgia Some of the benefits regarding Georgia retirement taxes include Social Security income in Georgia is not taxed Withdrawals from

Georgia does not tax Social Security retirement benefits and provides a maximum deduction of 65 000 per person on all types of retirement income for anyone 65 or older The state s sales tax rates and property tax rates

Tax Benefits of Retiring in Georgia Some of the benefits regarding Georgia retirement taxes include Social Security income in Georgia is not taxed Withdrawals from

Form 1040 Line 4 And Line 5 IRA Distributions Pensions And Annuities

7 Photos Inherited Ira Rmd Table 2018 And Description Alqu Blog

Is SaaS Taxable In Georgia The SaaS Sales Tax Index

Are Electric Bikes Worth Buying

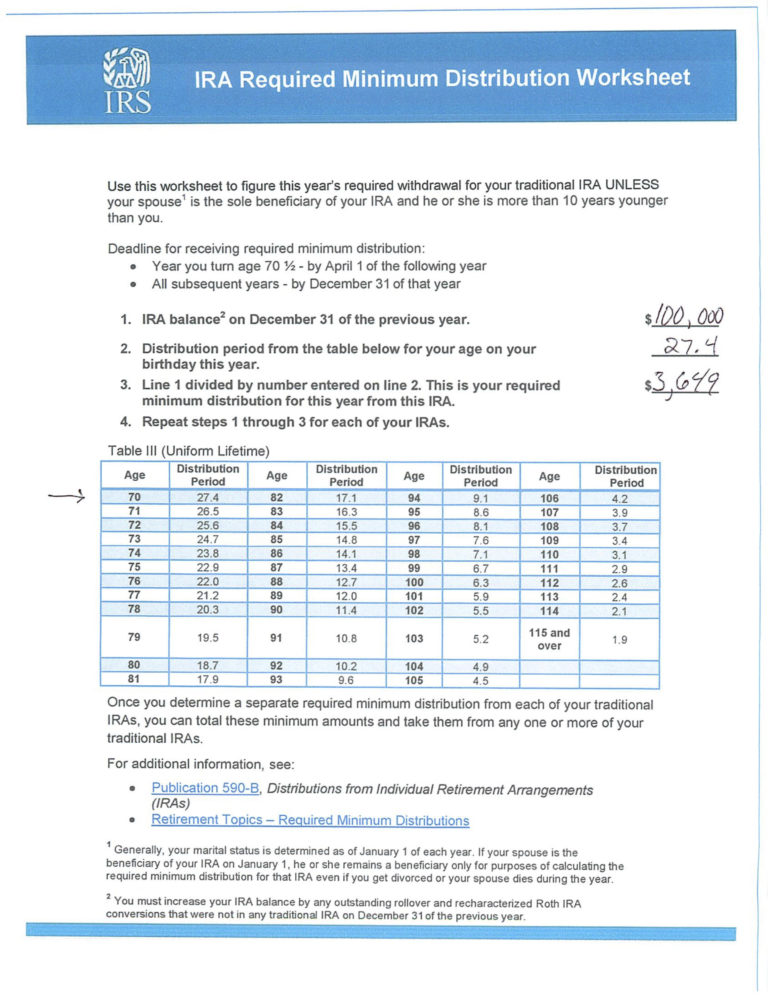

Ira Required Minimum Distribution Worksheet Yooob Db excel

Are US IRA Distributions Taxable In France Harrison Brook

Are US IRA Distributions Taxable In France Harrison Brook

What Are The New Ira Distribution Rules Tutorial Pics