In the age of digital, where screens have become the dominant feature of our lives however, the attraction of tangible printed objects hasn't waned. Whatever the reason, whether for education such as creative projects or just adding a personal touch to your home, printables for free have become a valuable resource. Through this post, we'll dive deeper into "Are Ira Distributions Taxable In New York State," exploring what they are, how to find them and how they can improve various aspects of your lives.

Get Latest Are Ira Distributions Taxable In New York State Below

Are Ira Distributions Taxable In New York State

Are Ira Distributions Taxable In New York State - Are Ira Distributions Taxable In New York State, Are Roth Ira Distributions Taxable In New York State, Are Inherited Ira Distributions Taxable In New York State, Are Ira Distributions Taxable In Ny State, Are Ira Distributions Taxable In New York, Are Inherited Ira Distributions Taxable In Ny, Are Ira Distributions State Taxable

Some pension distributions from certain sources are nontaxable in the state of New York while others are taxable If your pension distributions are taxable you could still qualify

If a taxpayer receives a taxable distribution from a Roth IRA during the change of residence year the distribution income is included in New York adjusted gross income for the

Are Ira Distributions Taxable In New York State offer a wide variety of printable, downloadable resources available online for download at no cost. They come in many types, like worksheets, templates, coloring pages, and more. The beauty of Are Ira Distributions Taxable In New York State lies in their versatility as well as accessibility.

More of Are Ira Distributions Taxable In New York State

Are IRA Distributions Taxable If You Are Disabled YouTube

Are IRA Distributions Taxable If You Are Disabled YouTube

New York State allows retired taxpayers to exclude certain types of pensions and Social Security benefits from taxation but IRAs are used when calculating the

Yes in general regular IRA distributions are subject to the 20 000 exclusion There are really only two kinds of compensation that would be allowable

Printables for free have gained immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

The ability to customize: It is possible to tailor designs to suit your personal needs whether it's making invitations to organize your schedule or even decorating your house.

-

Education Value These Are Ira Distributions Taxable In New York State can be used by students of all ages, making them a useful tool for parents and educators.

-

Simple: The instant accessibility to a plethora of designs and templates is time-saving and saves effort.

Where to Find more Are Ira Distributions Taxable In New York State

5 Things To Know About Required Minimum Distributions AZ IRA Real Estate

5 Things To Know About Required Minimum Distributions AZ IRA Real Estate

The New York State Office of the State Comptroller s website is provided in English However the Google Translate option may help you to read it in other languages If

The federal government including Social Security benefits certain public authorities In addition income from pension plans described in section 114 of Title 4 of

Now that we've piqued your curiosity about Are Ira Distributions Taxable In New York State Let's look into where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection in Are Ira Distributions Taxable In New York State for different objectives.

- Explore categories such as the home, decor, organisation, as well as crafts.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free or flashcards as well as learning materials.

- The perfect resource for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for no cost.

- The blogs covered cover a wide spectrum of interests, ranging from DIY projects to planning a party.

Maximizing Are Ira Distributions Taxable In New York State

Here are some creative ways in order to maximize the use of printables that are free:

1. Home Decor

- Print and frame stunning art, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Print out free worksheets and activities to aid in learning at your home for the classroom.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Are Ira Distributions Taxable In New York State are a treasure trove of fun and practical tools for a variety of needs and pursuits. Their accessibility and flexibility make them a wonderful addition to the professional and personal lives of both. Explore the vast array of Are Ira Distributions Taxable In New York State right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Are Ira Distributions Taxable In New York State truly for free?

- Yes, they are! You can download and print these documents for free.

-

Do I have the right to use free templates for commercial use?

- It's based on the usage guidelines. Always verify the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Some printables may have restrictions in their usage. Make sure you read the terms and conditions provided by the designer.

-

How do I print printables for free?

- Print them at home with a printer or visit an in-store print shop to get superior prints.

-

What software must I use to open printables free of charge?

- The majority of printed documents are in the PDF format, and can be opened using free software, such as Adobe Reader.

Isolating IRA Basis For Tax Efficient Roth IRA Conversions

Roth IRA Withdrawal Rules Oblivious Investor

Check more sample of Are Ira Distributions Taxable In New York State below

Form 1040 Line 4 And Line 5 IRA Distributions Pensions And Annuities

7 Photos Inherited Ira Rmd Table 2018 And Description Alqu Blog

Social Security Cost Of Living Adjustments 2023

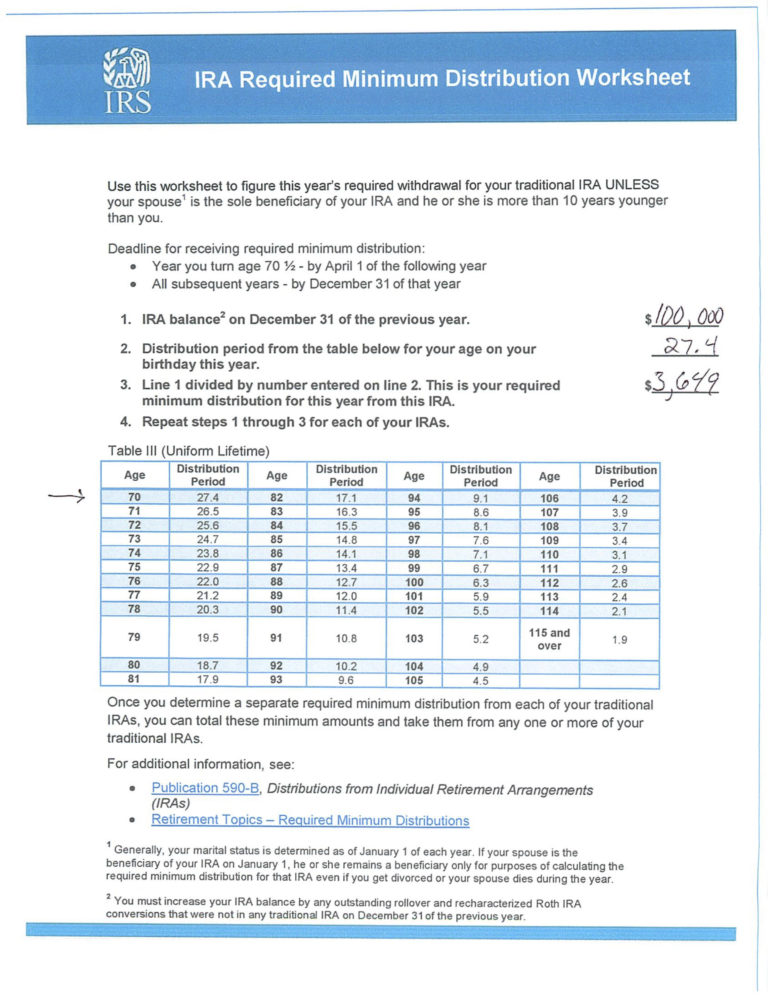

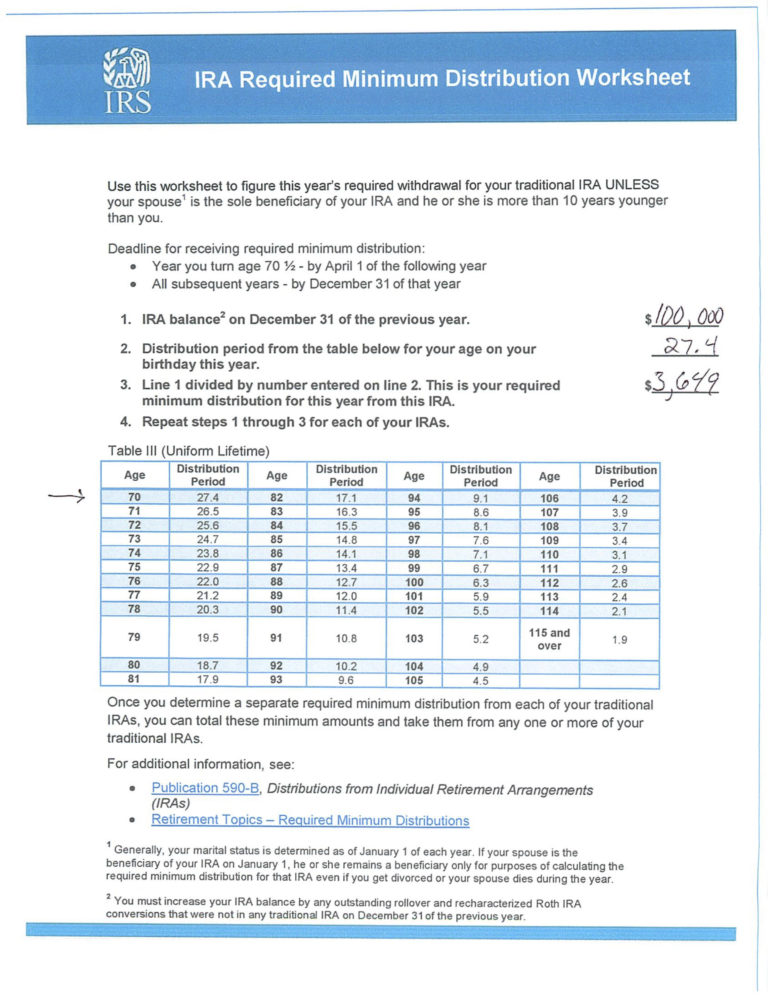

Ira Required Minimum Distribution Worksheet Yooob Db excel

New York Tax Rates Going Up With A Twist Hodgson Russ Noonan s

Are Electric Bikes Worth Buying

https://www.tax.ny.gov/pdf/memos/income/m98_7i.pdf

If a taxpayer receives a taxable distribution from a Roth IRA during the change of residence year the distribution income is included in New York adjusted gross income for the

https://www.aarp.org/money/taxes/info-2023/…

New York excludes 20 000 of annuity or retirement benefits for those 59 or older as well as government pension income from the U S New York State or New York localities California only

If a taxpayer receives a taxable distribution from a Roth IRA during the change of residence year the distribution income is included in New York adjusted gross income for the

New York excludes 20 000 of annuity or retirement benefits for those 59 or older as well as government pension income from the U S New York State or New York localities California only

Ira Required Minimum Distribution Worksheet Yooob Db excel

7 Photos Inherited Ira Rmd Table 2018 And Description Alqu Blog

New York Tax Rates Going Up With A Twist Hodgson Russ Noonan s

Are Electric Bikes Worth Buying

Are My Social Security Benefits Taxable Calculator

What Is A Roth IRA The Fancy Accountant

What Is A Roth IRA The Fancy Accountant

11 Step Guide To IRA Distributions