In a world where screens rule our lives and our lives are dominated by screens, the appeal of tangible printed objects hasn't waned. For educational purposes, creative projects, or just adding an element of personalization to your space, Are Inherited Ira Distributions Taxable In Ny can be an excellent resource. With this guide, you'll take a dive into the sphere of "Are Inherited Ira Distributions Taxable In Ny," exploring the benefits of them, where to get them, as well as how they can improve various aspects of your life.

Get Latest Are Inherited Ira Distributions Taxable In Ny Below

Are Inherited Ira Distributions Taxable In Ny

Are Inherited Ira Distributions Taxable In Ny - Are Inherited Ira Distributions Taxable In Ny, Are Inherited Ira Distributions Taxable, Is An Inherited Ira Taxable In Ny, Are Inherited Ira Distributions Taxable In Massachusetts, How Are Inherited Ira Distributions Taxed

Other than that scenario everything will probably be taxable in an inherited traditional IRA Do you want that giant tax hit as the beneficiary when you may be in your own highest earnings

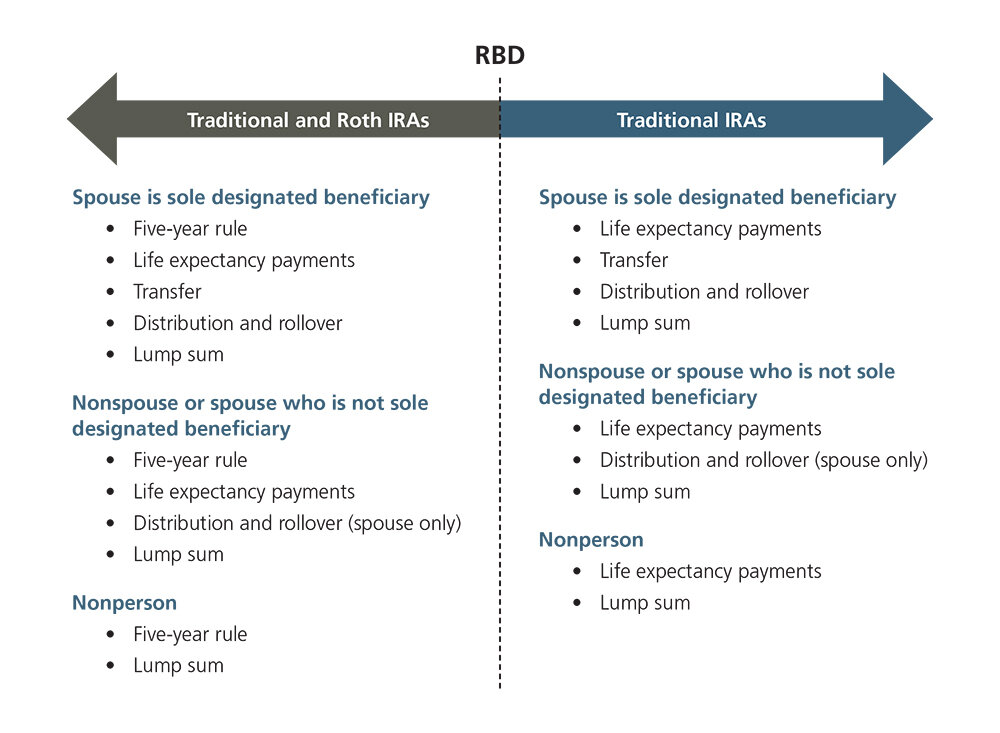

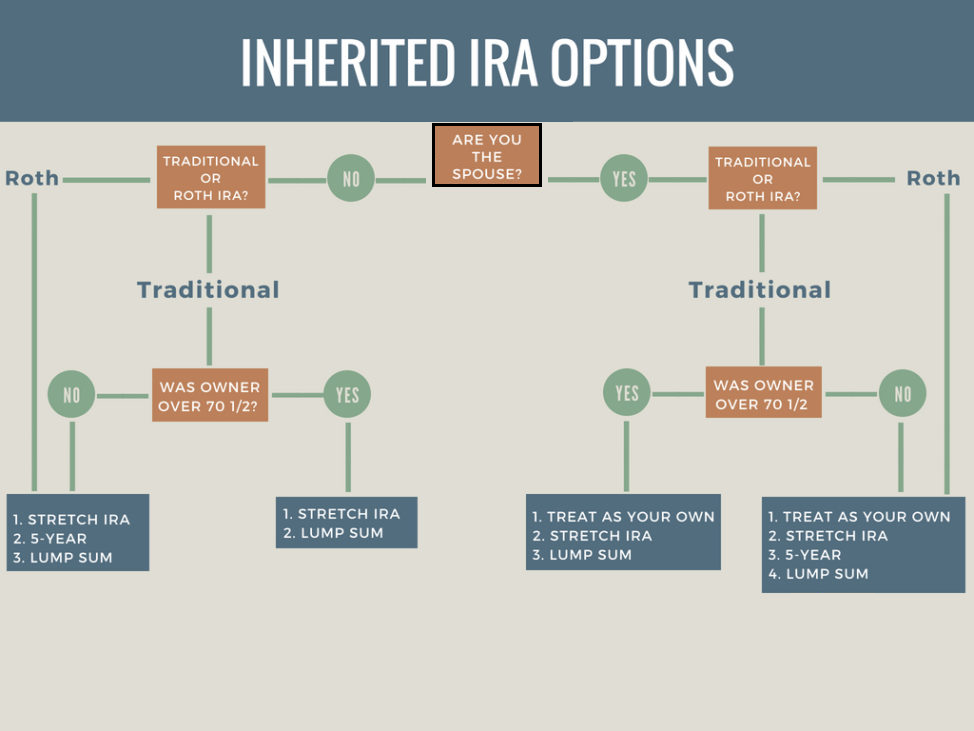

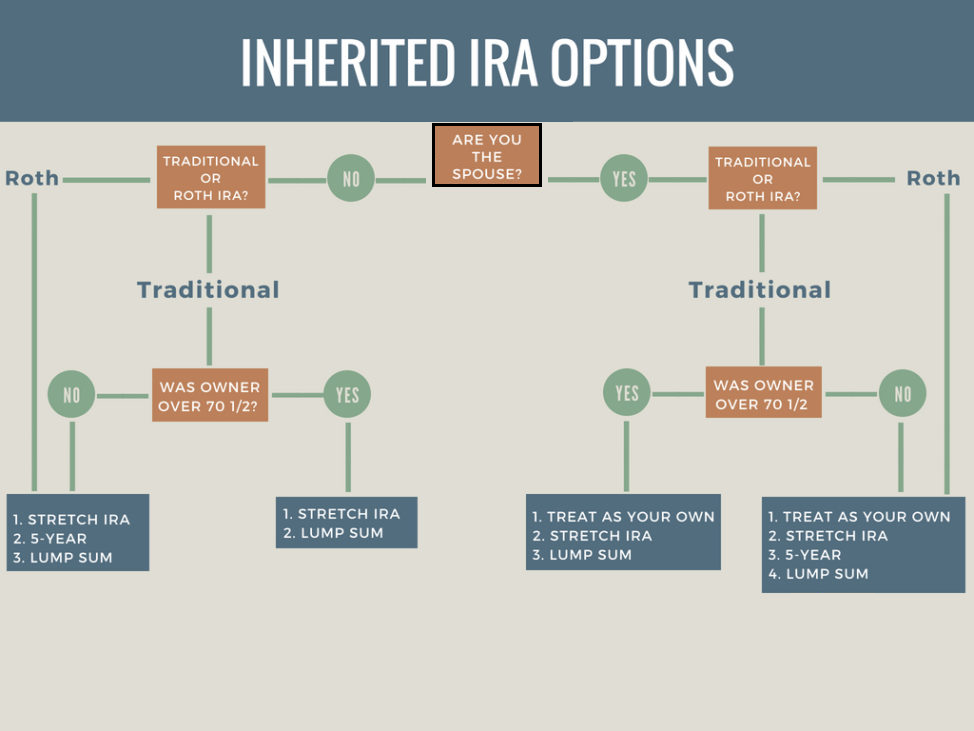

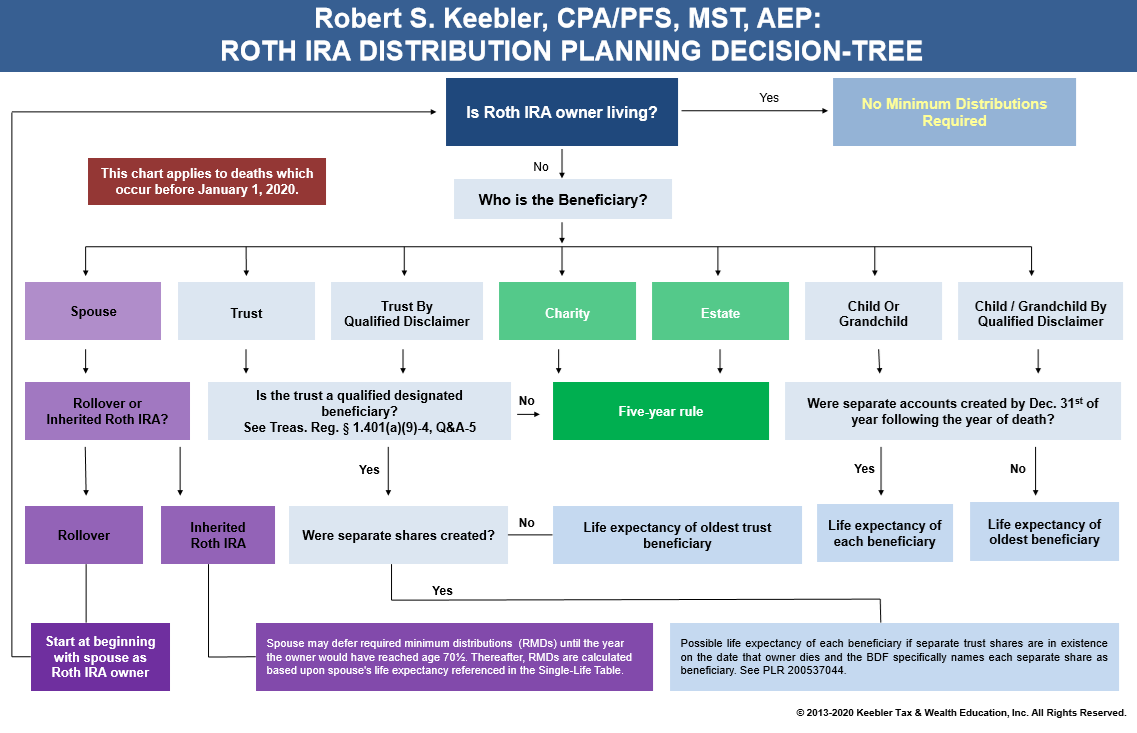

Distributions from an inherited IRA may be required Keep in mind though that any voluntary or required minimum distribution RMD from the account is taxable depending on the type of IRA

Printables for free cover a broad assortment of printable materials available online at no cost. They are available in a variety of types, like worksheets, templates, coloring pages, and much more. The beauty of Are Inherited Ira Distributions Taxable In Ny is their versatility and accessibility.

More of Are Inherited Ira Distributions Taxable In Ny

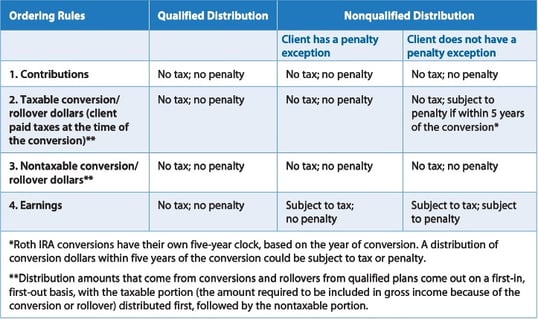

Isolating IRA Basis For Tax Efficient Roth IRA Conversions

Isolating IRA Basis For Tax Efficient Roth IRA Conversions

Accordingly with respect to the inherited IRA the individual and her brother are each entitled to an annual 10 000 pension and annuity income exclusion pursuant to section 612 c 3 a of the Tax Law and section 112 3 c 2 of the Regulations

IRA distributions are considered taxable income and they are not included in cash in hand when executing a will Typically inherited IRAs must be liquidated within 10 years

Are Inherited Ira Distributions Taxable In Ny have garnered immense popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Personalization It is possible to tailor printables to your specific needs whether you're designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational value: Printables for education that are free are designed to appeal to students of all ages, which makes them a useful tool for teachers and parents.

-

Affordability: immediate access many designs and templates helps save time and effort.

Where to Find more Are Inherited Ira Distributions Taxable In Ny

5 Things To Know About Required Minimum Distributions AZ IRA Real Estate

5 Things To Know About Required Minimum Distributions AZ IRA Real Estate

Generally non spouse beneficiaries take the IRA as an Inherited IRA and must withdraw the entire IRA balance on the 10th anniversary of the IRA holder s death Before the SECURE Act beneficiaries could take minimum required distributions over their own expected life spans known as the lifetime stretch

You ve written that IRA beneficiaries can share a 20 000 New York State tax exclusion My question Four sons inherit an IRA in equal shares from Mom who died after she had reached

We hope we've stimulated your curiosity about Are Inherited Ira Distributions Taxable In Ny Let's take a look at where you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Are Inherited Ira Distributions Taxable In Ny designed for a variety reasons.

- Explore categories such as interior decor, education, management, and craft.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets along with flashcards, as well as other learning materials.

- This is a great resource for parents, teachers, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for free.

- The blogs are a vast spectrum of interests, including DIY projects to planning a party.

Maximizing Are Inherited Ira Distributions Taxable In Ny

Here are some innovative ways ensure you get the very most use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print free worksheets to enhance learning at home for the classroom.

3. Event Planning

- Design invitations and banners and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable calendars or to-do lists. meal planners.

Conclusion

Are Inherited Ira Distributions Taxable In Ny are a treasure trove filled with creative and practical information for a variety of needs and pursuits. Their availability and versatility make them an essential part of both professional and personal lives. Explore the world of Are Inherited Ira Distributions Taxable In Ny today to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Are Inherited Ira Distributions Taxable In Ny truly cost-free?

- Yes, they are! You can download and print these items for free.

-

Can I use free templates for commercial use?

- It's based on the conditions of use. Always verify the guidelines of the creator prior to using the printables in commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Certain printables may be subject to restrictions on their use. You should read the terms and regulations provided by the designer.

-

How do I print printables for free?

- Print them at home using the printer, or go to the local print shops for better quality prints.

-

What program must I use to open Are Inherited Ira Distributions Taxable In Ny?

- Most PDF-based printables are available in the format of PDF, which can be opened with free software such as Adobe Reader.

Roth IRA Withdrawal Rules Oblivious Investor

Taxation And Investing Of Inherited IRA Distributions NJMoneyHelp

Check more sample of Are Inherited Ira Distributions Taxable In Ny below

IRA Beneficiary Options For Deaths Before January 1 2020 Ascensus

+1000px.jpg)

7 Photos Inherited Ira Rmd Table 2018 And Description Alqu Blog

Ira Required Minimum Distribution Table Ii Elcho Table

Form 1040 Line 4 And Line 5 IRA Distributions Pensions And Annuities

Ira Minimum Distribution Table Spouse 10 Years Younger Brokeasshome

/https://blogs-images.forbes.com/baldwin/files/2014/03/rmd_own_larger.png?resize=618%2C635&ssl=1)

Inheriting An IRA From Your Spouse Know Your Options New Century

https://www.investopedia.com/inherited-ira-rules...

Distributions from an inherited IRA may be required Keep in mind though that any voluntary or required minimum distribution RMD from the account is taxable depending on the type of IRA

https://www.fool.com/.../does-new-york-tax-iras.aspx

By Motley Fool Staff Updated Oct 16 2016 at 11 56AM New York state income tax rules give some special allowances for retirement distributions Find out more Traditional IRA

Distributions from an inherited IRA may be required Keep in mind though that any voluntary or required minimum distribution RMD from the account is taxable depending on the type of IRA

By Motley Fool Staff Updated Oct 16 2016 at 11 56AM New York state income tax rules give some special allowances for retirement distributions Find out more Traditional IRA

Form 1040 Line 4 And Line 5 IRA Distributions Pensions And Annuities

7 Photos Inherited Ira Rmd Table 2018 And Description Alqu Blog

/https://blogs-images.forbes.com/baldwin/files/2014/03/rmd_own_larger.png?resize=618%2C635&ssl=1)

Ira Minimum Distribution Table Spouse 10 Years Younger Brokeasshome

Inheriting An IRA From Your Spouse Know Your Options New Century

What Are The New Ira Distribution Rules Tutorial Pics

What Is A Roth IRA The Fancy Accountant

What Is A Roth IRA The Fancy Accountant

When Are Roth IRA Distributions Tax Free