In the digital age, where screens dominate our lives it's no wonder that the appeal of tangible printed objects hasn't waned. For educational purposes for creative projects, simply adding some personal flair to your home, printables for free have become a valuable resource. In this article, we'll dive in the world of "Are Foreign Pension Contributions Tax Deductible In Canada," exploring their purpose, where to find them and how they can enhance various aspects of your daily life.

Get Latest Are Foreign Pension Contributions Tax Deductible In Canada Below

National Insurance contribution rates%2C 2021–22.png?itok=iGs8c8Ix)

Are Foreign Pension Contributions Tax Deductible In Canada

Are Foreign Pension Contributions Tax Deductible In Canada - Are Foreign Pension Contributions Tax Deductible In Canada, Are Pension Contributions Tax Deductible In Canada, Are Employer Pension Contributions Tax Deductible In Canada, Are Pension Contributions Taxable In Canada, Are Employer Pension Contributions Taxable Canada

Generally Canada does not allow for foreign pension contributions to be deducted on the Canadian tax return and vice versa where the US does not allow

You may be able to deduct the contributions you made to a pension plan in a foreign country To find out how much you can deduct see line 20600

Are Foreign Pension Contributions Tax Deductible In Canada provide a diverse selection of printable and downloadable materials online, at no cost. They are available in a variety of types, like worksheets, templates, coloring pages and more. The benefit of Are Foreign Pension Contributions Tax Deductible In Canada is their versatility and accessibility.

More of Are Foreign Pension Contributions Tax Deductible In Canada

Taxation BA321 Short Quiz 008 Donations Made To The Following

Taxation BA321 Short Quiz 008 Donations Made To The Following

Under section 61 g and 56 1 of the Income Tax Act any payment received from a superannuation or pension benefits is generally considered taxable Canadian income even if it s from a foreign pension

Find information on the most common deductions and credits that can be claimed related to pension or annuity income Canada Pension Plan QPP and RRSP contributions on

Are Foreign Pension Contributions Tax Deductible In Canada have garnered immense popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

customization The Customization feature lets you tailor the templates to meet your individual needs such as designing invitations planning your schedule or decorating your home.

-

Educational Benefits: Education-related printables at no charge cater to learners from all ages, making them a great tool for parents and educators.

-

Affordability: Access to a variety of designs and templates saves time and effort.

Where to Find more Are Foreign Pension Contributions Tax Deductible In Canada

How Pension Contributions Work

How Pension Contributions Work

The short answer is maybe As Canadian residents we re taxed on worldwide income so withdrawals from foreign retirement accounts whether lump sum

Your contributions to a foreign social security arrangement might be eligible for a 15 non refundable tax credit Any foreign social security contributions that are over the limit for

Now that we've ignited your interest in printables for free Let's look into where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Are Foreign Pension Contributions Tax Deductible In Canada for various applications.

- Explore categories such as design, home decor, organisation, as well as crafts.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing with flashcards and other teaching materials.

- Ideal for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers post their original designs and templates at no cost.

- The blogs are a vast selection of subjects, ranging from DIY projects to planning a party.

Maximizing Are Foreign Pension Contributions Tax Deductible In Canada

Here are some fresh ways how you could make the most of Are Foreign Pension Contributions Tax Deductible In Canada:

1. Home Decor

- Print and frame beautiful artwork, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Print free worksheets to enhance learning at home as well as in the class.

3. Event Planning

- Invitations, banners and decorations for special events such as weddings and birthdays.

4. Organization

- Stay organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

Are Foreign Pension Contributions Tax Deductible In Canada are a treasure trove of fun and practical tools for a variety of needs and needs and. Their accessibility and flexibility make them a wonderful addition to both professional and personal lives. Explore the vast array of Are Foreign Pension Contributions Tax Deductible In Canada and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really are they free?

- Yes they are! You can download and print these resources at no cost.

-

Can I use free printables for commercial purposes?

- It's all dependent on the conditions of use. Be sure to read the rules of the creator before using their printables for commercial projects.

-

Do you have any copyright problems with Are Foreign Pension Contributions Tax Deductible In Canada?

- Some printables could have limitations in their usage. Be sure to review these terms and conditions as set out by the creator.

-

How can I print printables for free?

- You can print them at home with a printer or visit a local print shop for high-quality prints.

-

What software do I need to open printables for free?

- Most PDF-based printables are available in the format PDF. This can be opened using free programs like Adobe Reader.

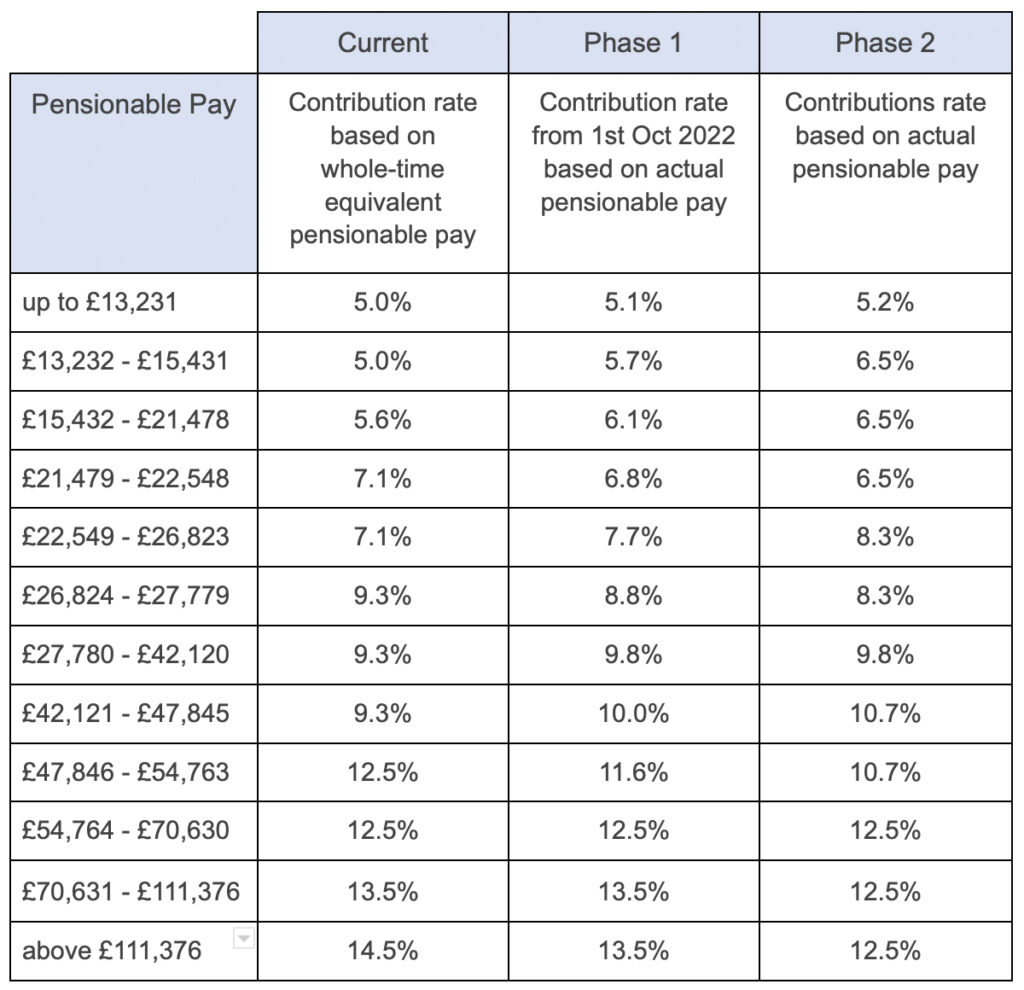

Changes In NHS Pension Contributions Are You A Winner Or Loser

Public Pension Funding It s No Easy Task Opinion Pennlive

Check more sample of Are Foreign Pension Contributions Tax Deductible In Canada below

Self Employed Business Tax Deduction Sheet A Success Of Your Business

Charitable Contributions Guide

Tax Free Pension Contributions The Ismaili

Foreign Pension Income Taxation A Canadian Tax Lawyer Analysis

Pending Rules Would Clarify Tax Break For Foreign Pension Funds

Annual Gift Tax Exclusion 2022 Irs Lesli Lowery

National Insurance contribution rates%2C 2021–22.png?itok=iGs8c8Ix?w=186)

https://www. canada.ca /en/revenue-agency/services...

You may be able to deduct the contributions you made to a pension plan in a foreign country To find out how much you can deduct see line 20600

https://www. canada.ca /en/revenue-agency/services/...

This form is used by individuals to calculate a deduction for contributions to a foreign employer sponsored pension plan or to a social security arrangement

You may be able to deduct the contributions you made to a pension plan in a foreign country To find out how much you can deduct see line 20600

This form is used by individuals to calculate a deduction for contributions to a foreign employer sponsored pension plan or to a social security arrangement

Foreign Pension Income Taxation A Canadian Tax Lawyer Analysis

Charitable Contributions Guide

Pending Rules Would Clarify Tax Break For Foreign Pension Funds

Annual Gift Tax Exclusion 2022 Irs Lesli Lowery

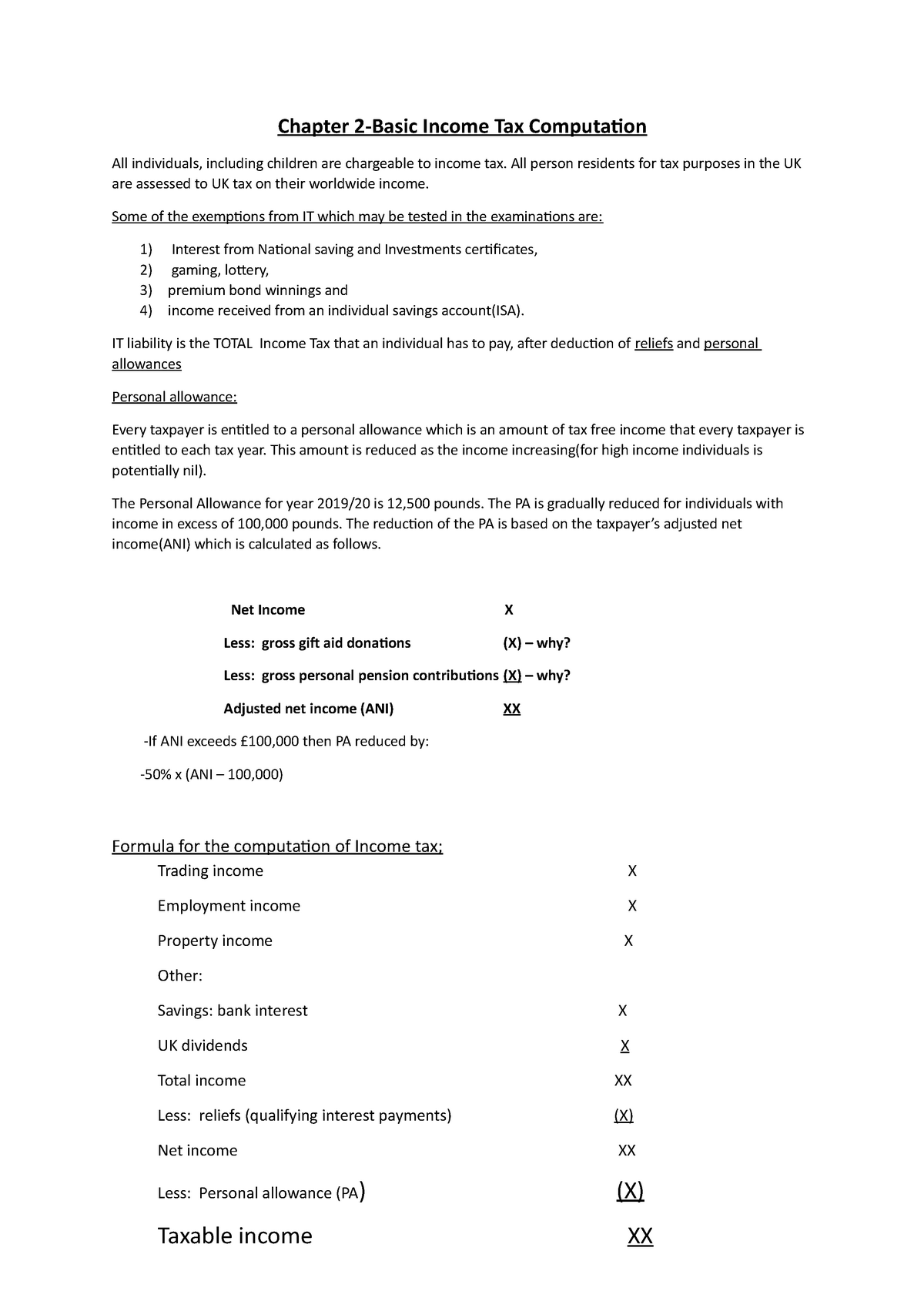

Lecture 1 Introdcution To Income Tax Chapter 2 Basic Income Tax

52 What Percent Of Your Income Should Your Mortgage Be InderjeetNuriya

52 What Percent Of Your Income Should Your Mortgage Be InderjeetNuriya

HSAs The Triple Tax Advantage Living On The Cheap Health Savings