Today, in which screens are the norm, the charm of tangible, printed materials hasn't diminished. It doesn't matter if it's for educational reasons such as creative projects or just adding an extra personal touch to your area, Are Employer Pension Contributions Tax Deductible In Canada are now a vital source. We'll dive into the world "Are Employer Pension Contributions Tax Deductible In Canada," exploring what they are, how to find them and how they can improve various aspects of your daily life.

Get Latest Are Employer Pension Contributions Tax Deductible In Canada Below

Are Employer Pension Contributions Tax Deductible In Canada

Are Employer Pension Contributions Tax Deductible In Canada -

Employer Contributions Many employer plans involve contributions from the employer sometimes matching or exceeding your contributions Simplicity and

Line 20700 Registered pension plan RPP deduction Generally you can deduct the total of all amounts from box 20 of your T4 slips box 032 of your T4A slips and on your

The Are Employer Pension Contributions Tax Deductible In Canada are a huge assortment of printable items that are available online at no cost. They come in many forms, including worksheets, coloring pages, templates and more. The great thing about Are Employer Pension Contributions Tax Deductible In Canada is in their variety and accessibility.

More of Are Employer Pension Contributions Tax Deductible In Canada

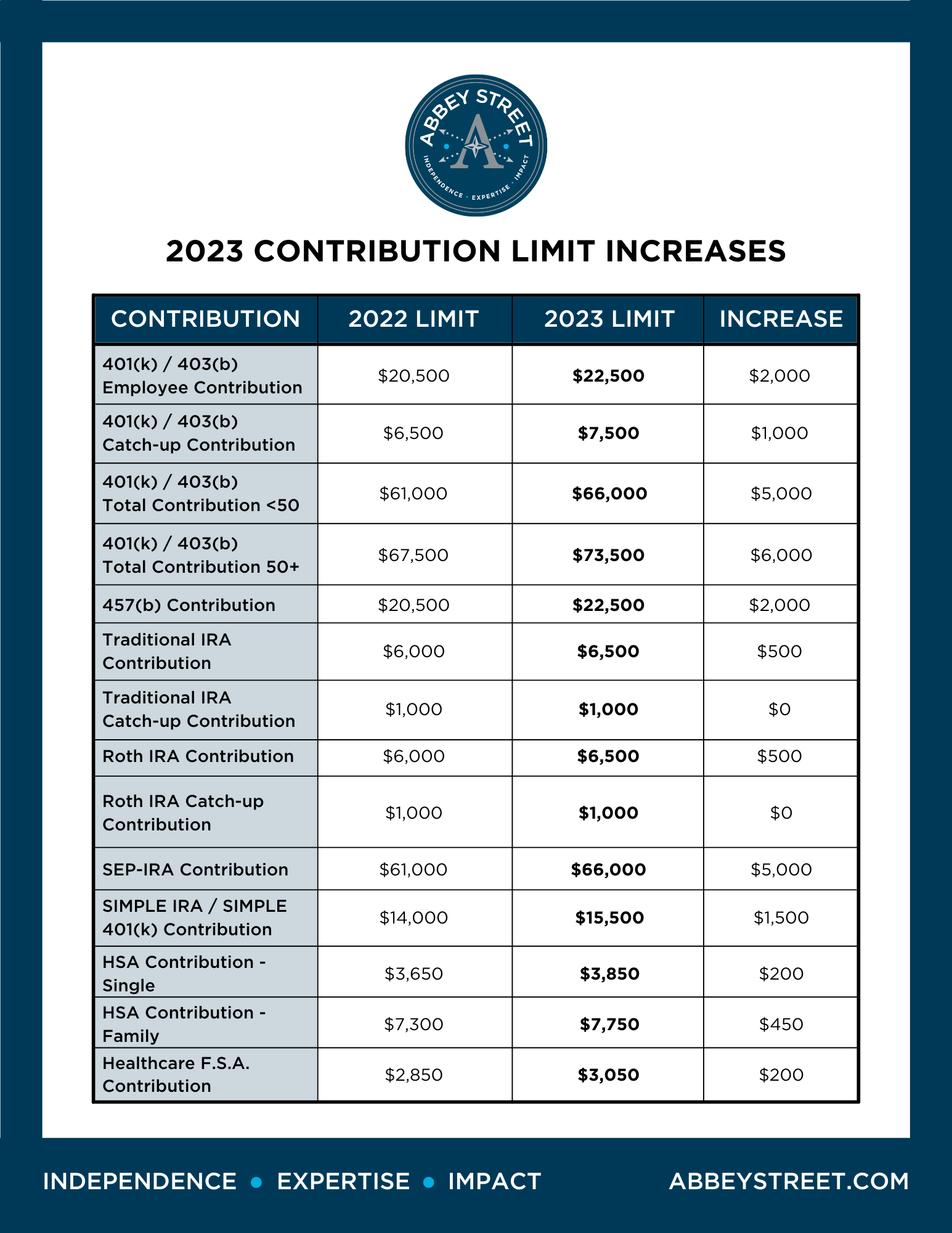

Tabela Salarial 2023 Irs Contribution Limits IMAGESEE

Tabela Salarial 2023 Irs Contribution Limits IMAGESEE

If you are a participant in an RPP you can deduct your employee contributions from your income on line 20700 of your return The income earned by the

RPP contributions whether they re made by you or your employer are not taxed for Canadian residents Canadians living abroad may have to pay local taxes If you live outside of Canada check with the local tax office

The Are Employer Pension Contributions Tax Deductible In Canada have gained huge popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or costly software.

-

Personalization This allows you to modify the templates to meet your individual needs be it designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Use: The free educational worksheets cater to learners of all ages, which makes these printables a powerful source for educators and parents.

-

Convenience: instant access numerous designs and templates is time-saving and saves effort.

Where to Find more Are Employer Pension Contributions Tax Deductible In Canada

Employer Contribution May Be Tax Free Under National Pension Scheme

Employer Contribution May Be Tax Free Under National Pension Scheme

Registered Pension Plan withdrawals are all taxable income at your current marginal tax rate Defined Benefit Pension Plan paid in regular installments Defined

Employers in Canada are responsible for deducting and matching employees CPP QPP and EI contributions Employers payroll obligations include

We've now piqued your interest in printables for free Let's look into where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection in Are Employer Pension Contributions Tax Deductible In Canada for different goals.

- Explore categories like decoration for your home, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing, flashcards, and learning materials.

- Great for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates, which are free.

- The blogs are a vast array of topics, ranging that includes DIY projects to party planning.

Maximizing Are Employer Pension Contributions Tax Deductible In Canada

Here are some unique ways for you to get the best of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, or festive decorations to decorate your living areas.

2. Education

- Use printable worksheets for free to enhance learning at home also in the classes.

3. Event Planning

- Design invitations, banners, and decorations for special occasions like birthdays and weddings.

4. Organization

- Be organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Are Employer Pension Contributions Tax Deductible In Canada are an abundance of creative and practical resources which cater to a wide range of needs and preferences. Their access and versatility makes these printables a useful addition to each day life. Explore the plethora of printables for free today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really are they free?

- Yes, they are! You can download and print these materials for free.

-

Are there any free printouts for commercial usage?

- It's all dependent on the rules of usage. Always review the terms of use for the creator before using any printables on commercial projects.

-

Do you have any copyright violations with printables that are free?

- Certain printables could be restricted regarding usage. Make sure to read the terms of service and conditions provided by the creator.

-

How can I print printables for free?

- You can print them at home using your printer or visit a print shop in your area for high-quality prints.

-

What software do I require to open Are Employer Pension Contributions Tax Deductible In Canada?

- The majority of printed documents are in PDF format, which can be opened with free software such as Adobe Reader.

National Insurance Contributions Explained IFS Taxlab

National Insurance contribution rates%2C 2021–22.png?itok=iGs8c8Ix)

Cu nto Paga Un Empleador En Impuestos Sobre La N mina Tasa De

Check more sample of Are Employer Pension Contributions Tax Deductible In Canada below

Self Employed Pension Contributions Tax Deductible Ways To Make Money

How Pension Contributions Work

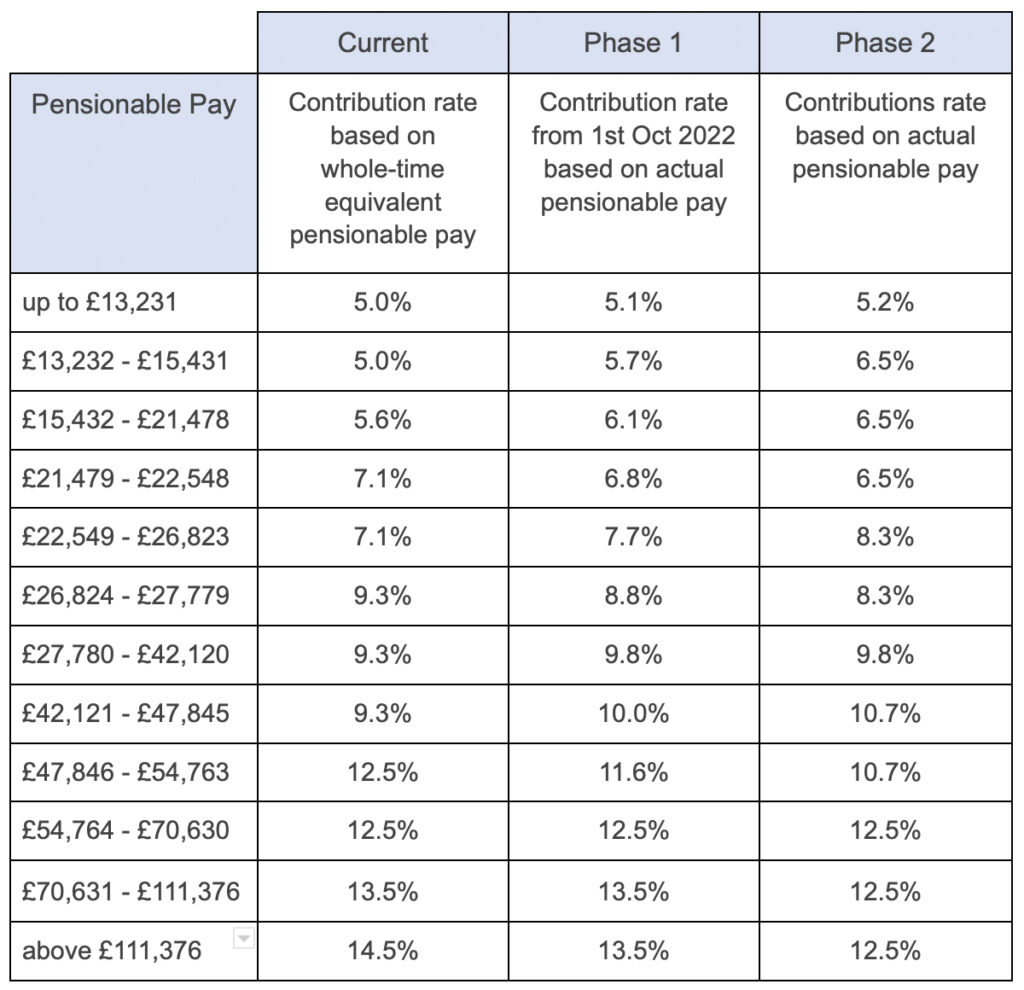

Changes In NHS Pension Contributions Are You A Winner Or Loser

Employer Pension Contributions Calculator Factorial

Public Pension Funding It s No Easy Task Opinion Pennlive

Brilliant Tax Write Off Template Stores Inventory Excel Format

https://www.canada.ca/en/revenue-agency/services...

Line 20700 Registered pension plan RPP deduction Generally you can deduct the total of all amounts from box 20 of your T4 slips box 032 of your T4A slips and on your

https://www.canada.ca/en/revenue-agency/services/...

Find information on the most common deductions and credits that can be claimed related to pension or annuity income Canada Pension Plan QPP and RRSP contributions on

Line 20700 Registered pension plan RPP deduction Generally you can deduct the total of all amounts from box 20 of your T4 slips box 032 of your T4A slips and on your

Find information on the most common deductions and credits that can be claimed related to pension or annuity income Canada Pension Plan QPP and RRSP contributions on

Employer Pension Contributions Calculator Factorial

How Pension Contributions Work

Public Pension Funding It s No Easy Task Opinion Pennlive

Brilliant Tax Write Off Template Stores Inventory Excel Format

Pension Contributions Tax Efficient For Both Employee Employer

Pension Contributions Tax Efficient For Both Employee Employer

Epf Contribution Rate Table JADUAL SOCSO PDF Epf Or Employee