Today, with screens dominating our lives yet the appeal of tangible printed objects hasn't waned. No matter whether it's for educational uses or creative projects, or simply to add an extra personal touch to your home, printables for free are now a useful resource. In this article, we'll dive in the world of "Are 401 K Distributions Taxable After Retirement," exploring the benefits of them, where to get them, as well as how they can be used to enhance different aspects of your daily life.

Get Latest Are 401 K Distributions Taxable After Retirement Below

Are 401 K Distributions Taxable After Retirement

Are 401 K Distributions Taxable After Retirement - Are 401 K Distributions Taxable After Retirement, How Are 401 K Distributions Taxed In Retirement, Are 401k Distributions Taxable, Do You Pay Taxes On 401k Withdrawals After Retirement, Do You Pay Taxes On 401k Distributions

All traditional 401 k plan withdrawals are considered income and subject to income tax as 401 k contributions are made with pretax dollars As a result retirement savers enjoy a

If you have a traditional 401 k you ll pay a 401 k distribution tax when you take the funds out at retirement If you have 401 k s with former employers a rollover to a Roth IRA or a 401 k account with your current employer might be a good option

Printables for free include a vast array of printable documents that can be downloaded online at no cost. The resources are offered in a variety styles, from worksheets to coloring pages, templates and much more. The beauty of Are 401 K Distributions Taxable After Retirement lies in their versatility as well as accessibility.

More of Are 401 K Distributions Taxable After Retirement

Qu est ce Qu un 401 k Et Comment a Marche 2023

:max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png)

Qu est ce Qu un 401 k Et Comment a Marche 2023

A loan from your employer s 401 k plan is not taxable if it meets the criteria below Generally if permitted by your plan you may borrow up to 50 of your vested account balance up to a maximum of 50 000

All 401 k plans offer specific tax advantages making them a great way to save for retirement Contributions to a traditional 401 k plan as well as any employer matches and earnings in the

The Are 401 K Distributions Taxable After Retirement have gained huge popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to purchase physical copies or costly software.

-

Personalization The Customization feature lets you tailor printed materials to meet your requirements when it comes to designing invitations, organizing your schedule, or decorating your home.

-

Education Value Downloads of educational content for free are designed to appeal to students of all ages. This makes them a useful tool for parents and teachers.

-

Accessibility: Instant access to a variety of designs and templates cuts down on time and efforts.

Where to Find more Are 401 K Distributions Taxable After Retirement

What Are The Benefits Of Having 401 k Plan

What Are The Benefits Of Having 401 k Plan

You may be eligible for a 401 k tax deduction if you have a retirement account Read about contribution limits employer contributions and tax deferred options There s a good chance that when you signed up for your employer s retirement plan you signed up for a traditional 401 k

A withdrawal you make from a 401 k after you retire is officially known as a distribution While you ve deferred taxes until now these distributions are now taxed as regular income That means you will pay the regular income tax

We hope we've stimulated your curiosity about Are 401 K Distributions Taxable After Retirement Let's see where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of printables that are free for a variety of needs.

- Explore categories such as home decor, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free, flashcards, and learning tools.

- This is a great resource for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs or templates for download.

- These blogs cover a broad array of topics, ranging everything from DIY projects to planning a party.

Maximizing Are 401 K Distributions Taxable After Retirement

Here are some new ways create the maximum value use of printables for free:

1. Home Decor

- Print and frame stunning art, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Use free printable worksheets for reinforcement of learning at home (or in the learning environment).

3. Event Planning

- Create invitations, banners, and other decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable planners as well as to-do lists and meal planners.

Conclusion

Are 401 K Distributions Taxable After Retirement are a treasure trove of creative and practical resources catering to different needs and interests. Their accessibility and flexibility make them a valuable addition to both professional and personal lives. Explore the vast array of Are 401 K Distributions Taxable After Retirement now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Are 401 K Distributions Taxable After Retirement truly completely free?

- Yes they are! You can print and download these resources at no cost.

-

Does it allow me to use free printing templates for commercial purposes?

- It's based on the conditions of use. Always review the terms of use for the creator before using any printables on commercial projects.

-

Are there any copyright concerns with Are 401 K Distributions Taxable After Retirement?

- Certain printables might have limitations concerning their use. Check the terms and regulations provided by the author.

-

How can I print Are 401 K Distributions Taxable After Retirement?

- Print them at home using an printer, or go to an area print shop for high-quality prints.

-

What program will I need to access printables that are free?

- Many printables are offered in PDF format. These can be opened with free software such as Adobe Reader.

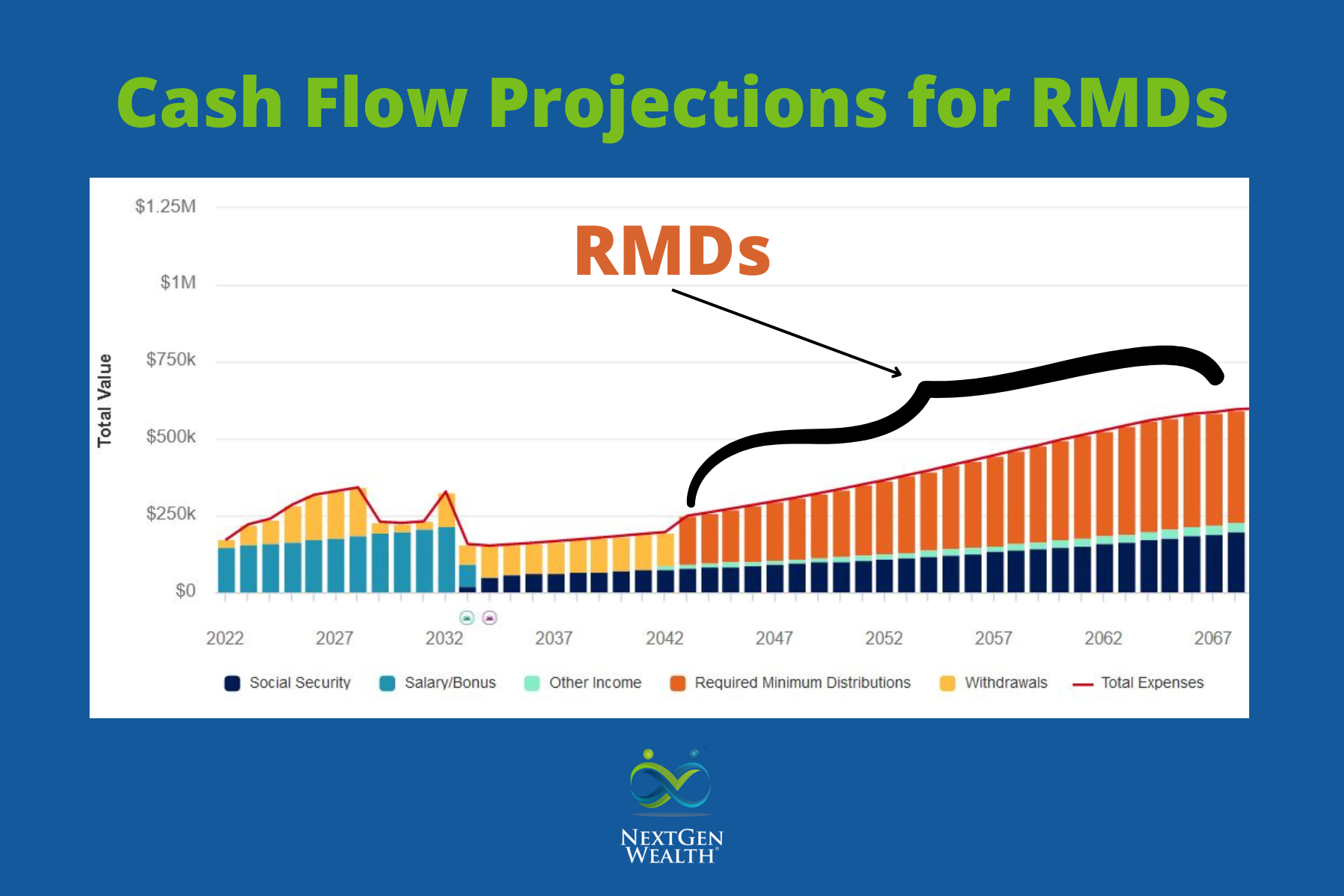

Will Required Minimum Distributions Affect My Retirement

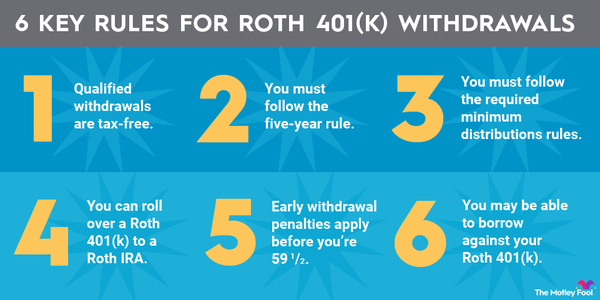

6 Things To Know About Roth 401 k Withdrawals The Motley Fool

Check more sample of Are 401 K Distributions Taxable After Retirement below

5 Things To Know About Required Minimum Distributions AZ IRA Real Estate

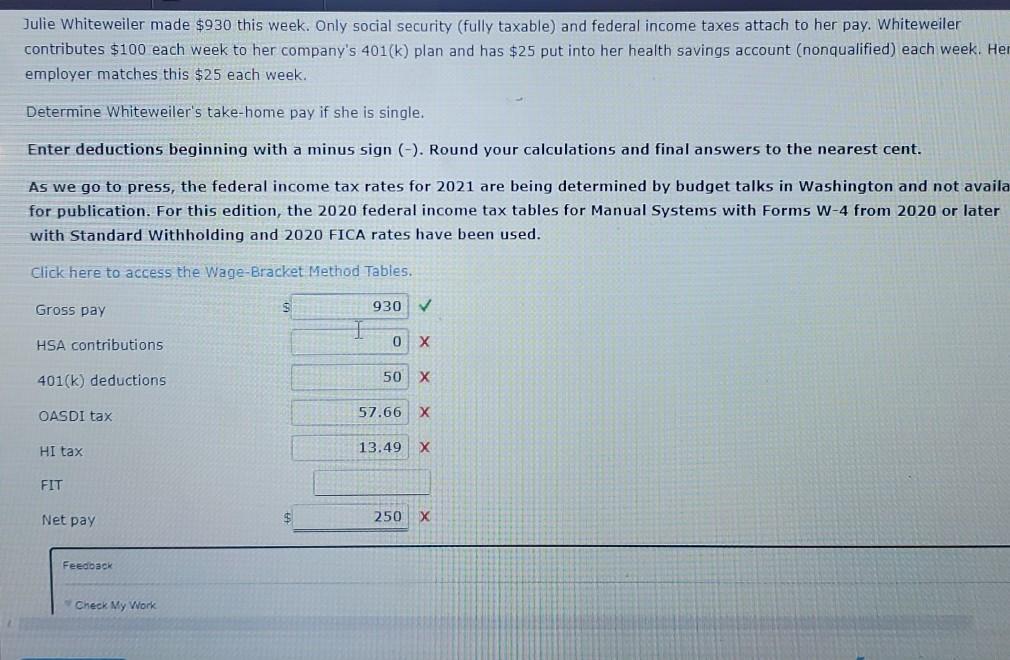

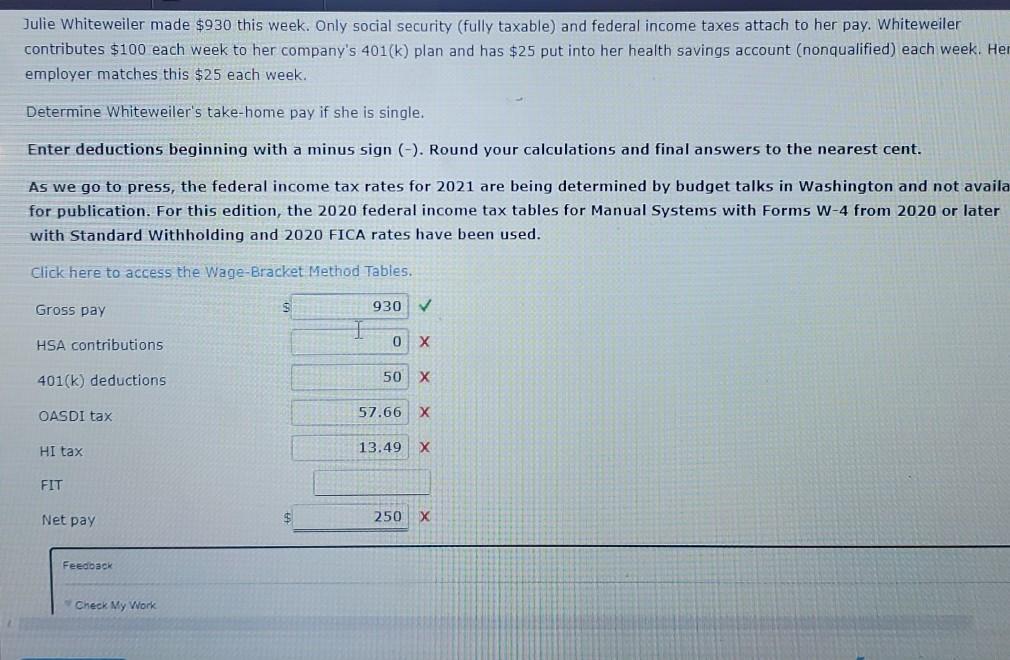

Solved Julie Whiteweiler Made 930 This Week Only Social Chegg

Cares Act 401k Withdrawal Taxes Calculator FayezTarran

After Tax 401 k Contribution Definition Pros Cons Rollover

5 Ways To Catch Up On 401 k Retirement Savings After 50 401k

Isolating IRA Basis For Tax Efficient Roth IRA Conversions

https://retirable.com/advice/retirement-accounts/...

If you have a traditional 401 k you ll pay a 401 k distribution tax when you take the funds out at retirement If you have 401 k s with former employers a rollover to a Roth IRA or a 401 k account with your current employer might be a good option

:max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png?w=186)

https://www.investopedia.com/articles/personal...

Most Americans retire in their mid 60s and the Internal Revenue Service IRS allows you to begin taking distributions from your 401 k without a 10 early withdrawal penalty as soon as you are

If you have a traditional 401 k you ll pay a 401 k distribution tax when you take the funds out at retirement If you have 401 k s with former employers a rollover to a Roth IRA or a 401 k account with your current employer might be a good option

Most Americans retire in their mid 60s and the Internal Revenue Service IRS allows you to begin taking distributions from your 401 k without a 10 early withdrawal penalty as soon as you are

After Tax 401 k Contribution Definition Pros Cons Rollover

Solved Julie Whiteweiler Made 930 This Week Only Social Chegg

5 Ways To Catch Up On 401 k Retirement Savings After 50 401k

Isolating IRA Basis For Tax Efficient Roth IRA Conversions

/GettyImages-580502689-578f02c03df78c09e9bbe87b.jpg)

Inherited A 401 k Account Here Are The Rules You Must Follow

Golden Rule 401 k

Golden Rule 401 k

What To Do If You Have To Take An Early Withdrawal From Your Solo 401k