In this age of technology, in which screens are the norm and our lives are dominated by screens, the appeal of tangible, printed materials hasn't diminished. Whether it's for educational purposes and creative work, or just adding an element of personalization to your home, printables for free have become an invaluable source. Through this post, we'll dive in the world of "Agriculture Income Tax Rebate," exploring their purpose, where to locate them, and the ways that they can benefit different aspects of your daily life.

Get Latest Agriculture Income Tax Rebate Below

Agriculture Income Tax Rebate

Agriculture Income Tax Rebate - Agriculture Income Tax Rebate, Agriculture Income Tax Exemption Limit, Agriculture Income Tax Return Form, Agriculture Income Tax Return, Agriculture Income Tax Return File, Agriculture Income Tax Deduction, Farm Income Tax Deductions, Farm Income Tax Return, Agricultural Land Income Tax Exemption, Assam Agricultural Income Tax Exemption

Web 10 janv 2022 nbsp 0183 32 13 4 5Y CAGR What is Agricultural Income Section 2 1A of the Income Tax Act 1961 provides the meaning of the agricultural income for the purpose of

Web A complete tax rebate is possible if The total agricultural income is lt Rs 5 000 The income from agricultural land is your only source of income no other income You have both agricultural income and other income

Agriculture Income Tax Rebate provide a diverse assortment of printable materials that are accessible online for free cost. They come in many designs, including worksheets coloring pages, templates and much more. One of the advantages of Agriculture Income Tax Rebate is in their versatility and accessibility.

More of Agriculture Income Tax Rebate

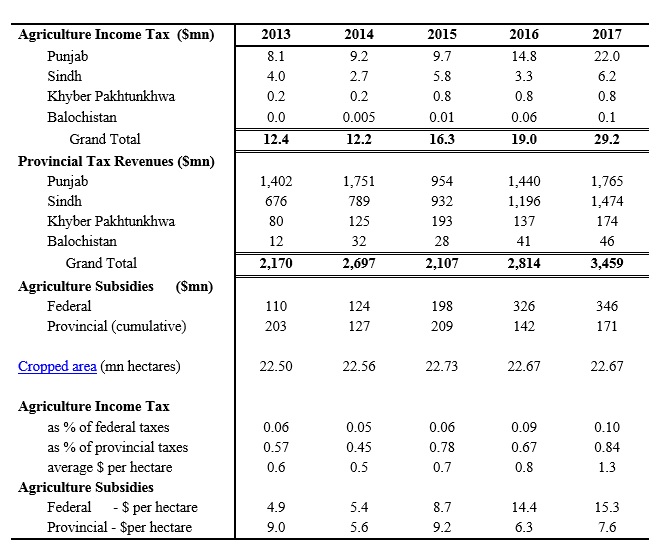

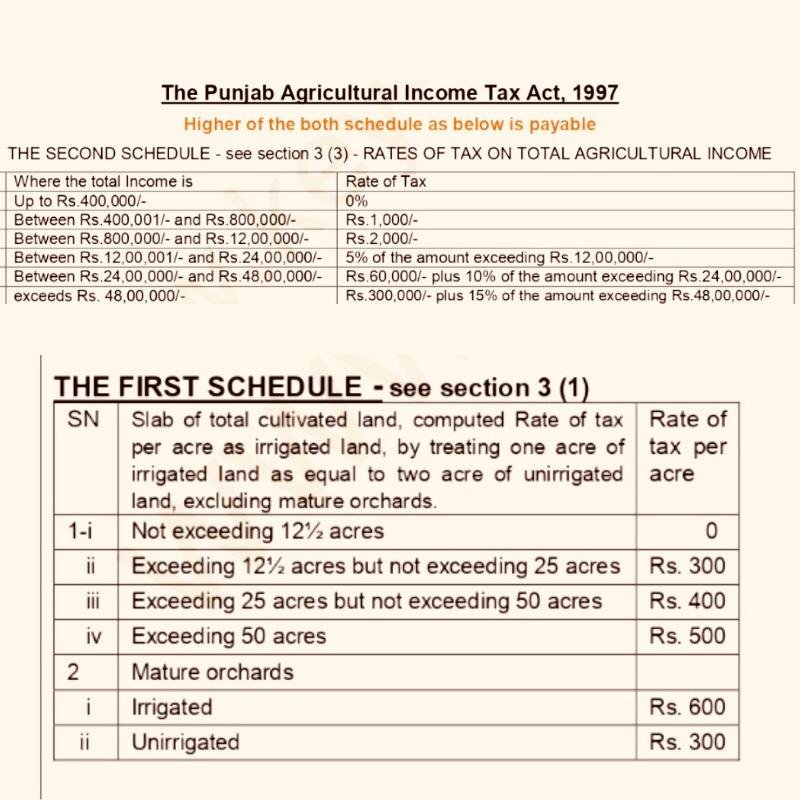

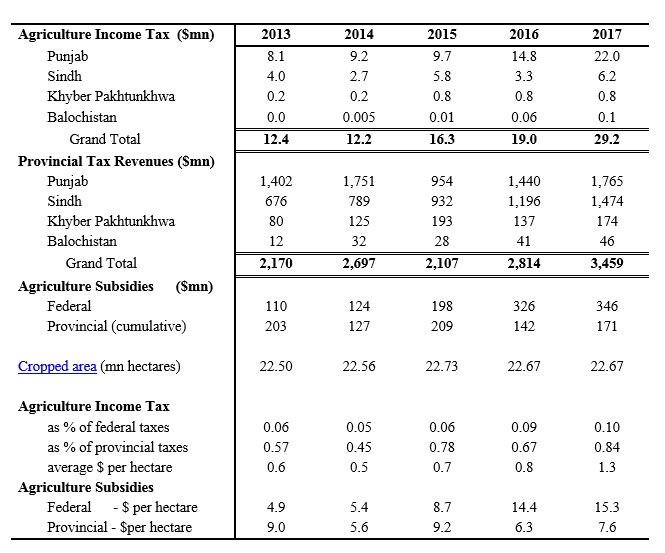

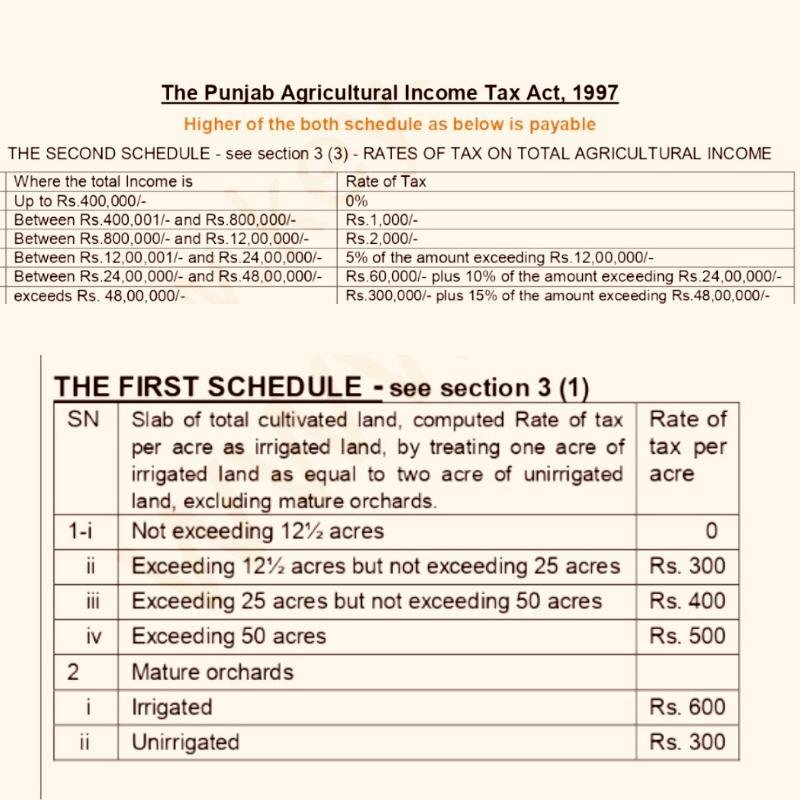

Tax On Agricultural Income In Pakistan Latest Tax Financial News

Tax On Agricultural Income In Pakistan Latest Tax Financial News

Web Total income minus this net agricultural income is higher than the exemption limit of Rs 2 50 000 for individuals below 60 years of age Rs 3 00 000 for senior citizens and Rs

Web Is agricultural income exempt from income tax Income from agriculture is exempt if the net agricultural income is less than Rs 5000 or if the total income apart from

Agriculture Income Tax Rebate have gained immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

Flexible: Your HTML0 customization options allow you to customize printables to fit your particular needs in designing invitations planning your schedule or decorating your home.

-

Educational value: Printables for education that are free offer a wide range of educational content for learners of all ages. This makes these printables a powerful tool for parents and educators.

-

Simple: Instant access to a variety of designs and templates, which saves time as well as effort.

Where to Find more Agriculture Income Tax Rebate

Section 87A Income Tax Rebate Under Section 87A For FY 2019 20

Section 87A Income Tax Rebate Under Section 87A For FY 2019 20

Web 19 f 233 vr 2022 nbsp 0183 32 1 Assessee is Individual HUF AOP BOI AJP 2 Agriculture Income more that 5000 3 Non agriculture income is more than basic exemption limit Let us

Web 17 janv 2016 nbsp 0183 32 The rebate on agricultural income is calculated in the following manner 1 Calculate the total taxable income along with agricultural income 2 Then calculate tax

If we've already piqued your curiosity about Agriculture Income Tax Rebate and other printables, let's discover where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of Agriculture Income Tax Rebate suitable for many motives.

- Explore categories such as decorating your home, education, management, and craft.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing with flashcards and other teaching tools.

- Great for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their creative designs with templates and designs for free.

- These blogs cover a broad range of interests, everything from DIY projects to planning a party.

Maximizing Agriculture Income Tax Rebate

Here are some inventive ways that you can make use use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or other seasonal decorations to fill your living spaces.

2. Education

- Utilize free printable worksheets to build your knowledge at home as well as in the class.

3. Event Planning

- Make invitations, banners as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

Agriculture Income Tax Rebate are an abundance of practical and innovative resources designed to meet a range of needs and interest. Their availability and versatility make them a great addition to the professional and personal lives of both. Explore the endless world of Agriculture Income Tax Rebate right now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really available for download?

- Yes, they are! You can print and download these files for free.

-

Do I have the right to use free printouts for commercial usage?

- It's dependent on the particular rules of usage. Always check the creator's guidelines before using printables for commercial projects.

-

Do you have any copyright problems with printables that are free?

- Certain printables might have limitations regarding usage. Check these terms and conditions as set out by the author.

-

How do I print Agriculture Income Tax Rebate?

- Print them at home with a printer or visit a local print shop for top quality prints.

-

What program is required to open printables at no cost?

- The majority of PDF documents are provided in the format PDF. This can be opened with free programs like Adobe Reader.

Agriculture Accelerator Fund To Be Setup To Union Budget 2023

Income Tax On Agriculture Income Easily Explained By TaxHelpdesk

Check more sample of Agriculture Income Tax Rebate below

2007 Tax Rebate Tax Deduction Rebates

Know About Agricultural Income Tax In Details

.jpg)

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

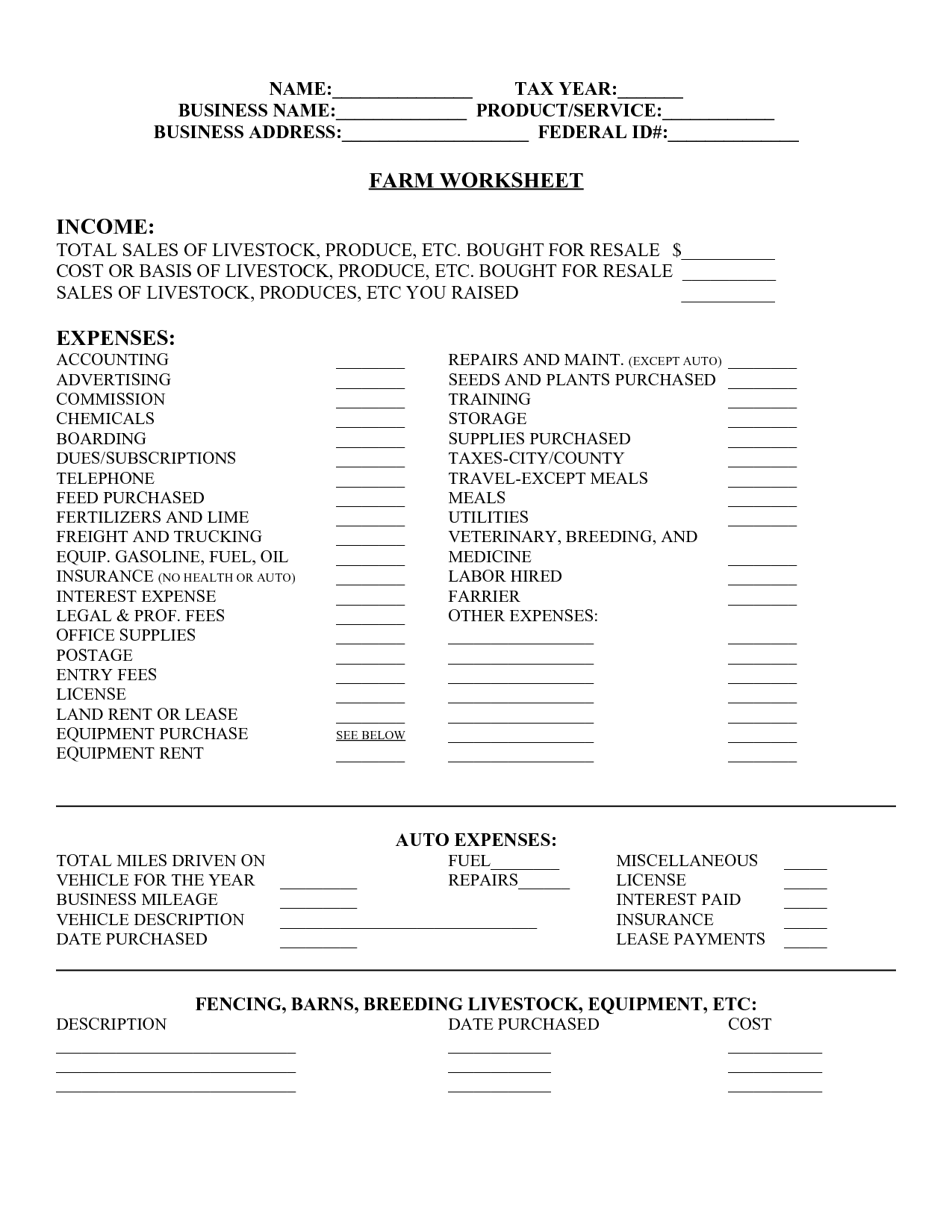

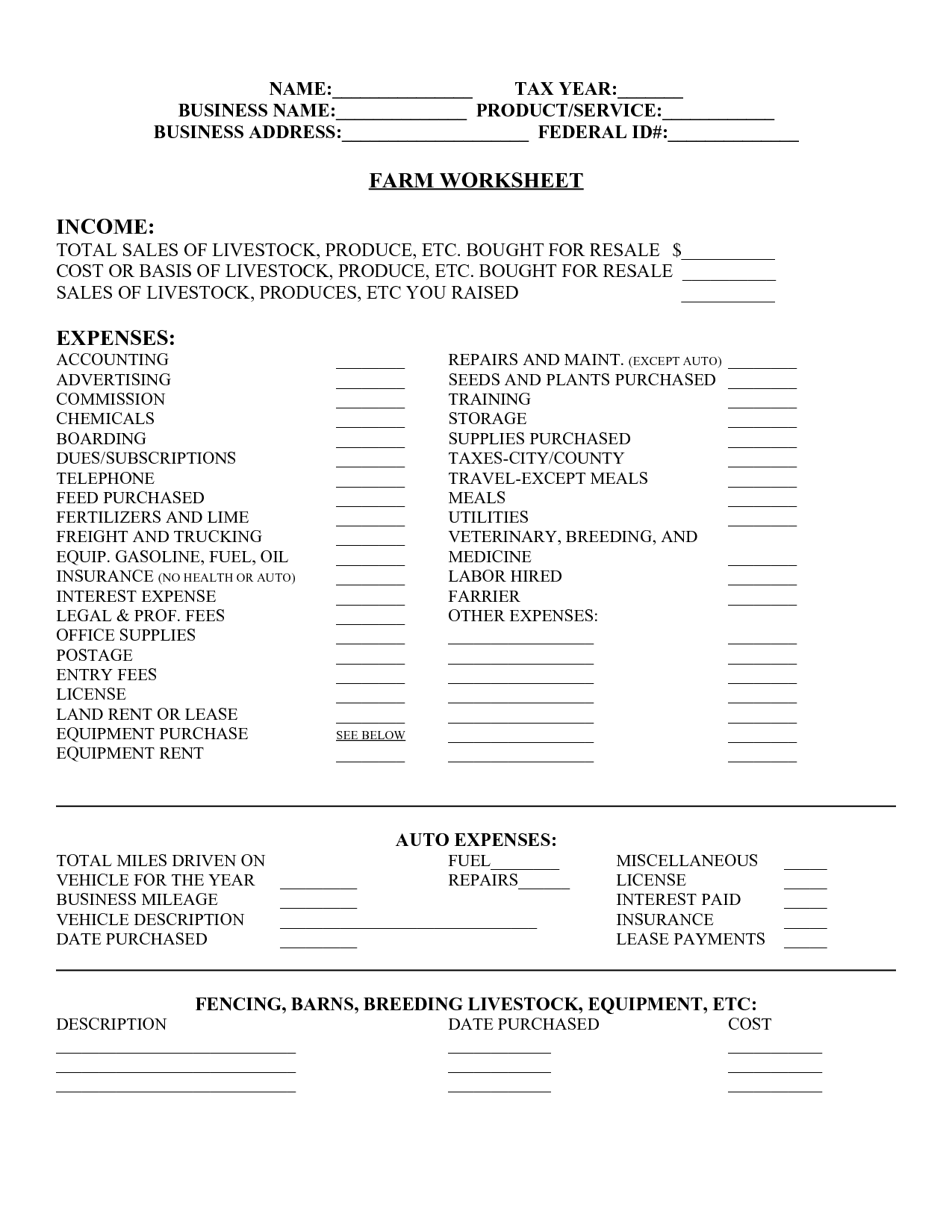

14 Monthly Income Expense Worksheet Template Worksheeto

Section 87A Tax Rebate Under Section 87A

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://saral.pro/blogs/agricultural-income

Web A complete tax rebate is possible if The total agricultural income is lt Rs 5 000 The income from agricultural land is your only source of income no other income You have both agricultural income and other income

https://taxguru.in/income-tax/calculate-tax-a…

Web 18 mars 2020 nbsp 0183 32 Agricultural income is exempt from Income Tax under section 10 1 of the Income Tax Act 1961 However its included for rate purposes in computing the Income Tax Liability if following two

Web A complete tax rebate is possible if The total agricultural income is lt Rs 5 000 The income from agricultural land is your only source of income no other income You have both agricultural income and other income

Web 18 mars 2020 nbsp 0183 32 Agricultural income is exempt from Income Tax under section 10 1 of the Income Tax Act 1961 However its included for rate purposes in computing the Income Tax Liability if following two

14 Monthly Income Expense Worksheet Template Worksheeto

.jpg)

Know About Agricultural Income Tax In Details

Section 87A Tax Rebate Under Section 87A

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Know New Rebate Under Section 87A Budget 2023

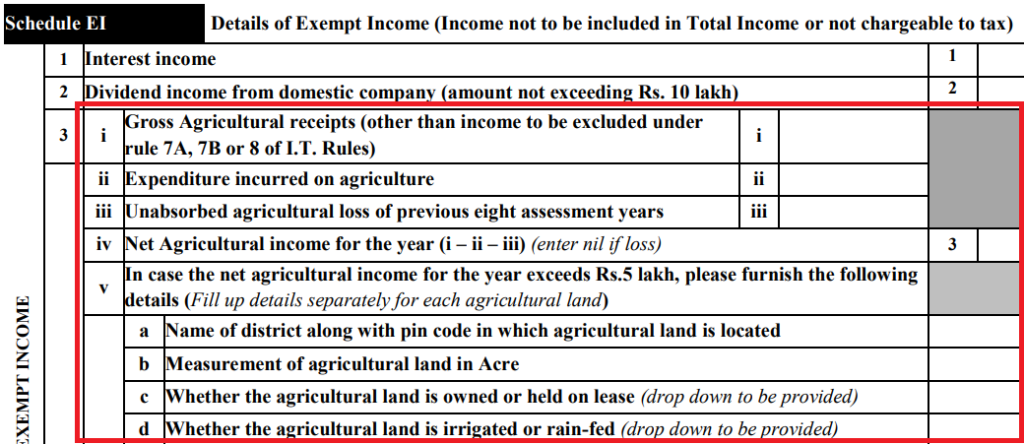

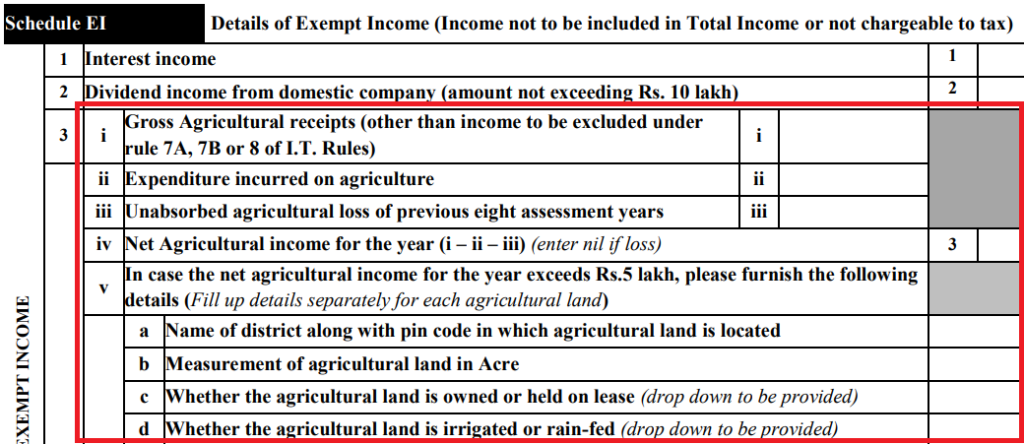

Key Changes In Income Tax Return ITR Forms For AY 2019 20

Key Changes In Income Tax Return ITR Forms For AY 2019 20

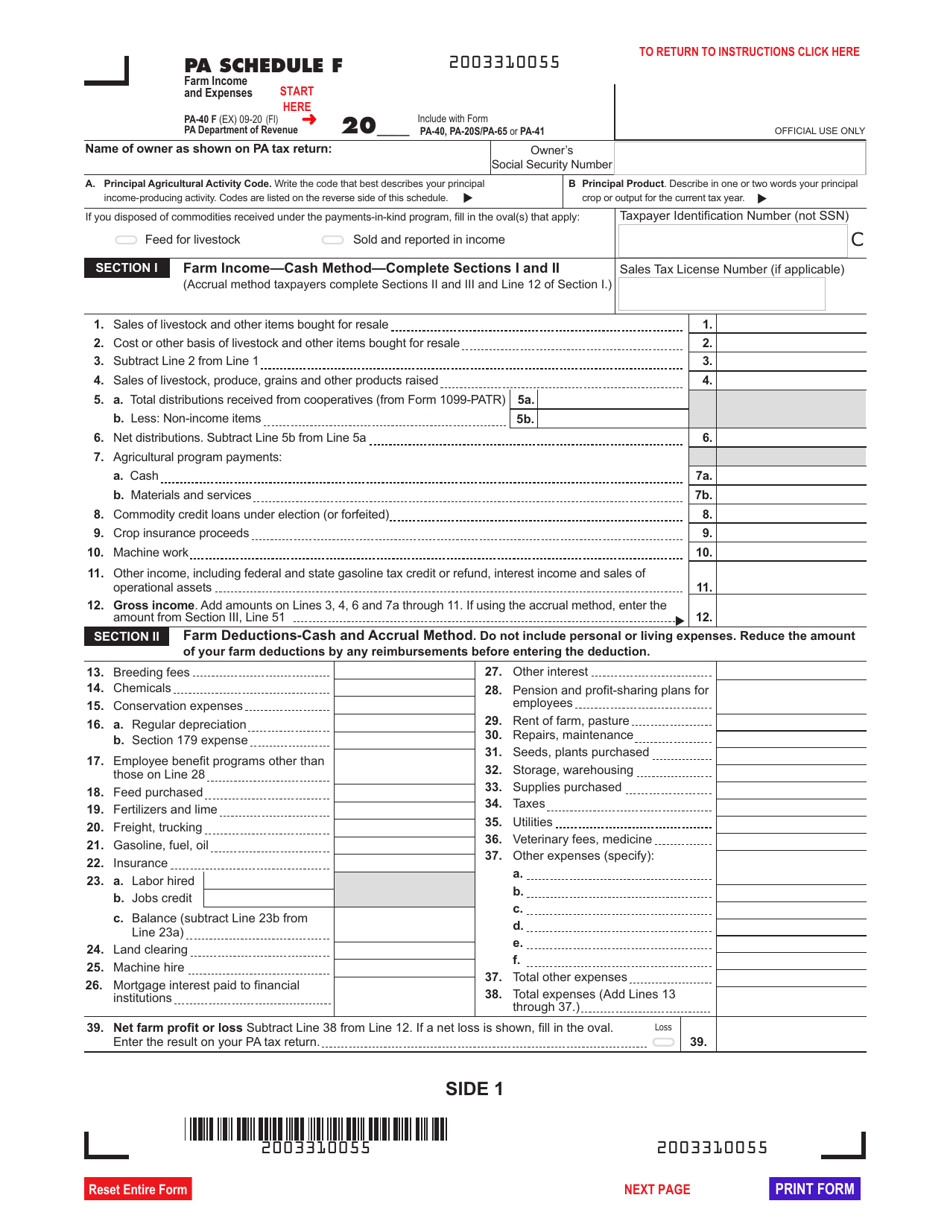

Form PA 40 Schedule F Download Fillable PDF Or Fill Online Farm Income