In this digital age, when screens dominate our lives yet the appeal of tangible printed material hasn't diminished. Be it for educational use, creative projects, or simply adding an extra personal touch to your home, printables for free are now a vital resource. In this article, we'll take a dive through the vast world of "Farm Income Tax Return," exploring their purpose, where to find them and ways they can help you improve many aspects of your life.

Get Latest Farm Income Tax Return Below

Farm Income Tax Return

Farm Income Tax Return -

A farmer must withhold income taxes on agricultural employees who are subject to FICA taxes The amount of federal income tax withheld from an employee s wages depends on his her filing status and withholding allowances these are identified on Form W 4 Employee s Withholding Allowance Certificate

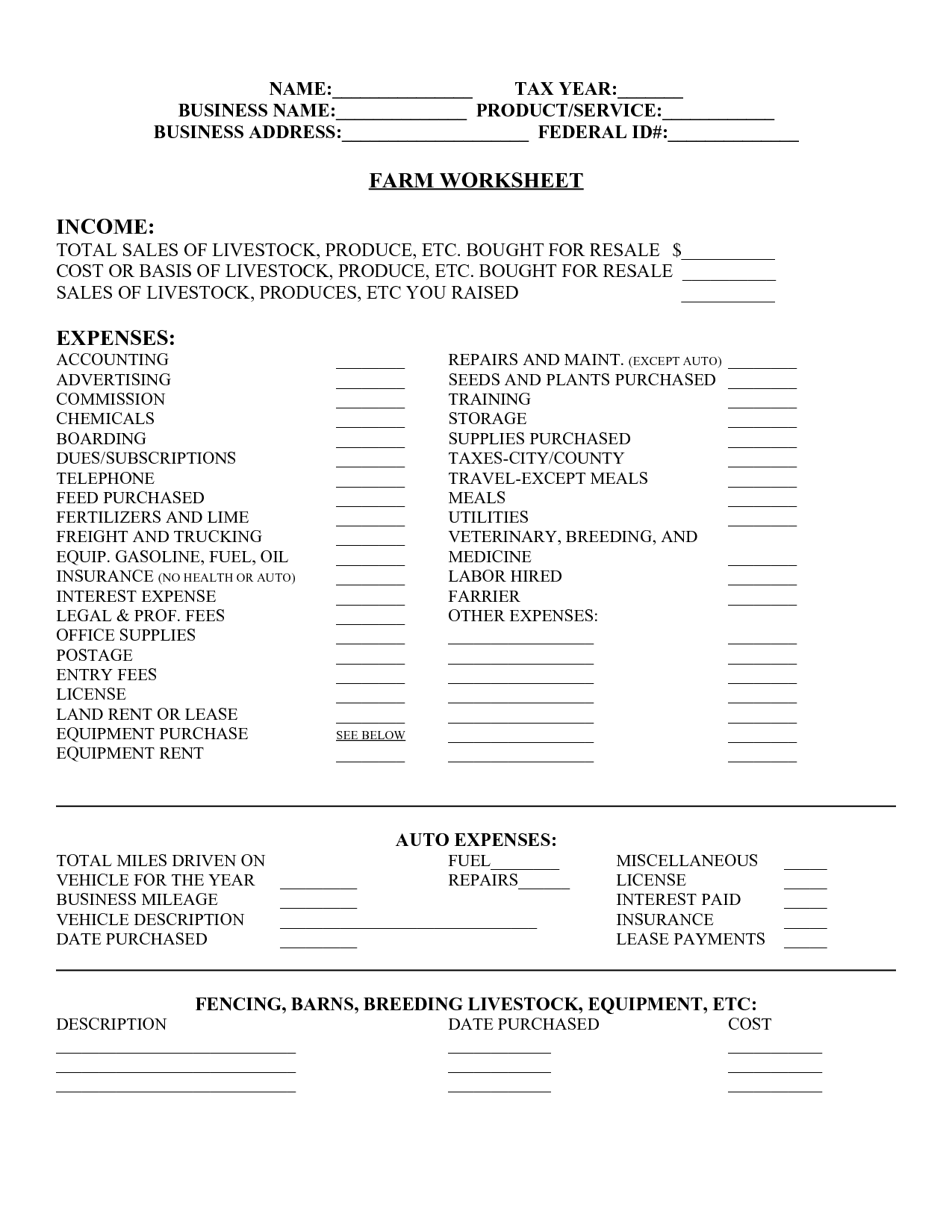

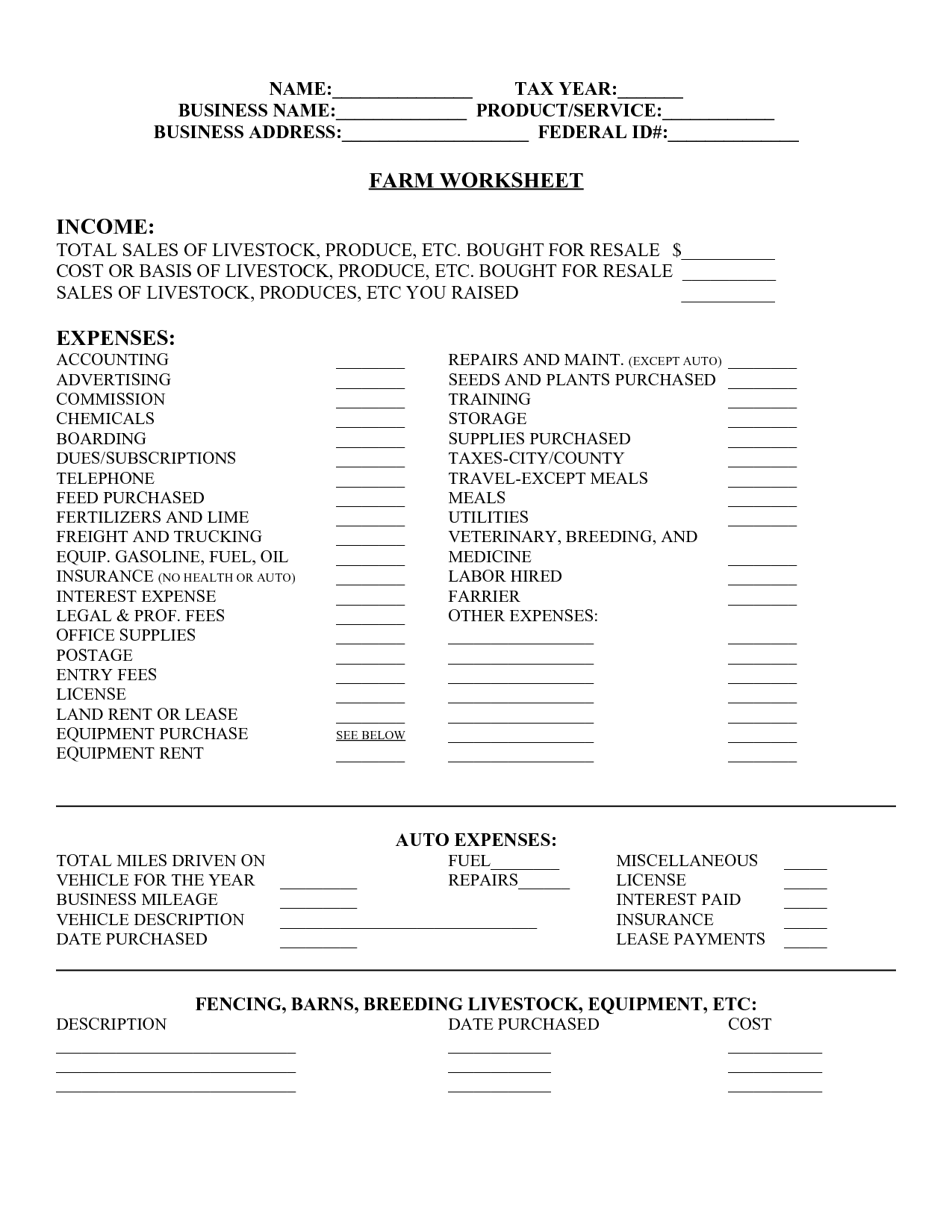

A farmer like other taxpayers must keep records to prepare an accurate income tax return and determine the correct amount of tax This chapter explains the benefits of keeping records what kinds of records you must keep and how long you must keep them for federal tax purposes

Farm Income Tax Return provide a diverse range of downloadable, printable materials that are accessible online for free cost. The resources are offered in a variety forms, including worksheets, coloring pages, templates and many more. The benefit of Farm Income Tax Return is their versatility and accessibility.

More of Farm Income Tax Return

Income Tax

Income Tax

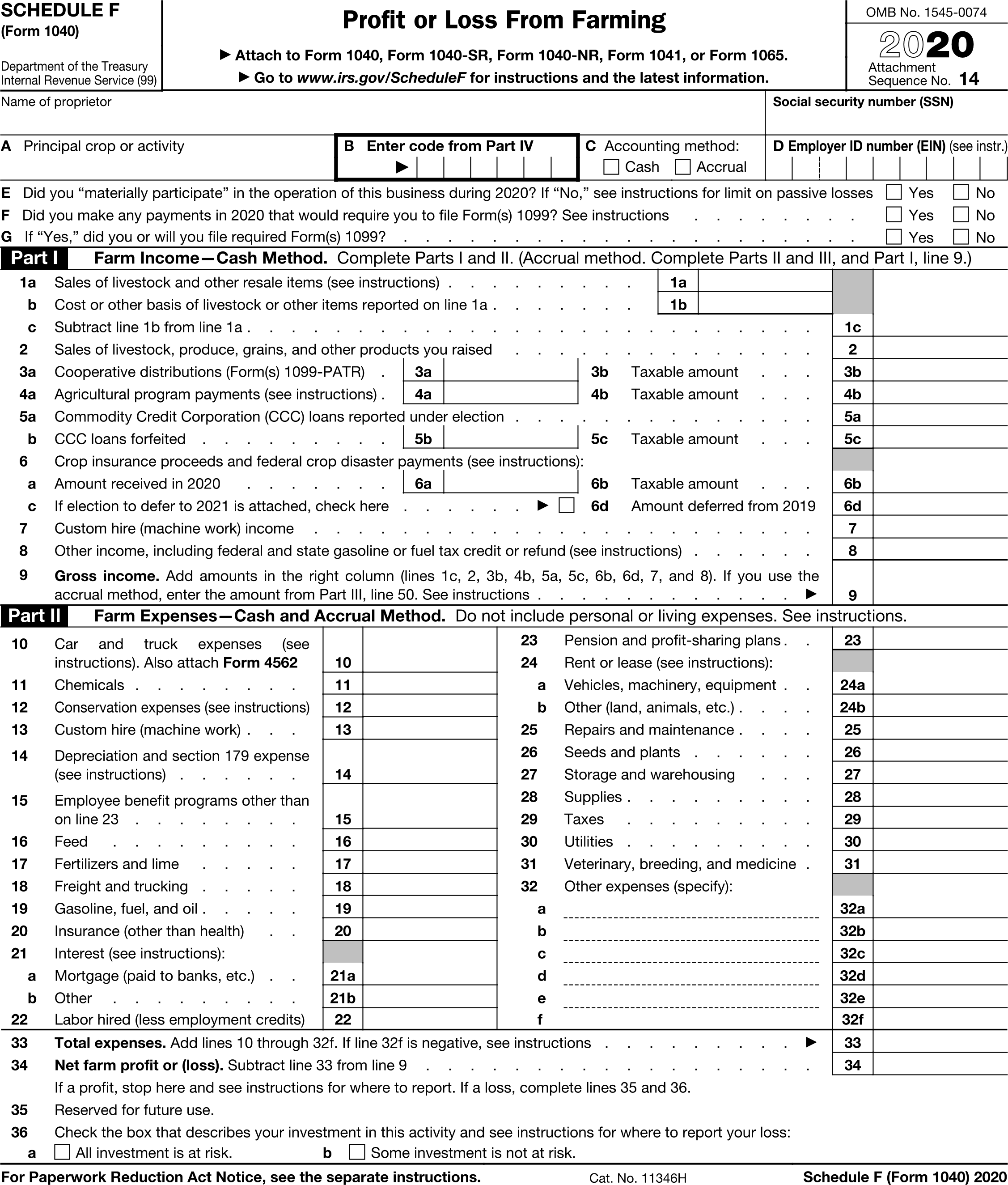

Key Takeaways Schedule F is used to compute the net farming profit or loss that gets reported on Form 1040 As a farmer you can report income and expenses using the cash method accrual method or crop method

Farmers are required to fill out a Schedule F on their tax returns to report farm income Understanding Farm Income In U S agricultural policy farm income can be divided as follows Gross

Print-friendly freebies have gained tremendous popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or costly software.

-

Individualization There is the possibility of tailoring printables to fit your particular needs when it comes to designing invitations making your schedule, or even decorating your home.

-

Educational Use: Printing educational materials for no cost cater to learners of all ages, making these printables a powerful tool for teachers and parents.

-

An easy way to access HTML0: The instant accessibility to various designs and templates reduces time and effort.

Where to Find more Farm Income Tax Return

FDX QR

FDX QR

Definition Farm income is the revenue a farm business generates from farming activities Farm income is considered separate from other types of income when filing a tax return

Preparing tax returns for farmers and ranchers requires specialized knowledge of tax rules and provisions that apply only to those in the business of farming Individuals partnerships and trusts and estates generally report farm income and expenses on Form 1040 Schedule F Taxpayers use this form to calculate net gain or

In the event that we've stirred your curiosity about Farm Income Tax Return Let's look into where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection and Farm Income Tax Return for a variety objectives.

- Explore categories such as design, home decor, organizing, and crafts.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing including flashcards, learning materials.

- It is ideal for teachers, parents, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers post their original designs and templates at no cost.

- The blogs covered cover a wide range of topics, everything from DIY projects to planning a party.

Maximizing Farm Income Tax Return

Here are some ways of making the most of Farm Income Tax Return:

1. Home Decor

- Print and frame beautiful art, quotes, or festive decorations to decorate your living areas.

2. Education

- Print free worksheets for reinforcement of learning at home for the classroom.

3. Event Planning

- Invitations, banners and decorations for special events like weddings and birthdays.

4. Organization

- Stay organized with printable planners for to-do list, lists of chores, and meal planners.

Conclusion

Farm Income Tax Return are a treasure trove of useful and creative resources designed to meet a range of needs and preferences. Their access and versatility makes them a great addition to every aspect of your life, both professional and personal. Explore the wide world of Farm Income Tax Return to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free are they free?

- Yes you can! You can download and print these resources at no cost.

-

Can I utilize free printables for commercial uses?

- It's dependent on the particular rules of usage. Always verify the guidelines of the creator before utilizing their templates for commercial projects.

-

Are there any copyright concerns when using printables that are free?

- Some printables may have restrictions concerning their use. Make sure to read the terms and condition of use as provided by the designer.

-

How do I print Farm Income Tax Return?

- Print them at home using either a printer or go to any local print store for higher quality prints.

-

What program do I need in order to open printables at no cost?

- Most PDF-based printables are available in PDF format. These can be opened using free programs like Adobe Reader.

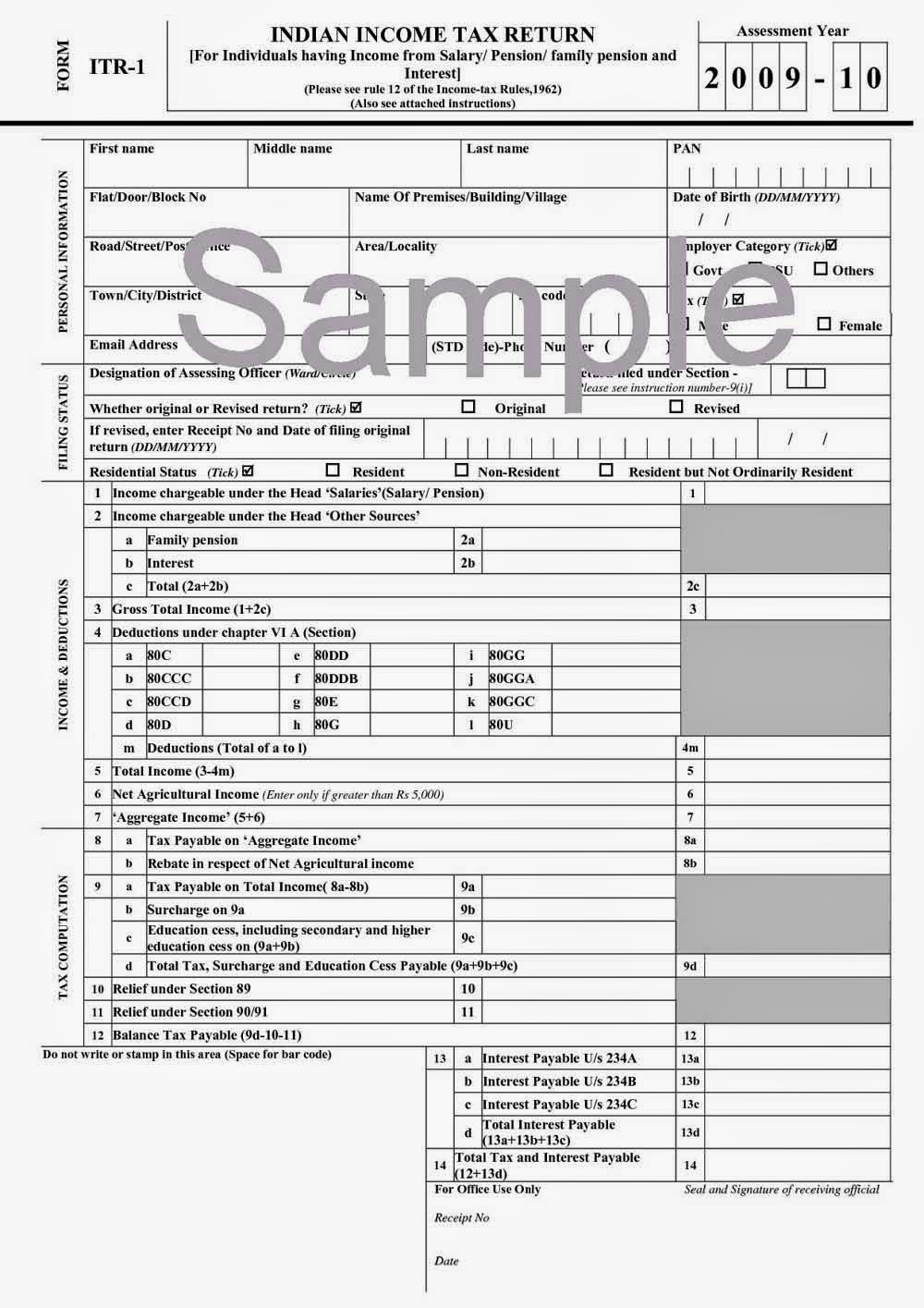

Latest ITR Forms Archives Certicom

Check more sample of Farm Income Tax Return below

Here s When IRS Will Start Accepting Tax Returns In 2023 Al

Nice Audit Report Of Reliance 2019 International Accounting Standard 10

Treatment Of Income From Different Sources AY 2023 24 FY 2022 23

Cases Where Filing Of The Income Tax Return Is Mandatory CA Cult

14 Monthly Income Expense Worksheet Template Worksheeto

Salary Income Tax Return Service At Best Price In Mumbai

https://www.irs.gov/publications/p225

A farmer like other taxpayers must keep records to prepare an accurate income tax return and determine the correct amount of tax This chapter explains the benefits of keeping records what kinds of records you must keep and how long you must keep them for federal tax purposes

https://www.irs.gov/instructions/i1040sf

Use Schedule F Form 1040 to report farm income and expenses File it with Form 1040 1040 SR 1040 SS 1040 NR 1041 or 1065 Your farming activity may subject you to state and local taxes and other requirements such as business licenses and fees Check with your state and local governments for more information

A farmer like other taxpayers must keep records to prepare an accurate income tax return and determine the correct amount of tax This chapter explains the benefits of keeping records what kinds of records you must keep and how long you must keep them for federal tax purposes

Use Schedule F Form 1040 to report farm income and expenses File it with Form 1040 1040 SR 1040 SS 1040 NR 1041 or 1065 Your farming activity may subject you to state and local taxes and other requirements such as business licenses and fees Check with your state and local governments for more information

Cases Where Filing Of The Income Tax Return Is Mandatory CA Cult

Nice Audit Report Of Reliance 2019 International Accounting Standard 10

14 Monthly Income Expense Worksheet Template Worksheeto

Salary Income Tax Return Service At Best Price In Mumbai

ITR Income Tax Return E verification To Complete Filing Process All

State Income Tax

State Income Tax

File Income Tax Return How To E File Your Income Tax Return Online