In this age of technology, where screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed materials hasn't faded away. No matter whether it's for educational uses such as creative projects or simply adding an individual touch to the space, Which States Do Not Tax Fers Pensions have become an invaluable resource. Here, we'll take a dive to the depths of "Which States Do Not Tax Fers Pensions," exploring what they are, where to locate them, and what they can do to improve different aspects of your daily life.

Get Latest Which States Do Not Tax Fers Pensions Below

Which States Do Not Tax Fers Pensions

Which States Do Not Tax Fers Pensions - Which States Do Not Tax Fers Pensions, Which States Do Not Tax Fers Retirement, Which States Do Not Tax Federal Government Pensions, Which States Do Not Tax Federal Pension, What States Do Not Tax Civil Service Pensions, Are State Pensions Federally Taxable

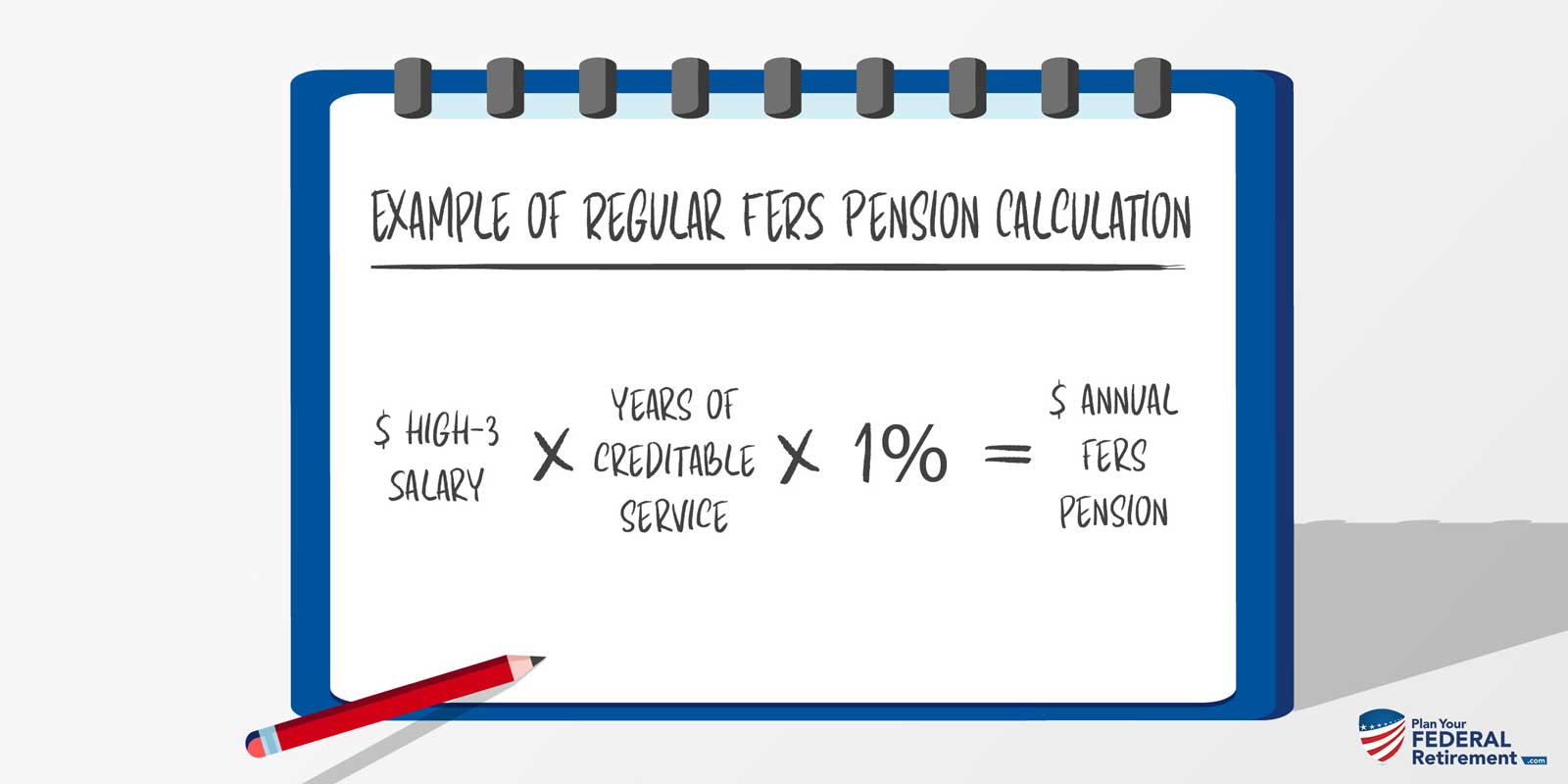

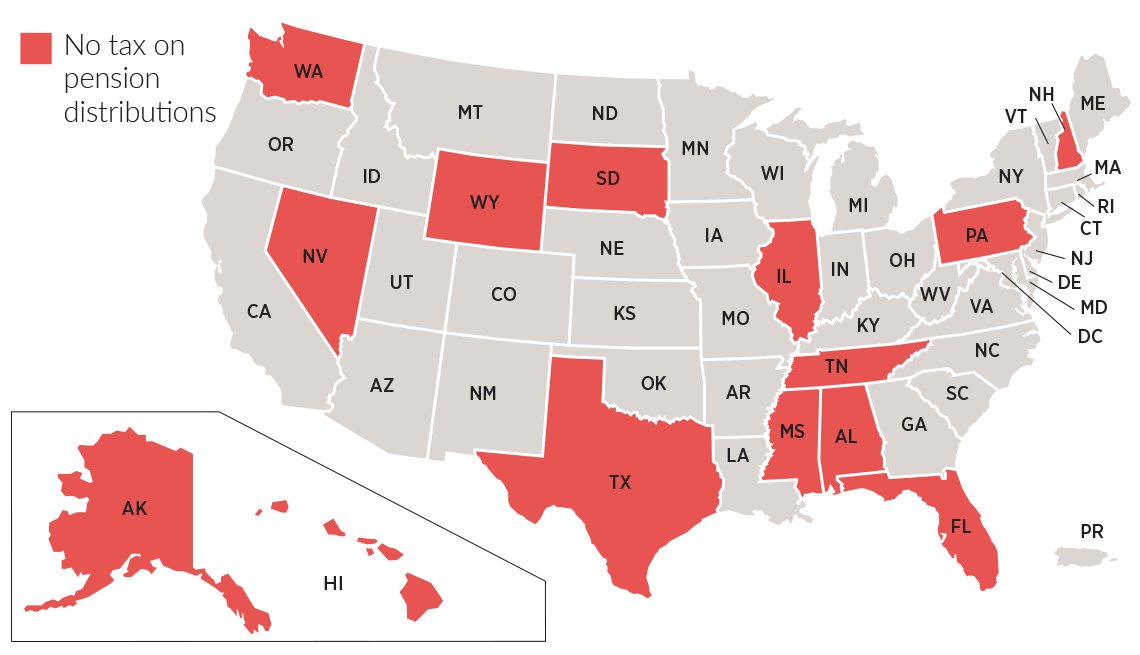

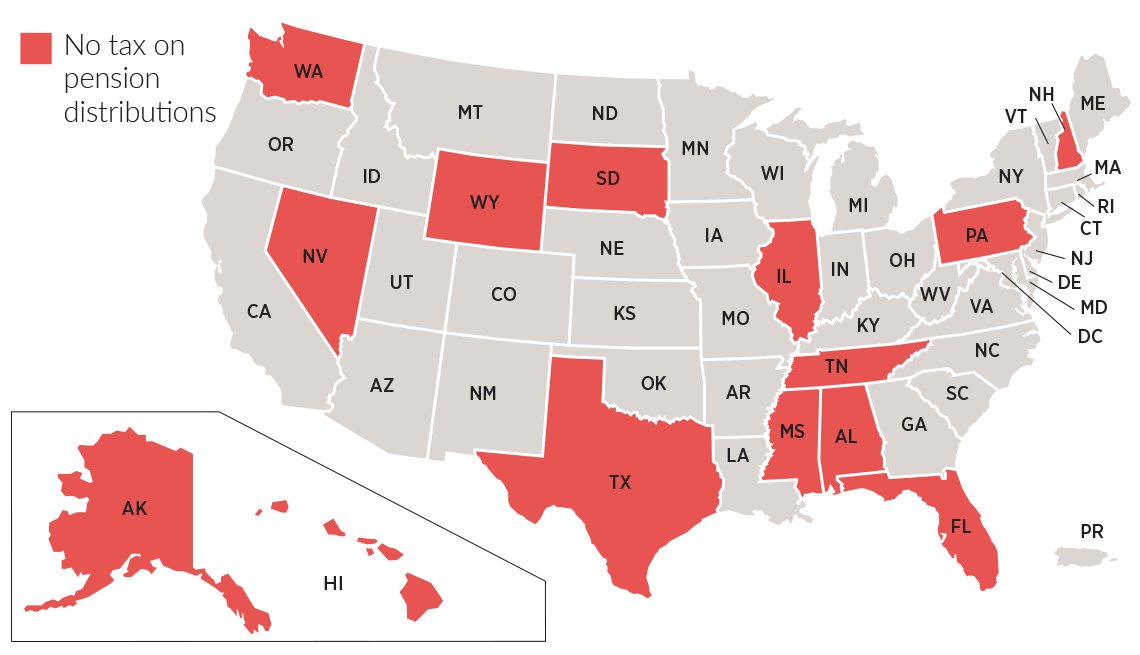

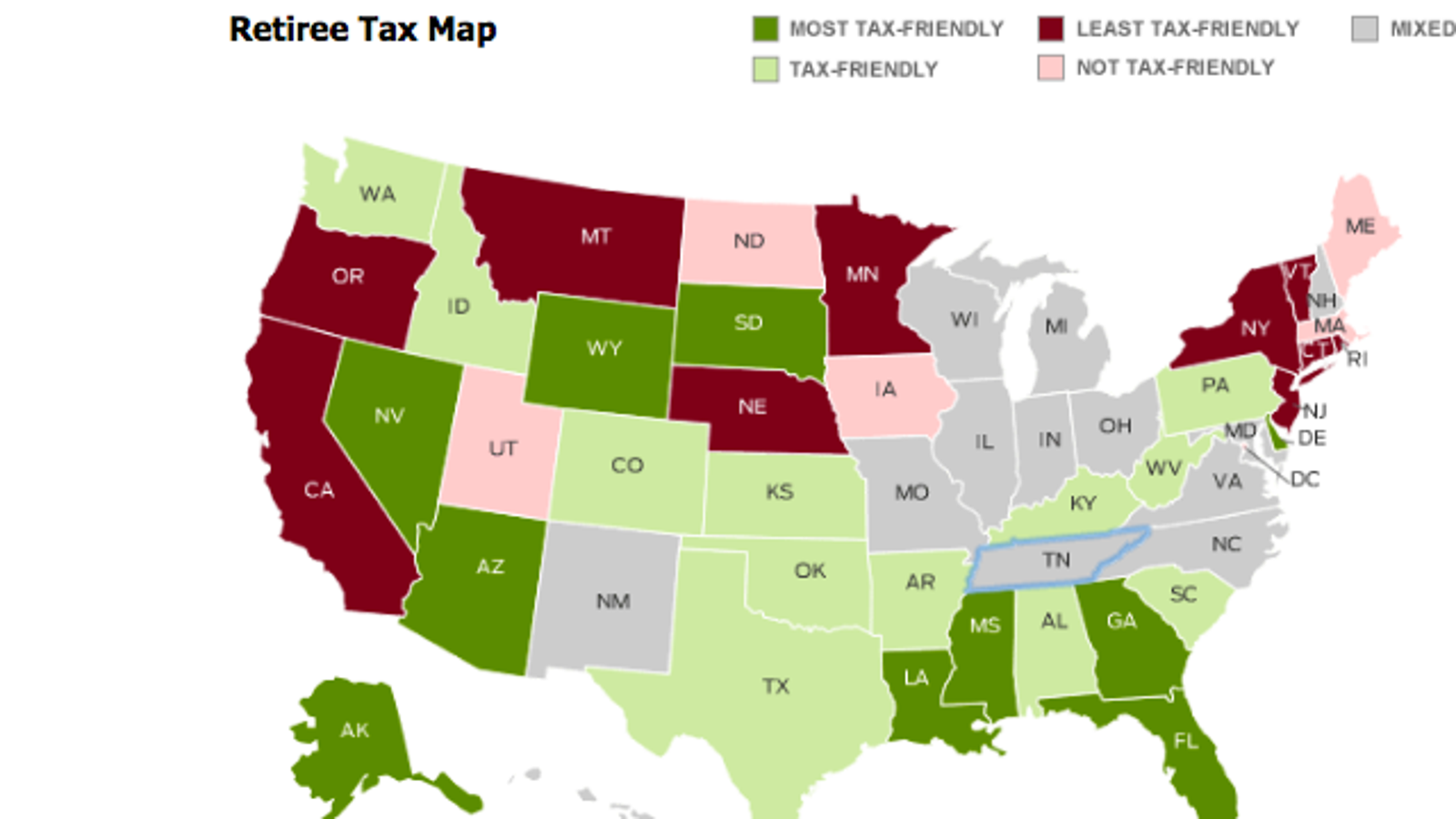

Some states don t tax any income period while others may tax your pension but leave income from your 401 k or individual retirement account IRA untaxed

There are just 13 states that do Colorado Connecticut Kansas Minnesota Missouri Montana Nebraska New Mexico North Dakota Rhode Island Utah Vermont and West Virginia Each state

Which States Do Not Tax Fers Pensions encompass a wide selection of printable and downloadable material that is available online at no cost. They are available in a variety of types, such as worksheets templates, coloring pages, and much more. The appeal of printables for free lies in their versatility as well as accessibility.

More of Which States Do Not Tax Fers Pensions

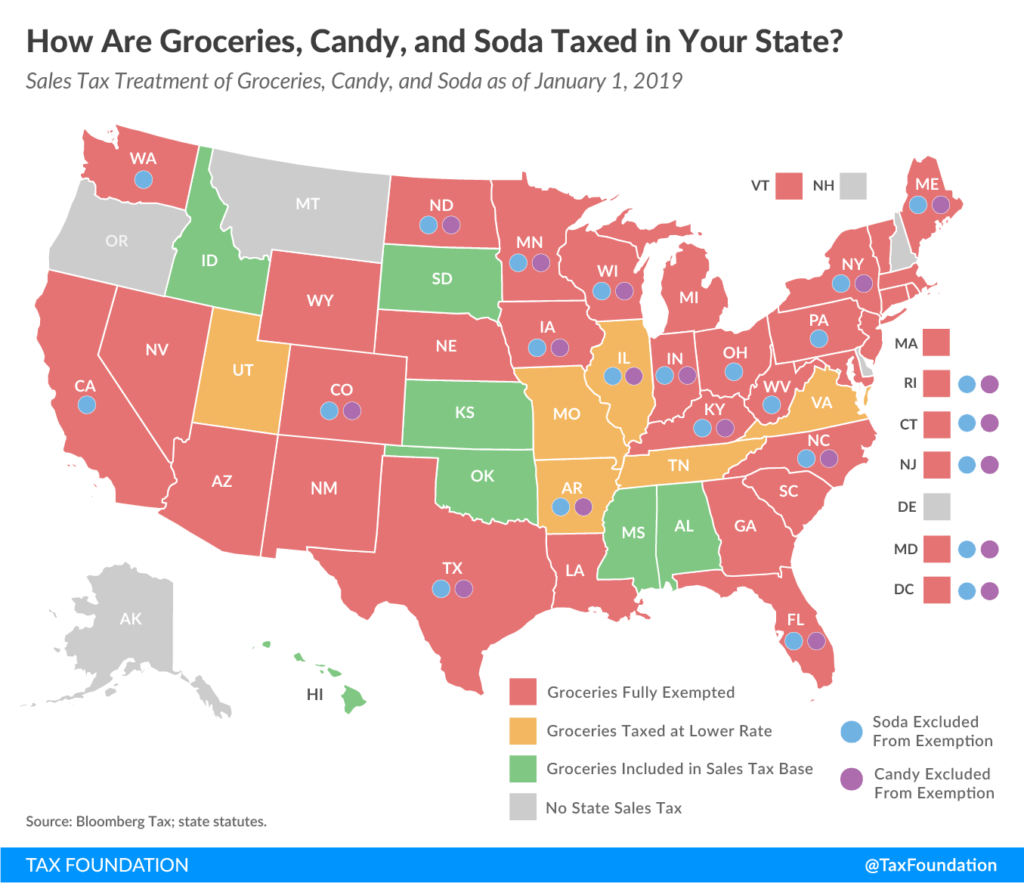

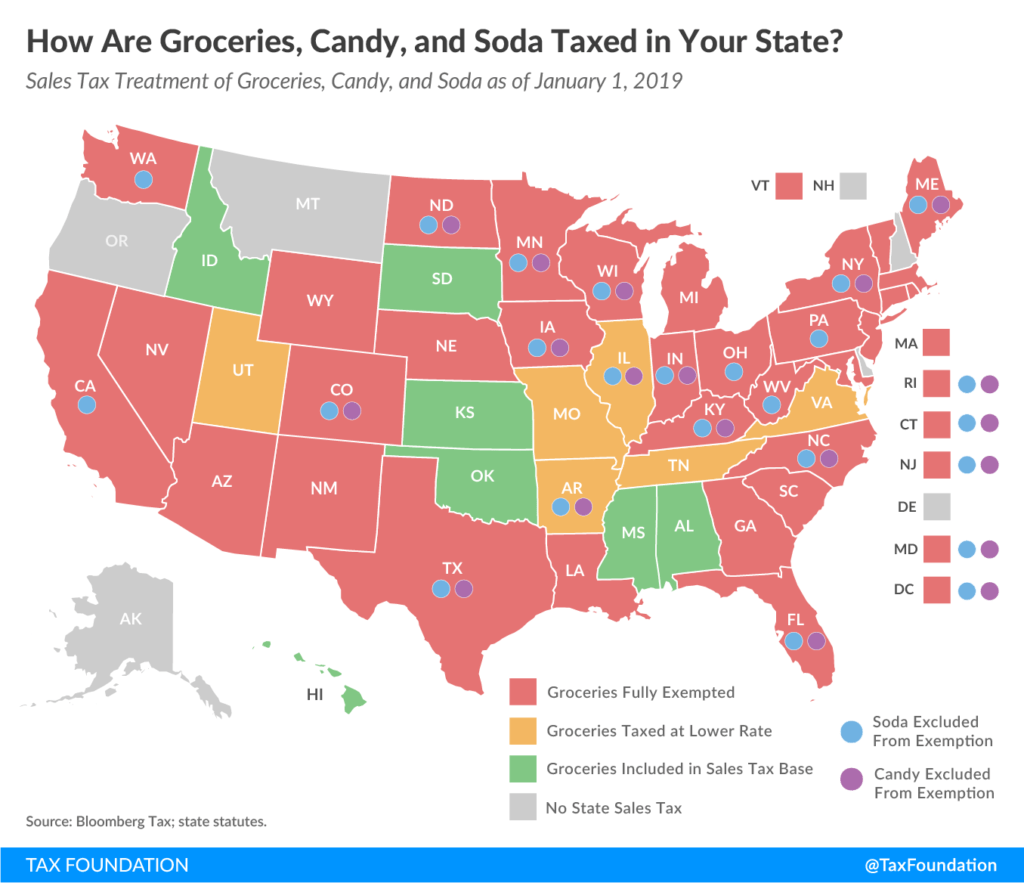

Sales Tax On Grocery Items By State Chart TopForeignStocks

Sales Tax On Grocery Items By State Chart TopForeignStocks

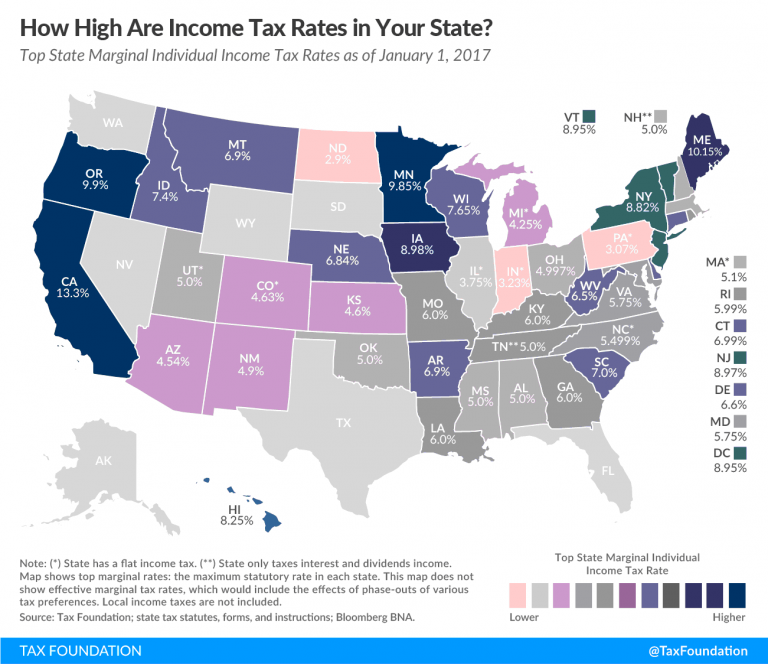

Eight states Alaska Florida Nevada South Dakota Tennessee Texas Washington and Wyoming don t tax income at all New Hampshire taxes only interest and dividend income And six states Alabama Hawaii Illinois Iowa Mississippi and Pennsylvania exclude pension income from state taxes

Four other states have income taxes but give retirees a break on pensions and retirement plan distributions Illinois which has a 4 95 percent flat income tax won t tax distributions from most pensions and 401 k plans as well as IRAs and Social Security payouts

The Which States Do Not Tax Fers Pensions have gained huge appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or costly software.

-

Personalization Your HTML0 customization options allow you to customize the templates to meet your individual needs in designing invitations as well as organizing your calendar, or decorating your home.

-

Educational Impact: The free educational worksheets cater to learners of all ages, which makes the perfect device for teachers and parents.

-

Accessibility: Instant access to the vast array of design and templates can save you time and energy.

Where to Find more Which States Do Not Tax Fers Pensions

What States Do Not Tax Federal Pensions Government Deal Funding

What States Do Not Tax Federal Pensions Government Deal Funding

In addition to the nine states above that don t have an income tax at all four states do not tax retirement income Illinois Iowa Mississippi and Pennsylvania Here s what you

Whether it s from a job 401 k IRA pension or Social Security retirees in these nine states won t have to worry about paying any state income tax However federal tax rules will

Now that we've ignited your interest in printables for free Let's take a look at where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of printables that are free for a variety of reasons.

- Explore categories such as the home, decor, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free along with flashcards, as well as other learning tools.

- Ideal for teachers, parents and students looking for extra sources.

3. Creative Blogs

- Many bloggers share their imaginative designs or templates for download.

- These blogs cover a wide array of topics, ranging including DIY projects to party planning.

Maximizing Which States Do Not Tax Fers Pensions

Here are some ideas ensure you get the very most use of Which States Do Not Tax Fers Pensions:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Use free printable worksheets to enhance learning at home either in the schoolroom or at home.

3. Event Planning

- Invitations, banners as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Which States Do Not Tax Fers Pensions are an abundance with useful and creative ideas catering to different needs and hobbies. Their accessibility and flexibility make them an invaluable addition to each day life. Explore the vast array of printables for free today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really cost-free?

- Yes you can! You can print and download these tools for free.

-

Do I have the right to use free templates for commercial use?

- It's contingent upon the specific usage guidelines. Always check the creator's guidelines before using any printables on commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Some printables may contain restrictions in their usage. Be sure to review the terms of service and conditions provided by the designer.

-

How can I print printables for free?

- You can print them at home using a printer or visit any local print store for superior prints.

-

What program do I need in order to open Which States Do Not Tax Fers Pensions?

- Most printables come as PDF files, which is open with no cost programs like Adobe Reader.

Retiring These States Won t Tax Your Distributions

Can I Cash Out My FERS Retirement News Daily

Check more sample of Which States Do Not Tax Fers Pensions below

States That Won t Tax Your Retirement Distributions In 2021

37 States That Don t Tax Social Security Benefits Citybiz

7 States That Do Not Tax Retirement Income

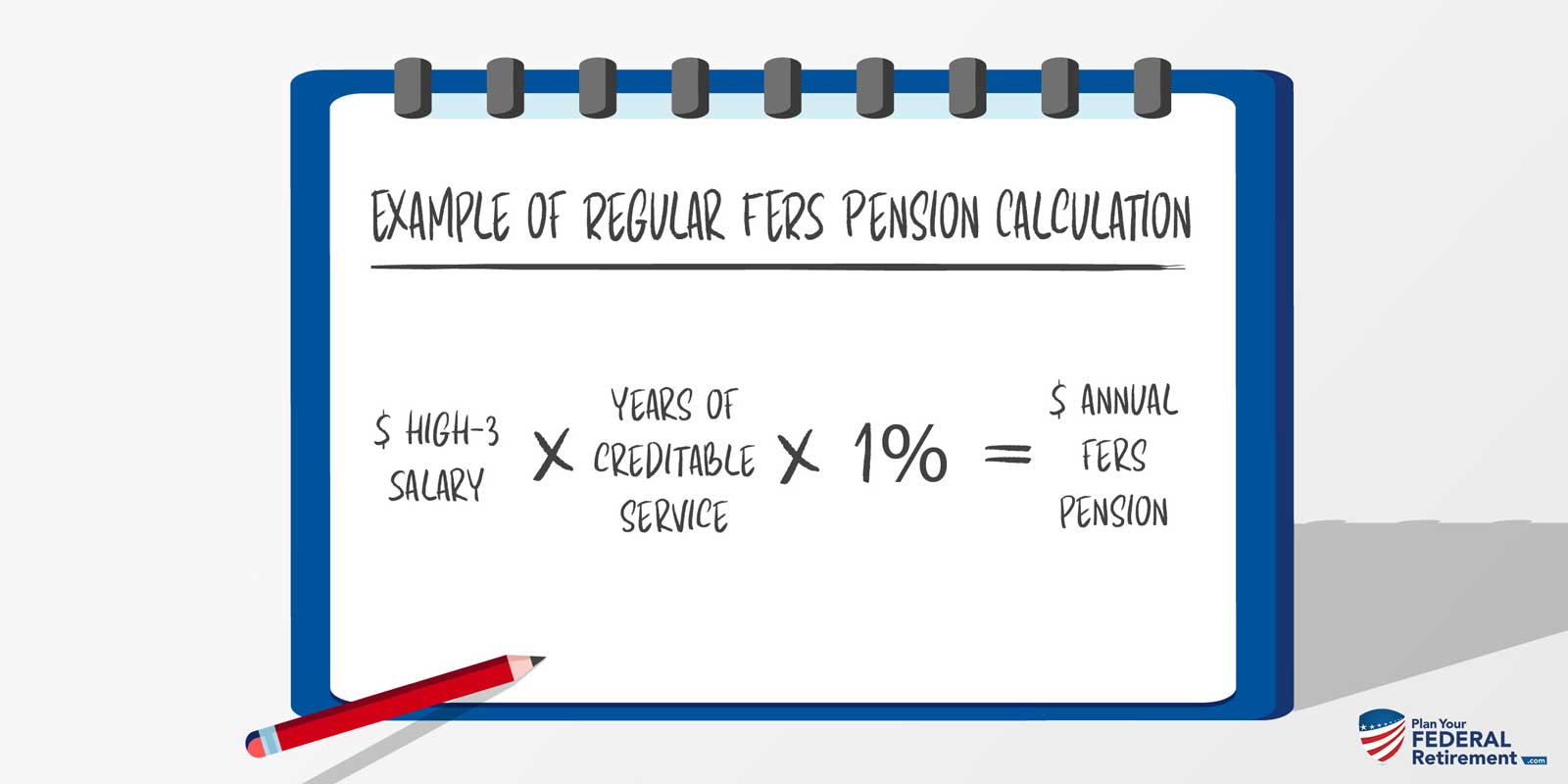

Fers Annuity Calculator CathanElliot

14 States Don t Tax Retirement Pension Payouts

Can I Cash Out My FERS Retirement News Daily

https://www.govexec.com/pay-benefits/2021/04/...

There are just 13 states that do Colorado Connecticut Kansas Minnesota Missouri Montana Nebraska New Mexico North Dakota Rhode Island Utah Vermont and West Virginia Each state

https://myfederalplan.com/states-that-wont-tax-your-federal-retirement

Some states that don t tax pension income include Alabama Florida and Nevada A few states also exempt military retirement pay from state income taxes If you re a retiree check your state s tax laws to see if your pension income is subject to taxation Tips for Maximizing Your Retirement Income

There are just 13 states that do Colorado Connecticut Kansas Minnesota Missouri Montana Nebraska New Mexico North Dakota Rhode Island Utah Vermont and West Virginia Each state

Some states that don t tax pension income include Alabama Florida and Nevada A few states also exempt military retirement pay from state income taxes If you re a retiree check your state s tax laws to see if your pension income is subject to taxation Tips for Maximizing Your Retirement Income

Fers Annuity Calculator CathanElliot

37 States That Don t Tax Social Security Benefits Citybiz

14 States Don t Tax Retirement Pension Payouts

Can I Cash Out My FERS Retirement News Daily

The Most Tax Friendly States For Retirement

States That Have No Income Tax

States That Have No Income Tax

John Brown s Notes And Essays States With The Highest And Lowest Sales