In the age of digital, with screens dominating our lives however, the attraction of tangible printed materials hasn't faded away. In the case of educational materials and creative work, or just adding an individual touch to your home, printables for free are now a useful source. For this piece, we'll dive into the sphere of "Which Of The Following Proceeds Of Life Insurance Policies Is Exempt From Estate Tax," exploring the different types of printables, where they are available, and how they can add value to various aspects of your daily life.

Get Latest Which Of The Following Proceeds Of Life Insurance Policies Is Exempt From Estate Tax Below

Which Of The Following Proceeds Of Life Insurance Policies Is Exempt From Estate Tax

Which Of The Following Proceeds Of Life Insurance Policies Is Exempt From Estate Tax - Which Of The Following Proceeds Of Life Insurance Policies Is Exempt From Estate Tax

The death benefits paid on life insurance policies can be subject to an estate tax in two situations The whole amount of the death benefit is included in the estate and subject to estate tax if the estate is

Which of the following applies to the income tax or estate tax treatment of life insurance policy proceeds Click the card to flip Benefits received under a periodic settlement

Which Of The Following Proceeds Of Life Insurance Policies Is Exempt From Estate Tax cover a large range of printable, free resources available online for download at no cost. These resources come in many kinds, including worksheets coloring pages, templates and much more. The great thing about Which Of The Following Proceeds Of Life Insurance Policies Is Exempt From Estate Tax is in their variety and accessibility.

More of Which Of The Following Proceeds Of Life Insurance Policies Is Exempt From Estate Tax

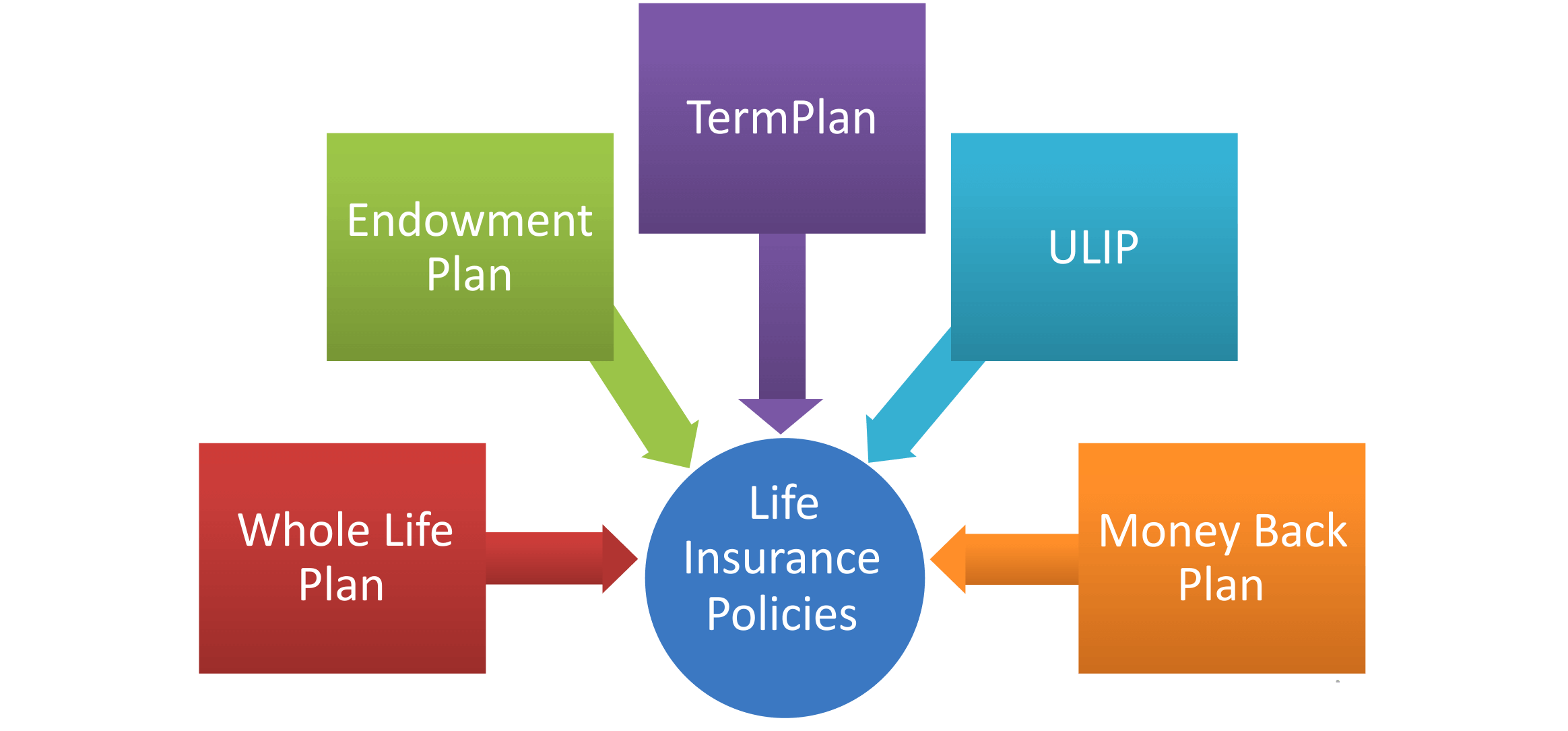

Type of life Insurance policy Comparepolicy

Type of life Insurance policy Comparepolicy

Family homes that are worth up to P10 million are now exempted from estate tax The gross estate consists of all properties real or personal tangible or intangible

If the death benefit is paid in installments the interest accrued is taxable If the policyholder names an estate as the beneficiary the estate may be subject to estate

Which Of The Following Proceeds Of Life Insurance Policies Is Exempt From Estate Tax have gained a lot of popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

Individualization There is the possibility of tailoring printables to your specific needs for invitations, whether that's creating them, organizing your schedule, or decorating your home.

-

Educational Benefits: Education-related printables at no charge offer a wide range of educational content for learners from all ages, making them an essential source for educators and parents.

-

Affordability: The instant accessibility to the vast array of design and templates reduces time and effort.

Where to Find more Which Of The Following Proceeds Of Life Insurance Policies Is Exempt From Estate Tax

The Ins And Outs Of Collecting Life Insurance Policy Proceeds

The Ins And Outs Of Collecting Life Insurance Policy Proceeds

If you want your life insurance proceeds to avoid the federal estate tax you might want to transfer ownership of your life insurance policy to another person or

Life insurance payouts are usually tax free If your policy s payout causes your estate s worth to exceed 13 61 million your heirs might be charged estate taxes Your beneficiaries

Since we've got your interest in Which Of The Following Proceeds Of Life Insurance Policies Is Exempt From Estate Tax Let's look into where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection and Which Of The Following Proceeds Of Life Insurance Policies Is Exempt From Estate Tax for a variety uses.

- Explore categories like the home, decor, organization, and crafts.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing along with flashcards, as well as other learning tools.

- Ideal for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates, which are free.

- The blogs are a vast spectrum of interests, ranging from DIY projects to planning a party.

Maximizing Which Of The Following Proceeds Of Life Insurance Policies Is Exempt From Estate Tax

Here are some ideas in order to maximize the use use of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, or festive decorations to decorate your living areas.

2. Education

- Print out free worksheets and activities to enhance learning at home either in the schoolroom or at home.

3. Event Planning

- Designs invitations, banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Which Of The Following Proceeds Of Life Insurance Policies Is Exempt From Estate Tax are a treasure trove filled with creative and practical information that satisfy a wide range of requirements and interest. Their accessibility and flexibility make them a great addition to both professional and personal lives. Explore the vast collection of Which Of The Following Proceeds Of Life Insurance Policies Is Exempt From Estate Tax today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free completely free?

- Yes you can! You can download and print these free resources for no cost.

-

Can I download free printing templates for commercial purposes?

- It's dependent on the particular conditions of use. Make sure you read the guidelines for the creator before utilizing printables for commercial projects.

-

Do you have any copyright violations with Which Of The Following Proceeds Of Life Insurance Policies Is Exempt From Estate Tax?

- Some printables may come with restrictions regarding their use. Always read the terms and conditions set forth by the author.

-

How do I print printables for free?

- Print them at home using any printer or head to a local print shop to purchase the highest quality prints.

-

What software do I require to open printables at no cost?

- Most PDF-based printables are available in the format PDF. This can be opened with free software such as Adobe Reader.

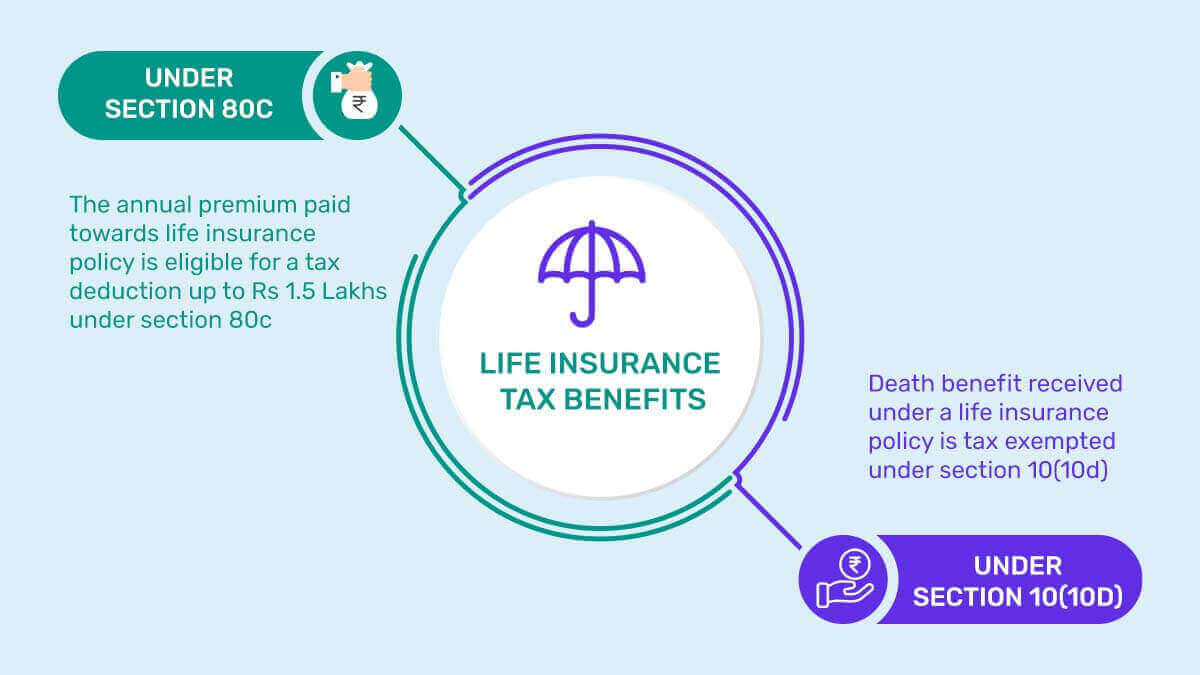

Life Insurance Tax Benefits In India 2023 PolicyBachat

BANKING INSURANCE WORLD FORMS OF LIFE INSURANCE POLICIES

Check more sample of Which Of The Following Proceeds Of Life Insurance Policies Is Exempt From Estate Tax below

How Many Life Insurance Policies Can You Have The Ins And Outs Of Life

Pleasant Hill Life Insurance

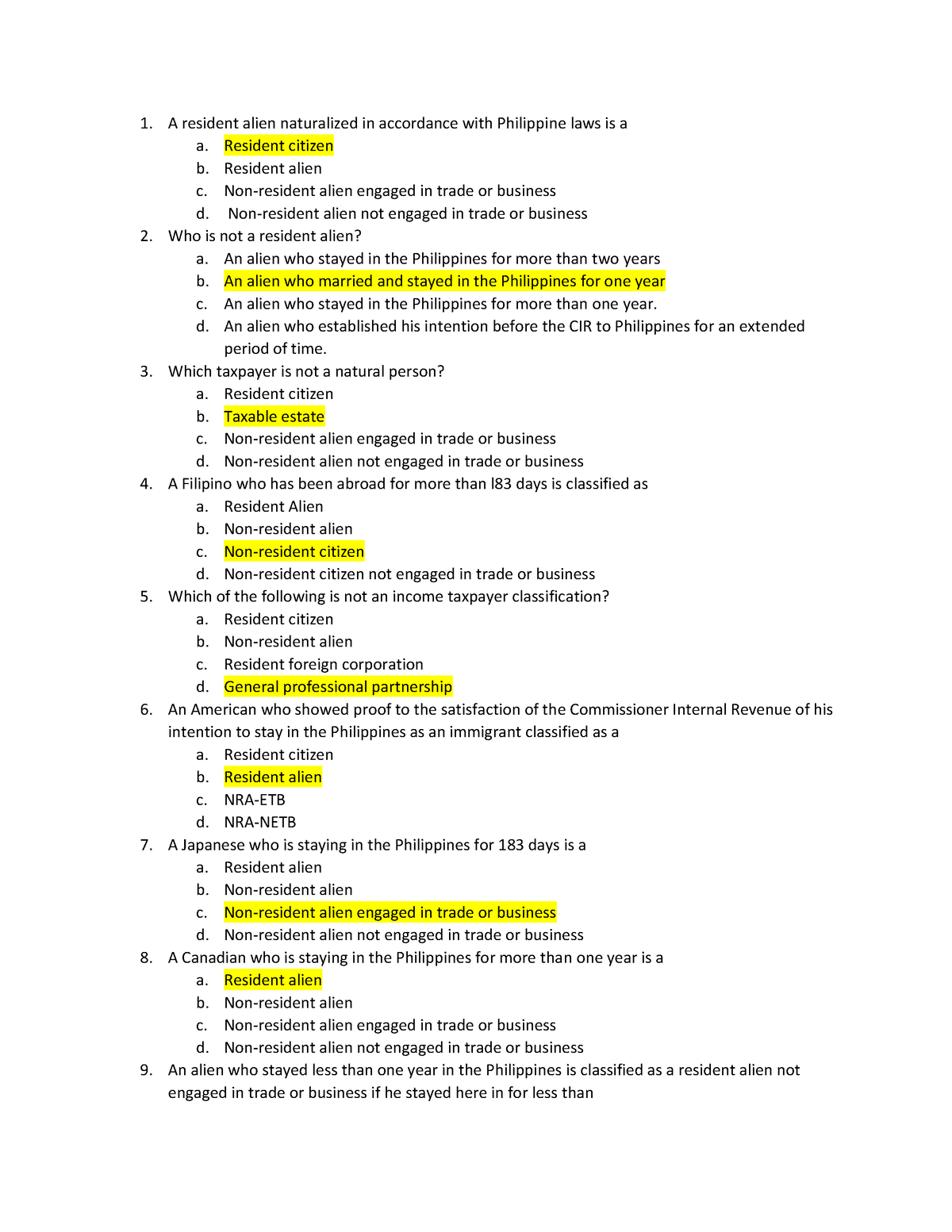

QUIZ 1 Income Taxation Answer Key A Resident Alien Naturalized In

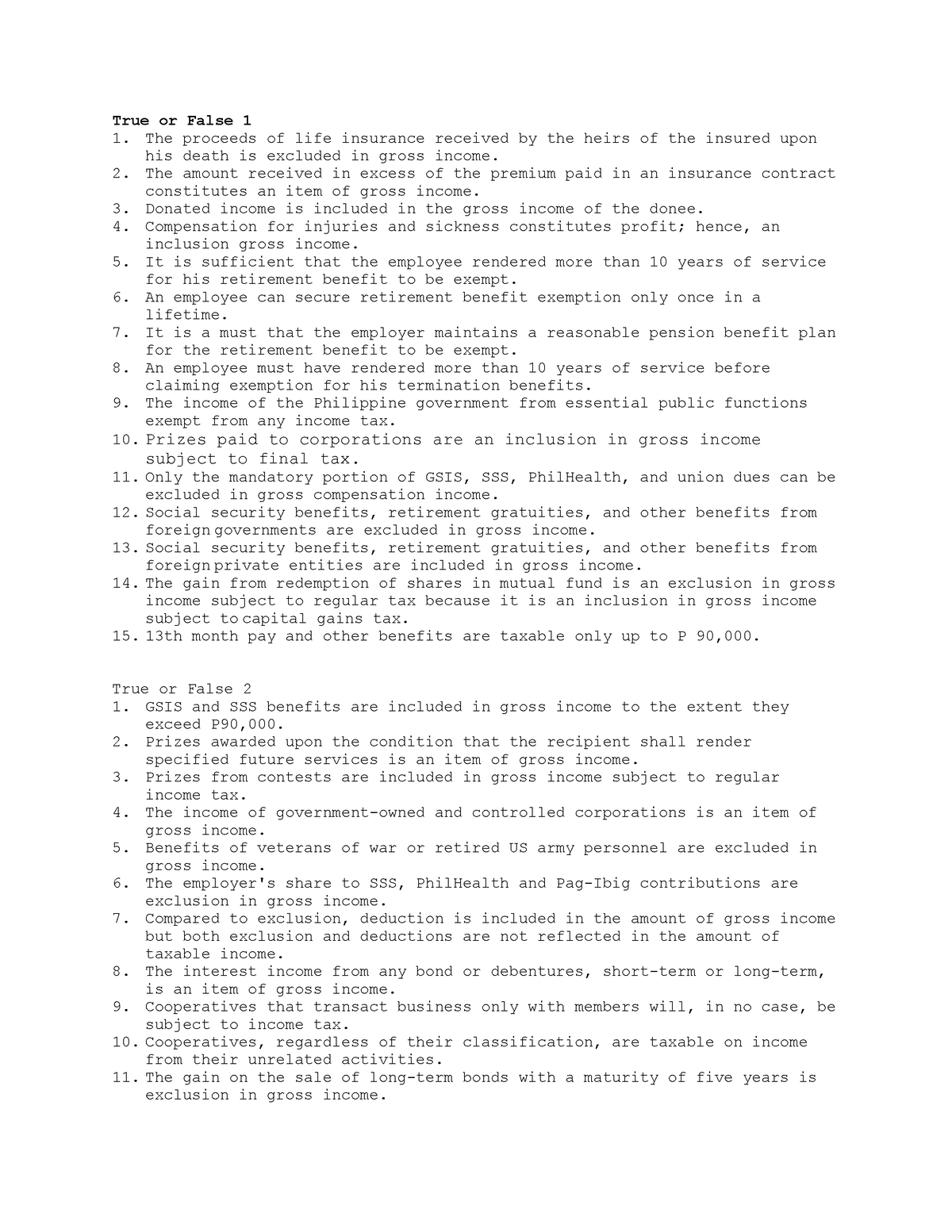

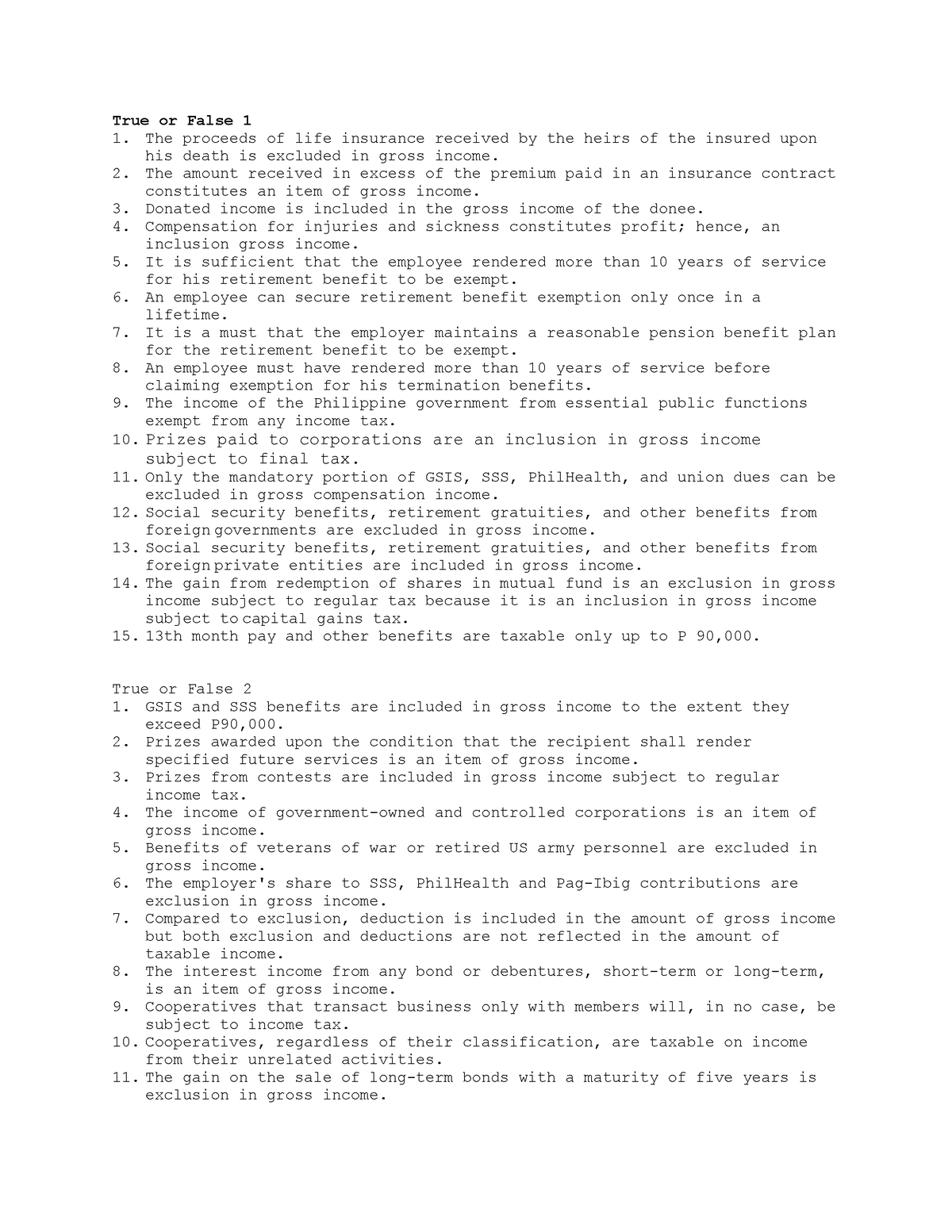

Income Taxation Chp 8 True Or False 1 The Proceeds Of Life Insurance

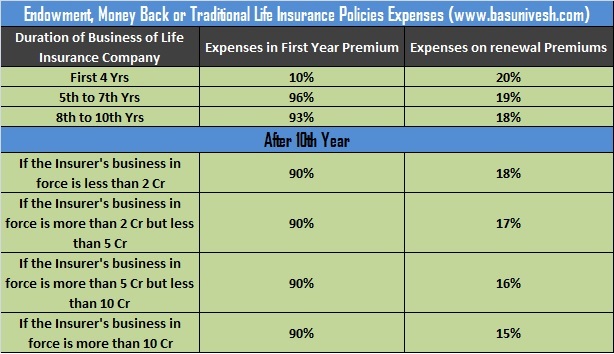

Taxation Of Life Insurance Maturity Proceeds CBDT s New Guidelines 2023

The Different Types Of Life Insurance Policies Chooyomi

https://quizlet.com/794597811/estate-planning-chapter-11-flash-cards

Which of the following applies to the income tax or estate tax treatment of life insurance policy proceeds Click the card to flip Benefits received under a periodic settlement

https://www.investopedia.com/articles/pf/06/...

Estates can limit taxes and in some cases avoid taxation in one key way transferring the ownership of life insurance policies usually to an irrevocable

Which of the following applies to the income tax or estate tax treatment of life insurance policy proceeds Click the card to flip Benefits received under a periodic settlement

Estates can limit taxes and in some cases avoid taxation in one key way transferring the ownership of life insurance policies usually to an irrevocable

Income Taxation Chp 8 True Or False 1 The Proceeds Of Life Insurance

Pleasant Hill Life Insurance

Taxation Of Life Insurance Maturity Proceeds CBDT s New Guidelines 2023

The Different Types Of Life Insurance Policies Chooyomi

Life Insurance Policies Life Insurance Policies Quiz

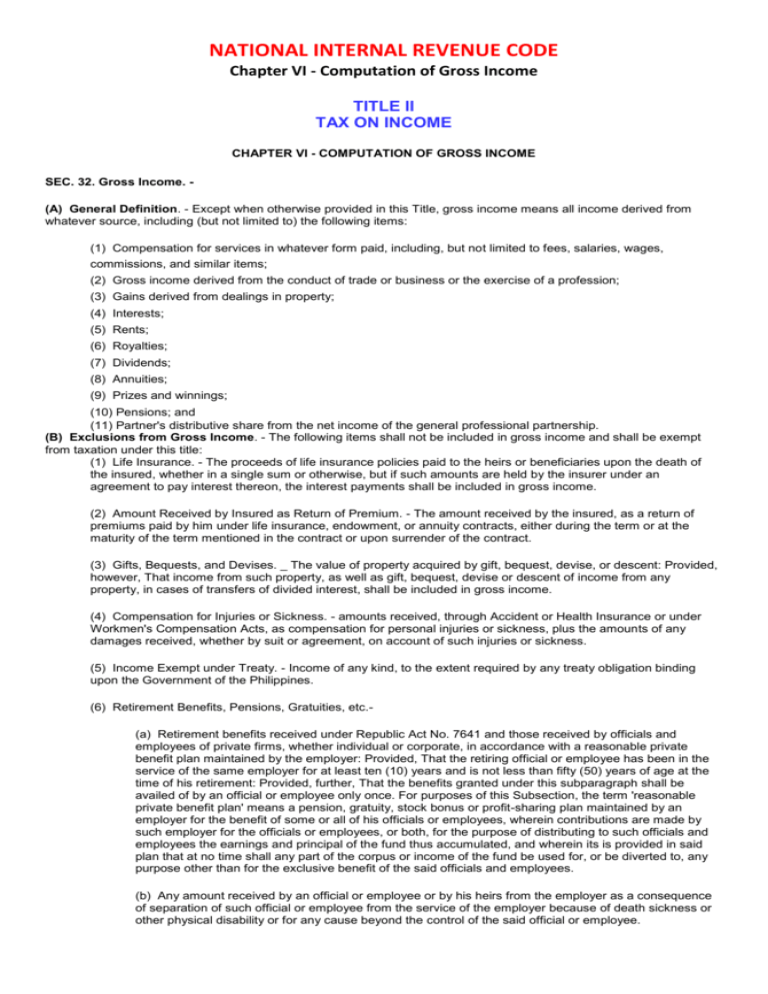

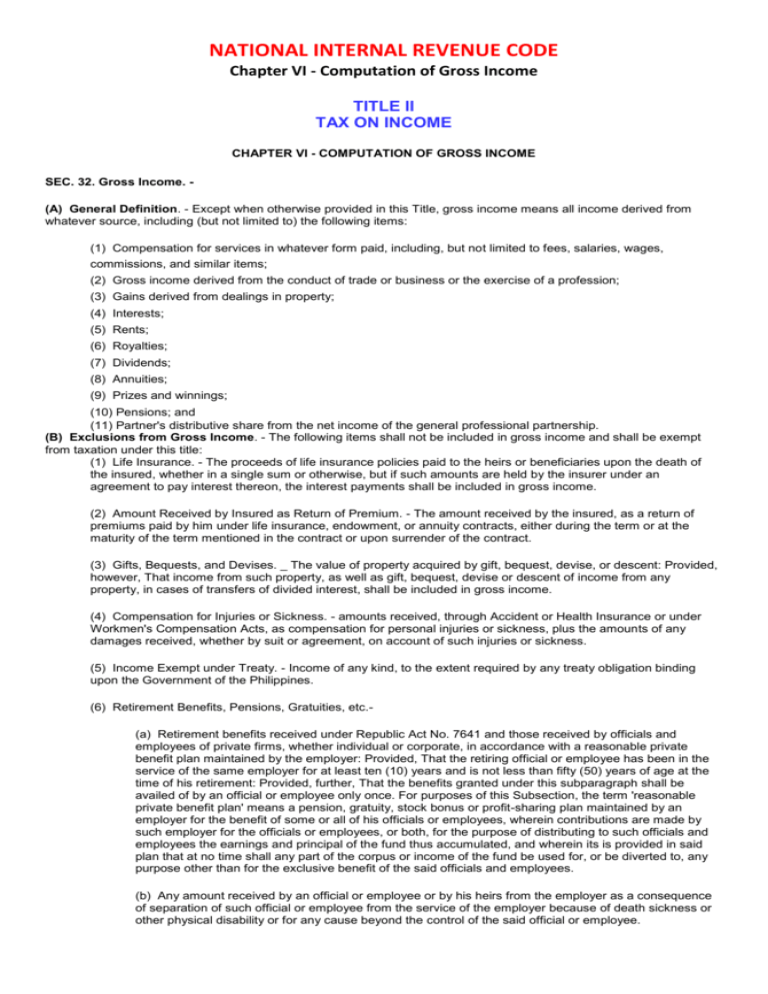

National Internal Revenue Code DepED

National Internal Revenue Code DepED

Endowment Or Money Back Life Insurance Policies Give Less Returns