In a world when screens dominate our lives, the charm of tangible, printed materials hasn't diminished. If it's to aid in education in creative or artistic projects, or simply to add an element of personalization to your home, printables for free can be an excellent resource. We'll dive deep into the realm of "When Can You Take Roth Ira Distributions Without Penalty," exploring what they are, where to find them, and ways they can help you improve many aspects of your life.

Get Latest When Can You Take Roth Ira Distributions Without Penalty Below

When Can You Take Roth Ira Distributions Without Penalty

When Can You Take Roth Ira Distributions Without Penalty - When Can You Take Roth Ira Distributions Without Penalty, At What Age Can You Take Roth Ira Distributions Without Penalty, When Can I Use My Roth Ira Without Penalty

In calculating the five year rule you could begin withdrawing funds without penalty on Jan 1 2027 not April 18 2028 Qualified Distributions A withdrawal that is tax and penalty free

If you take a distribution of Roth IRA earnings before you reach age 59 and before the account is five years old the earnings may be subject to taxes and penalties You may be able to avoid penalties but not taxes in the following situations You use the withdrawal up to a 10 000 lifetime maximum to pay for a first time home purchase

Printables for free include a vast collection of printable materials that are accessible online for free cost. These printables come in different styles, from worksheets to templates, coloring pages and more. The attraction of printables that are free is in their versatility and accessibility.

More of When Can You Take Roth Ira Distributions Without Penalty

401k Vs Roth Ira Calculator Choosing Your Gold IRA

401k Vs Roth Ira Calculator Choosing Your Gold IRA

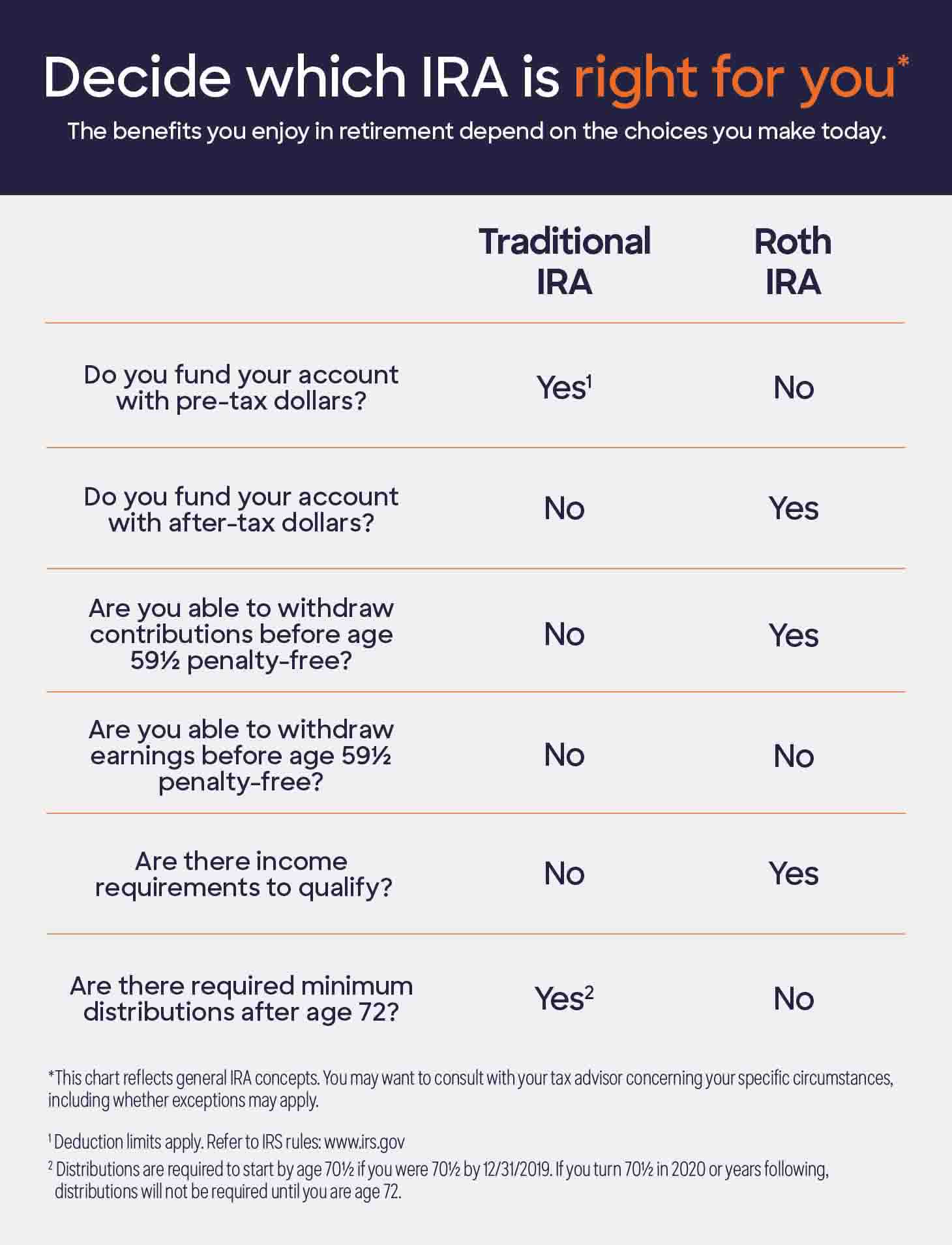

Roth IRA withdrawal rules allow withdrawals of contributions any time withdrawals of earnings are penalty free after age 59 1 2 and a 5 year holding period

Even so Roth IRA early withdrawals are a lot simpler if you re 59 or older You never incur a 10 penalty However if you want to withdraw earnings bear in mind If you don t meet the 5 year

When Can You Take Roth Ira Distributions Without Penalty have gained immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Customization: It is possible to tailor printables to your specific needs for invitations, whether that's creating them planning your schedule or even decorating your house.

-

Educational Use: Free educational printables cater to learners from all ages, making them a valuable resource for educators and parents.

-

The convenience of The instant accessibility to many designs and templates reduces time and effort.

Where to Find more When Can You Take Roth Ira Distributions Without Penalty

Roth IRA Withdrawal Rules Oblivious Investor

Roth IRA Withdrawal Rules Oblivious Investor

So if you convert 5 000 from a traditional IRA to a Roth IRA on Sept 1 2024 your countdown begins Jan 1 2024 You will pay a 10 early withdrawal penalty if you take the money out before Jan

The five year holding rule begins on the first day of the year for which you made your initial Roth IRA contribution or converted a traditional IRA to a Roth Once you ve held your Roth funds for five years and have reached age 59 1 2 all funds you withdraw from your Roth will be tax and penalty free whenever you withdraw them

In the event that we've stirred your interest in When Can You Take Roth Ira Distributions Without Penalty Let's see where they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of When Can You Take Roth Ira Distributions Without Penalty to suit a variety of purposes.

- Explore categories such as furniture, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free or flashcards as well as learning materials.

- This is a great resource for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers share their innovative designs as well as templates for free.

- The blogs are a vast selection of subjects, that range from DIY projects to party planning.

Maximizing When Can You Take Roth Ira Distributions Without Penalty

Here are some ideas of making the most of When Can You Take Roth Ira Distributions Without Penalty:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Use these printable worksheets free of charge to reinforce learning at home (or in the learning environment).

3. Event Planning

- Design invitations, banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

When Can You Take Roth Ira Distributions Without Penalty are an abundance of creative and practical resources designed to meet a range of needs and preferences. Their accessibility and flexibility make these printables a useful addition to every aspect of your life, both professional and personal. Explore the endless world of When Can You Take Roth Ira Distributions Without Penalty today to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are When Can You Take Roth Ira Distributions Without Penalty really are they free?

- Yes you can! You can print and download these resources at no cost.

-

Do I have the right to use free templates for commercial use?

- It's dependent on the particular rules of usage. Always verify the guidelines provided by the creator before utilizing their templates for commercial projects.

-

Do you have any copyright issues with printables that are free?

- Certain printables could be restricted on use. Make sure to read the terms and condition of use as provided by the creator.

-

How do I print printables for free?

- You can print them at home using any printer or head to a print shop in your area for better quality prints.

-

What program do I need to run When Can You Take Roth Ira Distributions Without Penalty?

- The majority of printables are in PDF format. They can be opened with free software such as Adobe Reader.

Does A Roth IRA Account Make Sense For You Gorfine Schiller Gardyn

Qualified Vs Non Qualified Roth IRA Distributions

Check more sample of When Can You Take Roth Ira Distributions Without Penalty below

Roth Ira Withdrawal Penalty Choosing Your Gold IRA

Early Withdrawal From IRA WITHOUT 10 Penalty YouTube

Roth Ira Which Term Is Best Whats Apy

Why Most Pharmacists Should Do A Backdoor Roth IRA

Roth Versus Traditional IRA AAII

7 Ways You Can Take Money From A Roth IRA Before Age 59 1 2 Without

https://www.schwab.com/ira/roth-ira/withdrawal-rules

If you take a distribution of Roth IRA earnings before you reach age 59 and before the account is five years old the earnings may be subject to taxes and penalties You may be able to avoid penalties but not taxes in the following situations You use the withdrawal up to a 10 000 lifetime maximum to pay for a first time home purchase

https://www.investopedia.com/articles/retirement/02/111202.asp

1 Unreimbursed Medical Expenses If you don t have health insurance or you have out of pocket medical expenses that aren t covered by insurance you may be able to take penalty free

If you take a distribution of Roth IRA earnings before you reach age 59 and before the account is five years old the earnings may be subject to taxes and penalties You may be able to avoid penalties but not taxes in the following situations You use the withdrawal up to a 10 000 lifetime maximum to pay for a first time home purchase

1 Unreimbursed Medical Expenses If you don t have health insurance or you have out of pocket medical expenses that aren t covered by insurance you may be able to take penalty free

Why Most Pharmacists Should Do A Backdoor Roth IRA

Early Withdrawal From IRA WITHOUT 10 Penalty YouTube

Roth Versus Traditional IRA AAII

7 Ways You Can Take Money From A Roth IRA Before Age 59 1 2 Without

Early Withdrawals From Your Roth IRA With No Penalty YouTube

IRA tutbotax manbetx2 0

IRA tutbotax manbetx2 0

Can I Contribute To My Roth IRA Marotta On Money