In this age of electronic devices, where screens dominate our lives The appeal of tangible printed materials isn't diminishing. It doesn't matter if it's for educational reasons project ideas, artistic or simply to add an individual touch to the space, What Percent Does California Tax Military Retirement Pay are now an essential resource. For this piece, we'll dive through the vast world of "What Percent Does California Tax Military Retirement Pay," exploring the different types of printables, where they can be found, and how they can improve various aspects of your life.

Get Latest What Percent Does California Tax Military Retirement Pay Below

What Percent Does California Tax Military Retirement Pay

What Percent Does California Tax Military Retirement Pay - What Percent Does California Tax Military Retirement Pay, How Much Does California Tax Military Retirement Pay, Is Military Retirement Pay Exempt From State Taxes, Does California Tax Military Retirement, What Percent Of Military Retirement Pay Is Taxed

Wednesday August 30 2023 A bill pending in the state Legislature would exempt retirees and surviving spouses from paying California income taxes on

Of 32 490 in the taxable year and does not have wages salaries tips and other employee compensation in excess of 32 490 in the taxable year For more information

Printables for free cover a broad selection of printable and downloadable materials available online at no cost. They are available in a variety of types, like worksheets, coloring pages, templates and much more. One of the advantages of What Percent Does California Tax Military Retirement Pay lies in their versatility as well as accessibility.

More of What Percent Does California Tax Military Retirement Pay

State Taxes On Military Retired Pay The Official Army Benefits Website

State Taxes On Military Retired Pay The Official Army Benefits Website

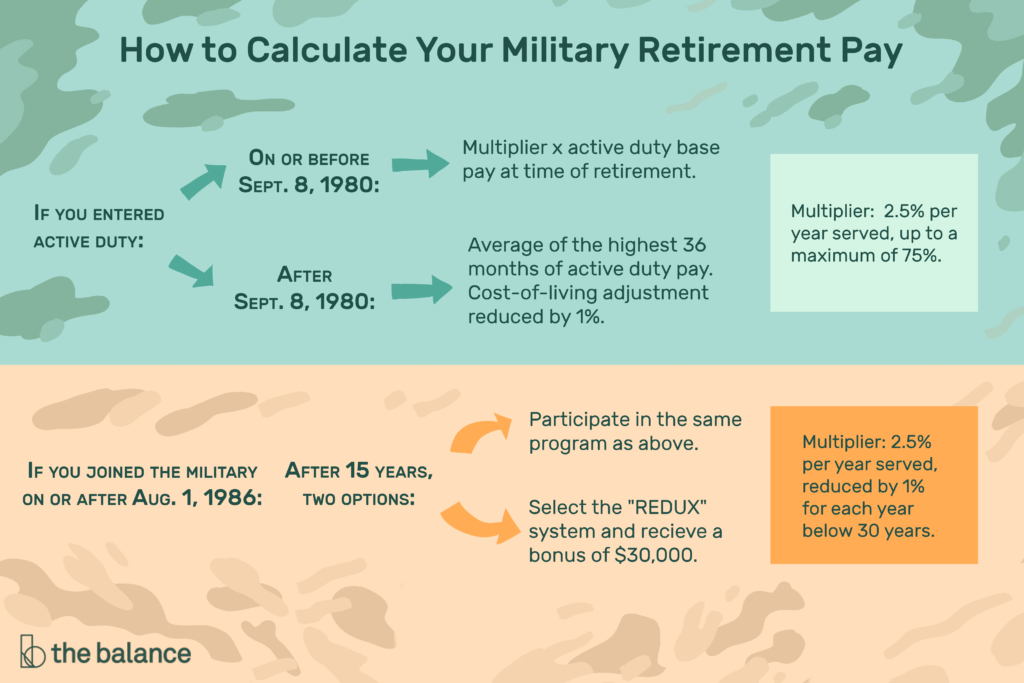

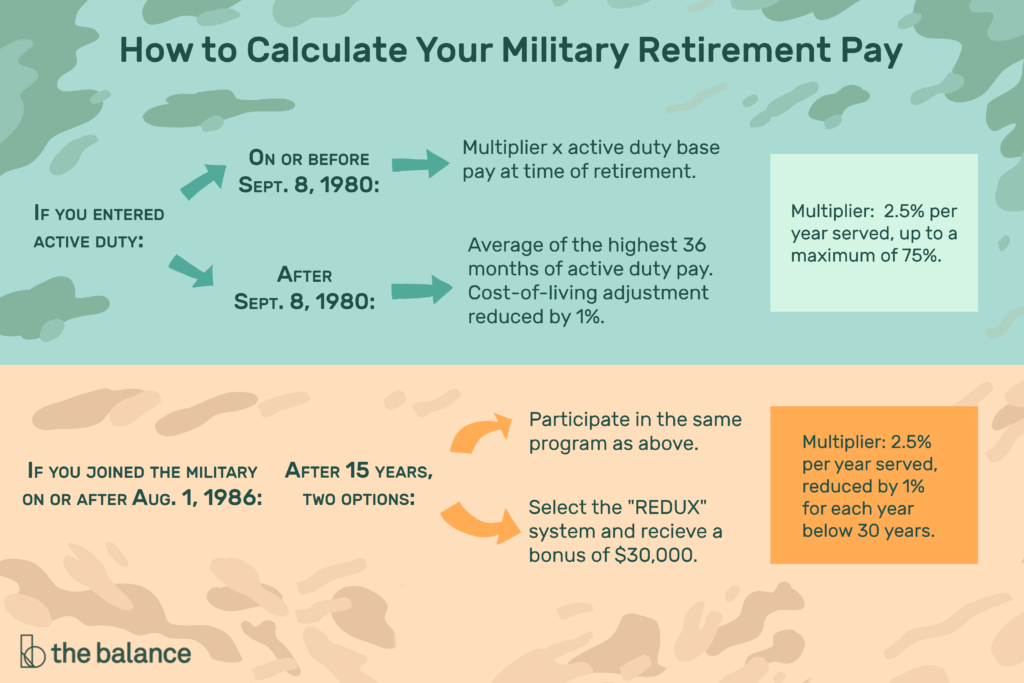

What are my California Military and Veterans State Tax Benefits California Taxes on Military Retired Pay Military retired pay received by California residents is taxed

Currently If you re a California resident your military retirement pay is taxable including all military pension income according to the California Franchise Tax

The What Percent Does California Tax Military Retirement Pay have gained huge recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Personalization You can tailor designs to suit your personal needs be it designing invitations or arranging your schedule or decorating your home.

-

Educational Value: Downloads of educational content for free can be used by students of all ages, making them a valuable source for educators and parents.

-

Simple: You have instant access many designs and templates saves time and effort.

Where to Find more What Percent Does California Tax Military Retirement Pay

Do Military Members Have To Pay State Tax On Their Military Retirement

Do Military Members Have To Pay State Tax On Their Military Retirement

Retired pay In 2022 up to 10 000 of retirement pay is tax free for retirees 55 and older That amount increases by 10 000 each year until 2025 when up to

Whether or not a state taxes their military pension benefits is also a factor Between 2000 and 2016 the nation s population of military retirees increased by 17 California

After we've peaked your interest in printables for free and other printables, let's discover where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of What Percent Does California Tax Military Retirement Pay for various uses.

- Explore categories such as decorations for the home, education and organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free along with flashcards, as well as other learning tools.

- Ideal for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their innovative designs or templates for download.

- These blogs cover a broad range of interests, that range from DIY projects to party planning.

Maximizing What Percent Does California Tax Military Retirement Pay

Here are some ideas that you can make use use of What Percent Does California Tax Military Retirement Pay:

1. Home Decor

- Print and frame beautiful art, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Print worksheets that are free to reinforce learning at home, or even in the classroom.

3. Event Planning

- Design invitations and banners and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep your calendars organized by printing printable calendars as well as to-do lists and meal planners.

Conclusion

What Percent Does California Tax Military Retirement Pay are a treasure trove of practical and imaginative resources that satisfy a wide range of requirements and interest. Their accessibility and flexibility make these printables a useful addition to every aspect of your life, both professional and personal. Explore the vast array of What Percent Does California Tax Military Retirement Pay and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really gratis?

- Yes they are! You can download and print these tools for free.

-

Can I use the free printables for commercial uses?

- It depends on the specific rules of usage. Always read the guidelines of the creator before using printables for commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Some printables may have restrictions in use. Make sure to read the terms and condition of use as provided by the creator.

-

How can I print What Percent Does California Tax Military Retirement Pay?

- Print them at home using your printer or visit a print shop in your area for higher quality prints.

-

What program is required to open printables free of charge?

- A majority of printed materials are with PDF formats, which is open with no cost software, such as Adobe Reader.

Tax Benefits And Credits FAQs For Retirees Potomac Financial Group

These States Don t Tax Military Retirement Pay YouTube

Check more sample of What Percent Does California Tax Military Retirement Pay below

States That Don t Tax Military Retirement Pay Discover Here

States That Don t Tax Military Retirement Pay Discover Here

States That Won t Tax Your Military Retirement Pay

Retiring These States Won t Tax Your Distributions

States That Tax Military Retirement Pay and States That Don t Kiplinger

What Are The States That Don t Tax Military Retirement ClearMatch

https://www.ftb.ca.gov/forms/2022/2022-1032...

Of 32 490 in the taxable year and does not have wages salaries tips and other employee compensation in excess of 32 490 in the taxable year For more information

https://www.ftb.ca.gov/file/personal/filing-situations/military.html

Military pay is not California sourced income Income can be from Non military wages California sales Rental property Combat and hazard zones A servicemember who

Of 32 490 in the taxable year and does not have wages salaries tips and other employee compensation in excess of 32 490 in the taxable year For more information

Military pay is not California sourced income Income can be from Non military wages California sales Rental property Combat and hazard zones A servicemember who

Retiring These States Won t Tax Your Distributions

States That Don t Tax Military Retirement Pay Discover Here

States That Tax Military Retirement Pay and States That Don t Kiplinger

What Are The States That Don t Tax Military Retirement ClearMatch

These States Don t Tax Military Retirement

List Military Retirement Income Tax

List Military Retirement Income Tax

States That Don t Tax Military Retirement 2023 Wisevoter