Today, where screens rule our lives The appeal of tangible printed materials hasn't faded away. No matter whether it's for educational uses or creative projects, or simply adding an element of personalization to your home, printables for free have proven to be a valuable source. We'll dive into the sphere of "What Is The Taxable Amount Of A Roth Ira Distribution," exploring their purpose, where to find them and what they can do to improve different aspects of your lives.

Get Latest What Is The Taxable Amount Of A Roth Ira Distribution Below

What Is The Taxable Amount Of A Roth Ira Distribution

What Is The Taxable Amount Of A Roth Ira Distribution - What Is The Taxable Amount Of A Roth Ira Distribution, What Portion Of A Roth Ira Distribution Is Taxable, What Is Taxable On A Roth Ira Distribution, Do I Pay Taxes On A Roth Ira Distribution, How To Determine Taxable Amount Of Roth Ira Distribution, How Do I Know If My Roth Ira Distribution Is Taxable

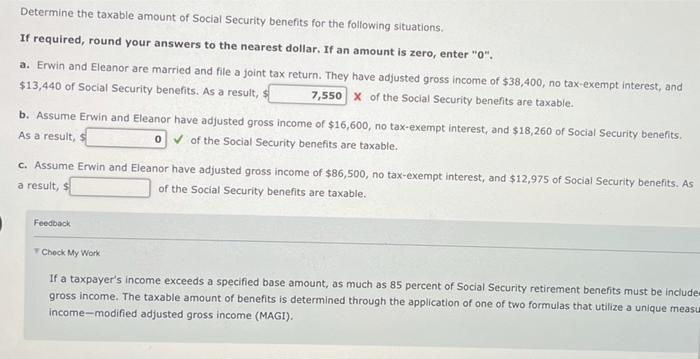

Distributions from a Roth IRA may be subject to income taxes and in some cases the 10 penalty Here are a few common scenarios to consider If you are at least age 59 but have not met the five year requirement distributions of earnings from the account will be taxed but not subject to the 10 penalty

This interview will help you determine if your distribution from a Roth IRA or designated Roth account is taxable This topic doesn t address either the return of a Roth IRA contribution or return of a prior year s excess contribution or a corrective distribution of excess contribution from a designated Roth account

Printables for free cover a broad range of printable, free items that are available online at no cost. These printables come in different forms, including worksheets, templates, coloring pages, and many more. The great thing about What Is The Taxable Amount Of A Roth Ira Distribution is in their versatility and accessibility.

More of What Is The Taxable Amount Of A Roth Ira Distribution

8 Key Benefits Of A Roth IRA Dividend Power

8 Key Benefits Of A Roth IRA Dividend Power

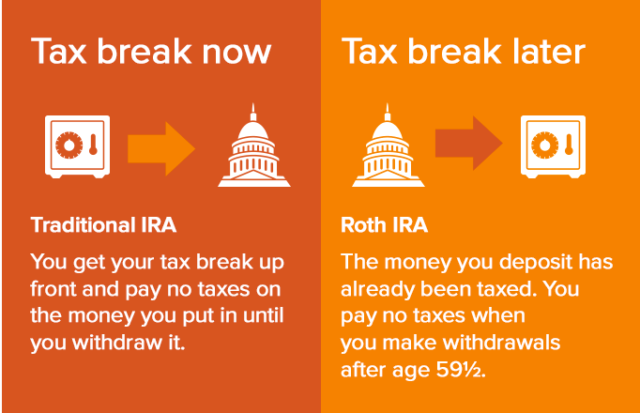

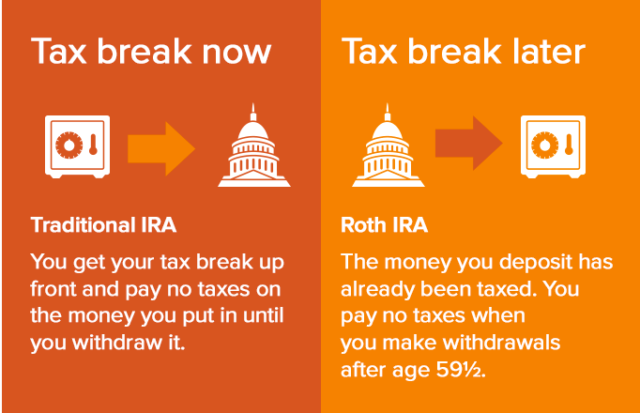

Only Roth IRAs offer tax free withdrawals The income tax was paid when the money was deposited If you withdraw money before age 59 you will have to pay income tax and even a 10 penalty

You can take tax and penalty free early distributions before age 59 1 2 if you made your first contribution to your Roth IRA at least five years previously and one of the following applies

The What Is The Taxable Amount Of A Roth Ira Distribution have gained huge popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

Customization: The Customization feature lets you tailor printables to fit your particular needs whether you're designing invitations or arranging your schedule or even decorating your house.

-

Educational value: The free educational worksheets cater to learners of all ages, which makes them an invaluable tool for parents and teachers.

-

Simple: You have instant access a plethora of designs and templates saves time and effort.

Where to Find more What Is The Taxable Amount Of A Roth Ira Distribution

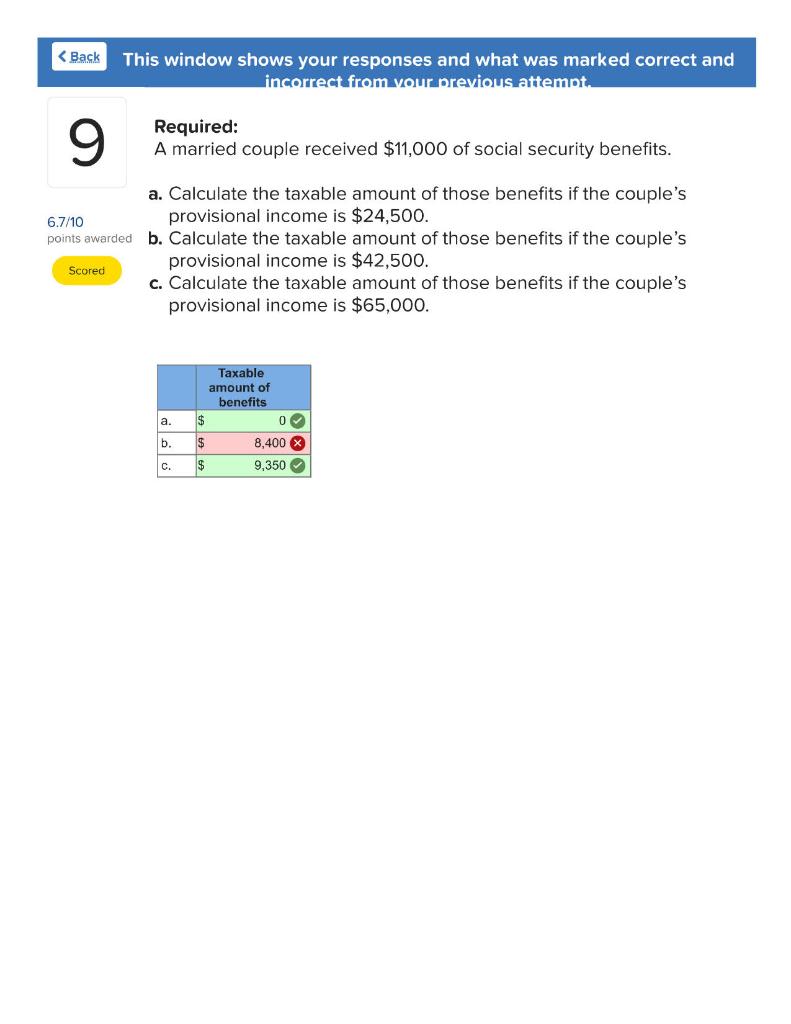

Solved

Solved

Money you put into a Roth IRA is not tax deductible meaning you can t deduct it from your taxable income Although you pay taxes on the money you put into a Roth IRA the investment

Amount of Roth IRA contributions you can make The maximum annual contribution for 2023 is 6 500 or 7 500 if you re age 50 or older and you can make those contributions through April of 2024

Now that we've ignited your interest in What Is The Taxable Amount Of A Roth Ira Distribution Let's take a look at where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of printables that are free for a variety of needs.

- Explore categories such as the home, decor, management, and craft.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing with flashcards and other teaching tools.

- It is ideal for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers post their original designs as well as templates for free.

- The blogs covered cover a wide selection of subjects, that includes DIY projects to party planning.

Maximizing What Is The Taxable Amount Of A Roth Ira Distribution

Here are some ways of making the most of What Is The Taxable Amount Of A Roth Ira Distribution:

1. Home Decor

- Print and frame stunning art, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Print worksheets that are free to reinforce learning at home (or in the learning environment).

3. Event Planning

- Designs invitations, banners and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars checklists for tasks, as well as meal planners.

Conclusion

What Is The Taxable Amount Of A Roth Ira Distribution are an abundance with useful and creative ideas that cater to various needs and interests. Their accessibility and versatility make they a beneficial addition to your professional and personal life. Explore the vast array of What Is The Taxable Amount Of A Roth Ira Distribution and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are What Is The Taxable Amount Of A Roth Ira Distribution really are they free?

- Yes, they are! You can download and print these resources at no cost.

-

Do I have the right to use free templates for commercial use?

- It is contingent on the specific usage guidelines. Always read the guidelines of the creator before using printables for commercial projects.

-

Do you have any copyright problems with What Is The Taxable Amount Of A Roth Ira Distribution?

- Certain printables might have limitations in their usage. Be sure to check the terms and conditions set forth by the creator.

-

How do I print printables for free?

- You can print them at home with your printer or visit any local print store for more high-quality prints.

-

What software do I require to view printables that are free?

- The majority of printables are in the format PDF. This is open with no cost software, such as Adobe Reader.

What Is A Roth IRA The Fancy Accountant

Solved Determine The Taxable Amount Of Social Security Chegg

Check more sample of What Is The Taxable Amount Of A Roth Ira Distribution below

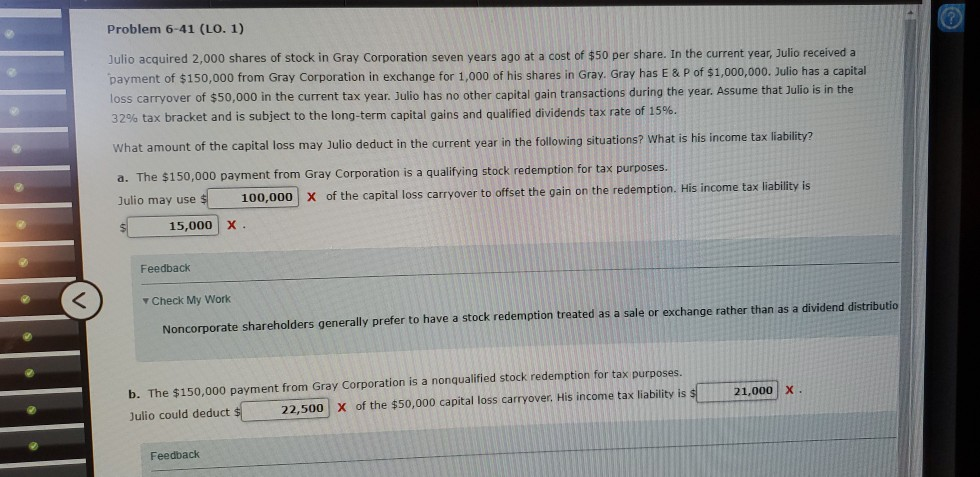

Solved Problem 6 41 LO 1 Julio Acquired 2 000 Shares Of Chegg

How A Taxable Brokerage Account Can Be Better Than A Roth IRA

IRA Contribution Limits In 2023 Meld Financial

Roth IRA Withdrawal Rules Oblivious Investor

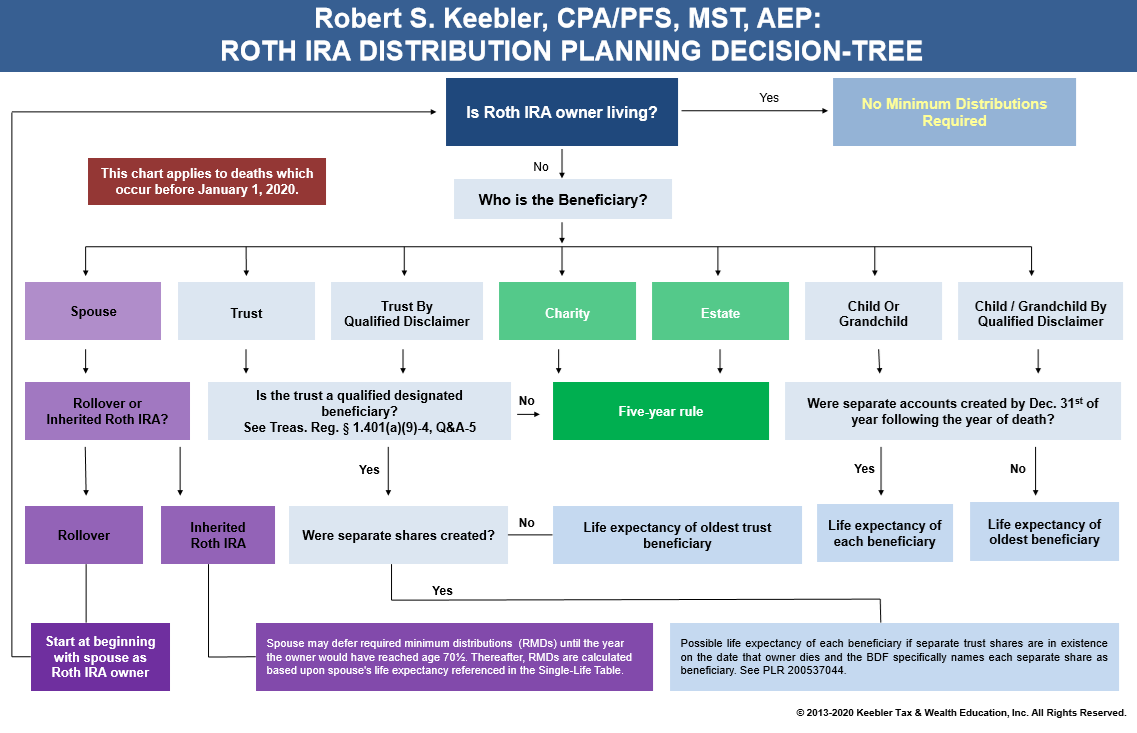

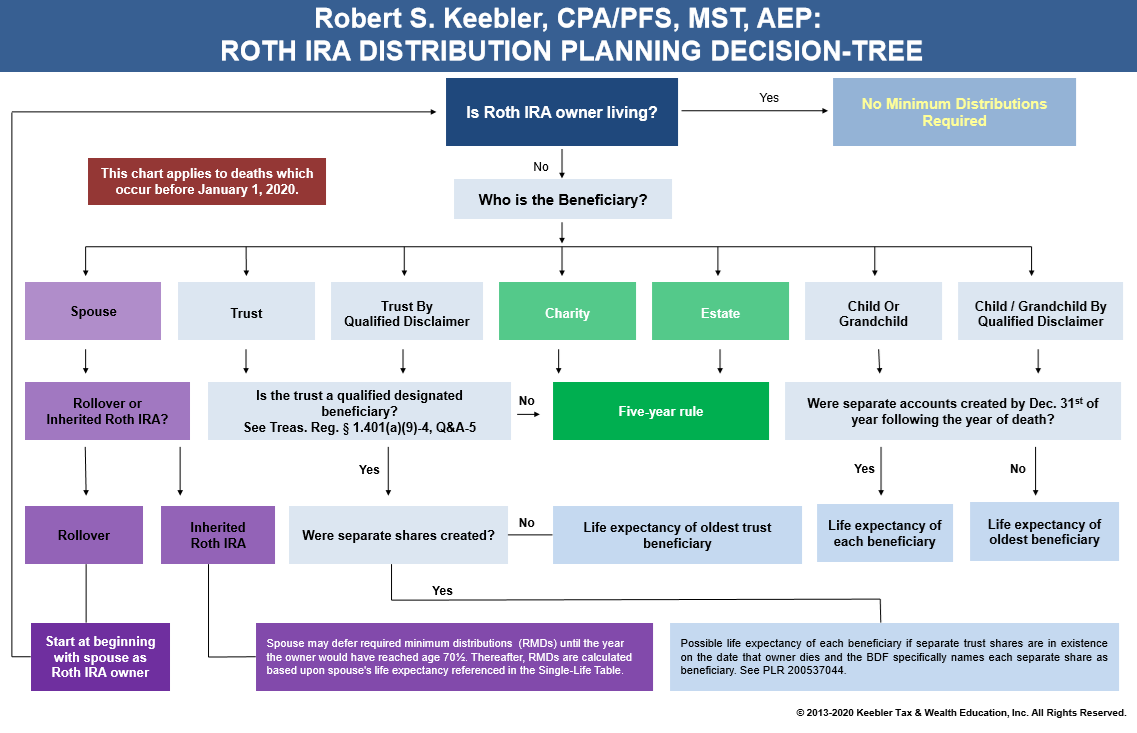

2023 Roth IRA Distribution Chart Ultimate Estate Planner

Figure 2 1 Is The Distribution From Your Roth IRA A Qualified

https://www.irs.gov/help/ita/is-the-distribution...

This interview will help you determine if your distribution from a Roth IRA or designated Roth account is taxable This topic doesn t address either the return of a Roth IRA contribution or return of a prior year s excess contribution or a corrective distribution of excess contribution from a designated Roth account

https://www.investopedia.com/retirement/tax...

Distributions of earnings that are part of a non qualified distribution are taxable and may be subject to an additional 10 early distribution penalty There is a distinction regarding

This interview will help you determine if your distribution from a Roth IRA or designated Roth account is taxable This topic doesn t address either the return of a Roth IRA contribution or return of a prior year s excess contribution or a corrective distribution of excess contribution from a designated Roth account

Distributions of earnings that are part of a non qualified distribution are taxable and may be subject to an additional 10 early distribution penalty There is a distinction regarding

Roth IRA Withdrawal Rules Oblivious Investor

How A Taxable Brokerage Account Can Be Better Than A Roth IRA

2023 Roth IRA Distribution Chart Ultimate Estate Planner

Figure 2 1 Is The Distribution From Your Roth IRA A Qualified

Social Security Cost Of Living Adjustments 2023

Is It Worth Doing A Backdoor Roth IRA Pros And Cons

Is It Worth Doing A Backdoor Roth IRA Pros And Cons

How To Calculate Taxable Amount Of An IRA Distribution