In this digital age, where screens rule our lives yet the appeal of tangible printed products hasn't decreased. For educational purposes as well as creative projects or just adding an individual touch to the area, What Is The Federal Energy Tax Credit For 2021 are now a useful source. In this article, we'll dive into the world "What Is The Federal Energy Tax Credit For 2021," exploring the different types of printables, where they are, and how they can enrich various aspects of your lives.

Get Latest What Is The Federal Energy Tax Credit For 2021 Below

What Is The Federal Energy Tax Credit For 2021

What Is The Federal Energy Tax Credit For 2021 - What Is The Federal Energy Tax Credit For 2021, What Is The Federal Energy Tax Credit, How Does The Federal Energy Tax Credit Work, What Qualifies For Federal Energy Tax Credit

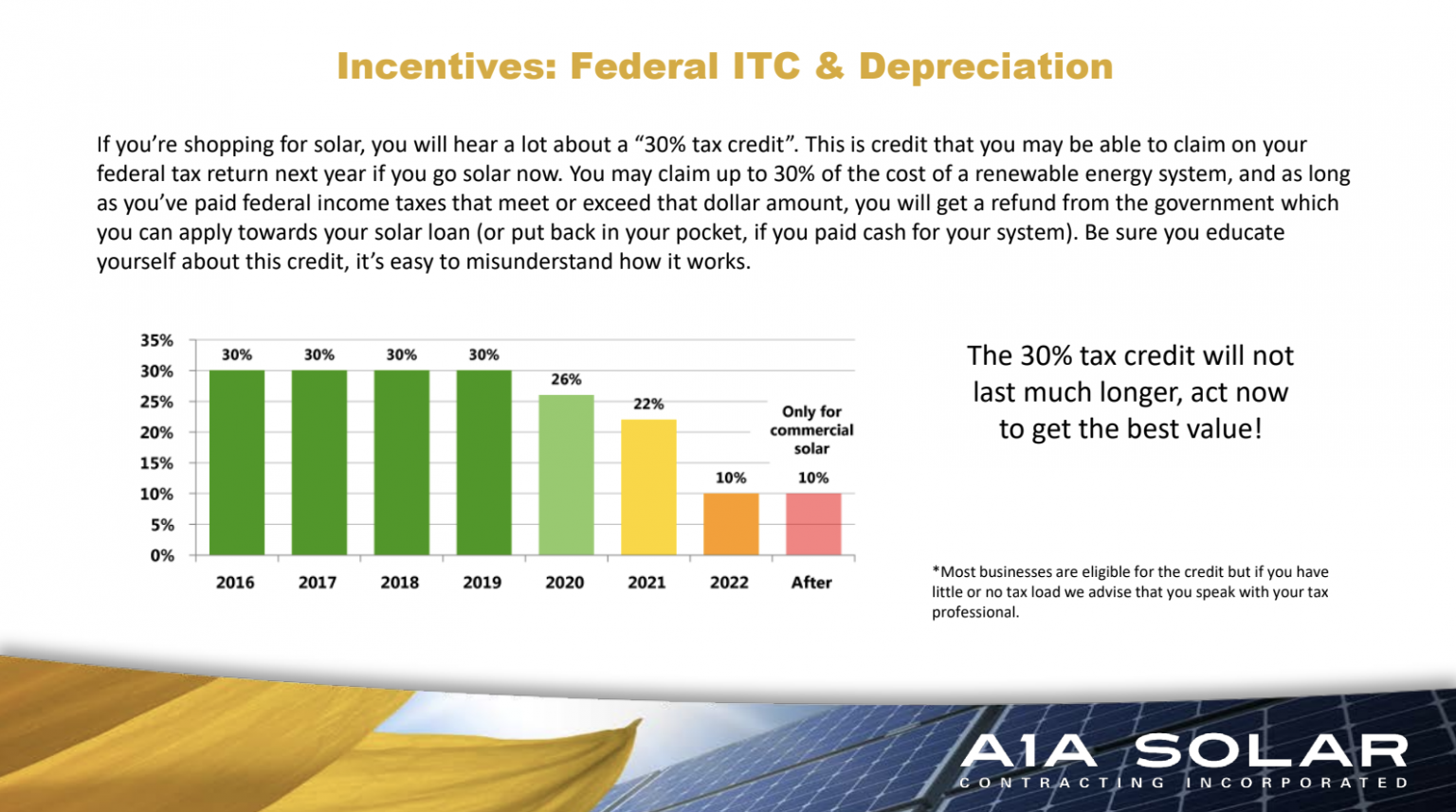

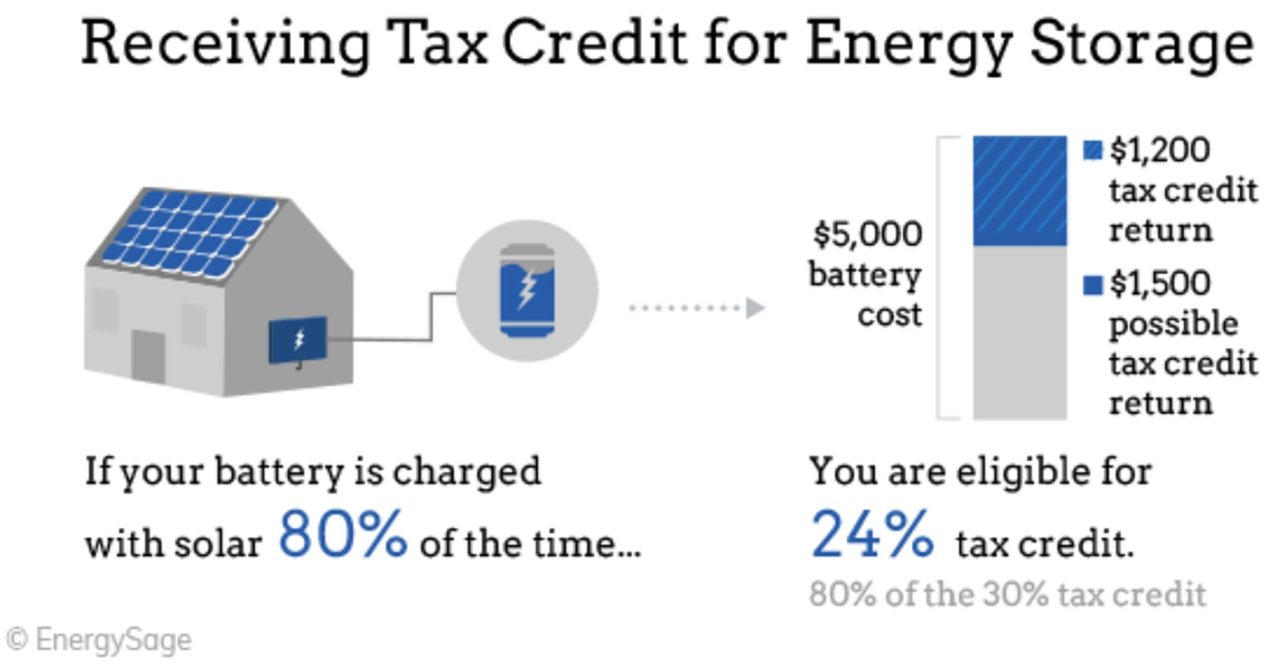

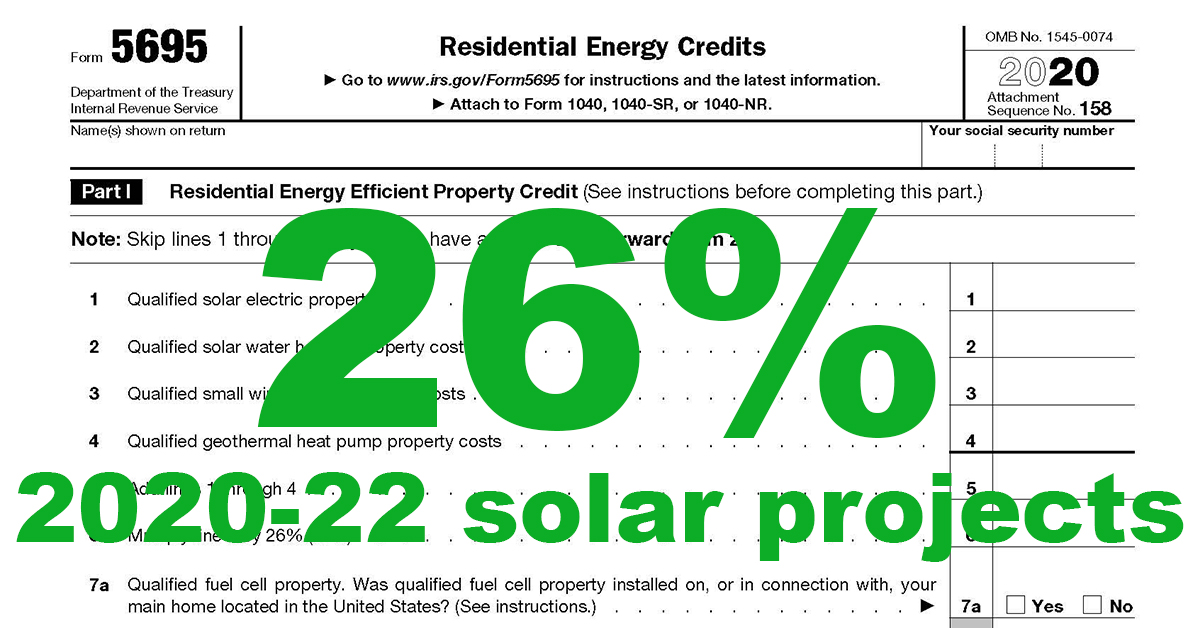

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help

The What Is The Federal Energy Tax Credit For 2021 are a huge range of printable, free materials available online at no cost. They come in many designs, including worksheets templates, coloring pages, and more. One of the advantages of What Is The Federal Energy Tax Credit For 2021 is their flexibility and accessibility.

More of What Is The Federal Energy Tax Credit For 2021

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of

What Is The Federal Energy Tax Credit For 2021 have risen to immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or costly software.

-

Personalization The Customization feature lets you tailor the design to meet your needs for invitations, whether that's creating them planning your schedule or even decorating your house.

-

Educational Use: Downloads of educational content for free are designed to appeal to students of all ages. This makes them an essential tool for teachers and parents.

-

Simple: Access to numerous designs and templates helps save time and effort.

Where to Find more What Is The Federal Energy Tax Credit For 2021

Get A 30 Federal Tax Credit For Your Solar Panel System While You Can

Get A 30 Federal Tax Credit For Your Solar Panel System While You Can

Explainer Final rules from the Treasury Department governing energy tax credit transfers cement guidance for one of the bigger changes to come out of the 2022

The Inflation Reduction Act amended the credit to be worth up to 1 200 per year for qualifying property placed in service on or after January 1 2023 and before

Now that we've ignited your interest in printables for free Let's take a look at where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection with What Is The Federal Energy Tax Credit For 2021 for all purposes.

- Explore categories such as the home, decor, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free including flashcards, learning tools.

- The perfect resource for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates at no cost.

- The blogs covered cover a wide range of topics, ranging from DIY projects to planning a party.

Maximizing What Is The Federal Energy Tax Credit For 2021

Here are some innovative ways to make the most of What Is The Federal Energy Tax Credit For 2021:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Print free worksheets for reinforcement of learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations for banners, invitations and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Keep track of your schedule with printable calendars, to-do lists, and meal planners.

Conclusion

What Is The Federal Energy Tax Credit For 2021 are an abundance of creative and practical resources which cater to a wide range of needs and hobbies. Their accessibility and flexibility make these printables a useful addition to your professional and personal life. Explore the plethora of What Is The Federal Energy Tax Credit For 2021 and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually free?

- Yes you can! You can print and download these items for free.

-

Do I have the right to use free printables for commercial purposes?

- It's based on the terms of use. Always consult the author's guidelines before using their printables for commercial projects.

-

Are there any copyright concerns with printables that are free?

- Some printables may have restrictions on usage. Make sure to read the terms and conditions offered by the creator.

-

How can I print printables for free?

- Print them at home with a printer or visit a local print shop to purchase premium prints.

-

What program must I use to open printables for free?

- The majority are printed in PDF format, which can be opened with free software such as Adobe Reader.

Final Days Of The 30 ITC Solar And Energy Storage Tax Credit Briggs

2023 Residential Clean Energy Credit Guide ReVision Energy

Check more sample of What Is The Federal Energy Tax Credit For 2021 below

Congress Gets Renewable Tax Credit Extension Right Renewable Energy World

The Federal Investment Tax Credit ITC For Solar Has Been Extended

Claim Your Federal Tax Credits For Solar Puget Sound Solar LLC

Energy Tax Credits For Your Small Business Shipley Energy

Federal Solar Tax Credits For Businesses Department Of Energy

Energy Tax Credit Denver CO DALCO Heating Air Conditioning

https://www.energystar.gov/about/federal-tax-credits

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help

https://www.energy.gov/sites/default/files/2021/02...

Claiming a 1 000 federal tax credit reduces your federal income taxes due by 1 000 1 What is the federal solar tax credit The federal residential solar energy credit is a tax

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help

Claiming a 1 000 federal tax credit reduces your federal income taxes due by 1 000 1 What is the federal solar tax credit The federal residential solar energy credit is a tax

Energy Tax Credits For Your Small Business Shipley Energy

The Federal Investment Tax Credit ITC For Solar Has Been Extended

Federal Solar Tax Credits For Businesses Department Of Energy

Energy Tax Credit Denver CO DALCO Heating Air Conditioning

Les Bases De La Fiscalit Au Canada Workingholidayincanada

FAQ Energy Tax Credit For New Windows 2023 Inflation Reduction Act

FAQ Energy Tax Credit For New Windows 2023 Inflation Reduction Act

Energy Subcommittee Examines Federal Energy Tax Policy Daily Energy