Today, when screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed objects hasn't waned. In the case of educational materials and creative work, or simply to add an individual touch to your area, What Is Retirement Savings Contributions Credit Form 8880 have proven to be a valuable source. Here, we'll dive to the depths of "What Is Retirement Savings Contributions Credit Form 8880," exploring the different types of printables, where you can find them, and how they can enhance various aspects of your daily life.

Get Latest What Is Retirement Savings Contributions Credit Form 8880 Below

What Is Retirement Savings Contributions Credit Form 8880

What Is Retirement Savings Contributions Credit Form 8880 - What Is Retirement Savings Contributions Credit Form 8880, What Is Retirement Savings Contribution Credit, Who Qualifies For The Retirement Savings Contribution Credit, How Much Is The Retirement Savings Contribution Credit, Why Am I Getting A Retirement Savings Contribution Credit

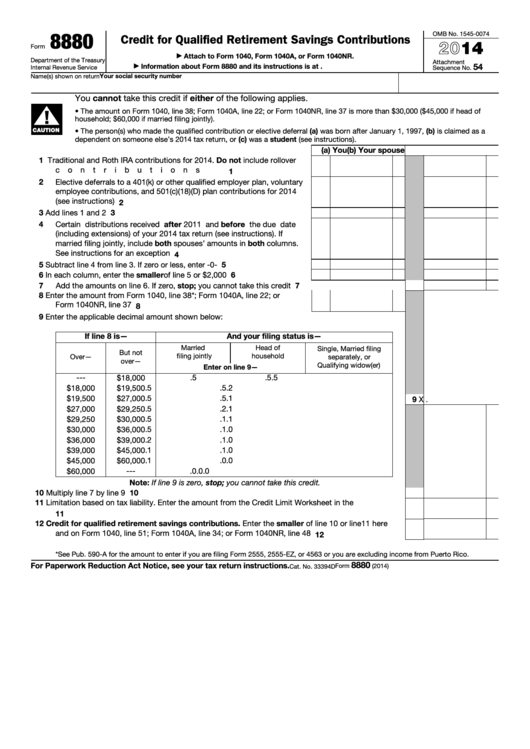

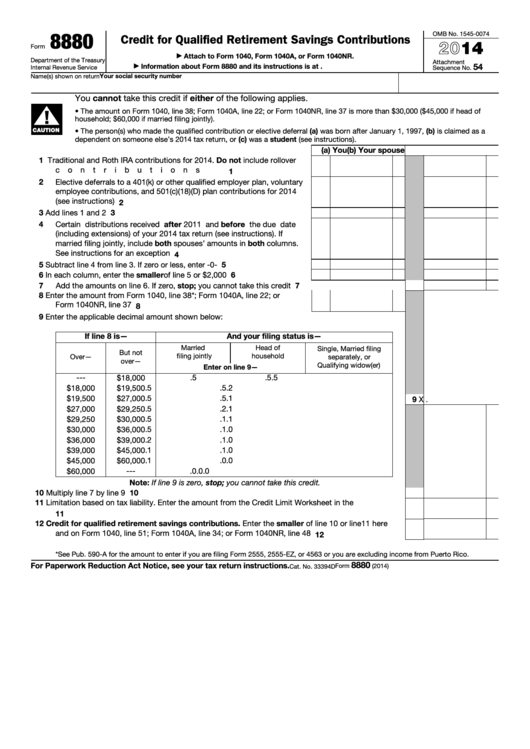

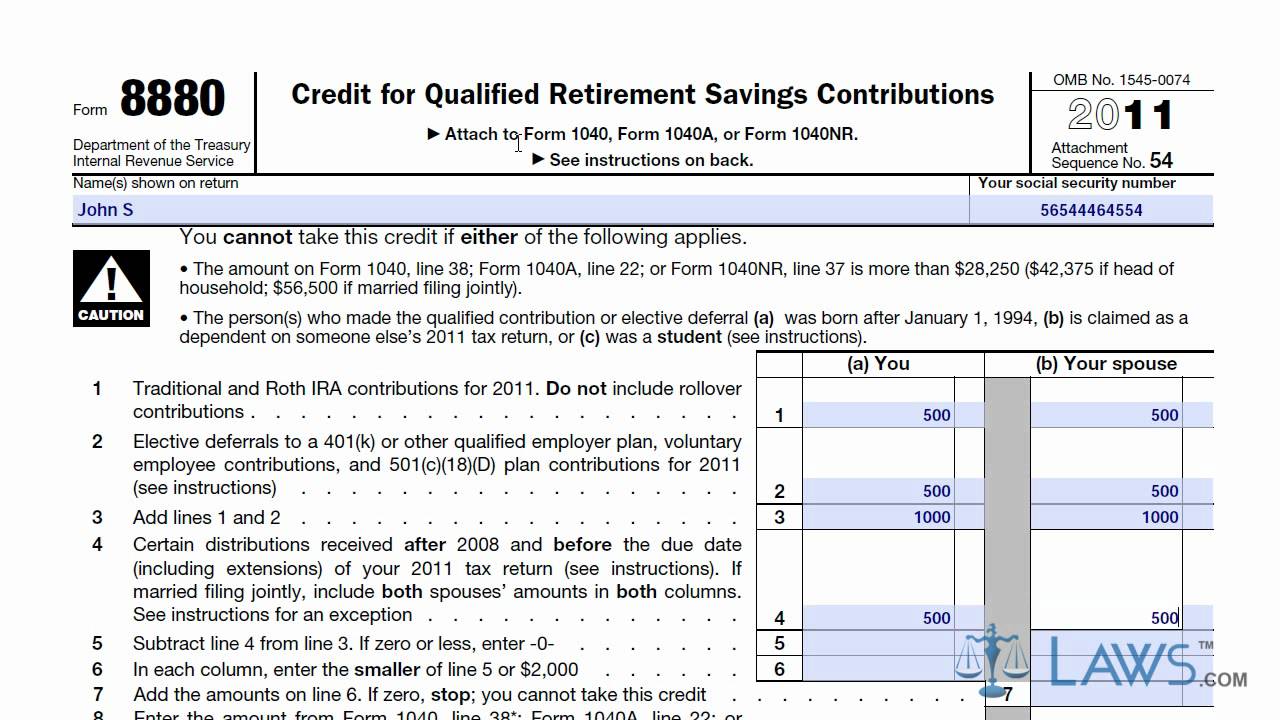

You can then calculate and claim the amount of the Saver s Credit you are eligible for by completing Form 8880 Credit for Qualified Retirement Savings

Information about Form 8880 Credit for Qualified Retirement Savings Contributions including recent updates related forms and instructions on how to file

What Is Retirement Savings Contributions Credit Form 8880 provide a diverse assortment of printable material that is available online at no cost. They are available in numerous forms, like worksheets templates, coloring pages and many more. The benefit of What Is Retirement Savings Contributions Credit Form 8880 is their versatility and accessibility.

More of What Is Retirement Savings Contributions Credit Form 8880

Retirement Savings Contributions Credit First Fruits

Retirement Savings Contributions Credit First Fruits

The Qualified Retirement Savings Contribution Credit is also known as the Saver s Credit Taxpayers use IRS Form 8880 for the Qualified Retirement Savings

The retirement savings contribution credit the saver s credit for short is a nonrefundable tax credit worth up to 1 000 2 000 if married filing jointly for

What Is Retirement Savings Contributions Credit Form 8880 have garnered immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

The ability to customize: Your HTML0 customization options allow you to customize printables to fit your particular needs such as designing invitations or arranging your schedule or even decorating your house.

-

Educational Worth: Downloads of educational content for free are designed to appeal to students of all ages. This makes them a useful tool for teachers and parents.

-

Affordability: Instant access to a myriad of designs as well as templates will save you time and effort.

Where to Find more What Is Retirement Savings Contributions Credit Form 8880

Retirement Savings Contribution Credit Get A Tax Credit Just For

Retirement Savings Contribution Credit Get A Tax Credit Just For

To claim the Saver s Credit you need to complete Form 8880 Credit for Qualified Retirement Savings Contributions to calculate the amount of your credit You

Your Form 8880 will guide you through a calculation to determine the maximum credit amount you are eligible to claim The size of your tax credit is a

Now that we've ignited your interest in printables for free and other printables, let's discover where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of What Is Retirement Savings Contributions Credit Form 8880 designed for a variety motives.

- Explore categories like the home, decor, organizing, and crafts.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free or flashcards as well as learning materials.

- Perfect for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers post their original designs and templates for no cost.

- These blogs cover a wide range of topics, including DIY projects to planning a party.

Maximizing What Is Retirement Savings Contributions Credit Form 8880

Here are some ideas in order to maximize the use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes or decorations for the holidays to beautify your living spaces.

2. Education

- Use free printable worksheets to aid in learning at your home, or even in the classroom.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep track of your schedule with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

What Is Retirement Savings Contributions Credit Form 8880 are an abundance of useful and creative resources for a variety of needs and preferences. Their accessibility and flexibility make they a beneficial addition to your professional and personal life. Explore the world of What Is Retirement Savings Contributions Credit Form 8880 today to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly available for download?

- Yes they are! You can download and print these free resources for no cost.

-

Can I utilize free printables for commercial use?

- It's based on the terms of use. Always review the terms of use for the creator before using printables for commercial projects.

-

Are there any copyright problems with printables that are free?

- Some printables could have limitations on usage. You should read the terms and conditions offered by the author.

-

How do I print What Is Retirement Savings Contributions Credit Form 8880?

- You can print them at home using either a printer or go to the local print shops for the highest quality prints.

-

What program do I need to run printables that are free?

- The majority of printed documents are in PDF format, which can be opened using free programs like Adobe Reader.

Form 8880 Credit For Qualified Retirement Savings Contributions

:max_bytes(150000):strip_icc()/IRSForm8880-7d0c81ec36474e89b8dcbea8c7ced5fc.jpg)

What Is Retirement Savings Tax Credit Leia Aqui Why Am I Getting A

:max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png)

Check more sample of What Is Retirement Savings Contributions Credit Form 8880 below

What Is Retirement Savings Tax Credit Leia Aqui Why Am I Getting A

Retirement Savings Contributions Credit 2023 Calculator Eligibility

Retirement Savings Contribution Credit Get A Tax Credit For Saving

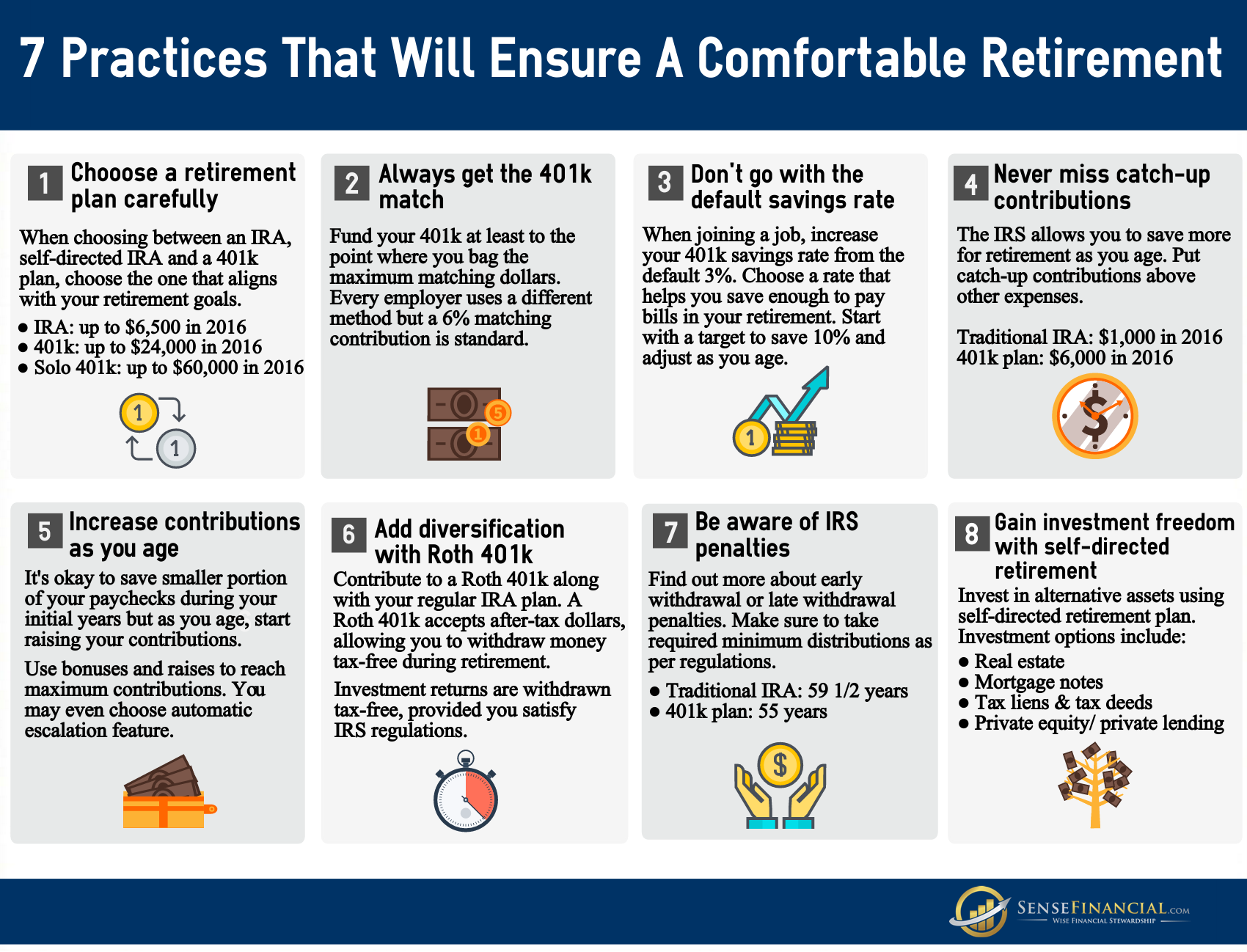

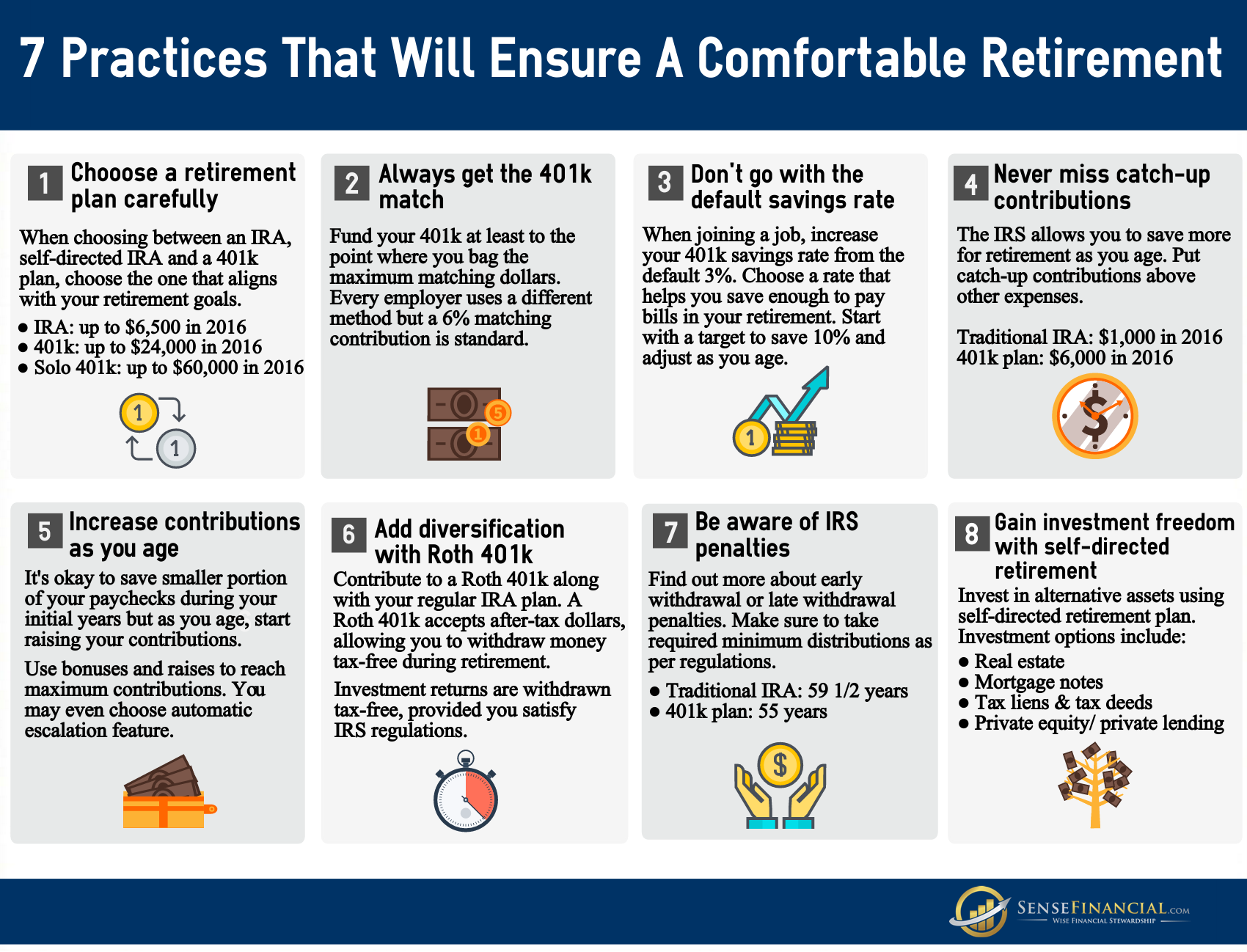

Infographic 8 Retirement Tips That Will Ensure A Comfortable Retirement

Fillable Form 8880 Credit For Qualified Retirement Savings

Form 8880 Credit For Qualified Retirement Savings Contributions

https://www.irs.gov/forms-pubs/about-form-8880

Information about Form 8880 Credit for Qualified Retirement Savings Contributions including recent updates related forms and instructions on how to file

https://www.irs.gov/pub/irs-pdf/f8880.pdf

Use Form 8880 to figure the amount if any of your retirement savings contributions credit also known as the saver s credit The maximum amount of the credit is 1 000 2 000

Information about Form 8880 Credit for Qualified Retirement Savings Contributions including recent updates related forms and instructions on how to file

Use Form 8880 to figure the amount if any of your retirement savings contributions credit also known as the saver s credit The maximum amount of the credit is 1 000 2 000

Infographic 8 Retirement Tips That Will Ensure A Comfortable Retirement

Retirement Savings Contributions Credit 2023 Calculator Eligibility

Fillable Form 8880 Credit For Qualified Retirement Savings

Form 8880 Credit For Qualified Retirement Savings Contributions

Pin On Retirement Planning

What S The Maximum 401k Contribution Limit In 2022 Hanover Mortgages

What S The Maximum 401k Contribution Limit In 2022 Hanover Mortgages

Form 8880 YouTube