In the age of digital, where screens dominate our lives but the value of tangible printed objects isn't diminished. It doesn't matter if it's for educational reasons or creative projects, or simply to add personal touches to your space, What Is Federal Ev Tax Credit have proven to be a valuable source. In this article, we'll take a dive into the sphere of "What Is Federal Ev Tax Credit," exploring what they are, where to locate them, and what they can do to improve different aspects of your daily life.

Get Latest What Is Federal Ev Tax Credit Below

What Is Federal Ev Tax Credit

What Is Federal Ev Tax Credit -

For the first time in years some Teslas will qualify for a 7 500 federal tax credit for new electric vehicles But only some vehicles and only some buyers are eligible

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

What Is Federal Ev Tax Credit offer a wide variety of printable, downloadable materials online, at no cost. They come in many types, like worksheets, coloring pages, templates and more. The great thing about What Is Federal Ev Tax Credit is their versatility and accessibility.

More of What Is Federal Ev Tax Credit

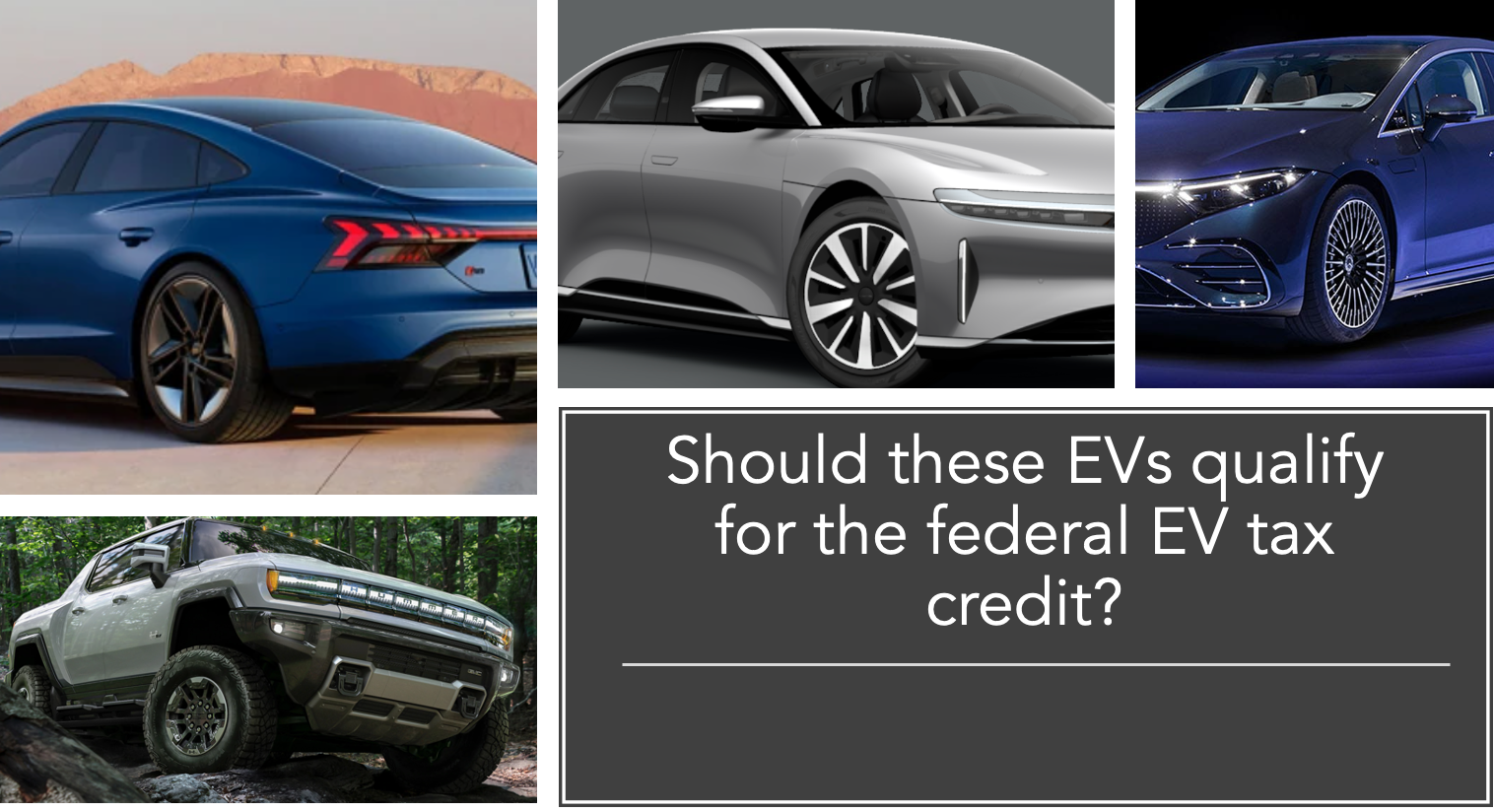

Should These EVs Qualify For The Federal EV Tax Credit EVAdoption

Should These EVs Qualify For The Federal EV Tax Credit EVAdoption

If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D

Since 2008 the federal government has offered federal tax credits of up to 7 500 when you purchase an electric vehicle EV or plug in hybrid electric vehicle PHEV With the Inflation

What Is Federal Ev Tax Credit have risen to immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

Modifications: There is the possibility of tailoring printables to your specific needs for invitations, whether that's creating them for your guests, organizing your schedule or even decorating your house.

-

Educational Benefits: Education-related printables at no charge are designed to appeal to students of all ages. This makes them an invaluable tool for parents and educators.

-

An easy way to access HTML0: Fast access the vast array of design and templates is time-saving and saves effort.

Where to Find more What Is Federal Ev Tax Credit

Revamping The Federal EV Tax Credit Could Help Average Car Buyers

Revamping The Federal EV Tax Credit Could Help Average Car Buyers

The EV tax credit is a federal incentive to encourage consumers to purchase EVs Taxpayers who meet the income requirements and buy a vehicle that satisfies the price battery and

In 2024 several EVs are eligible for the federal government s tax credit program which can reduce what you owe the IRS by up to 7500 for a single tax year

If we've already piqued your curiosity about What Is Federal Ev Tax Credit Let's take a look at where they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection in What Is Federal Ev Tax Credit for different objectives.

- Explore categories such as design, home decor, craft, and organization.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free for flashcards, lessons, and worksheets. tools.

- Ideal for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates free of charge.

- The blogs are a vast array of topics, ranging all the way from DIY projects to planning a party.

Maximizing What Is Federal Ev Tax Credit

Here are some new ways of making the most of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Utilize free printable worksheets to enhance learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations and banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Be organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

What Is Federal Ev Tax Credit are an abundance of creative and practical resources that cater to various needs and interest. Their accessibility and versatility make them an essential part of each day life. Explore the world of What Is Federal Ev Tax Credit now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly available for download?

- Yes they are! You can download and print these items for free.

-

Do I have the right to use free printouts for commercial usage?

- It's dependent on the particular terms of use. Always read the guidelines of the creator before utilizing printables for commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Some printables may have restrictions on use. Make sure to read the terms and conditions offered by the designer.

-

How can I print What Is Federal Ev Tax Credit?

- You can print them at home with your printer or visit an in-store print shop to get better quality prints.

-

What software will I need to access printables free of charge?

- The majority are printed in the format of PDF, which can be opened using free software like Adobe Reader.

EV Tax Credit Explained What You Need To Know YouTube

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Check more sample of What Is Federal Ev Tax Credit below

List Of Vehicles Eligible For The New 7 500 Federal EV Tax Credit

4 Ways How Does The Federal Ev Tax Credit Work Alproject

Explained The Updated EV Tax Credit Rules Elektriken

Everything You Need To Know About The IRS s New EV Tax Credit Guidance

Ending Federal EV Tax Credits Is The Opposite Of Improving Market

U S Lawmakers Propose To Extend EV Tax Credit At A Cost Of 11 4

https://www.irs.gov/credits-deductions/credits-for...

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

https://www.fueleconomy.gov/feg/tax2023.shtml

All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500

Everything You Need To Know About The IRS s New EV Tax Credit Guidance

4 Ways How Does The Federal Ev Tax Credit Work Alproject

Ending Federal EV Tax Credits Is The Opposite Of Improving Market

U S Lawmakers Propose To Extend EV Tax Credit At A Cost Of 11 4

The Lowdown On The Federal EV Tax Credit

Proposed Federal EV Tax Credit Reform Will It Move The Sales Needle

Proposed Federal EV Tax Credit Reform Will It Move The Sales Needle

Tax Credits ElectricVehicleSolar