In this digital age, with screens dominating our lives and the appeal of physical printed material hasn't diminished. Whatever the reason, whether for education or creative projects, or just adding personal touches to your space, Tax Credits And Rebates For Homeowners are now an essential resource. Here, we'll take a dive into the world of "Tax Credits And Rebates For Homeowners," exploring their purpose, where they can be found, and how they can improve various aspects of your life.

Get Latest Tax Credits And Rebates For Homeowners Below

Tax Credits And Rebates For Homeowners

Tax Credits And Rebates For Homeowners -

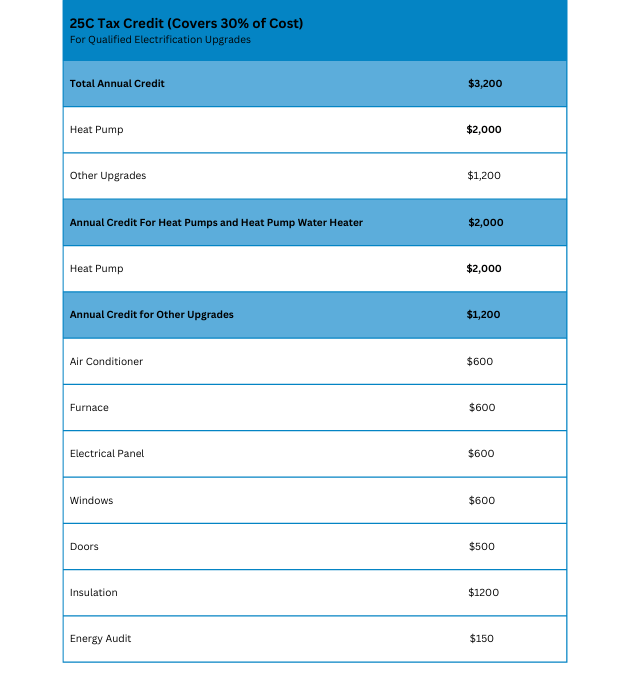

Web 26 juil 2023 nbsp 0183 32 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 biomass stoves and boilers have a separate annual credit limit of

Web 20 d 233 c 2022 nbsp 0183 32 The law provides up to 14 000 in rebates and tax credits per household with the goal of lowering Americans carbon footprint Although the act technically takes

Printables for free include a vast collection of printable materials that are accessible online for free cost. These resources come in many designs, including worksheets coloring pages, templates and more. One of the advantages of Tax Credits And Rebates For Homeowners is their flexibility and accessibility.

More of Tax Credits And Rebates For Homeowners

Constellation s Best Of 2017

Constellation s Best Of 2017

Web The flagship home energy discount included in the IRA is the residential clean energy credit which offers homeowners 30 off the cost of new qualified clean energy

Web 20 juil 2023 nbsp 0183 32 A Consumer Guide to the Inflation Reduction Act Here s how to save on electric vehicles solar panels heat pumps and more via tax credits and rebates July 20 2023 iStock

Tax Credits And Rebates For Homeowners have gained immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies of the software or expensive hardware.

-

customization They can make print-ready templates to your specific requirements be it designing invitations as well as organizing your calendar, or decorating your home.

-

Educational Value Educational printables that can be downloaded for free offer a wide range of educational content for learners of all ages, making them an essential aid for parents as well as educators.

-

The convenience of immediate access many designs and templates will save you time and effort.

Where to Find more Tax Credits And Rebates For Homeowners

10 Rebates And Tax Credits More Homeowners Should Take Advantage Of

10 Rebates And Tax Credits More Homeowners Should Take Advantage Of

Web 13 f 233 vr 2023 nbsp 0183 32 Homeowners can get a tax credit for 30 of the cost to buy and install solar panels up from the previous 26 And there s no dollar limit If you pay 15 000 to put solar panels on your

Web 24 f 233 vr 2023 nbsp 0183 32 Two are tax credits available now for those who can afford to pay for something up front or finance it then reap tax benefits over time The others are state

Since we've got your interest in printables for free Let's find out where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection in Tax Credits And Rebates For Homeowners for different applications.

- Explore categories such as furniture, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free with flashcards and other teaching materials.

- Ideal for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for free.

- These blogs cover a broad spectrum of interests, all the way from DIY projects to planning a party.

Maximizing Tax Credits And Rebates For Homeowners

Here are some inventive ways for you to get the best use of Tax Credits And Rebates For Homeowners:

1. Home Decor

- Print and frame beautiful images, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Use printable worksheets for free to enhance learning at home, or even in the classroom.

3. Event Planning

- Invitations, banners and decorations for special events like birthdays and weddings.

4. Organization

- Stay organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Tax Credits And Rebates For Homeowners are an abundance of useful and creative resources that can meet the needs of a variety of people and hobbies. Their access and versatility makes them an essential part of each day life. Explore the wide world of Tax Credits And Rebates For Homeowners right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Tax Credits And Rebates For Homeowners truly gratis?

- Yes they are! You can print and download these documents for free.

-

Are there any free printables for commercial uses?

- It's all dependent on the usage guidelines. Always review the terms of use for the creator before utilizing their templates for commercial projects.

-

Are there any copyright problems with printables that are free?

- Certain printables may be subject to restrictions on usage. Be sure to review the conditions and terms of use provided by the author.

-

How do I print printables for free?

- You can print them at home using any printer or head to a local print shop to purchase more high-quality prints.

-

What software do I need to run Tax Credits And Rebates For Homeowners?

- Most printables come in the format of PDF, which can be opened using free software like Adobe Reader.

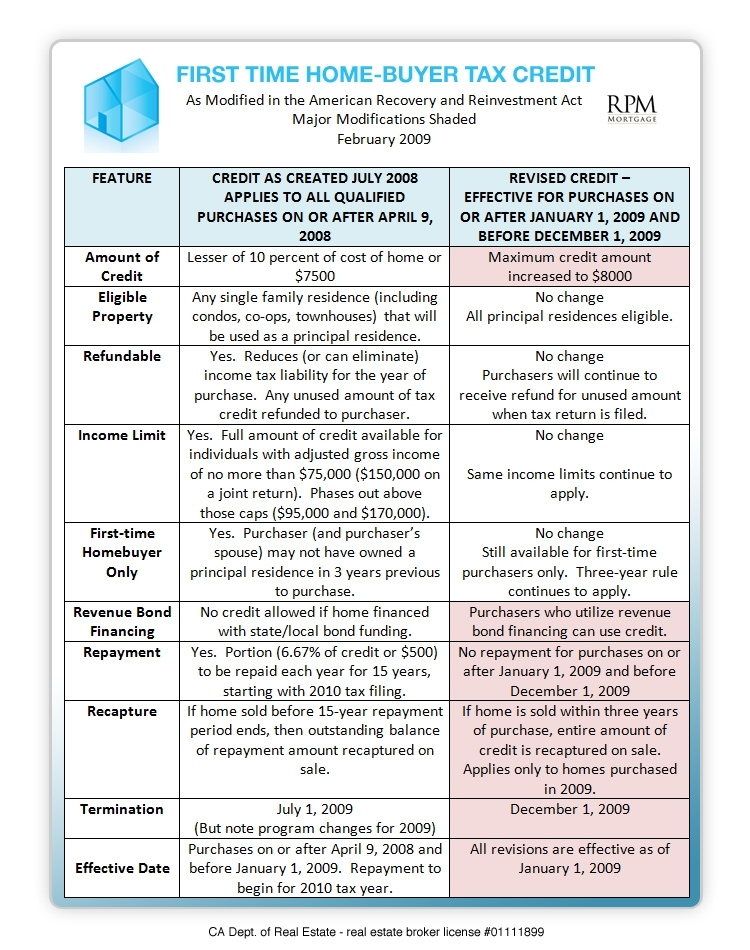

10 Rebates And Tax Credits More Homeowners Should Take Advantage Of

Tampa Homeowners take Advantage Of The Inflation Reduction Act s Tax

Check more sample of Tax Credits And Rebates For Homeowners below

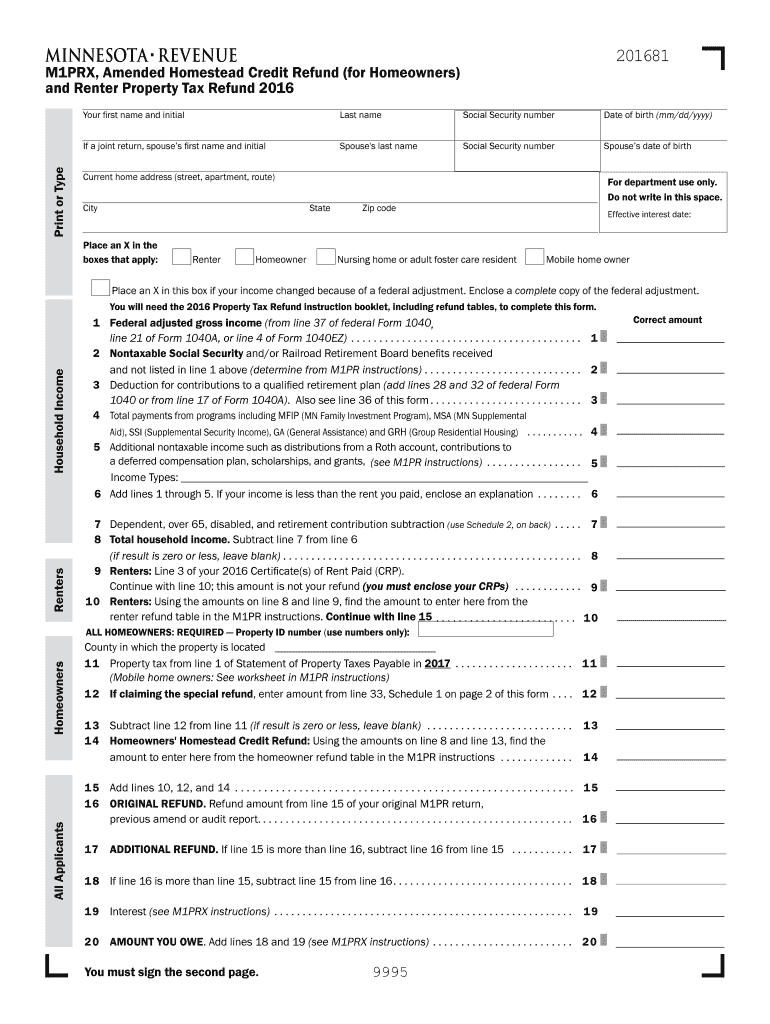

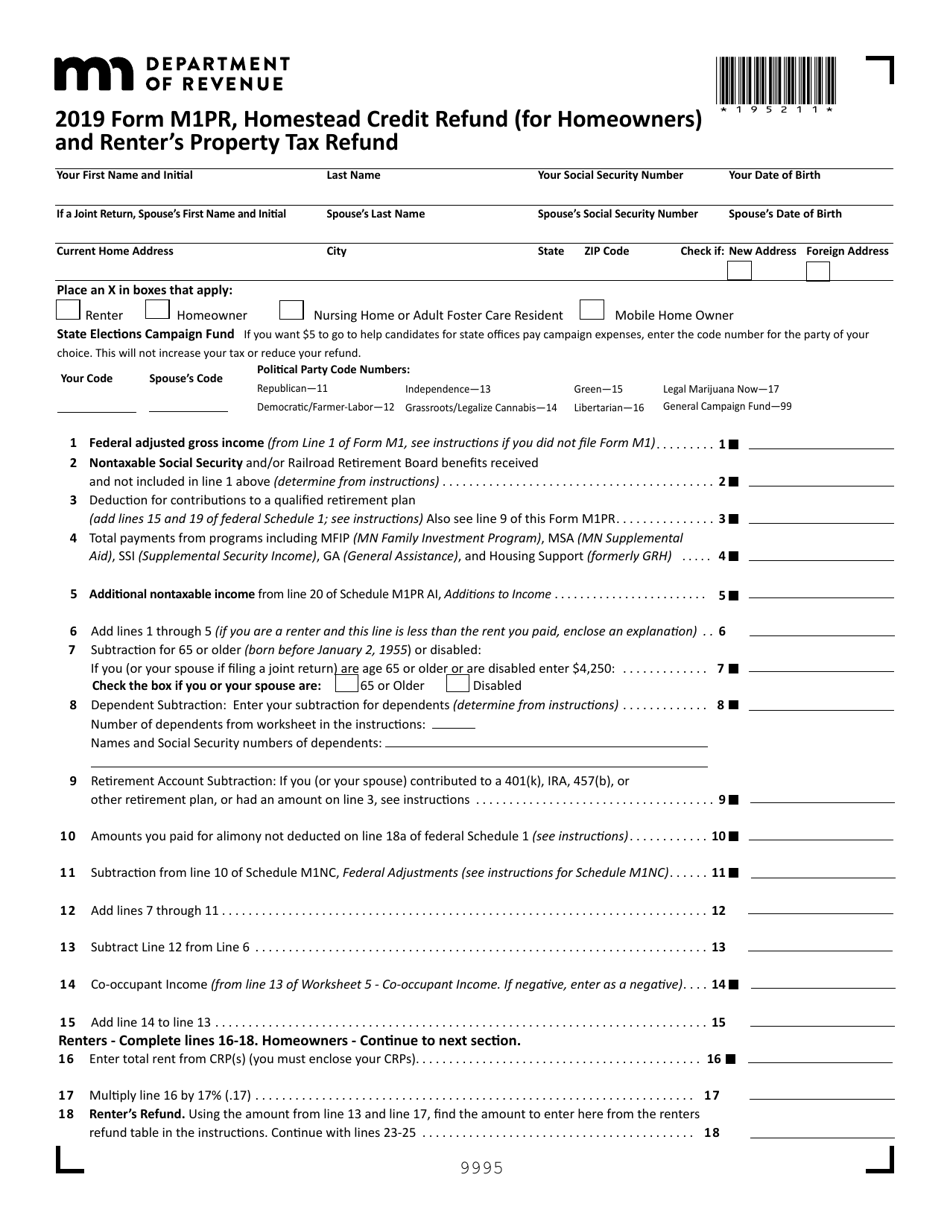

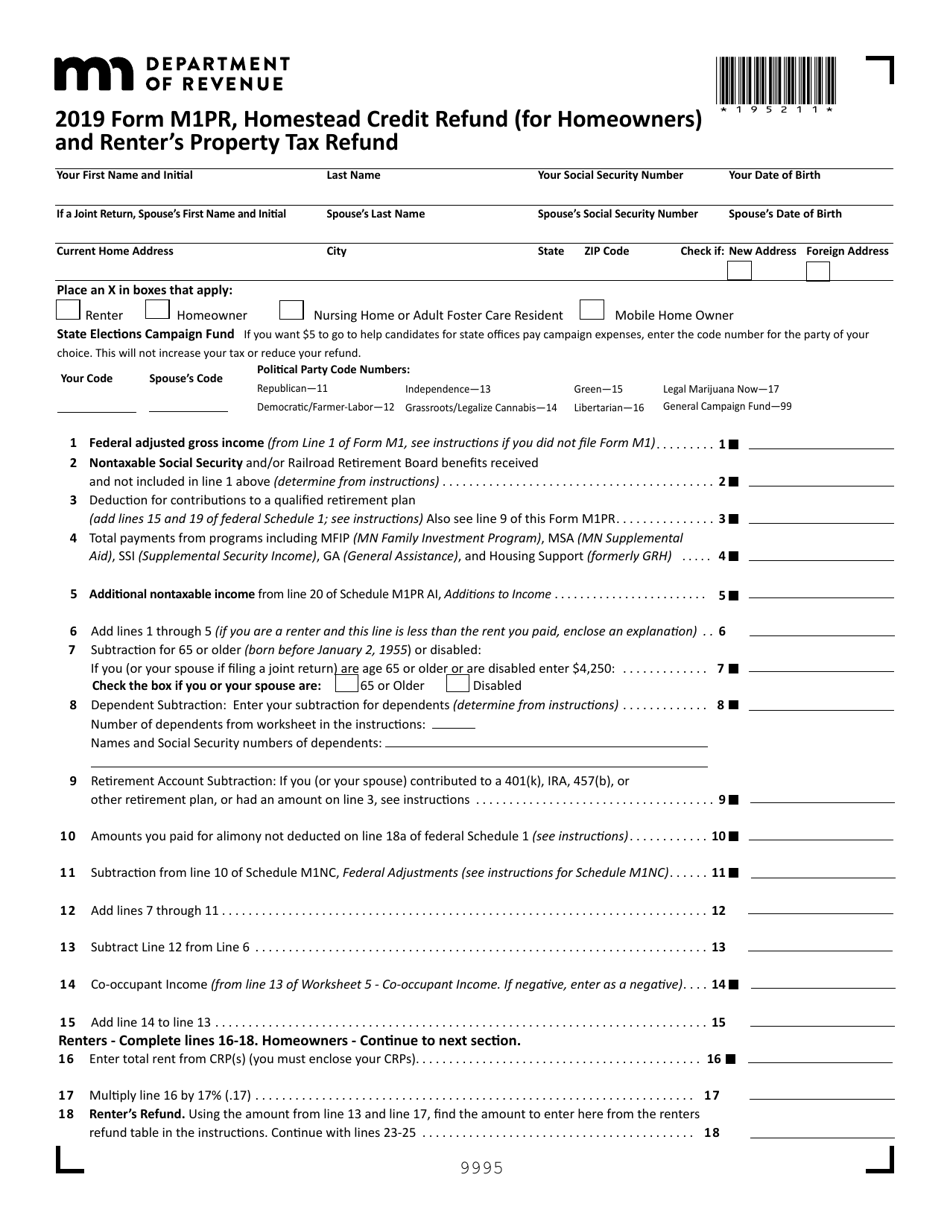

M1PRX Amended Homestead Credit Refund For Homeowners Fill Out And

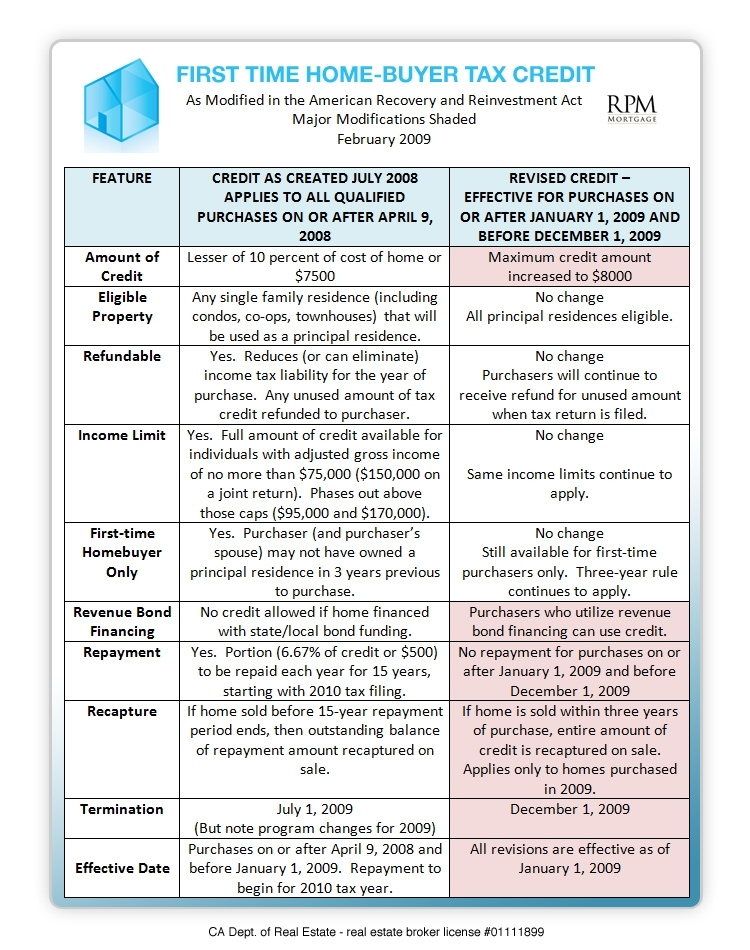

Homeowners Tax Credit Overview The Basis Point

The Homeowners Guide To Energy Tax Credits And Rebates Constellation

Fillable Form M1pr Minnesota Homestead Credit Refund For Homeowners

Form M1PR Download Fillable PDF Or Fill Online Homestead Credit Refund

Energystar gov Offers A Treasure Chest Of Goodies And Information For

https://www.bobvila.com/articles/home-improvement-tax-credits

Web 20 d 233 c 2022 nbsp 0183 32 The law provides up to 14 000 in rebates and tax credits per household with the goal of lowering Americans carbon footprint Although the act technically takes

https://www.energystar.gov/about/federal_tax…

Web 30 d 233 c 2022 nbsp 0183 32 Savings for Homeowners New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent Improvements

Web 20 d 233 c 2022 nbsp 0183 32 The law provides up to 14 000 in rebates and tax credits per household with the goal of lowering Americans carbon footprint Although the act technically takes

Web 30 d 233 c 2022 nbsp 0183 32 Savings for Homeowners New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent Improvements

Fillable Form M1pr Minnesota Homestead Credit Refund For Homeowners

Homeowners Tax Credit Overview The Basis Point

Form M1PR Download Fillable PDF Or Fill Online Homestead Credit Refund

Energystar gov Offers A Treasure Chest Of Goodies And Information For

Texas Solar Power For Your House Rebates Tax Credits Savings

Tax Credits And Rebates Mauzy

Tax Credits And Rebates Mauzy

Mass Tax Rebate Check