In the age of digital, when screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed items hasn't gone away. Be it for educational use in creative or artistic projects, or simply to add an individual touch to the space, What Is A Non Deductible Traditional Ira have proven to be a valuable source. For this piece, we'll dive in the world of "What Is A Non Deductible Traditional Ira," exploring the different types of printables, where they are, and what they can do to improve different aspects of your life.

Get Latest What Is A Non Deductible Traditional Ira Below

What Is A Non Deductible Traditional Ira

What Is A Non Deductible Traditional Ira - What Is A Non Deductible Traditional Ira, What Is A Non-deductible Traditional Ira Contribution, Is Non Deductible Traditional Ira Worth It, What Is A Non-deductible Ira

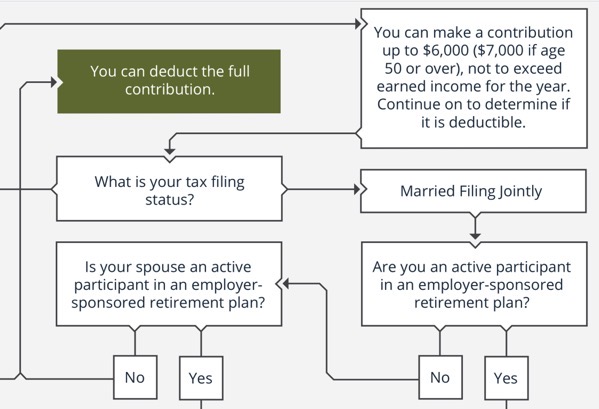

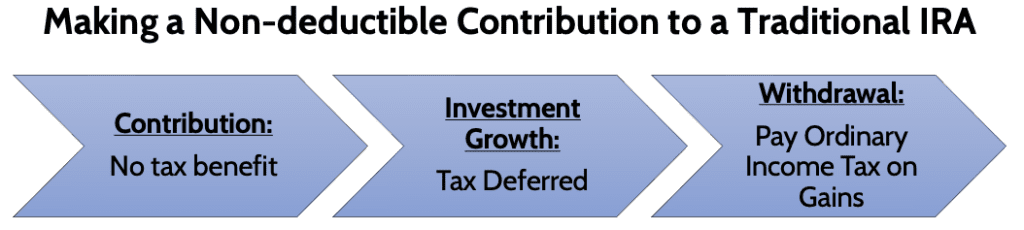

A non deductible IRA is a type of retirement account similar to a traditional IRA or Roth IRA What sets non deductible IRAs apart is that contributions to the

Nondeductible IRAs are similar to traditional IRAs except they use after tax contributions It s generally used by people who earn more than the IRA income limit

Printables for free cover a broad range of printable, free materials online, at no cost. The resources are offered in a variety forms, like worksheets templates, coloring pages, and much more. One of the advantages of What Is A Non Deductible Traditional Ira lies in their versatility and accessibility.

More of What Is A Non Deductible Traditional Ira

How Is The Roth IRA Different From A Non deductible IRA NJMoneyHelp

How Is The Roth IRA Different From A Non deductible IRA NJMoneyHelp

Those who don t qualify for a traditional IRA or Roth IRA may choose to make nondeductible IRA contributions See 12 Ways to Avoid the IRA Early Withdrawal Penalty

You might not be able to deduct contributions to your traditional IRA from your taxable income if your income exceeds certain levels The amount you can save may be limited as well but you can

The What Is A Non Deductible Traditional Ira have gained huge popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

The ability to customize: The Customization feature lets you tailor designs to suit your personal needs for invitations, whether that's creating them or arranging your schedule or even decorating your house.

-

Educational Use: Education-related printables at no charge can be used by students of all ages, making them a valuable tool for teachers and parents.

-

Convenience: immediate access a variety of designs and templates helps save time and effort.

Where to Find more What Is A Non Deductible Traditional Ira

Simple Ira Contribution Limits 2022 Choosing Your Gold IRA

Simple Ira Contribution Limits 2022 Choosing Your Gold IRA

Ultimate Guide to Retirement How do deductible and nondeductible IRAs differ A deductible IRA can lower your tax bill by allowing you to deduct your contributions on

Anyone with earned income can make a non deductible after tax contribution to an IRA and benefit from tax deferred growth But it may not be worth it due in part to

Now that we've ignited your interest in printables for free Let's find out where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of What Is A Non Deductible Traditional Ira suitable for many reasons.

- Explore categories like home decor, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets including flashcards, learning tools.

- This is a great resource for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for no cost.

- These blogs cover a broad spectrum of interests, starting from DIY projects to party planning.

Maximizing What Is A Non Deductible Traditional Ira

Here are some inventive ways create the maximum value use of printables that are free:

1. Home Decor

- Print and frame gorgeous art, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Use these printable worksheets free of charge for reinforcement of learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners, and decorations for special events such as weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

What Is A Non Deductible Traditional Ira are an abundance of practical and innovative resources catering to different needs and interest. Their accessibility and flexibility make them a fantastic addition to both personal and professional life. Explore the world of What Is A Non Deductible Traditional Ira to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free are they free?

- Yes they are! You can download and print these items for free.

-

Do I have the right to use free printables to make commercial products?

- It's based on specific rules of usage. Always verify the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright rights issues with What Is A Non Deductible Traditional Ira?

- Some printables may contain restrictions on use. Be sure to review the terms and regulations provided by the creator.

-

How can I print printables for free?

- Print them at home with the printer, or go to a print shop in your area for superior prints.

-

What software must I use to open printables for free?

- Most PDF-based printables are available with PDF formats, which can be opened using free software like Adobe Reader.

What Is A Non Deductible IRA SoFi

Non Deductible IRA Definition How It Works Seeking Alpha

Check more sample of What Is A Non Deductible Traditional Ira below

Deductible IRA Contribution Independent Fiduciary Advisor

Traditional Vs Roth IRAs What s The Difference Fi3 Advisors

Should You Contribute To A Non Deductible IRA

/istock512752254.kroach.ira.cropped.lowercase-5bfc3077c9e77c0026b5e58b.jpg)

What Is A Non Deductible IRA Telegraph

Non Deductible IRA Tax Hack YouTube

2022 RETIREMENT ACCOUNT CONTRIBUTION LIMITS ANNOUNCED Day Hagan

https://www.fool.com/retirement/plans/non-deductible-iras

Nondeductible IRAs are similar to traditional IRAs except they use after tax contributions It s generally used by people who earn more than the IRA income limit

https://turbotax.intuit.com/tax-tips/investments...

Any money you contribute to a traditional IRA that you do not deduct on your tax return is a nondeductible contribution You still must report these contributions

Nondeductible IRAs are similar to traditional IRAs except they use after tax contributions It s generally used by people who earn more than the IRA income limit

Any money you contribute to a traditional IRA that you do not deduct on your tax return is a nondeductible contribution You still must report these contributions

What Is A Non Deductible IRA Telegraph

Traditional Vs Roth IRAs What s The Difference Fi3 Advisors

Non Deductible IRA Tax Hack YouTube

2022 RETIREMENT ACCOUNT CONTRIBUTION LIMITS ANNOUNCED Day Hagan

How To Do A Backdoor Roth IRA Contribution

Entering IRA Contributions In A 1040 Return In ProSeries

Entering IRA Contributions In A 1040 Return In ProSeries

Non Deductible IRA Contributions Require Tracking Roger Rossmeisl CPA