In this digital age, when screens dominate our lives it's no wonder that the appeal of tangible printed products hasn't decreased. If it's to aid in education and creative work, or simply to add a personal touch to your home, printables for free can be an excellent resource. We'll dive through the vast world of "Tax Deduction On Tuition Fees Under Section 10," exploring their purpose, where to find them, and how they can improve various aspects of your daily life.

Get Latest Tax Deduction On Tuition Fees Under Section 10 Below

Tax Deduction On Tuition Fees Under Section 10

Tax Deduction On Tuition Fees Under Section 10 - Tax Deduction On Tuition Fees Under Section 10, How Much Tax Relief On Tuition Fees, Is Tds Applicable On Tuition Fees, Can You Claim Tax On Education Expenses

Tax deduction on tuition fees Contents Allowances for Children s Education and Hostel Expenditure Types of Fee reimbursable under Section 10 14

First under section 10 you can structure your salary by including child education allowance Again under section 80C you can claim tuition fee paid for your

The Tax Deduction On Tuition Fees Under Section 10 are a huge range of printable, free materials available online at no cost. The resources are offered in a variety formats, such as worksheets, templates, coloring pages and many more. The attraction of printables that are free is their flexibility and accessibility.

More of Tax Deduction On Tuition Fees Under Section 10

Deduction From Salary Under Section 16 Of Income Tax Act How To Earn

Deduction From Salary Under Section 16 Of Income Tax Act How To Earn

Section 10 Tax exemption for tuition fee of up to Rs 1 200 Rs 100 per month per child for a maximum of two children Section 80C In addition you can claim

You paid 7 000 tuition and fees in August 2023 and your child began college in September 2023 You filed your 2023 tax return on February 17 2024 and claimed an American opportunity credit of 2 500 After you

Print-friendly freebies have gained tremendous recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Modifications: It is possible to tailor printables to fit your particular needs when it comes to designing invitations for your guests, organizing your schedule or decorating your home.

-

Educational Use: Printing educational materials for no cost provide for students of all ages. This makes them an invaluable tool for parents and educators.

-

Accessibility: Fast access a plethora of designs and templates will save you time and effort.

Where to Find more Tax Deduction On Tuition Fees Under Section 10

Every Single Tax Deduction You Could Possibly Ask For Page 26 Of 40

Every Single Tax Deduction You Could Possibly Ask For Page 26 Of 40

Tuition and fees deduction Student loan interest deduction Qualified student loan Qualified education expenses Business deduction for work related

Save income tax by claiming for tax exemption under Section 10 14 and Section 80C for tuition fee and hostel fees for up to two children

If we've already piqued your interest in Tax Deduction On Tuition Fees Under Section 10, let's explore where they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Tax Deduction On Tuition Fees Under Section 10 to suit a variety of motives.

- Explore categories such as decoration for your home, education, organizing, and crafts.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing along with flashcards, as well as other learning tools.

- Perfect for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates at no cost.

- These blogs cover a broad array of topics, ranging starting from DIY projects to planning a party.

Maximizing Tax Deduction On Tuition Fees Under Section 10

Here are some new ways that you can make use use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Utilize free printable worksheets to help reinforce your learning at home (or in the learning environment).

3. Event Planning

- Invitations, banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable planners with to-do lists, planners, and meal planners.

Conclusion

Tax Deduction On Tuition Fees Under Section 10 are an abundance of useful and creative resources that can meet the needs of a variety of people and needs and. Their availability and versatility make them a great addition to both professional and personal life. Explore the vast array of Tax Deduction On Tuition Fees Under Section 10 today to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free available for download?

- Yes, they are! You can download and print these free resources for no cost.

-

Does it allow me to use free printables for commercial uses?

- It's determined by the specific usage guidelines. Be sure to read the rules of the creator before utilizing their templates for commercial projects.

-

Are there any copyright concerns when using printables that are free?

- Some printables may have restrictions in their usage. Be sure to review the conditions and terms of use provided by the creator.

-

How do I print printables for free?

- You can print them at home using any printer or head to a local print shop to purchase better quality prints.

-

What program do I require to open printables at no cost?

- A majority of printed materials are in PDF format. They can be opened with free programs like Adobe Reader.

Tuition Deduction Vs Education Credits Tax Guide Tuition College

Budget 2023 Expectation Will Govt Hike Income Tax Deduction On Tuition

Check more sample of Tax Deduction On Tuition Fees Under Section 10 below

Smart Things To Know Deduction Under Section 80C For Tuition Fee

How To Claim Tax Benefit On Tuition Fees Under Section 80C DOP Core

Standard Deduction 2020 Self Employed Standard Deduction 2021

How To Claim Tax Benefit On Tuition Fees Under Section 80C Children

Tax Deductions Template For Freelancers Google Sheets

Tuition Fees Deduction Under Section 80c

https://www.knowyourgst.com/blog/tution-fee-and...

First under section 10 you can structure your salary by including child education allowance Again under section 80C you can claim tuition fee paid for your

https://cleartax.in/s/section-10-of-income-tax-act

Section 10 contains all the exemptions that an individual can opt for under the Income Tax Act They include gratuity travel allowance rent allowance allowance for

First under section 10 you can structure your salary by including child education allowance Again under section 80C you can claim tuition fee paid for your

Section 10 contains all the exemptions that an individual can opt for under the Income Tax Act They include gratuity travel allowance rent allowance allowance for

How To Claim Tax Benefit On Tuition Fees Under Section 80C Children

How To Claim Tax Benefit On Tuition Fees Under Section 80C DOP Core

Tax Deductions Template For Freelancers Google Sheets

Tuition Fees Deduction Under Section 80c

How To Claim The Tuition And Fees Deduction Tuition Deduction Tax

How To Claim Tax Benefit On Tuition Fees Under Section 80C PO Tools

How To Claim Tax Benefit On Tuition Fees Under Section 80C PO Tools

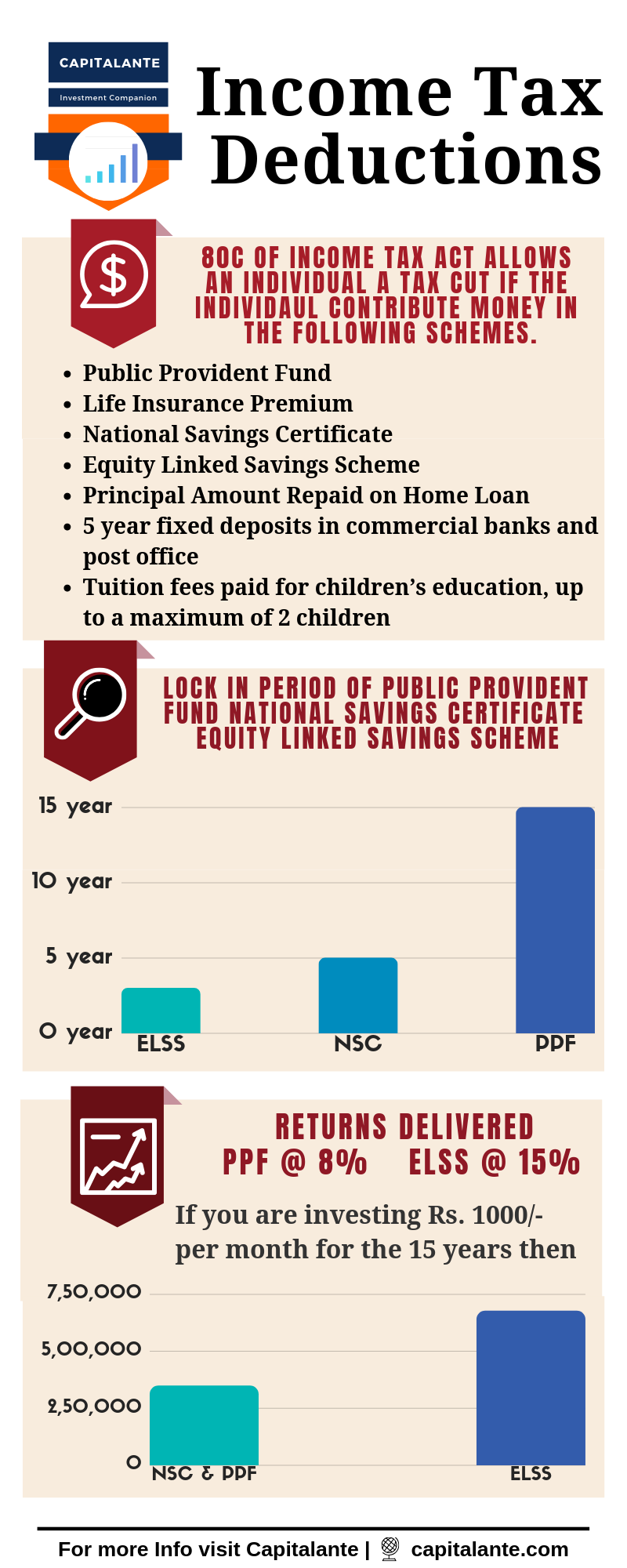

Income Tax Deductions In India Capitalante