In this age of electronic devices, when screens dominate our lives yet the appeal of tangible printed materials isn't diminishing. Whatever the reason, whether for education project ideas, artistic or simply adding an individual touch to your area, Tax Deduction Appliances are a great source. In this article, we'll take a dive in the world of "Tax Deduction Appliances," exploring the benefits of them, where you can find them, and how they can improve various aspects of your life.

Get Latest Tax Deduction Appliances Below

Tax Deduction Appliances

Tax Deduction Appliances - Tax Deduction Appliances, Tax Credit Appliances, Tax Deduction Energy Efficient Appliances, Tax Deduction For Donating Appliances, Are Home Appliances Tax Deductible, Are Major Appliances Tax Deductible

IR 2022 225 December 22 2022 WASHINGTON The Internal Revenue Service today released frequently asked questions FAQs about energy efficient home improvements

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

Tax Deduction Appliances encompass a wide array of printable documents that can be downloaded online at no cost. They are available in a variety of designs, including worksheets coloring pages, templates and many more. The value of Tax Deduction Appliances is their versatility and accessibility.

More of Tax Deduction Appliances

PIC Enhanced Tax Deduction Part 2 Tax Made Easy

PIC Enhanced Tax Deduction Part 2 Tax Made Easy

Published on Mar 8 2021 7 minute read By Rebecca Henderson Riley Adams CPA Tax credits reduce your tax bill on a dollar for dollar basis However deductions are what

Central air conditioners water heaters furnaces boilers and heat pumps Biomass stoves and boilers Home energy audits The amount of the credit

Printables that are free have gained enormous popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

Modifications: There is the possibility of tailoring printed materials to meet your requirements in designing invitations, organizing your schedule, or even decorating your home.

-

Educational Value: These Tax Deduction Appliances provide for students of all ages, making them a useful tool for teachers and parents.

-

Easy to use: You have instant access many designs and templates, which saves time as well as effort.

Where to Find more Tax Deduction Appliances

Special Tax Deduction On Renovation Extension Jan 20 2022 Johor

Special Tax Deduction On Renovation Extension Jan 20 2022 Johor

Tax incentive These encourage taxpayers to do something like install efficient appliances in exchange for a tax reduction Tax refund You re probably

The legislation includes 4 5 billion in funding for states to provide rebates for the purchase of new electric appliances including ranges cooktops and wall ovens

If we've already piqued your interest in printables for free and other printables, let's discover where you can find these elusive treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of Tax Deduction Appliances suitable for many motives.

- Explore categories like decorating your home, education, craft, and organization.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets including flashcards, learning tools.

- This is a great resource for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs or templates for download.

- The blogs are a vast selection of subjects, including DIY projects to party planning.

Maximizing Tax Deduction Appliances

Here are some ideas ensure you get the very most of Tax Deduction Appliances:

1. Home Decor

- Print and frame beautiful artwork, quotes as well as seasonal decorations, to embellish your living areas.

2. Education

- Print free worksheets for teaching at-home also in the classes.

3. Event Planning

- Design invitations and banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized with printable planners as well as to-do lists and meal planners.

Conclusion

Tax Deduction Appliances are a treasure trove of innovative and useful resources designed to meet a range of needs and interest. Their availability and versatility make them a wonderful addition to your professional and personal life. Explore the many options of printables for free today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free gratis?

- Yes you can! You can print and download these resources at no cost.

-

Does it allow me to use free printables to make commercial products?

- It's based on the terms of use. Always verify the guidelines provided by the creator before utilizing their templates for commercial projects.

-

Are there any copyright issues with printables that are free?

- Some printables may contain restrictions on use. Be sure to review the terms of service and conditions provided by the designer.

-

How do I print printables for free?

- You can print them at home using the printer, or go to a local print shop to purchase higher quality prints.

-

What software do I require to view Tax Deduction Appliances?

- The majority of printables are in PDF format. They is open with no cost software such as Adobe Reader.

10 Tax Deduction Worksheet Worksheeto

Tax Deduction Stock Photo Photo By LendingMemo Under CC 2 Flickr

Check more sample of Tax Deduction Appliances below

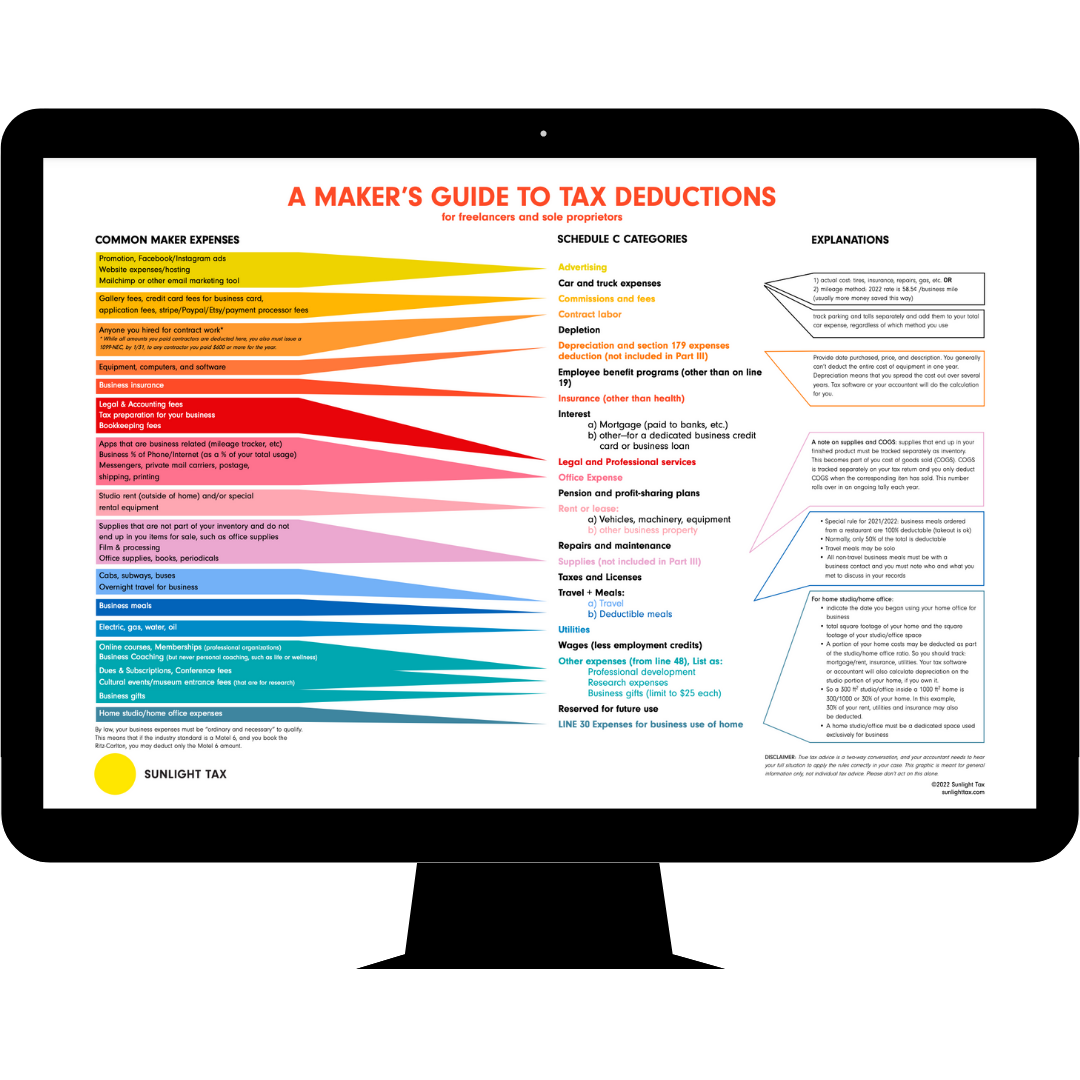

Makers Tax Deductions Guide Sunlight Tax

Deduction Form Self Employed Tax Employment Form

How To Fully Maximize Your 1099 Tax Deductions Steady

Tax Deduction Tax Deduction 1040 IRS Tax Return Form And C Flickr

Premium AI Image Tax Deduction Planning Concept Businessman Calculating

Maximising Tax Benefits Your Guide To Claiming A Rental Property

https://www.irs.gov/credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

https://ttlc.intuit.com/turbotax-support/en-us/...

You can t claim Energy Star appliances or water saving improvements like low flow toilets low flow shower heads or xeriscaping on your federal return But many

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

You can t claim Energy Star appliances or water saving improvements like low flow toilets low flow shower heads or xeriscaping on your federal return But many

Tax Deduction Tax Deduction 1040 IRS Tax Return Form And C Flickr

Deduction Form Self Employed Tax Employment Form

Premium AI Image Tax Deduction Planning Concept Businessman Calculating

Maximising Tax Benefits Your Guide To Claiming A Rental Property

Illumination Wealth ManagementSection 199A Tax Reduction Strategies

How To Take Home Office Tax Deduction Update Tips

How To Take Home Office Tax Deduction Update Tips

New Tax Laws Business Deduction Changes You Need To Know About