In this digital age, where screens have become the dominant feature of our lives The appeal of tangible printed objects isn't diminished. In the case of educational materials or creative projects, or simply to add an individual touch to your area, Tax Credits Pension Lump Sum are now a useful source. Here, we'll dive to the depths of "Tax Credits Pension Lump Sum," exploring what they are, where to find them and how they can enrich various aspects of your daily life.

Get Latest Tax Credits Pension Lump Sum Below

Tax Credits Pension Lump Sum

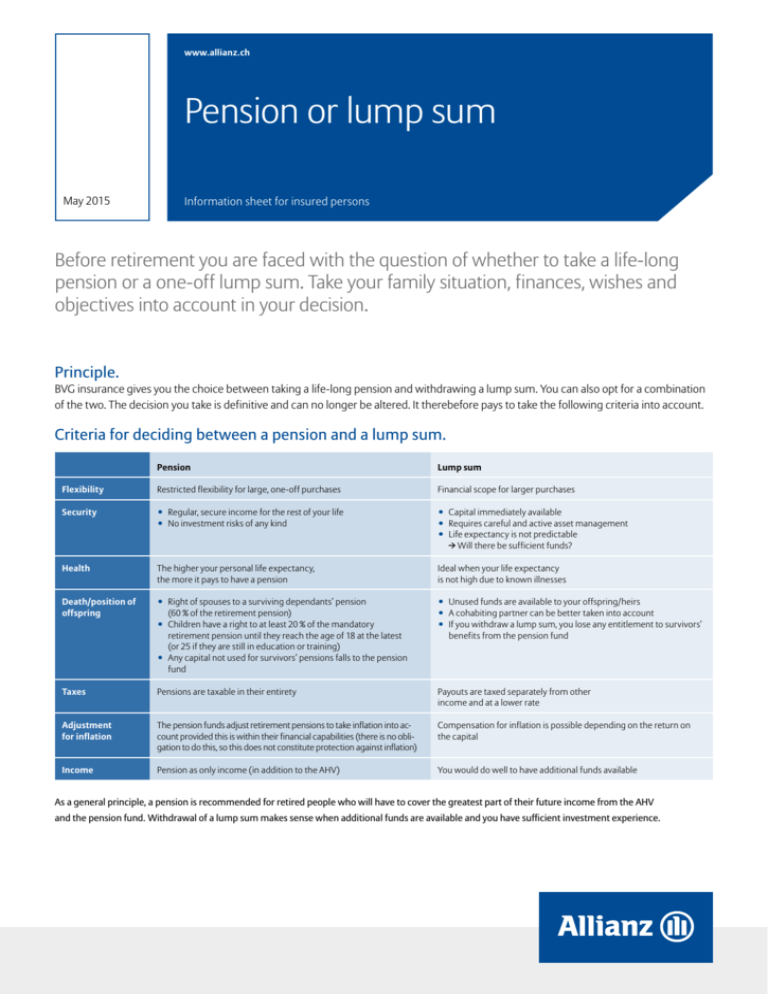

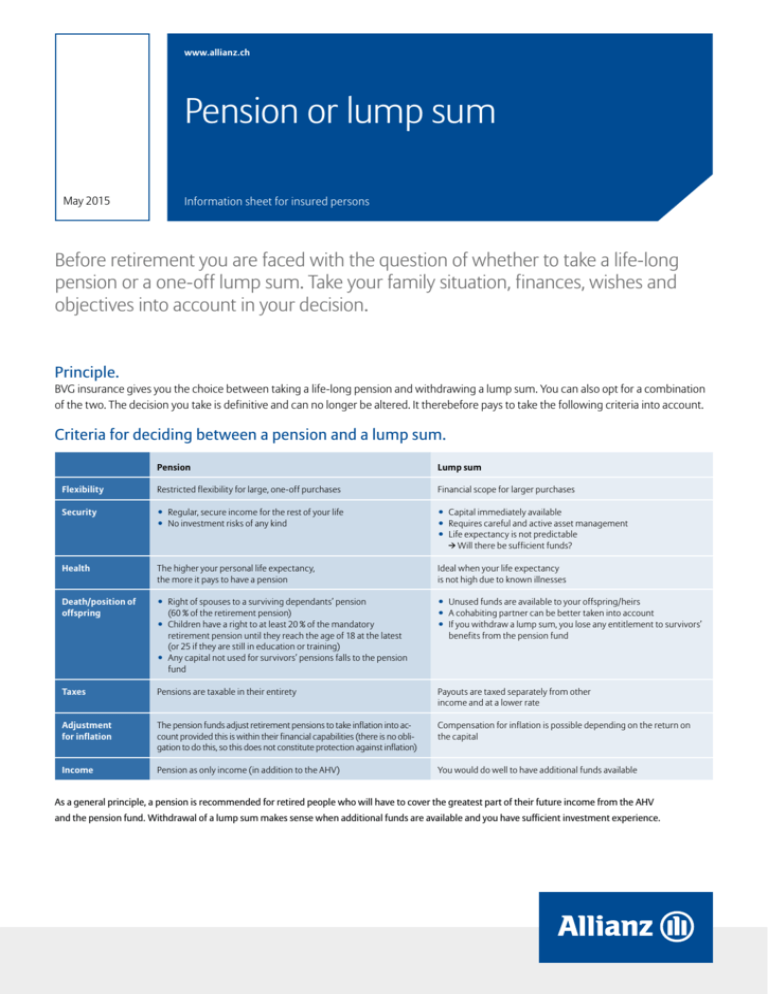

Tax Credits Pension Lump Sum - Tax Credits Pension Lump Sum, Tax Relief Pension Lump Sum, Tax On Defined Benefit Pension Lump Sum, Tax Relief On Retirement Lump Sum Benefits, Does Pension Lump Sum Affect Tax Credits, Is My Pension Lump Sum Classed As Income, Can You Claim Tax Back On A Pension Lump Sum

55 if you took a lump sum 25 plus your marginal rate of income tax if you took any other form of pension benefits for example pension payments or cash withdrawals If you took pension

Rules vary but most pension schemes dictate that you need to be at least 55 to take a lump sum from your pension This is called the normal minimum pension age NMPA and it is due to rise to

The Tax Credits Pension Lump Sum are a huge assortment of printable material that is available online at no cost. They are available in numerous designs, including worksheets templates, coloring pages, and much more. The appealingness of Tax Credits Pension Lump Sum lies in their versatility as well as accessibility.

More of Tax Credits Pension Lump Sum

Hier Finden Sie Mehr Informationen Zu Unserem Doppelzimmer In Der

Hier Finden Sie Mehr Informationen Zu Unserem Doppelzimmer In Der

Pension lump sum withdrawal tax calculator Calculate how much tax you ll pay when you withdraw a lump sum from your pension in the 2024 25 2023 24 and 2022 23 tax years Grace Witherden Senior writer When you re 55 or older you can withdraw some or all of your pension pot even if you re not yet ready to retire

Updated on 6 April 2024 Pensions flexibility You may be able to draw money out of your defined contribution pension also called a money purchase pension very flexibly as much as you like when you like once you have reached the

Tax Credits Pension Lump Sum have garnered immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or expensive software.

-

Modifications: The Customization feature lets you tailor printed materials to meet your requirements for invitations, whether that's creating them and schedules, or even decorating your house.

-

Educational Impact: These Tax Credits Pension Lump Sum provide for students of all ages, making them a valuable tool for teachers and parents.

-

Accessibility: You have instant access various designs and templates is time-saving and saves effort.

Where to Find more Tax Credits Pension Lump Sum

Retirement Pension Lump Sum Or Monthly Annuity Payment Your Money

Retirement Pension Lump Sum Or Monthly Annuity Payment Your Money

Any social security pension lump sum under F No 2 A 2005 section 7 trivial commutation and winding up lump sums and death benefits under ITEPA 2003 section 636B and 636C In calculating pension income for tax credits the following are disregarded

For example if you hold enhanced protection with lump sum protection of 40 and the value of your pension pots on 5 April 2023 is 1 6 million you are entitled to a tax free lump sum of up to

Now that we've piqued your interest in Tax Credits Pension Lump Sum we'll explore the places you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection and Tax Credits Pension Lump Sum for a variety goals.

- Explore categories like home decor, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free for flashcards, lessons, and worksheets. materials.

- It is ideal for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates, which are free.

- The blogs covered cover a wide selection of subjects, that includes DIY projects to party planning.

Maximizing Tax Credits Pension Lump Sum

Here are some ways that you can make use of Tax Credits Pension Lump Sum:

1. Home Decor

- Print and frame stunning artwork, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Print out free worksheets and activities for reinforcement of learning at home either in the schoolroom or at home.

3. Event Planning

- Create invitations, banners, and decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable planners along with lists of tasks, and meal planners.

Conclusion

Tax Credits Pension Lump Sum are an abundance of useful and creative resources that can meet the needs of a variety of people and interest. Their access and versatility makes them a fantastic addition to each day life. Explore the vast world of Tax Credits Pension Lump Sum to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Tax Credits Pension Lump Sum really completely free?

- Yes you can! You can print and download these free resources for no cost.

-

Can I make use of free printables in commercial projects?

- It's determined by the specific rules of usage. Always verify the guidelines provided by the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Some printables could have limitations in use. You should read the terms and conditions provided by the author.

-

How can I print Tax Credits Pension Lump Sum?

- You can print them at home using any printer or head to a print shop in your area for high-quality prints.

-

What software will I need to access printables that are free?

- A majority of printed materials are as PDF files, which can be opened using free software such as Adobe Reader.

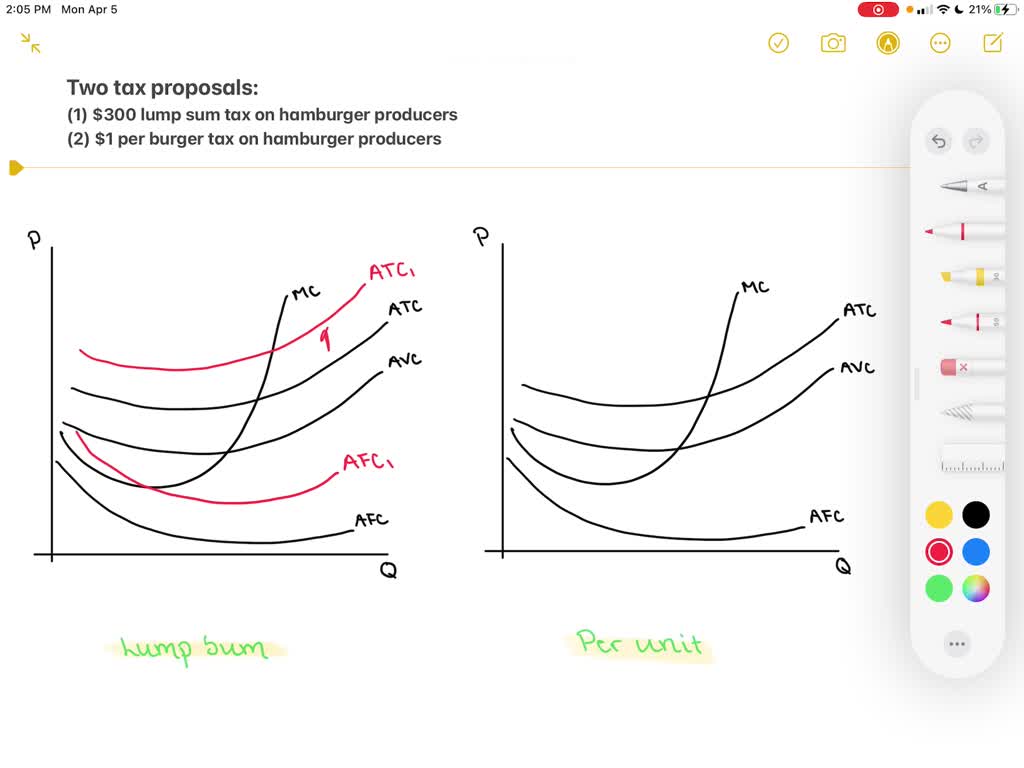

SOLVED The City Government Is Considering Two Tax Proposals A Lump

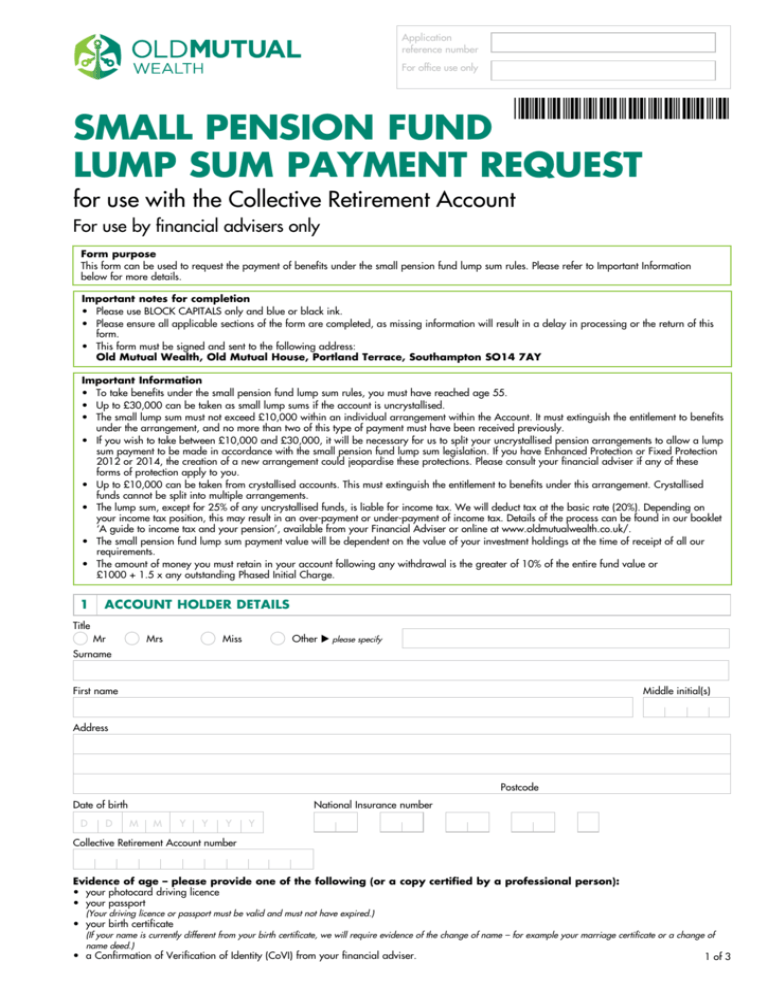

SMALL PENSION FUND LUMP SUM PAYMENT REQUEST

Check more sample of Tax Credits Pension Lump Sum below

Teachers Pension Lump Sum Teachers Financial Planning

Should You Take A Lump Sum Or An Annuity Balanced Wealth Management

Lump Sum Payment Definition Example Tax Implications

Tax free Lump Sum On Death Hutt Professional Financial Planning

Understanding Tax On Pension Lump Sum Withdrawals

Difference Between Annuity And Lump Sum Payment Infographics Images

https://inews.co.uk/inews-lifestyle/money/pensions...

Rules vary but most pension schemes dictate that you need to be at least 55 to take a lump sum from your pension This is called the normal minimum pension age NMPA and it is due to rise to

https://www.which.co.uk/money/pensions-and...

Does taking a pension lump sum affect tax credits and benefits Yes your pension income forms part of the assessment for benefits including tax credits and housing benefit But how it is assessed will depend on whether or

Rules vary but most pension schemes dictate that you need to be at least 55 to take a lump sum from your pension This is called the normal minimum pension age NMPA and it is due to rise to

Does taking a pension lump sum affect tax credits and benefits Yes your pension income forms part of the assessment for benefits including tax credits and housing benefit But how it is assessed will depend on whether or

Tax free Lump Sum On Death Hutt Professional Financial Planning

Should You Take A Lump Sum Or An Annuity Balanced Wealth Management

Understanding Tax On Pension Lump Sum Withdrawals

Difference Between Annuity And Lump Sum Payment Infographics Images

Comparing Lump Sum Versus Payments Personal Finance Advice For Real

Tax free Lump Sum Inequality James Hambro Partners

Tax free Lump Sum Inequality James Hambro Partners

Your Pension Tax Free Lump Sum St James s Place