In this day and age with screens dominating our lives however, the attraction of tangible printed materials hasn't faded away. Whatever the reason, whether for education, creative projects, or simply to add an extra personal touch to your area, State Of Illinois Real Estate Transfer Tax Exemptions are now an essential resource. The following article is a dive deep into the realm of "State Of Illinois Real Estate Transfer Tax Exemptions," exploring the benefits of them, where to locate them, and the ways that they can benefit different aspects of your lives.

Get Latest State Of Illinois Real Estate Transfer Tax Exemptions Below

State Of Illinois Real Estate Transfer Tax Exemptions

State Of Illinois Real Estate Transfer Tax Exemptions - State Of Illinois Real Estate Transfer Tax Exemptions, Who Pays Real Estate Transfer Tax In Illinois, Illinois Real Estate Transfer Tax Law, Exemptions From Property Transfer Tax Include

In addition to potential federal taxes the taxes owed in Illinois fall in the general category of transfer taxes meaning the state and local governments require real estate sellers

Real estate transfers except those qualifying for exempt status under a c d e f g h i j or l listed below Which property transfers are exempt from real

Printables for free cover a broad assortment of printable content that can be downloaded from the internet at no cost. These printables come in different forms, including worksheets, templates, coloring pages, and much more. The benefit of State Of Illinois Real Estate Transfer Tax Exemptions is in their versatility and accessibility.

More of State Of Illinois Real Estate Transfer Tax Exemptions

Real Estate Transfer Tax What Are They Where Does The Money Go

Real Estate Transfer Tax What Are They Where Does The Money Go

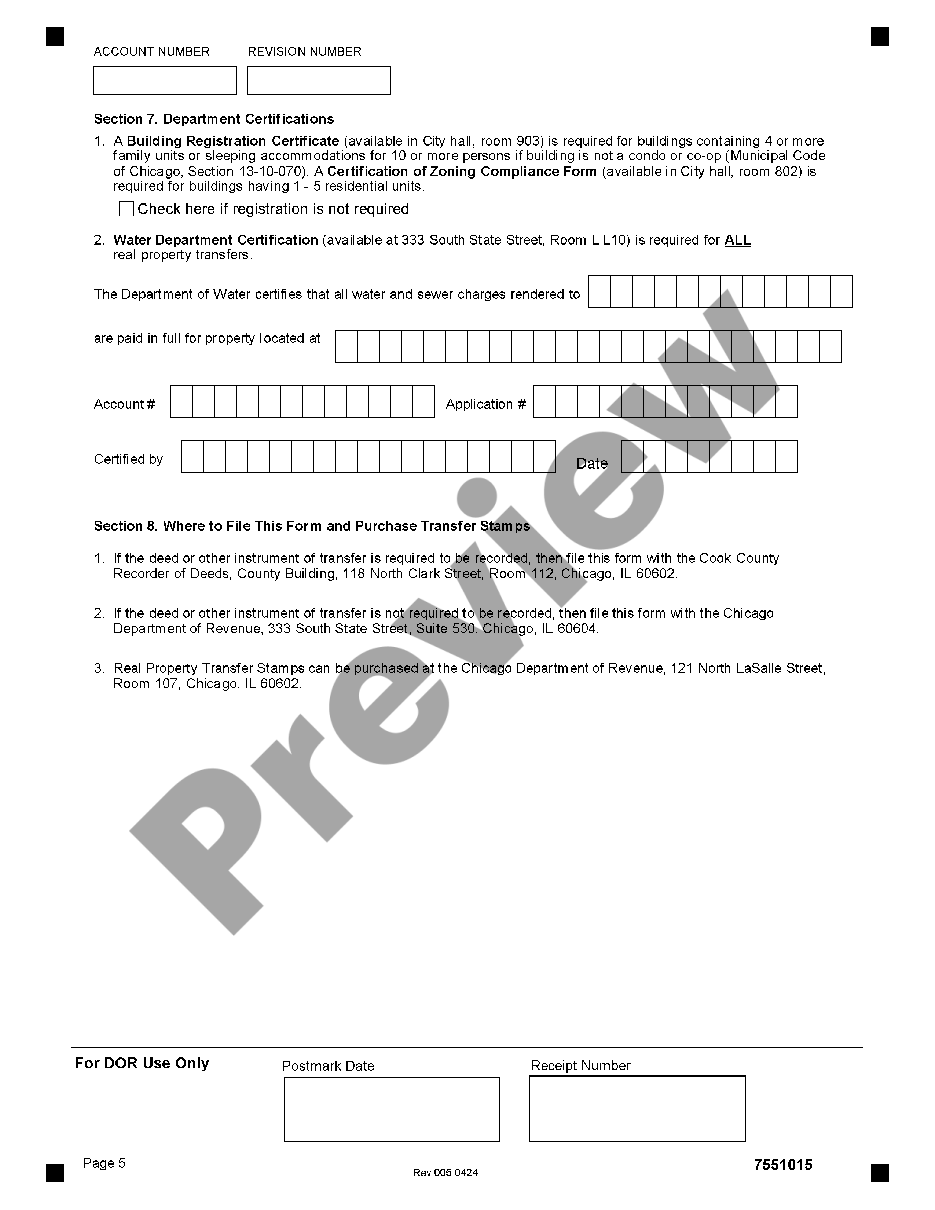

This Note also addresses deductions from full actual consideration exemptions and the steps for reporting paying and declaring exemptions from State of Illinois transfer

31 45 Exemptions The following deeds or trust documents shall be exempt from the provisions of this Article except as provided in this Section a Deeds

The State Of Illinois Real Estate Transfer Tax Exemptions have gained huge popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

Customization: There is the possibility of tailoring printables to your specific needs in designing invitations, organizing your schedule, or even decorating your home.

-

Educational value: The free educational worksheets provide for students of all ages. This makes these printables a powerful source for educators and parents.

-

Easy to use: Quick access to a plethora of designs and templates reduces time and effort.

Where to Find more State Of Illinois Real Estate Transfer Tax Exemptions

How High Are Property Taxes In Your State American Property Owners

How High Are Property Taxes In Your State American Property Owners

Transfer Tax Ordinance Information Unless exempt by statute whenever there is a transfer of title to real property or an Assignment of Beneficial Interest A B I in a land

A tax is imposed on the privilege of transferring title to real estate located in Illinois on the privilege of transferring a beneficial interest in real property located in Illinois and

Since we've got your interest in State Of Illinois Real Estate Transfer Tax Exemptions Let's look into where you can find these elusive treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection and State Of Illinois Real Estate Transfer Tax Exemptions for a variety objectives.

- Explore categories such as design, home decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free along with flashcards, as well as other learning materials.

- Ideal for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their imaginative designs as well as templates for free.

- These blogs cover a broad range of topics, all the way from DIY projects to planning a party.

Maximizing State Of Illinois Real Estate Transfer Tax Exemptions

Here are some fresh ways ensure you get the very most of printables for free:

1. Home Decor

- Print and frame stunning art, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Use free printable worksheets to enhance learning at home as well as in the class.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Make sure you are organized with printable calendars or to-do lists. meal planners.

Conclusion

State Of Illinois Real Estate Transfer Tax Exemptions are a treasure trove filled with creative and practical information for a variety of needs and hobbies. Their accessibility and flexibility make them a wonderful addition to both professional and personal lives. Explore the endless world of State Of Illinois Real Estate Transfer Tax Exemptions today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are State Of Illinois Real Estate Transfer Tax Exemptions really free?

- Yes, they are! You can download and print the resources for free.

-

Can I utilize free printables for commercial purposes?

- It's dependent on the particular rules of usage. Always verify the guidelines of the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues when you download State Of Illinois Real Estate Transfer Tax Exemptions?

- Certain printables could be restricted in use. Be sure to review the terms of service and conditions provided by the designer.

-

How do I print State Of Illinois Real Estate Transfer Tax Exemptions?

- Print them at home using either a printer at home or in an in-store print shop to get the highest quality prints.

-

What software do I need to open printables that are free?

- Most printables come in the PDF format, and can be opened using free programs like Adobe Reader.

Transfer Tax In The Philippines Lumina Homes

Estate Tax And Date Of Death DOD Appraisal Services Colorado

Check more sample of State Of Illinois Real Estate Transfer Tax Exemptions below

Real Estate Tax Exemptions Rakowski Saia PLLC

What Do I Need To Know About Property Transfer Tax Silver Law

Foreign Buyers Only Account For 5 Metro Vancouver Real Estate Sales

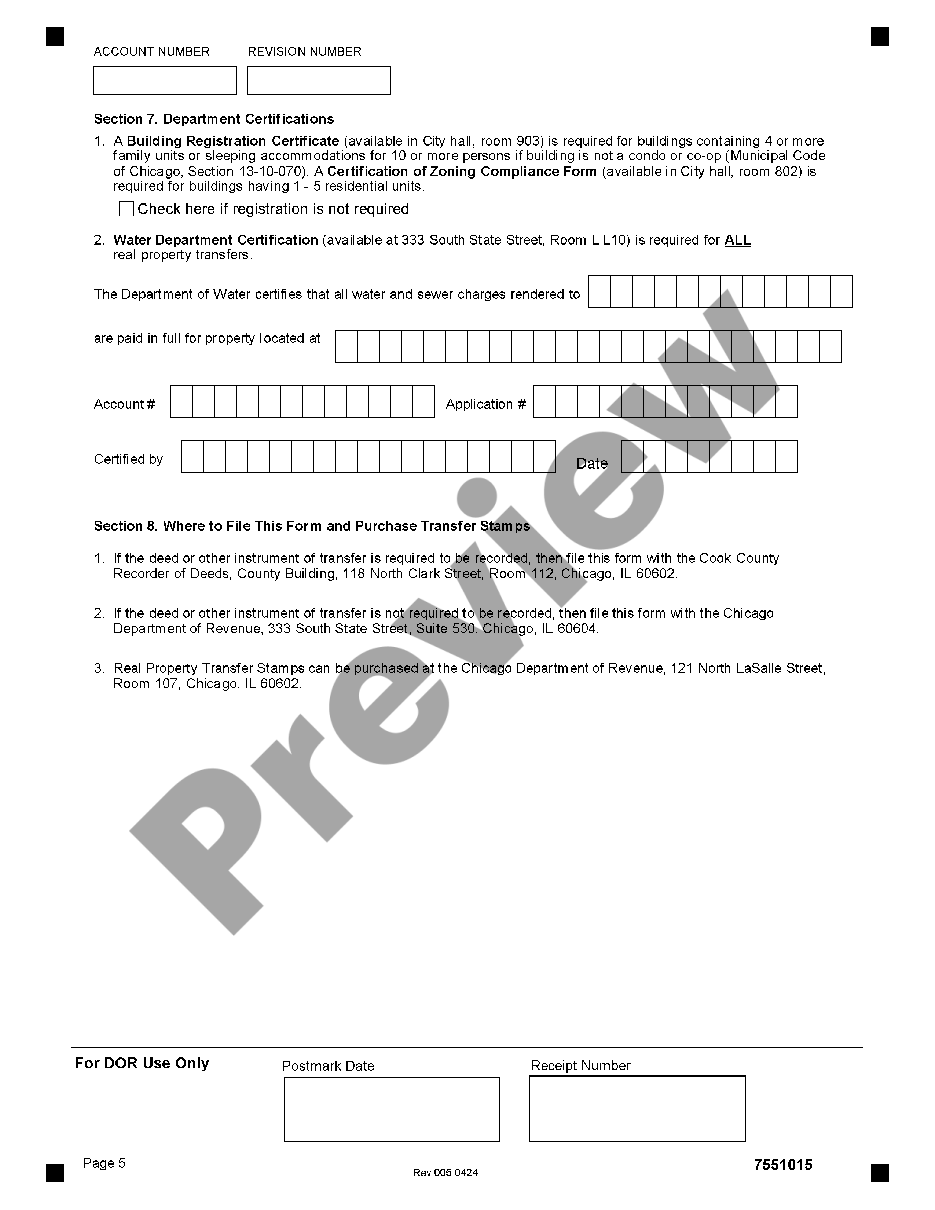

Joliet City Of Chicago Illinois Real Estate Transfer Tax Declaration

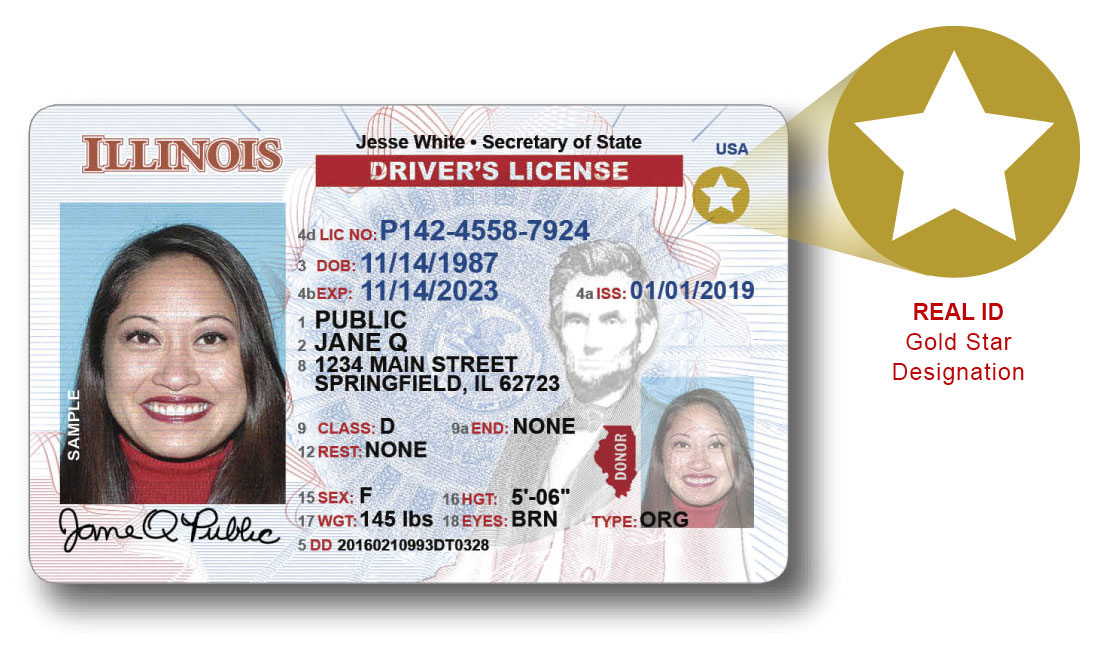

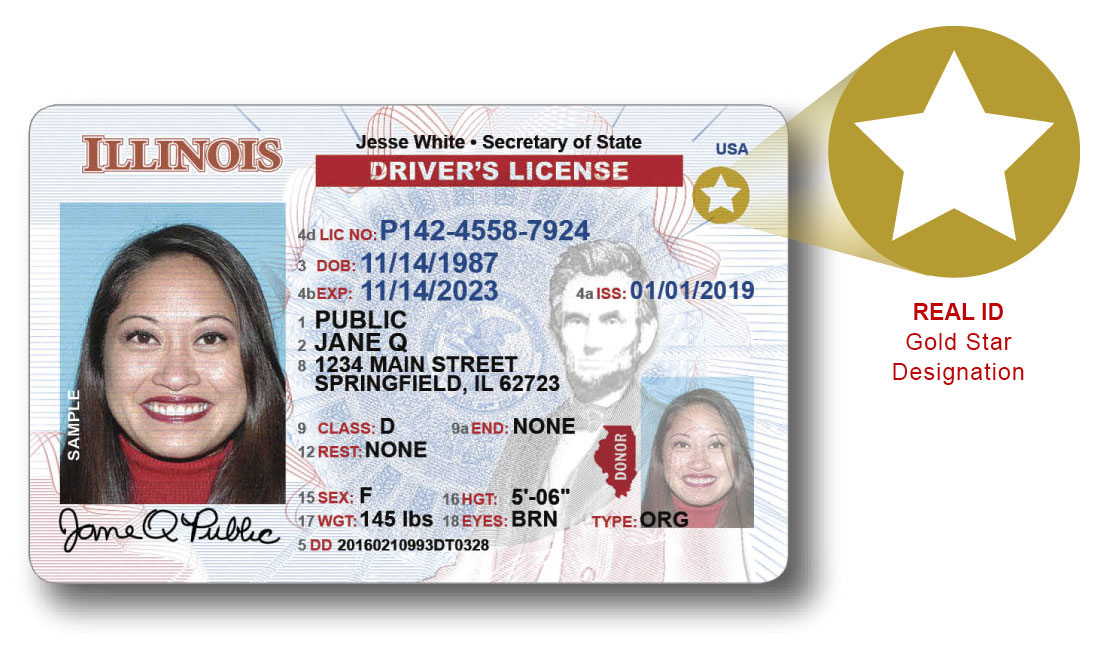

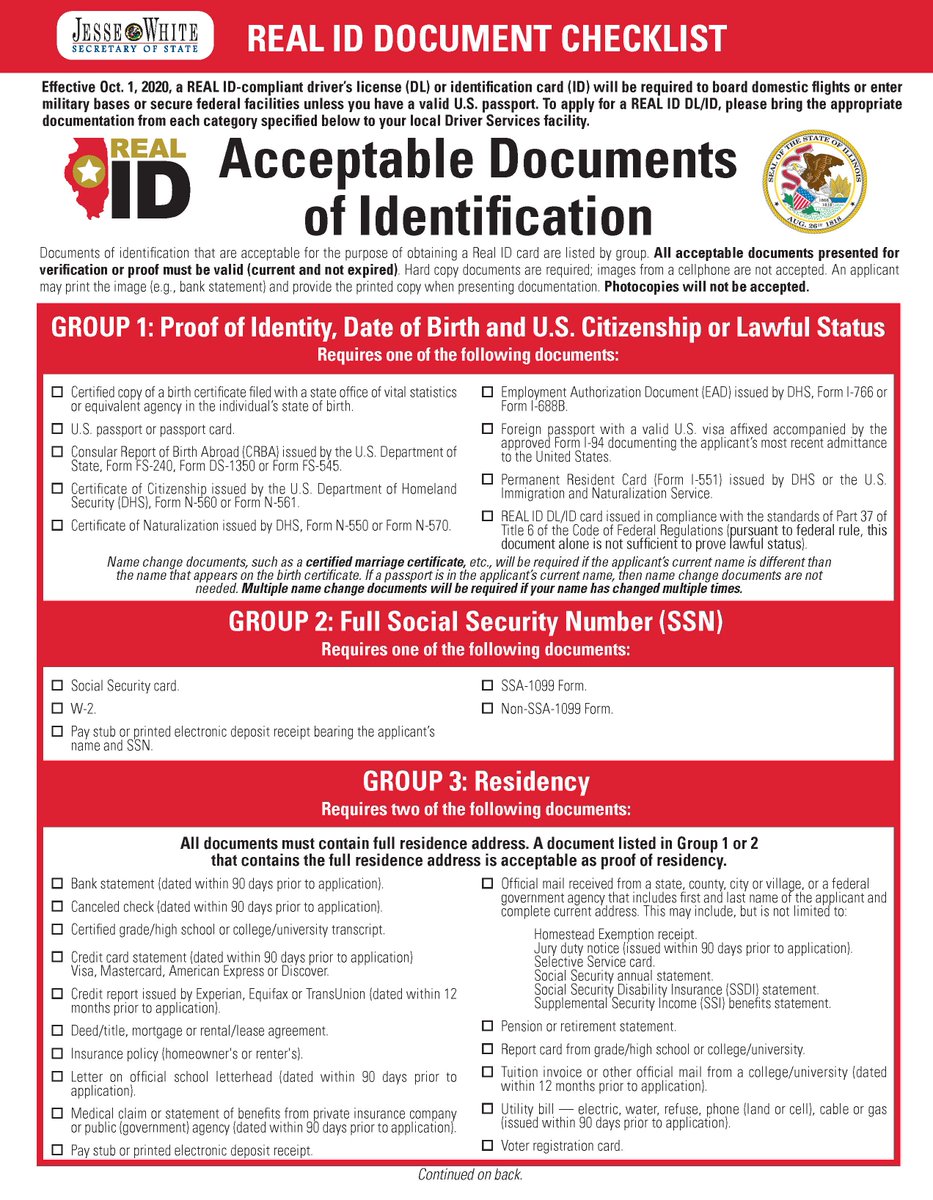

Real ID Deadline Extended To 2023 Chicago Defender

Illinois With Holding Income Tax Return Wiki Form Fill Out And Sign

https:// tax.illinois.gov /content/dam/soi/en/web/...

Real estate transfers except those qualifying for exempt status under a c d e f g h i j or l listed below Which property transfers are exempt from real

https://www. illinoisrealtors.org /wp-content/...

Assuming you are in a community which has a transfer tax you can pay as little as 50 per transaction or as much as 10 per 1 000 of a real estate transaction HOW DOES A

Real estate transfers except those qualifying for exempt status under a c d e f g h i j or l listed below Which property transfers are exempt from real

Assuming you are in a community which has a transfer tax you can pay as little as 50 per transaction or as much as 10 per 1 000 of a real estate transaction HOW DOES A

Joliet City Of Chicago Illinois Real Estate Transfer Tax Declaration

What Do I Need To Know About Property Transfer Tax Silver Law

Real ID Deadline Extended To 2023 Chicago Defender

Illinois With Holding Income Tax Return Wiki Form Fill Out And Sign

Property Transfer Tax Exemption Guide

Property Tax 101 Real Estate Tax Cycle The Shoppers Weekly

Property Tax 101 Real Estate Tax Cycle The Shoppers Weekly

Illinois State Senator Christopher Belt On Twitter Starting October 1