In this digital age, with screens dominating our lives yet the appeal of tangible printed objects isn't diminished. For educational purposes as well as creative projects or simply adding an individual touch to the space, Rebate And Relief Under Income Tax Act have proven to be a valuable source. Here, we'll take a dive deeper into "Rebate And Relief Under Income Tax Act," exploring their purpose, where to locate them, and ways they can help you improve many aspects of your daily life.

Get Latest Rebate And Relief Under Income Tax Act Below

Rebate And Relief Under Income Tax Act

Rebate And Relief Under Income Tax Act - Rebate And Relief Under Income Tax Act, Rebates And Relief Allowed Under Income Tax Act, Explain Rebate And Relief Of Tax, Rebate Under Income Tax Act, What Is 87a Rebate In Income Tax

Web An income tax rebate is a refund on taxes payable when the amount paid as income tax is less than the tax payable If you have paid more tax than you owe you will be entitled to

Web 1 Subject to the provisions of this section an assessee being an individual or a Hindu undivided family shall be entitled to a deduction from the amount of income tax as

Rebate And Relief Under Income Tax Act include a broad range of printable, free items that are available online at no cost. These resources come in various forms, like worksheets templates, coloring pages and many more. The appeal of printables for free lies in their versatility as well as accessibility.

More of Rebate And Relief Under Income Tax Act

REBATE AND RELIEFS UNDER INCOME TAX

REBATE AND RELIEFS UNDER INCOME TAX

Web REBATES AND RELIEFS Income tax Act 1961 F REVERSAL OF IGST ITC AND PAYMENT THROUGH DRC 03 F 10 37 of the Income Tax Act F Export of service F

Web 2 mai 2023 nbsp 0183 32 Rebate under Section 87A helps taxpayers reduce their income tax liability You can claim the said rebate if your total income i e after Chapter VIA deductions does not exceed Rs 5 lakh in a financial

Printables that are free have gained enormous popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

Personalization It is possible to tailor printed materials to meet your requirements such as designing invitations to organize your schedule or even decorating your house.

-

Educational Use: Downloads of educational content for free offer a wide range of educational content for learners of all ages. This makes them an essential resource for educators and parents.

-

Convenience: Instant access to a myriad of designs as well as templates will save you time and effort.

Where to Find more Rebate And Relief Under Income Tax Act

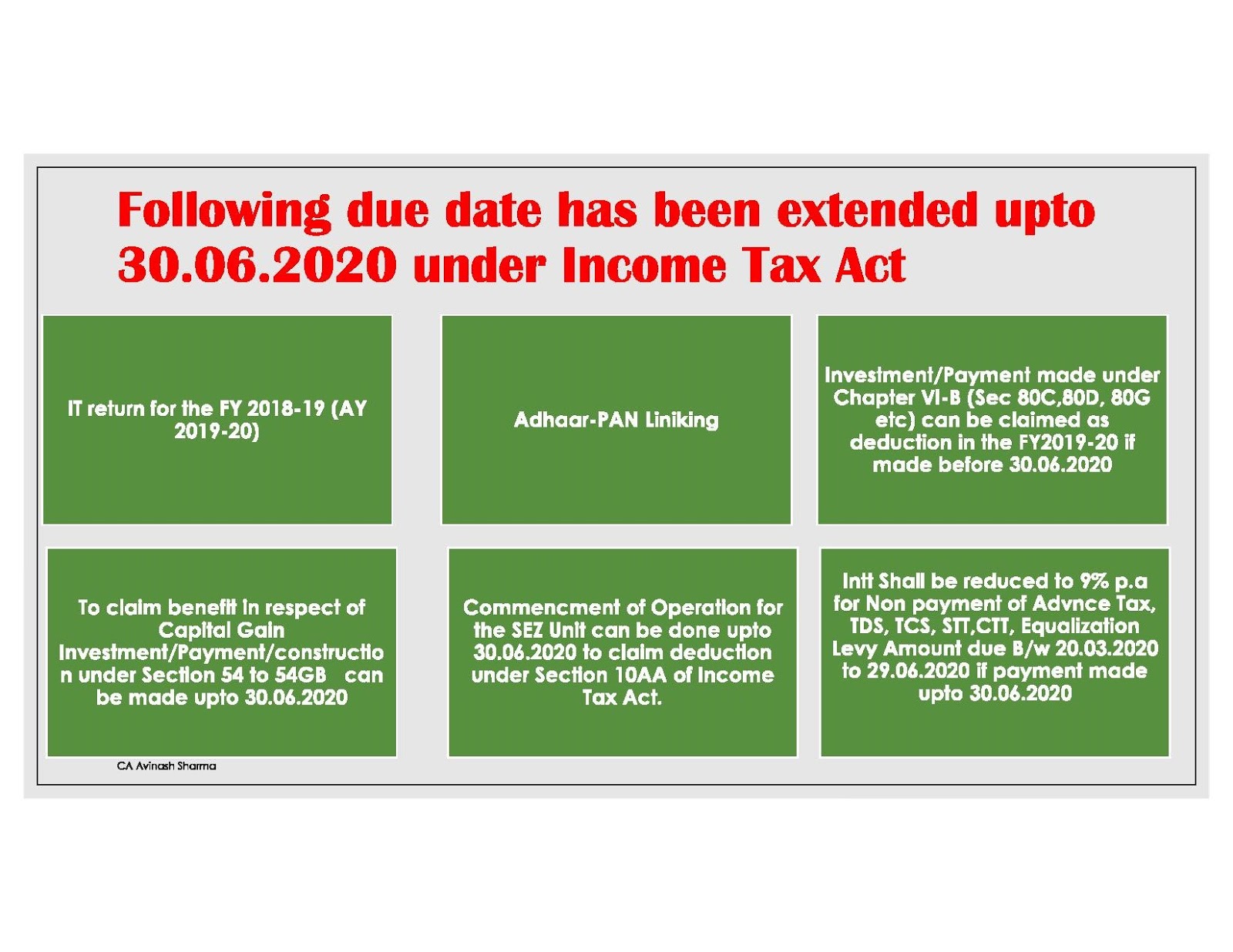

Relief Under Income Tax Act Taxation Ordinance 2020 CA Avinash

Relief Under Income Tax Act Taxation Ordinance 2020 CA Avinash

Web 18 oct 2021 nbsp 0183 32 Rebate under section 87A of Income Tax Act is a provision which helps the taxpayers to reduce the tax liability This section is available to the person whose income does not exceed Rs 5 Lakhs The tax

Web 19 oct 2021 nbsp 0183 32 Rebate under section 87A of the Income Tax Act is a provision that helps taxpayers to reduce their tax liability This section is available to the person whose

We hope we've stimulated your curiosity about Rebate And Relief Under Income Tax Act, let's explore where you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of Rebate And Relief Under Income Tax Act for various uses.

- Explore categories like furniture, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets, flashcards, and learning tools.

- Great for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs as well as templates for free.

- The blogs are a vast range of topics, everything from DIY projects to planning a party.

Maximizing Rebate And Relief Under Income Tax Act

Here are some fresh ways that you can make use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or seasonal decorations that will adorn your living spaces.

2. Education

- Print out free worksheets and activities to enhance your learning at home for the classroom.

3. Event Planning

- Invitations, banners as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Be organized by using printable calendars or to-do lists. meal planners.

Conclusion

Rebate And Relief Under Income Tax Act are an abundance of fun and practical tools designed to meet a range of needs and needs and. Their accessibility and versatility make them a valuable addition to both personal and professional life. Explore the vast array of Rebate And Relief Under Income Tax Act today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really free?

- Yes, they are! You can download and print these resources at no cost.

-

Do I have the right to use free printables to make commercial products?

- It's contingent upon the specific rules of usage. Make sure you read the guidelines for the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues when you download Rebate And Relief Under Income Tax Act?

- Certain printables could be restricted on use. Be sure to check the terms and regulations provided by the creator.

-

How can I print Rebate And Relief Under Income Tax Act?

- You can print them at home with either a printer or go to a print shop in your area for more high-quality prints.

-

What program do I need to run printables that are free?

- Most PDF-based printables are available in PDF format. They can be opened with free software like Adobe Reader.

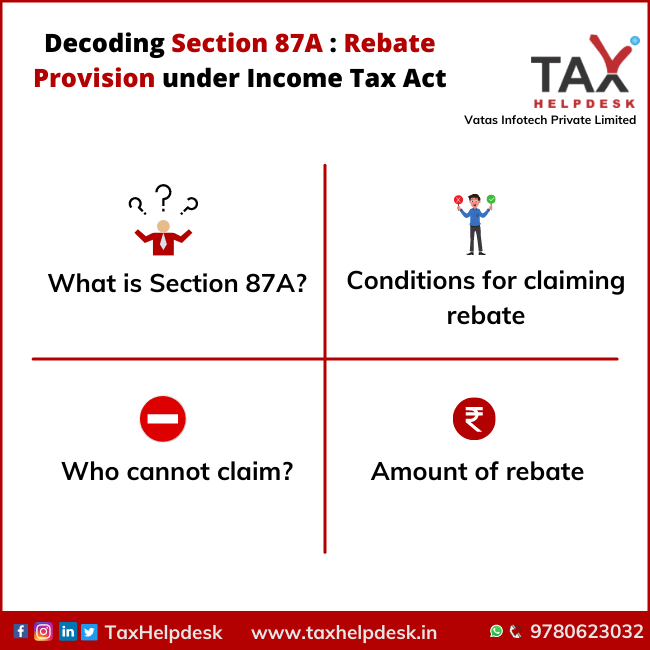

Income Tax Return TaxHelpdesk

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Check more sample of Rebate And Relief Under Income Tax Act below

DEDUCTION UNDER SECTION 80C TO 80U PDF

T20 0261 Additional 2020 Recovery Rebates For Individuals In The

Section 4a Income Tax Act KaydenqiLewis

Guide On Tax Reliefs For First Time Working Parents Heartland Boy

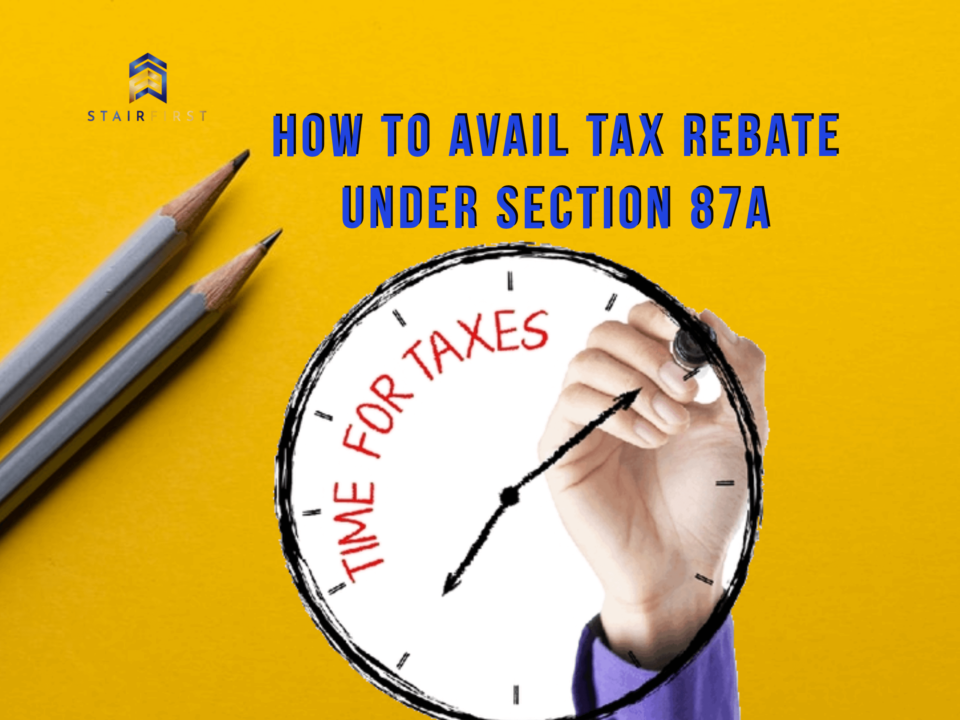

Rebate Under Section 87A Of Income Tax Act Insights From StairFirst

Section 2 41 Definition Of Relative Under Income Tax Act P R S R Co

https://taxmacs.com/.../2018/05/8.-Chapter-VIII-Rebates-an…

Web 1 Subject to the provisions of this section an assessee being an individual or a Hindu undivided family shall be entitled to a deduction from the amount of income tax as

https://wirc-icai.org/.../part3/reliefs-under-income-tax-act-1961.html

Web INCOME TAX RELIEFS SECTION 87A Persons Covered Rebate REBATE FROM INCOME TAX PAYABLE WHEN THE NET TOTAL INCOME OF THE RESIDENT

Web 1 Subject to the provisions of this section an assessee being an individual or a Hindu undivided family shall be entitled to a deduction from the amount of income tax as

Web INCOME TAX RELIEFS SECTION 87A Persons Covered Rebate REBATE FROM INCOME TAX PAYABLE WHEN THE NET TOTAL INCOME OF THE RESIDENT

Guide On Tax Reliefs For First Time Working Parents Heartland Boy

T20 0261 Additional 2020 Recovery Rebates For Individuals In The

Rebate Under Section 87A Of Income Tax Act Insights From StairFirst

Section 2 41 Definition Of Relative Under Income Tax Act P R S R Co

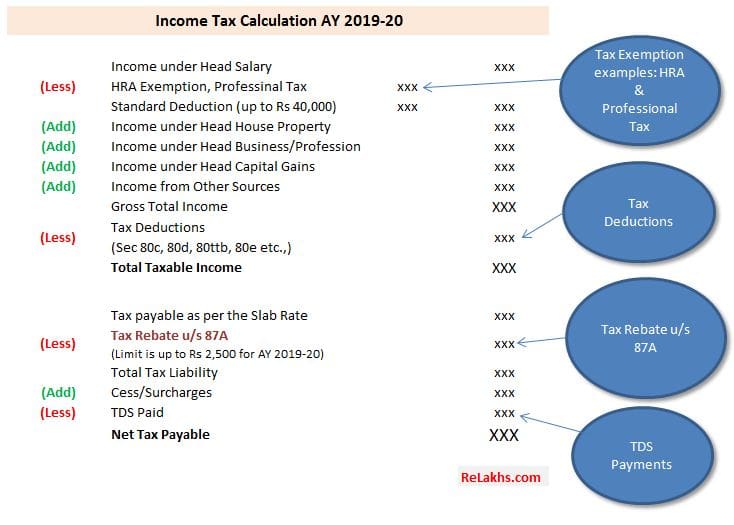

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

Relief Under Income Tax Act Taxation Ordinance 2020 CA Avinash