In this age of electronic devices, where screens dominate our lives it's no wonder that the appeal of tangible printed objects hasn't waned. In the case of educational materials, creative projects, or simply to add personal touches to your home, printables for free are a great source. Here, we'll dive into the world "Qualified Electric Vehicle Credit Form 8834," exploring what they are, where they are available, and how they can enrich various aspects of your life.

Get Latest Qualified Electric Vehicle Credit Form 8834 Below

Qualified Electric Vehicle Credit Form 8834

Qualified Electric Vehicle Credit Form 8834 - Qualified Electric Vehicle Credit (form 8834), What Is The Qualified Electric Vehicle Credit, What Form For Electric Vehicle Credit, Are Electric Vehicles Eligible For Tax Credit

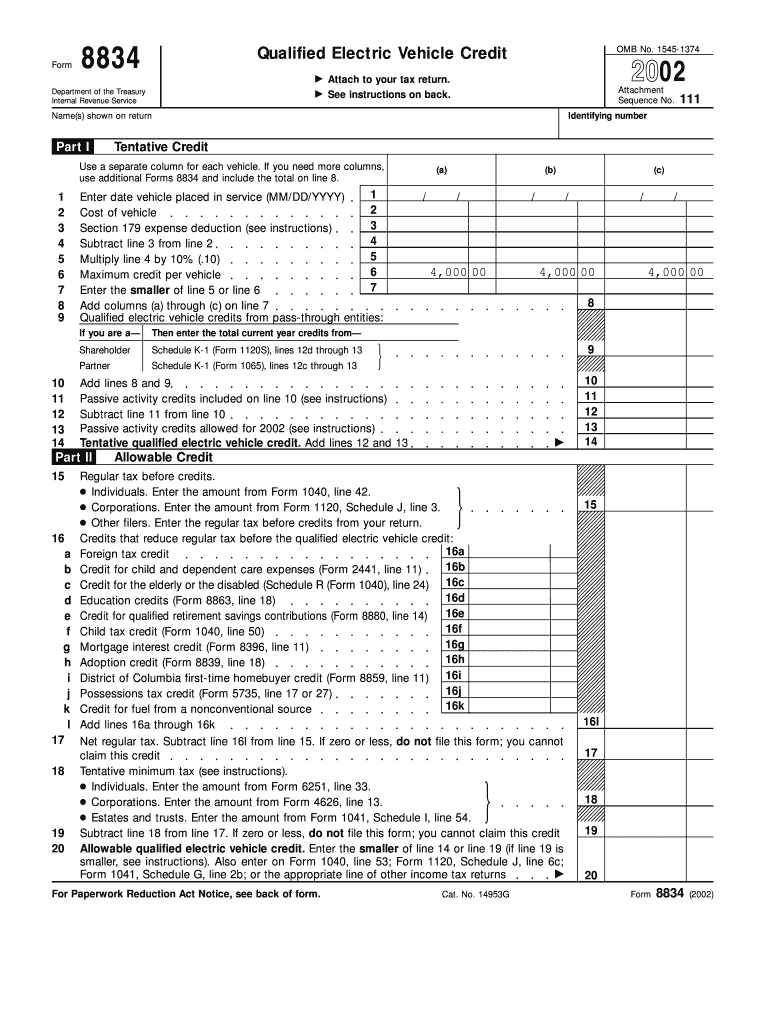

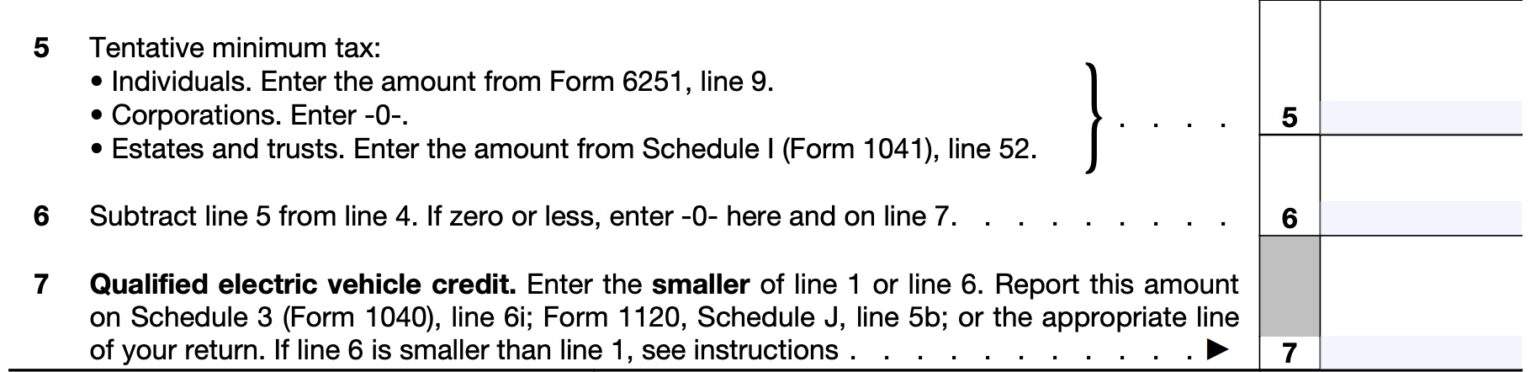

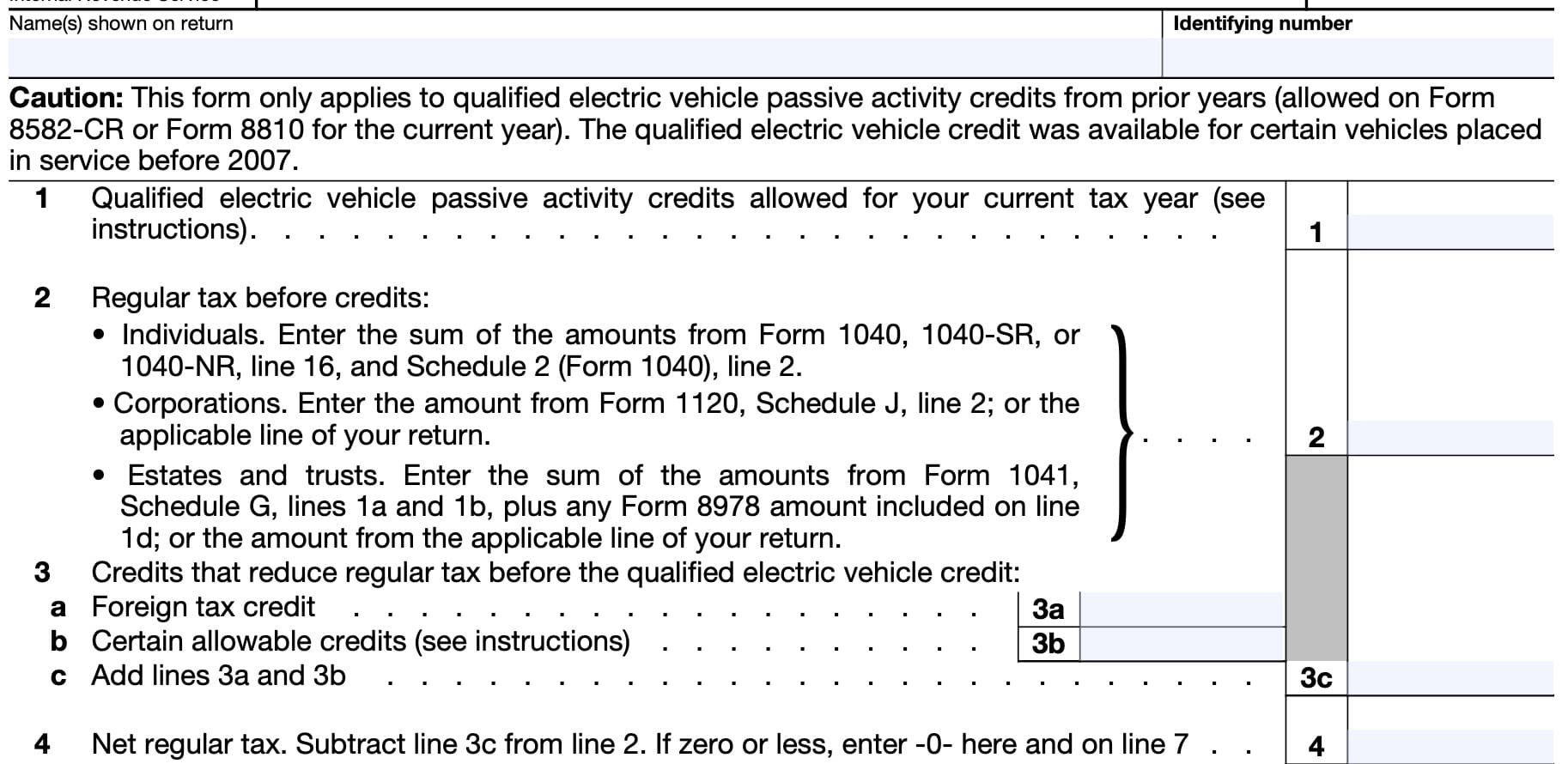

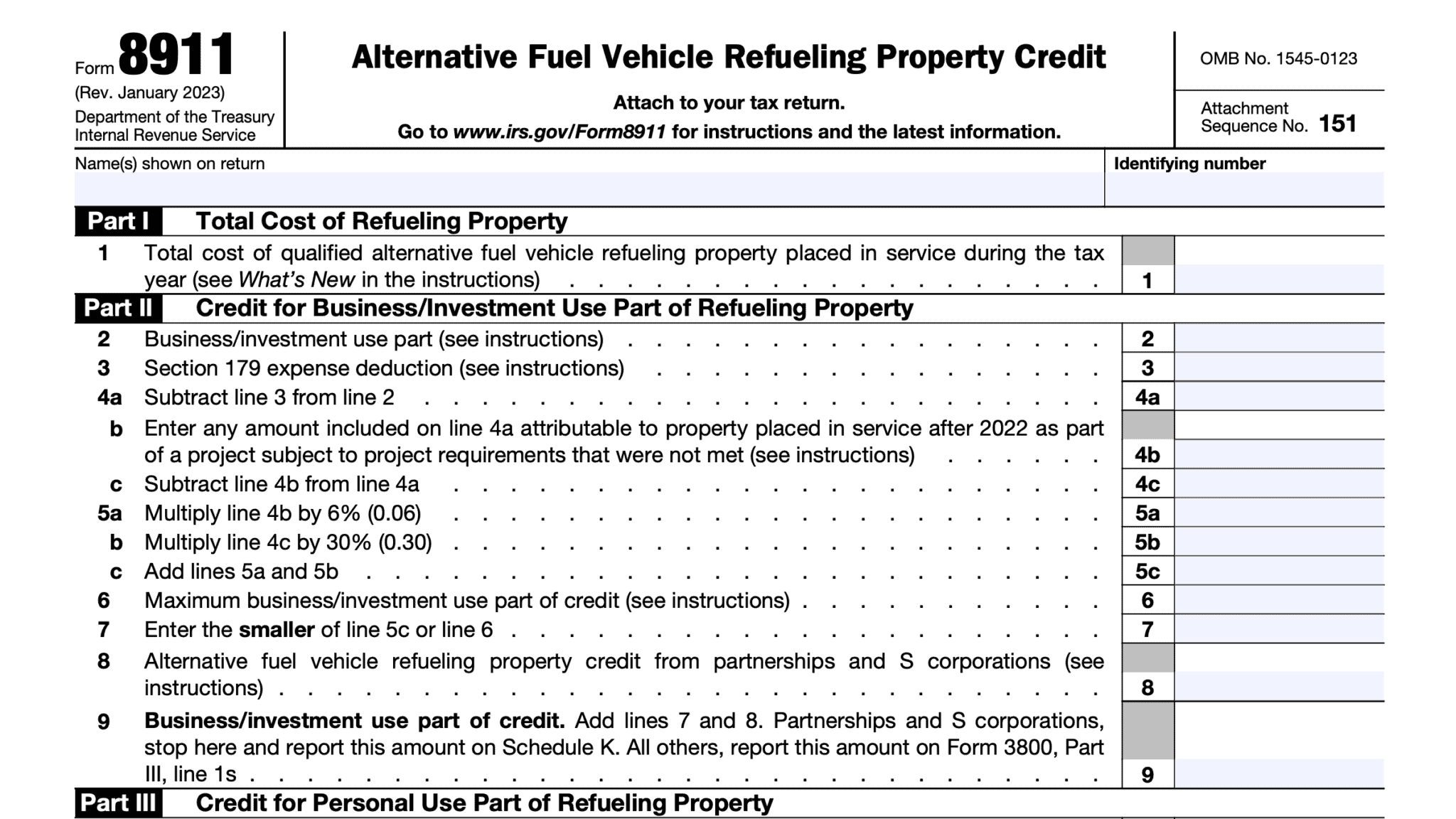

Use Form 8834 to claim any qualified electric vehicle passive activity credits from prior years allowed on Form 8582 CR or Form 8810 for the current tax year Part I and the

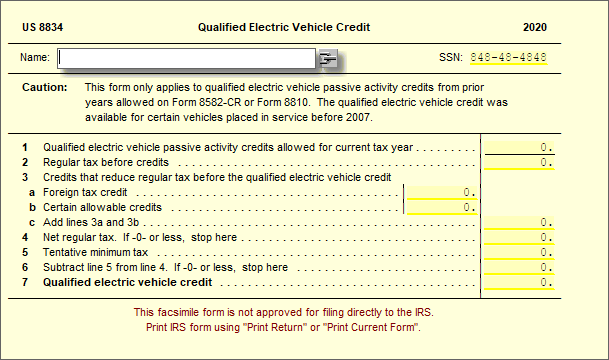

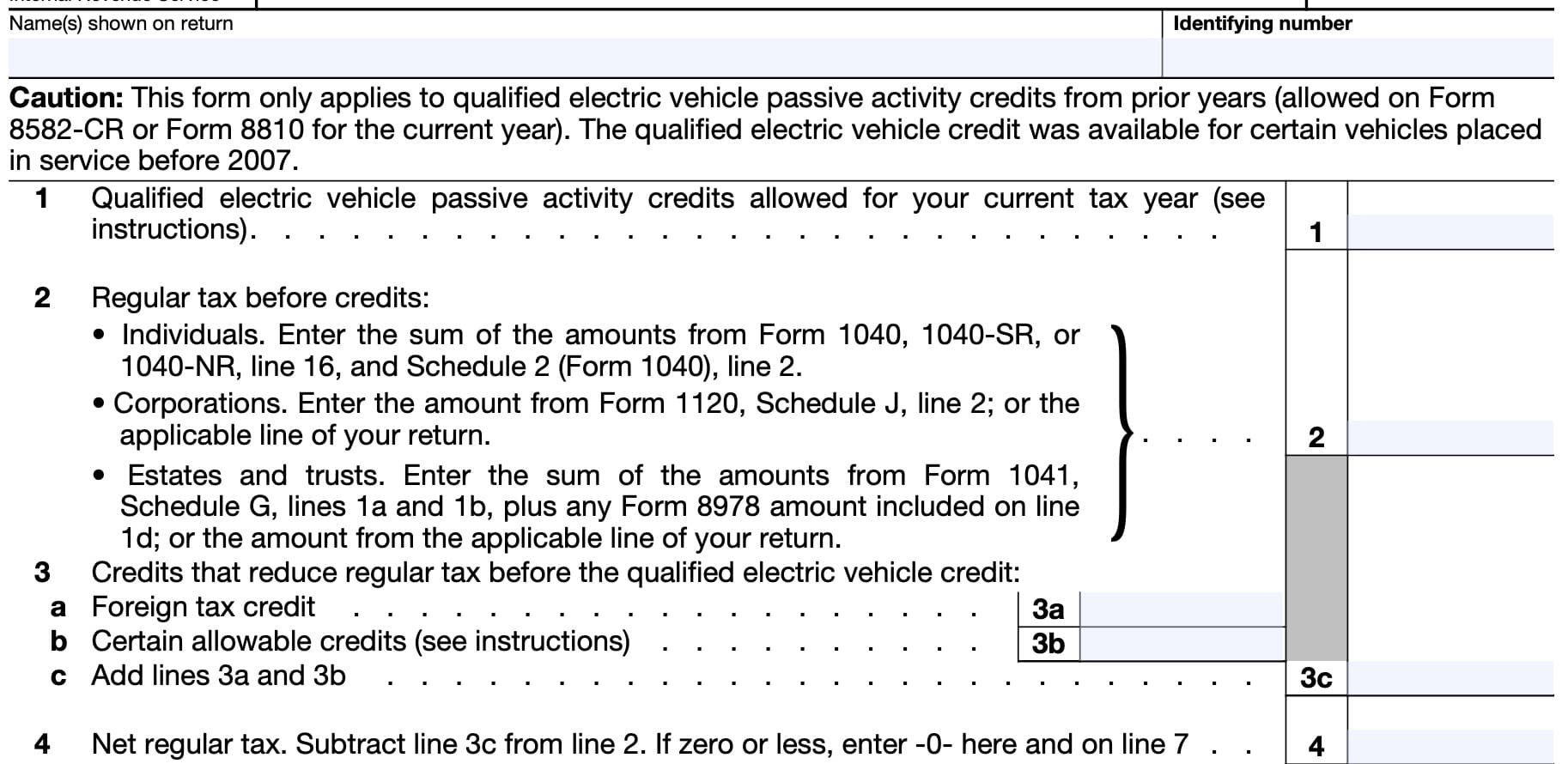

8834 Caution This form only applies to qualified electric vehicle passive activity credits from prior years allowed on Form 8582 CR or Form 8810 for the current year The

Qualified Electric Vehicle Credit Form 8834 cover a large range of printable, free resources available online for download at no cost. The resources are offered in a variety formats, such as worksheets, templates, coloring pages, and many more. The appealingness of Qualified Electric Vehicle Credit Form 8834 is their flexibility and accessibility.

More of Qualified Electric Vehicle Credit Form 8834

Qualified Electric Vehicle Credit Cray Kaiser

Qualified Electric Vehicle Credit Cray Kaiser

You can use Form 8834 to claim any qualified electric vehicle passive activity credit allowed for the current tax year To enter a prior year carryover of this

You must complete and attach Form 8834 to your tax return to claim the electric vehicle credit Enter your credit on your tax return as discussed next Individuals Individuals

Qualified Electric Vehicle Credit Form 8834 have gained a lot of popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or expensive software.

-

customization: The Customization feature lets you tailor the design to meet your needs, whether it's designing invitations or arranging your schedule or decorating your home.

-

Educational Impact: Downloads of educational content for free provide for students of all ages. This makes them an essential resource for educators and parents.

-

The convenience of You have instant access an array of designs and templates saves time and effort.

Where to Find more Qualified Electric Vehicle Credit Form 8834

Fillable Online 2002 Form 8834 Qualified Electric Vehicle Credit Fax

Fillable Online 2002 Form 8834 Qualified Electric Vehicle Credit Fax

Qualified Electric Vehicle Credit Form 8834 Qualified electric vehicle passive activity credits that are allowed for the current tax year are calculated on Form

See Form 8834 Per IRS Form 8834 Qualified Electric Vehicle Credit Caution This form only applies to qualified electric vehicle passive activity credits from prior years

If we've already piqued your curiosity about Qualified Electric Vehicle Credit Form 8834 Let's look into where they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of Qualified Electric Vehicle Credit Form 8834 designed for a variety needs.

- Explore categories like design, home decor, management, and craft.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free along with flashcards, as well as other learning materials.

- This is a great resource for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for no cost.

- The blogs covered cover a wide spectrum of interests, including DIY projects to party planning.

Maximizing Qualified Electric Vehicle Credit Form 8834

Here are some fresh ways ensure you get the very most of Qualified Electric Vehicle Credit Form 8834:

1. Home Decor

- Print and frame beautiful artwork, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Print out free worksheets and activities to enhance your learning at home (or in the learning environment).

3. Event Planning

- Make invitations, banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Be organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

Qualified Electric Vehicle Credit Form 8834 are an abundance of creative and practical resources which cater to a wide range of needs and preferences. Their accessibility and flexibility make they a beneficial addition to each day life. Explore the vast world of Qualified Electric Vehicle Credit Form 8834 today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually gratis?

- Yes you can! You can download and print these free resources for no cost.

-

Can I make use of free printables for commercial use?

- It depends on the specific conditions of use. Always verify the guidelines provided by the creator before utilizing their templates for commercial projects.

-

Are there any copyright concerns with Qualified Electric Vehicle Credit Form 8834?

- Some printables may contain restrictions on use. You should read the terms and regulations provided by the author.

-

How can I print Qualified Electric Vehicle Credit Form 8834?

- You can print them at home using either a printer or go to an area print shop for higher quality prints.

-

What software is required to open printables free of charge?

- Most PDF-based printables are available in PDF format, which is open with no cost software like Adobe Reader.

8834 Qualified Electric Vehicle Credit UltimateTax Solution Center

Form 8834 Qualified Electric Vehicle Credit Inscription On The Page

Check more sample of Qualified Electric Vehicle Credit Form 8834 below

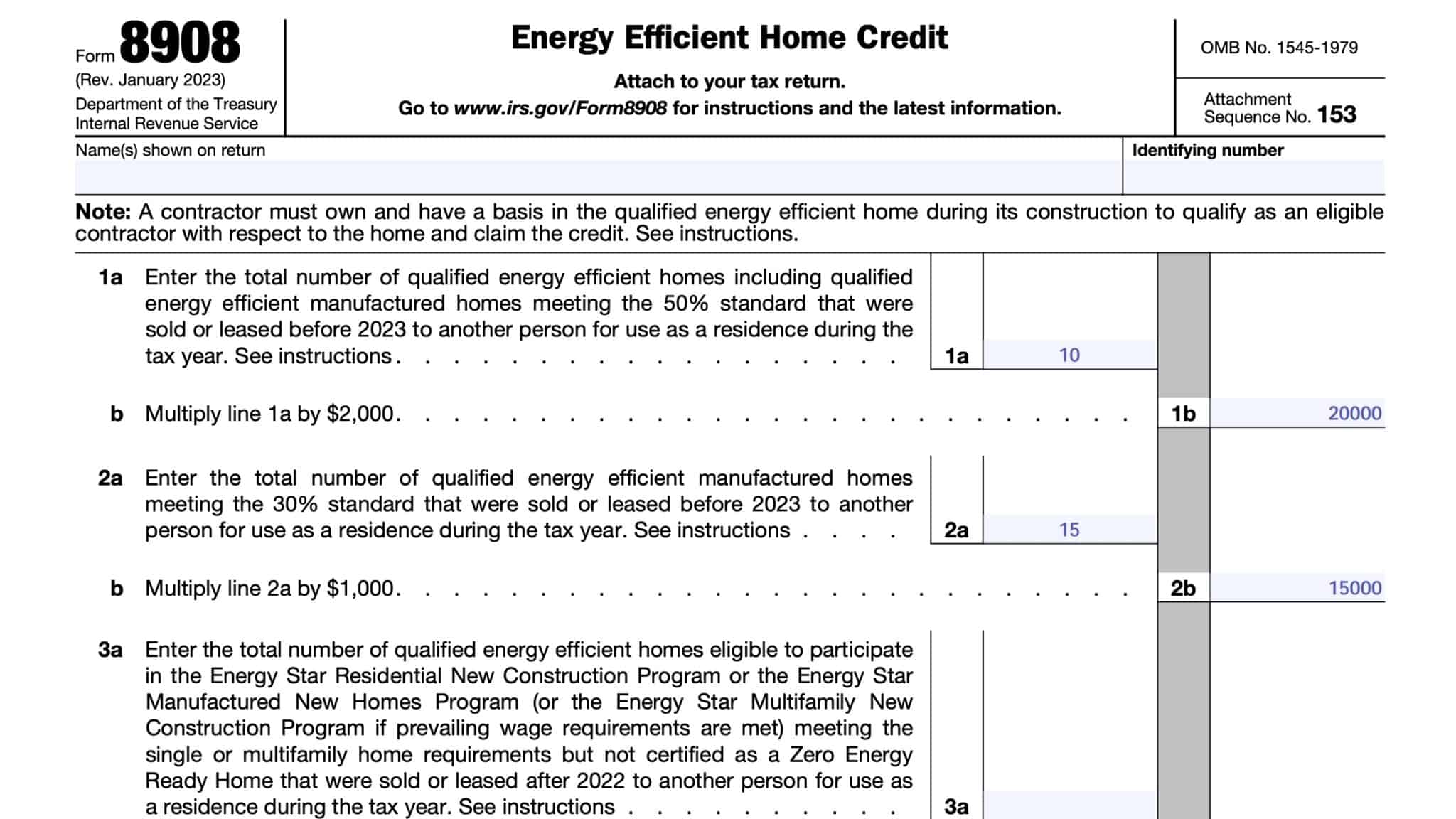

IRS Form 8834 Instructions Qualified Electric Vehicle Credit

IRS Form 8834 Instructions Qualified Electric Vehicle Credit

Use Form 8834 To Get Your Qualified Electric Vehicle Credit

IRS Form 8834 Instructions Qualified Electric Vehicle Credit

Electric Car Credit Income Limit How The Electric Car Tax Credit Works

Gem Golf Cart Wiring Diagram Magazine Order Now

https://www.irs.gov/pub/irs-pdf/f8834.pdf

8834 Caution This form only applies to qualified electric vehicle passive activity credits from prior years allowed on Form 8582 CR or Form 8810 for the current year The

https://www.irs.gov/pub/irs-prior/f8834--2019.pdf

Form 8834 Rev December 2019 8834 Caution This form only applies to qualified electric vehicle passive activity credits from prior years allowed on Form 8582 CR or

8834 Caution This form only applies to qualified electric vehicle passive activity credits from prior years allowed on Form 8582 CR or Form 8810 for the current year The

Form 8834 Rev December 2019 8834 Caution This form only applies to qualified electric vehicle passive activity credits from prior years allowed on Form 8582 CR or

IRS Form 8834 Instructions Qualified Electric Vehicle Credit

IRS Form 8834 Instructions Qualified Electric Vehicle Credit

Electric Car Credit Income Limit How The Electric Car Tax Credit Works

Gem Golf Cart Wiring Diagram Magazine Order Now

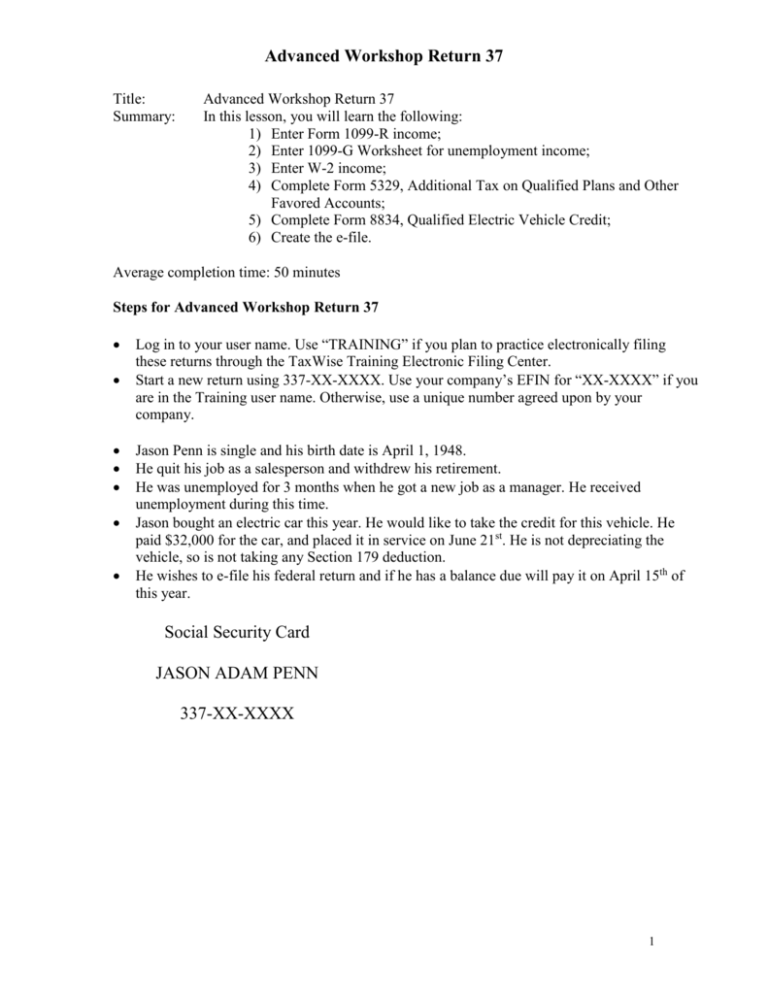

Steps For Advanced Workshop Return 37

Form 8834 Qualified Electric Vehicle Credit 2014 Free Download

Form 8834 Qualified Electric Vehicle Credit 2014 Free Download

IRS Form 8834 Instructions Qualified Electric Vehicle Credit