In this digital age, with screens dominating our lives The appeal of tangible, printed materials hasn't diminished. If it's to aid in education project ideas, artistic or just adding the personal touch to your space, National Pension Scheme Nps Tax Rebate U S 80ccd 2 have become a valuable source. With this guide, you'll dive deeper into "National Pension Scheme Nps Tax Rebate U S 80ccd 2," exploring what they are, how you can find them, and how they can be used to enhance different aspects of your lives.

Get Latest National Pension Scheme Nps Tax Rebate U S 80ccd 2 Below

National Pension Scheme Nps Tax Rebate U S 80ccd 2

National Pension Scheme Nps Tax Rebate U S 80ccd 2 - National Pension Scheme (nps) Tax Rebate U/s 80ccd(2), Nps Pension Scheme Tax Benefit, National Pension Scheme Under 80ccd, Is Nps Under 80ccd, What Is Nps Contribution U/s 80ccd

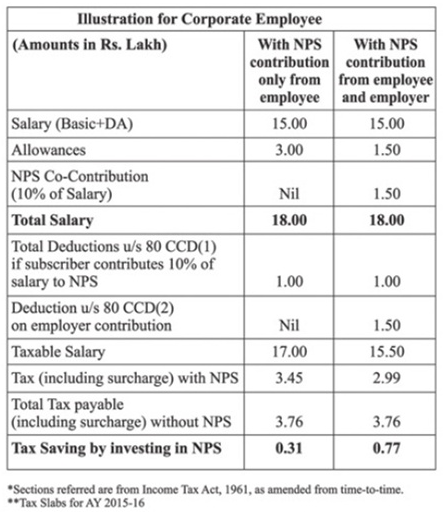

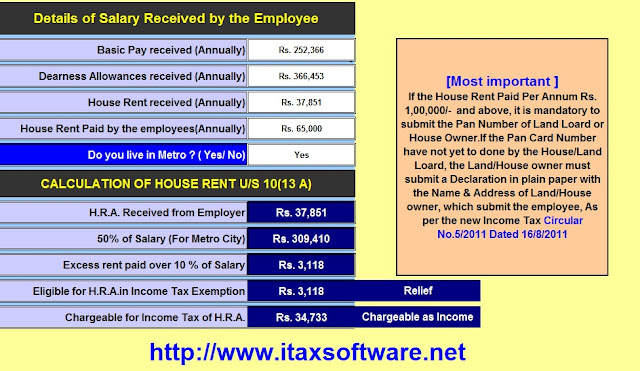

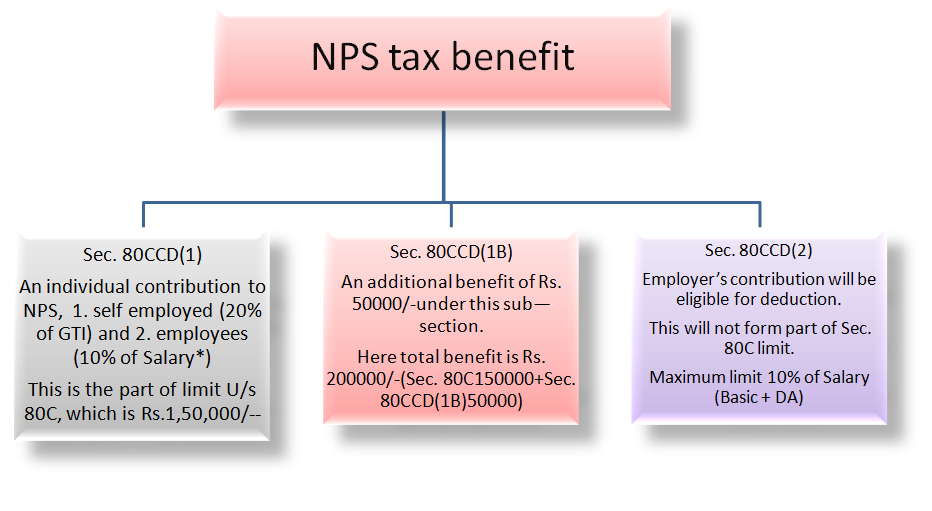

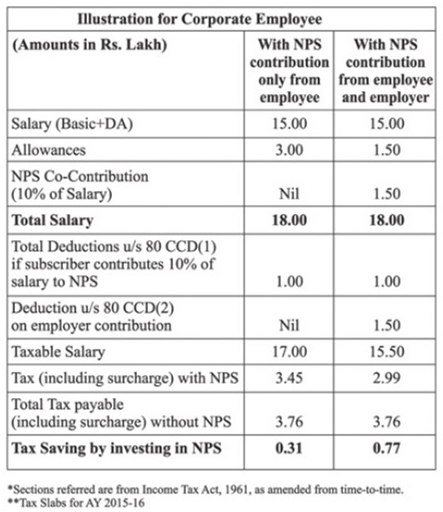

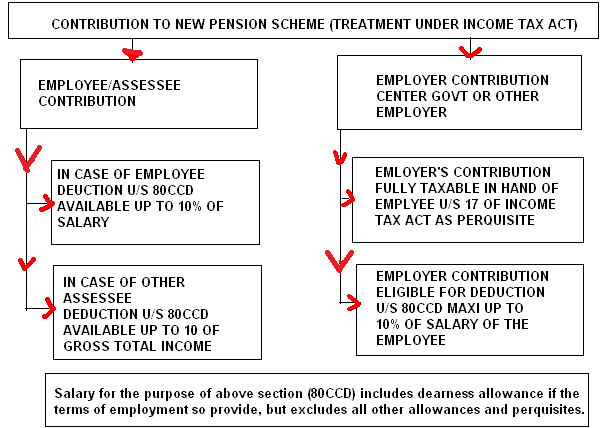

Web 18 f 233 vr 2023 nbsp 0183 32 Section 80CCD 2 of the Income Tax Act 1961 is a provision that allows individuals to claim an additional deduction on contributions made towards the National

Web 21 sept 2022 nbsp 0183 32 Rs 15 600 for individuals in the highest income tax bracket of 30 Section 80CCD 2 deals with employer contribution to an employee s pension accounts The amount of deduction is limited to

National Pension Scheme Nps Tax Rebate U S 80ccd 2 offer a wide assortment of printable items that are available online at no cost. These resources come in many forms, like worksheets templates, coloring pages, and more. The great thing about National Pension Scheme Nps Tax Rebate U S 80ccd 2 is in their versatility and accessibility.

More of National Pension Scheme Nps Tax Rebate U S 80ccd 2

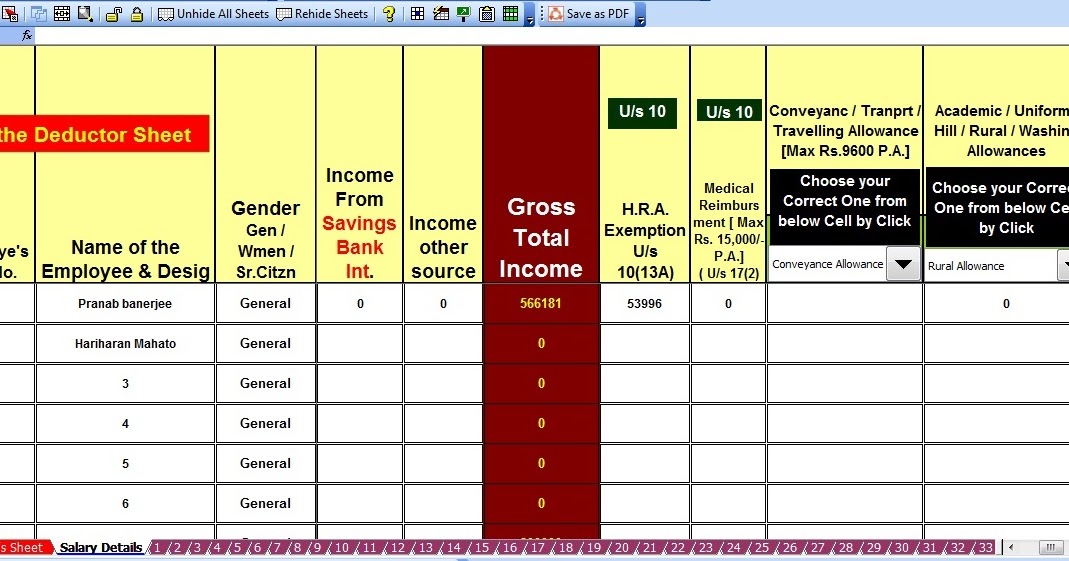

Deduction U s 80CCD 2 In Respect Of Contribution To New Pension Fund

Deduction U s 80CCD 2 In Respect Of Contribution To New Pension Fund

Web 3 f 233 vr 2023 nbsp 0183 32 Budget 2023 proposes to make the following deductions available to eligible individuals under the new tax regime from April 1 2023 i Standard deduction for

Web 7 f 233 vr 2020 nbsp 0183 32 NPS Tax Benefits NPS tax benefits are available through 3 sections 80CCD 1 80CCD 2 and 80CCD 1B We discuss each below 1 Section 80CCD 1 Employee contribution up to 10 of basic

National Pension Scheme Nps Tax Rebate U S 80ccd 2 have gained a lot of recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or costly software.

-

Individualization It is possible to tailor printed materials to meet your requirements in designing invitations as well as organizing your calendar, or decorating your home.

-

Educational Use: Printing educational materials for no cost are designed to appeal to students of all ages. This makes them a vital instrument for parents and teachers.

-

Easy to use: You have instant access many designs and templates is time-saving and saves effort.

Where to Find more National Pension Scheme Nps Tax Rebate U S 80ccd 2

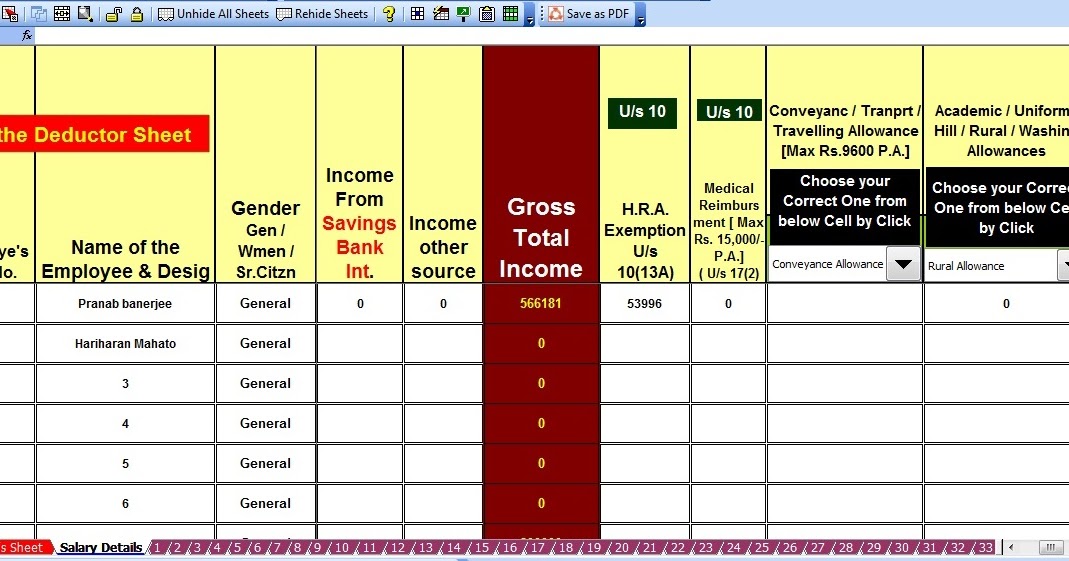

NPS Tax Benefits Sec 80CCD 1 80CCD 2 And 80CCD 1B With Automated

NPS Tax Benefits Sec 80CCD 1 80CCD 2 And 80CCD 1B With Automated

Web 2 avr 2019 nbsp 0183 32 NPS Tax Benefit Sec 80C and Additional Tax Rebate NPS tax benefits are offered under section 80C Section 80 CCD 1 amp Section 80 CCD 1B and Section

Web 1 What are the tax benefits under NPS Tax Benefit available to Individual Any individual who is Subscriber of NPS can claim tax benefit under Sec 80 CCD 1 with in the overall

Since we've got your interest in National Pension Scheme Nps Tax Rebate U S 80ccd 2 Let's look into where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection in National Pension Scheme Nps Tax Rebate U S 80ccd 2 for different uses.

- Explore categories like home decor, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free along with flashcards, as well as other learning tools.

- Ideal for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates, which are free.

- These blogs cover a broad spectrum of interests, all the way from DIY projects to party planning.

Maximizing National Pension Scheme Nps Tax Rebate U S 80ccd 2

Here are some creative ways create the maximum value use of National Pension Scheme Nps Tax Rebate U S 80ccd 2:

1. Home Decor

- Print and frame beautiful artwork, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use these printable worksheets free of charge for teaching at-home either in the schoolroom or at home.

3. Event Planning

- Design invitations and banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized with printable planners as well as to-do lists and meal planners.

Conclusion

National Pension Scheme Nps Tax Rebate U S 80ccd 2 are an abundance of practical and imaginative resources designed to meet a range of needs and hobbies. Their accessibility and versatility make them a fantastic addition to your professional and personal life. Explore the vast collection of National Pension Scheme Nps Tax Rebate U S 80ccd 2 today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really are they free?

- Yes you can! You can download and print these items for free.

-

Can I use free templates for commercial use?

- It's determined by the specific usage guidelines. Be sure to read the rules of the creator before using printables for commercial projects.

-

Are there any copyright issues when you download National Pension Scheme Nps Tax Rebate U S 80ccd 2?

- Some printables may have restrictions concerning their use. Be sure to review the terms and regulations provided by the creator.

-

How can I print National Pension Scheme Nps Tax Rebate U S 80ccd 2?

- Print them at home with either a printer at home or in a local print shop for superior prints.

-

What program do I need to open printables free of charge?

- Most PDF-based printables are available in the format of PDF, which can be opened with free software like Adobe Reader.

NPS Tax Benefits Sec 80CCD 1 80CCD 2 And 80CCD 1B BasuNivesh

How To Claim Deduction For Pension U s 80CCD Learn By Quicko

Check more sample of National Pension Scheme Nps Tax Rebate U S 80ccd 2 below

Income Tax Information NPS Tax Benefit Sec 80CCD 1 80CCD 1B And

NPS Tax Benefit Under Section 80CCD 1 80CCD 2 And 80CCD 1B

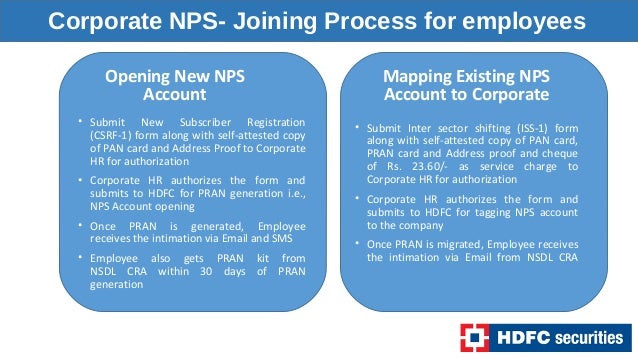

National Pension Scheme NPS Tax Benefits For Employees And Corpora

Best NPS Funds 2019 Top Performing NPS Scheme

80ccd 2 Of Income Tax Act Pdf Tax Walls

NPS Tax Benefits Sec 80CCD 1 80CCD 2 And 80CCD 1B With Automated

https://www.etmoney.com/learn/nps/nps-tax-…

Web 21 sept 2022 nbsp 0183 32 Rs 15 600 for individuals in the highest income tax bracket of 30 Section 80CCD 2 deals with employer contribution to an employee s pension accounts The amount of deduction is limited to

https://groww.in/p/tax/section-80ccd

Web Section 80CCD 2 refers to a tax benefit for employers with respect to a contribution made to the pension scheme If your employer contributes to your NPS account your employer

Web 21 sept 2022 nbsp 0183 32 Rs 15 600 for individuals in the highest income tax bracket of 30 Section 80CCD 2 deals with employer contribution to an employee s pension accounts The amount of deduction is limited to

Web Section 80CCD 2 refers to a tax benefit for employers with respect to a contribution made to the pension scheme If your employer contributes to your NPS account your employer

Best NPS Funds 2019 Top Performing NPS Scheme

NPS Tax Benefit Under Section 80CCD 1 80CCD 2 And 80CCD 1B

80ccd 2 Of Income Tax Act Pdf Tax Walls

NPS Tax Benefits Sec 80CCD 1 80CCD 2 And 80CCD 1B With Automated

Investing Can Be Interesting Financial Awareness Deduction Under

General Exemptions Deductions For Salaried Employees

General Exemptions Deductions For Salaried Employees

How To Claim Section 80CCD 1B TaxHelpdesk