In this age of electronic devices, where screens dominate our lives however, the attraction of tangible printed objects isn't diminished. Be it for educational use project ideas, artistic or simply to add the personal touch to your space, Married Filing Separately Recovery Rebate Credit have become a valuable resource. Here, we'll dive deep into the realm of "Married Filing Separately Recovery Rebate Credit," exploring the benefits of them, where to find them and how they can be used to enhance different aspects of your lives.

Get Latest Married Filing Separately Recovery Rebate Credit Below

Married Filing Separately Recovery Rebate Credit

Married Filing Separately Recovery Rebate Credit - Married Filing Separately Recovery Rebate Credit, Can Married Filing Separately Claim Recovery Rebate Credit, Can Married Filing Separately Get Recovery Rebate Credit

Web 14 janv 2022 nbsp 0183 32 The 2021 EIP recovery rebate credit has the same income phaseout thresholds as for 2020 75 000 for single filers and 150 000 for married couples filing

Web 13 janv 2022 nbsp 0183 32 If spouses file separately the spouse who has an SSN may claim the 2021 Recovery Rebate Credit the other spouse without a valid SSN will not qualify unless

Married Filing Separately Recovery Rebate Credit offer a wide variety of printable, downloadable material that is available online at no cost. They are available in numerous kinds, including worksheets templates, coloring pages and much more. The value of Married Filing Separately Recovery Rebate Credit is in their variety and accessibility.

More of Married Filing Separately Recovery Rebate Credit

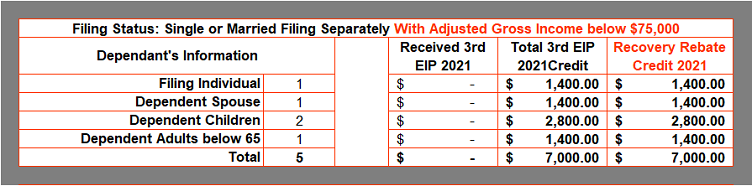

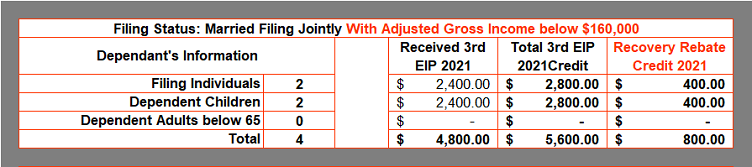

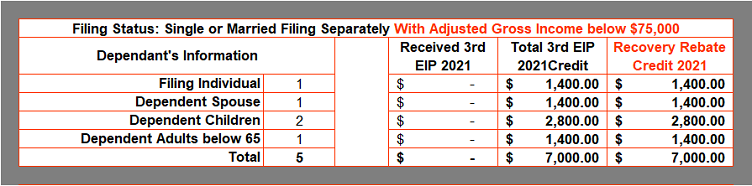

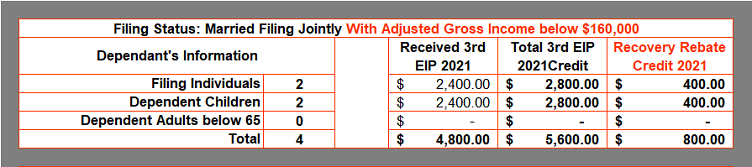

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

Web 2021 Recovery Rebate Credit Questions and Answers Background If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021

Web 1 juil 2020 nbsp 0183 32 Married filing separately may be an option In most situations it is better for a married couple to file a joint return rather than file separately However the phaseout of the recovery rebates credit may

Married Filing Separately Recovery Rebate Credit have gained immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

Personalization This allows you to modify printables to your specific needs be it designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational value: Educational printables that can be downloaded for free can be used by students of all ages. This makes them an invaluable device for teachers and parents.

-

An easy way to access HTML0: The instant accessibility to a plethora of designs and templates can save you time and energy.

Where to Find more Married Filing Separately Recovery Rebate Credit

Fillable Online Claiming The Recovery Rebate Credit If Your Filing

Fillable Online Claiming The Recovery Rebate Credit If Your Filing

Web 27 nov 2022 nbsp 0183 32 I am married filing separately and claimed the recovery rebate credit in 2021 IRS disallowed and and had to repay it Why would this be I met the income

Web 18 janv 2022 nbsp 0183 32 At first glance it looks like filing Married Filing Separately will result in an additional 877 in taxes for the couple However Michelle s return will also contain an Recovery Rebate Credit of 4 200 meaning

We hope we've stimulated your curiosity about Married Filing Separately Recovery Rebate Credit we'll explore the places they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection with Married Filing Separately Recovery Rebate Credit for all objectives.

- Explore categories like decoration for your home, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free including flashcards, learning tools.

- Great for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers post their original designs and templates, which are free.

- These blogs cover a wide variety of topics, including DIY projects to planning a party.

Maximizing Married Filing Separately Recovery Rebate Credit

Here are some unique ways create the maximum value use of printables for free:

1. Home Decor

- Print and frame gorgeous art, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Utilize free printable worksheets for reinforcement of learning at home as well as in the class.

3. Event Planning

- Make invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Married Filing Separately Recovery Rebate Credit are an abundance filled with creative and practical information that cater to various needs and passions. Their accessibility and flexibility make them an invaluable addition to the professional and personal lives of both. Explore the endless world of Married Filing Separately Recovery Rebate Credit right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Married Filing Separately Recovery Rebate Credit truly absolutely free?

- Yes, they are! You can download and print these tools for free.

-

Do I have the right to use free printables to make commercial products?

- It is contingent on the specific usage guidelines. Always check the creator's guidelines prior to utilizing the templates for commercial projects.

-

Are there any copyright issues in printables that are free?

- Some printables may come with restrictions on their use. Make sure to read the terms and regulations provided by the author.

-

How can I print Married Filing Separately Recovery Rebate Credit?

- You can print them at home with an printer, or go to the local print shop for more high-quality prints.

-

What software do I need to run printables for free?

- A majority of printed materials are in PDF format. They can be opened using free software such as Adobe Reader.

The Recovery Rebate Credit Calculator ShauntelRaya

Can A Married Couple File Single They Can Contribute To A Roth Ira As

Check more sample of Married Filing Separately Recovery Rebate Credit below

Recovery Rebate Credit Married In 2023 Recovery Rebate

How To Claim Recovery Rebate Credit Turbotax Romainedesign Recovery

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

Cares Act Recovery Rebate Credit Recovery Rebate

Recovery Credit Printable Rebate Form

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-c...

Web 13 janv 2022 nbsp 0183 32 If spouses file separately the spouse who has an SSN may claim the 2021 Recovery Rebate Credit the other spouse without a valid SSN will not qualify unless

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-a...

Web 17 f 233 vr 2022 nbsp 0183 32 The credit amount begins to be reduced at the same income thresholds as the 2020 Recovery Rebate Credits for example with adjusted gross income of more

Web 13 janv 2022 nbsp 0183 32 If spouses file separately the spouse who has an SSN may claim the 2021 Recovery Rebate Credit the other spouse without a valid SSN will not qualify unless

Web 17 f 233 vr 2022 nbsp 0183 32 The credit amount begins to be reduced at the same income thresholds as the 2020 Recovery Rebate Credits for example with adjusted gross income of more

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

How To Claim Recovery Rebate Credit Turbotax Romainedesign Recovery

Cares Act Recovery Rebate Credit Recovery Rebate

Recovery Credit Printable Rebate Form

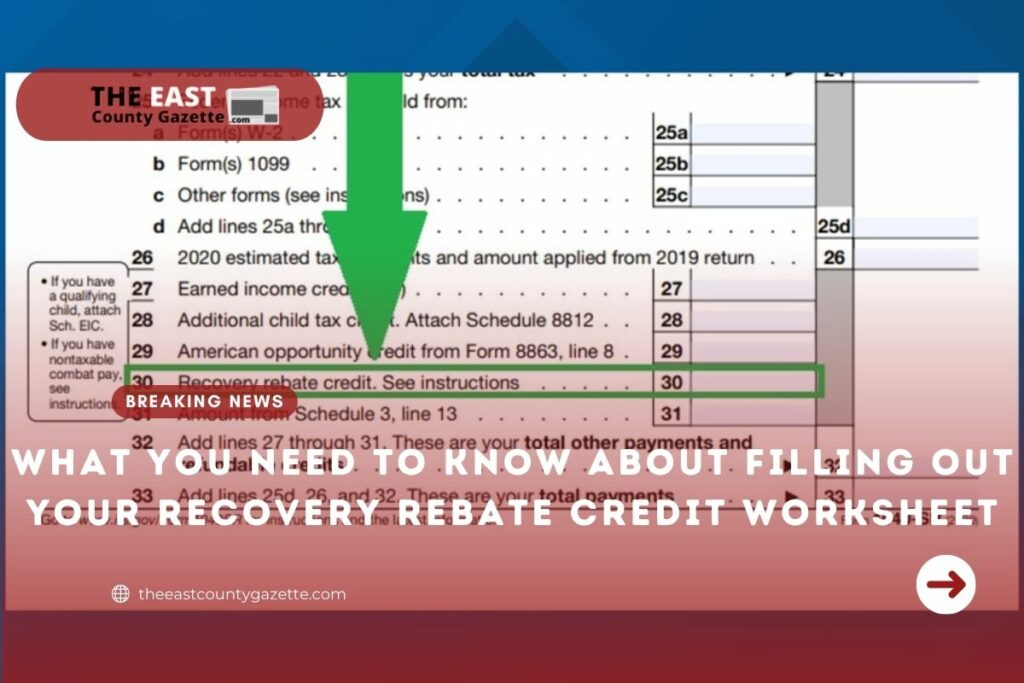

What You Need To Know About Filling Out Your Recovery Rebate Credit

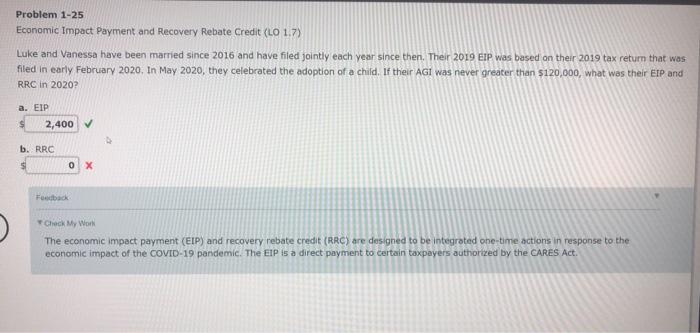

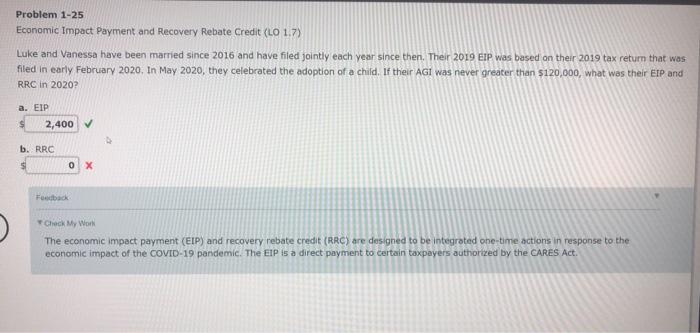

Solved Problem 1 25 Economic Impact Payment And Recovery Chegg

Solved Problem 1 25 Economic Impact Payment And Recovery Chegg

Recovery Rebate Credit Married Filing Separately Recovery Rebate