In the digital age, with screens dominating our lives but the value of tangible printed items hasn't gone away. It doesn't matter if it's for educational reasons as well as creative projects or simply adding an individual touch to your space, Maine Estate Tax Return Instructions have become an invaluable resource. Through this post, we'll dive through the vast world of "Maine Estate Tax Return Instructions," exploring the different types of printables, where to find them and the ways that they can benefit different aspects of your life.

Get Latest Maine Estate Tax Return Instructions Below

Maine Estate Tax Return Instructions

Maine Estate Tax Return Instructions - Maine Estate Tax Return Instructions, Does Maine Have An Estate Tax, Federal Estate Tax Return Instructions

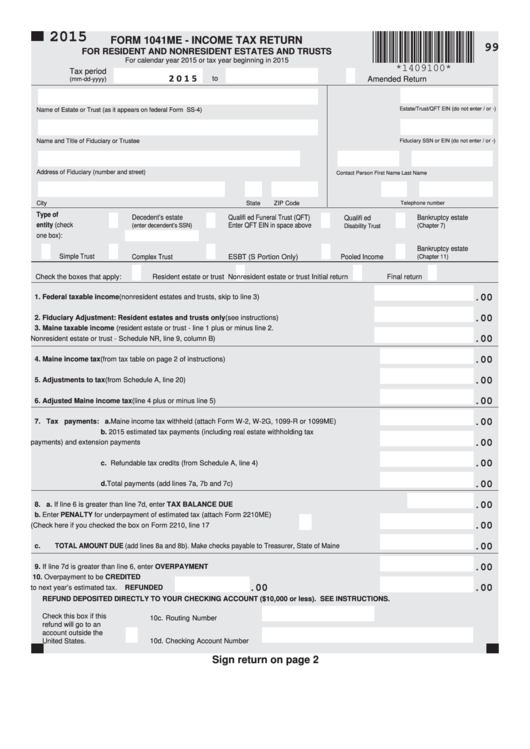

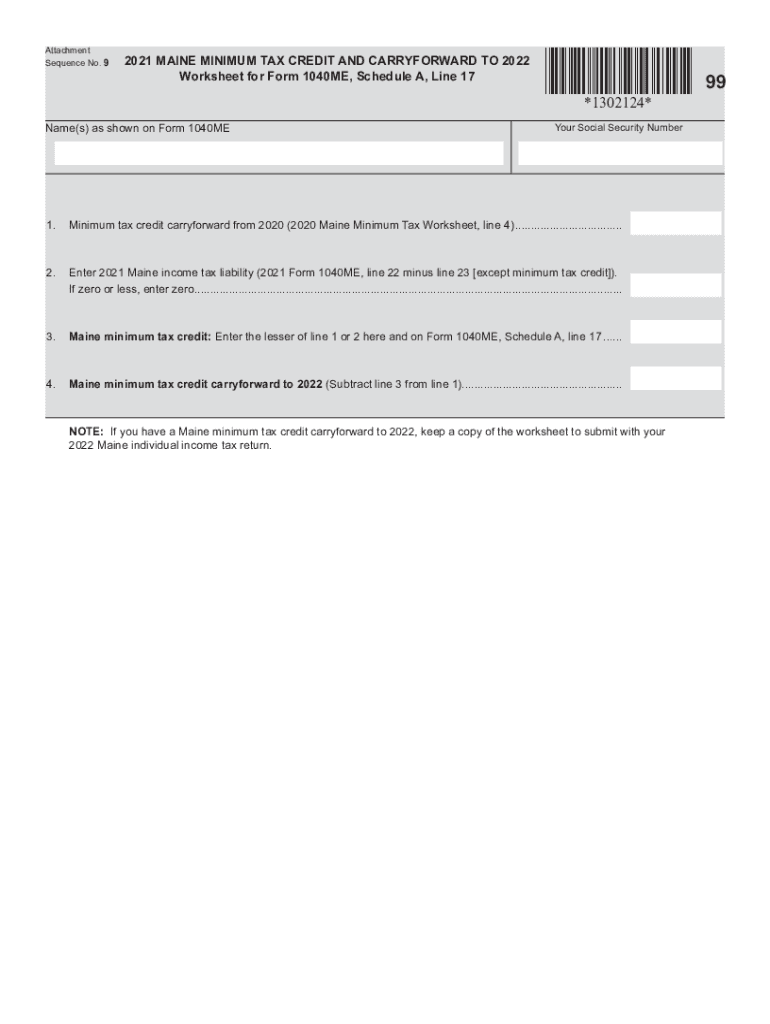

Instructions for Form 1040ES ME at www maine gov revenue forms Any person who prepares a taxpayer s return for compensation or call 207 624 7894 to order the forms Note Maine s estate trust estimated tax ling requirements

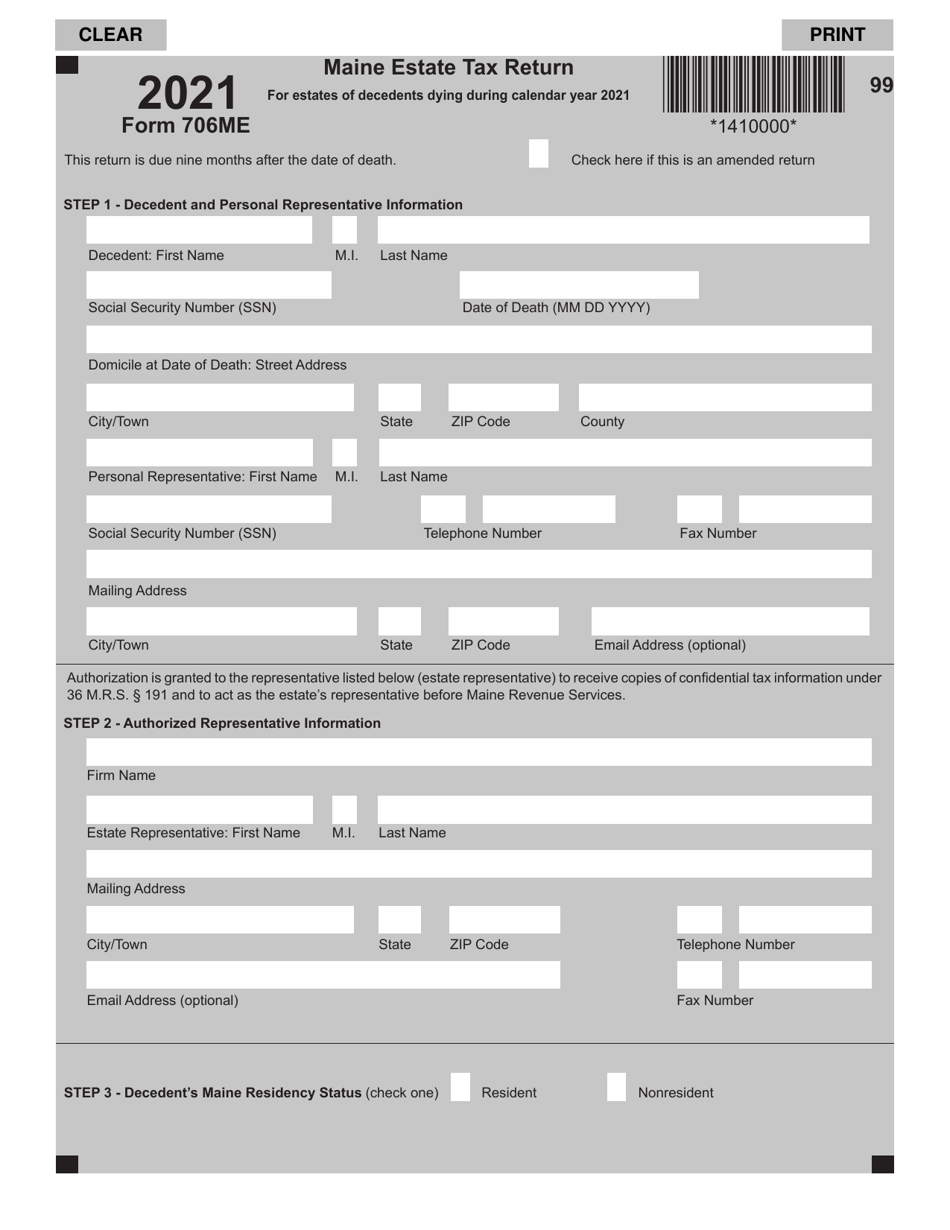

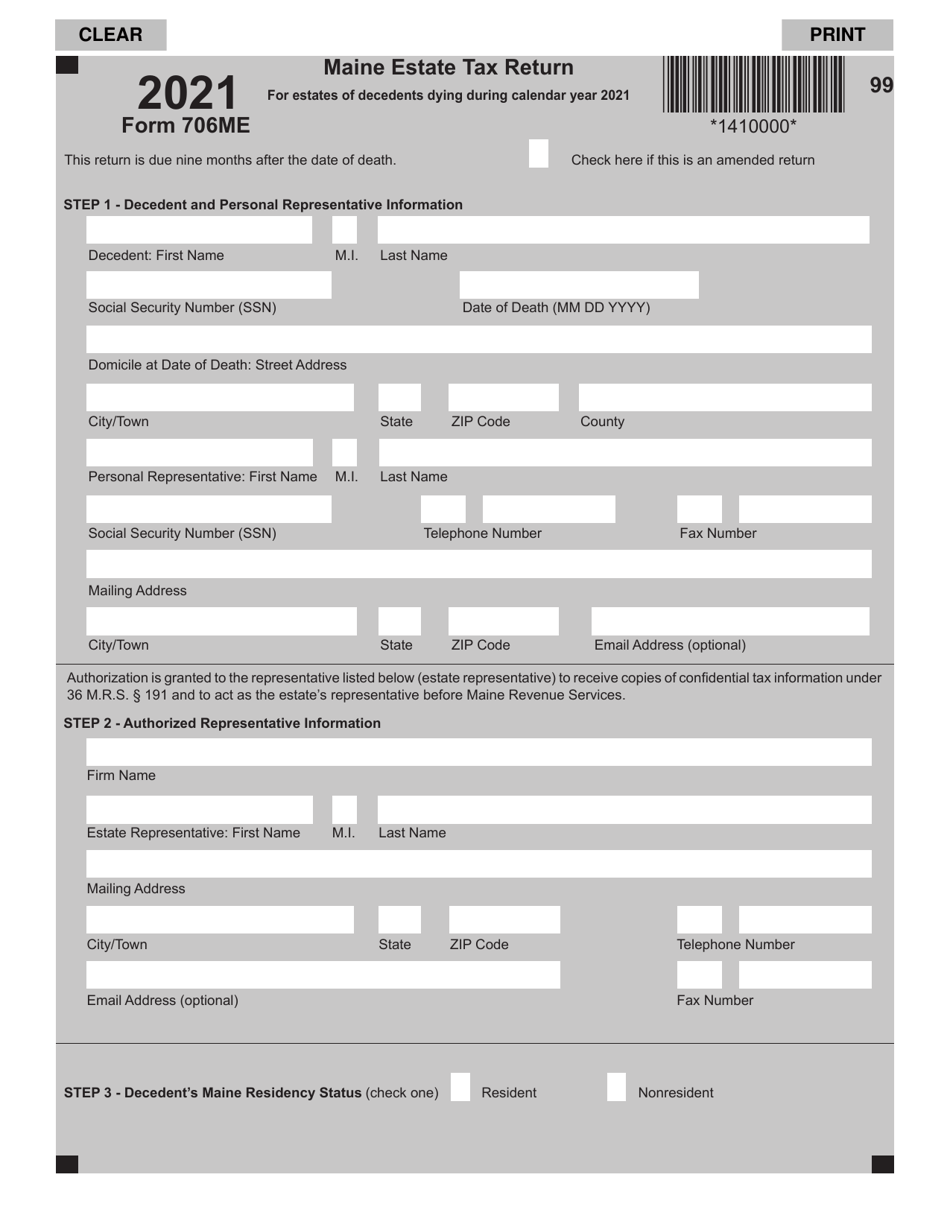

INSTRUCTIONS FILE ONLINE 706ME PDF Maine Estate Tax Return Estate tax instructions PDF Maine Tax Portal 700 SOV PDF Estate Tax Statement of Value for Lien Discharge Included Maine Tax Portal

Printables for free include a vast assortment of printable documents that can be downloaded online at no cost. These resources come in various forms, including worksheets, templates, coloring pages, and more. One of the advantages of Maine Estate Tax Return Instructions lies in their versatility and accessibility.

More of Maine Estate Tax Return Instructions

Maine Revenue Services

Maine Revenue Services

Fact Checked by Chris Thompson The estate tax rates in Maine range from 8 to 12 The tax applies on estates worth more than 6 8 million in 2024 up from 6 41 million in 2023 This guide has the

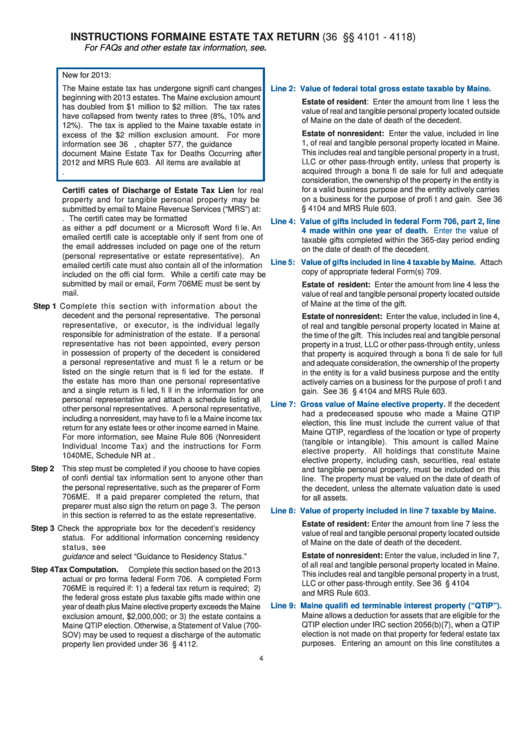

INSTRUCTIONS FOR MAINE ESTATE TAX RETURN 36 M R S 4101 4118 For FAQs and other estate tax information see www maine gov revenue taxes income estate tax estate tax 706me Note References to federal form line numbers are subject

Print-friendly freebies have gained tremendous recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

customization: There is the possibility of tailoring printed materials to meet your requirements whether you're designing invitations planning your schedule or even decorating your house.

-

Educational Worth: Printables for education that are free cater to learners of all ages, which makes them a useful aid for parents as well as educators.

-

Accessibility: Access to a variety of designs and templates cuts down on time and efforts.

Where to Find more Maine Estate Tax Return Instructions

Form 1041me Maine Income Tax Return For Resident And Nonresident

Form 1041me Maine Income Tax Return For Resident And Nonresident

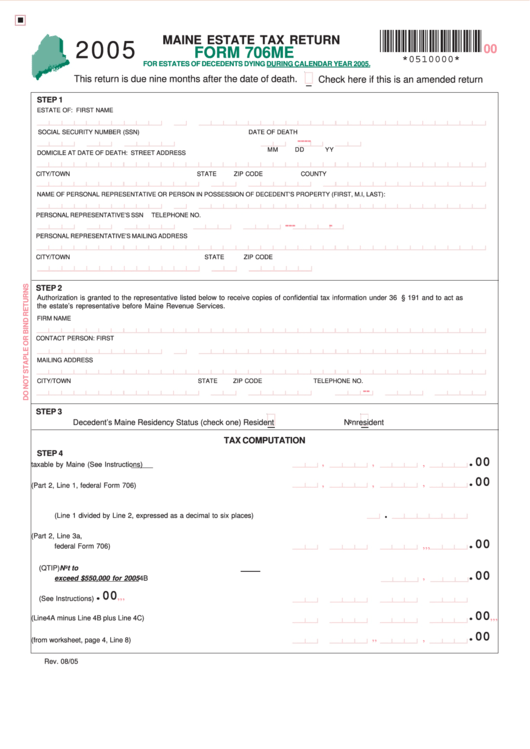

What Estate Tax Functions are Available on Maine Tax Portal Estate Tax forms are now accepted on the Maine Tax Portal MTP Personal Representatives of the estate can file either Form 706ME or the Form 700 SOV Statement of Value For information on which

Add the line 7 results together for all worksheets and subtract this total amount from the Maine estate tax calculated prior to the application of this credit and enter the result on Form 706ME line 10 Attach a copy of each worksheet to the Maine estate tax return

Now that we've piqued your interest in Maine Estate Tax Return Instructions Let's see where the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection in Maine Estate Tax Return Instructions for different motives.

- Explore categories like interior decor, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free with flashcards and other teaching tools.

- Great for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs or templates for download.

- The blogs are a vast selection of subjects, all the way from DIY projects to party planning.

Maximizing Maine Estate Tax Return Instructions

Here are some inventive ways ensure you get the very most use of Maine Estate Tax Return Instructions:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Utilize free printable worksheets to reinforce learning at home (or in the learning environment).

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Be organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Maine Estate Tax Return Instructions are a treasure trove of practical and imaginative resources that cater to various needs and desires. Their access and versatility makes these printables a useful addition to every aspect of your life, both professional and personal. Explore the many options of Maine Estate Tax Return Instructions to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Maine Estate Tax Return Instructions really cost-free?

- Yes, they are! You can print and download these resources at no cost.

-

Can I use free printouts for commercial usage?

- It's based on the terms of use. Always review the terms of use for the creator before using printables for commercial projects.

-

Do you have any copyright concerns with Maine Estate Tax Return Instructions?

- Some printables could have limitations regarding their use. Be sure to read the terms and conditions provided by the author.

-

How can I print printables for free?

- Print them at home with your printer or visit an area print shop for high-quality prints.

-

What software do I require to open printables that are free?

- The majority of printed documents are in PDF format. They is open with no cost programs like Adobe Reader.

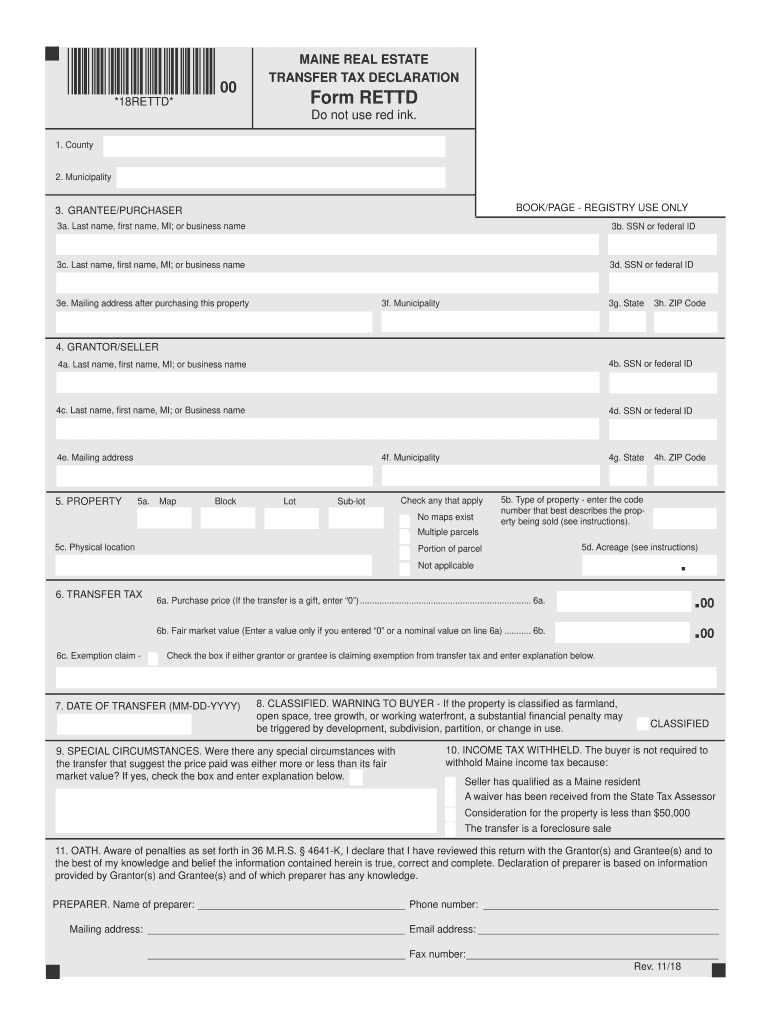

Rettd 2018 2023 Form Fill Out And Sign Printable PDF Template SignNow

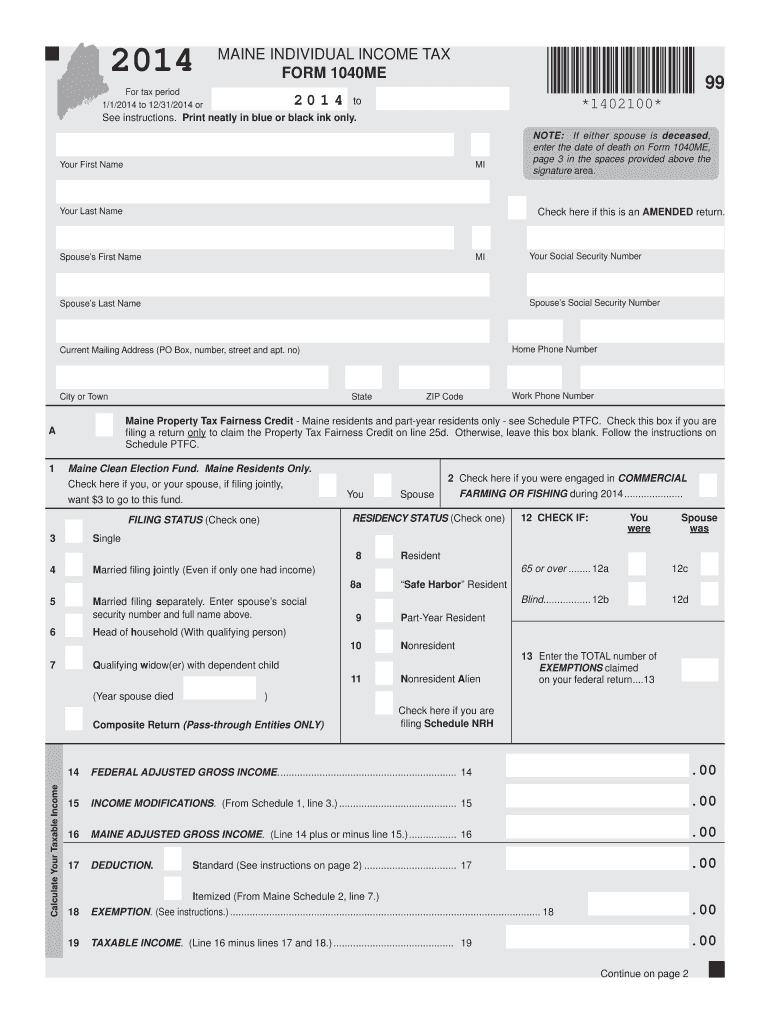

Maine Tax Forms And Instructions For 2019 Form 1040ME

Check more sample of Maine Estate Tax Return Instructions below

MAINE INDIVIDUAL INCOME TAX FORM 1040ME 2 0 1 4 Maine Gov Fill Out

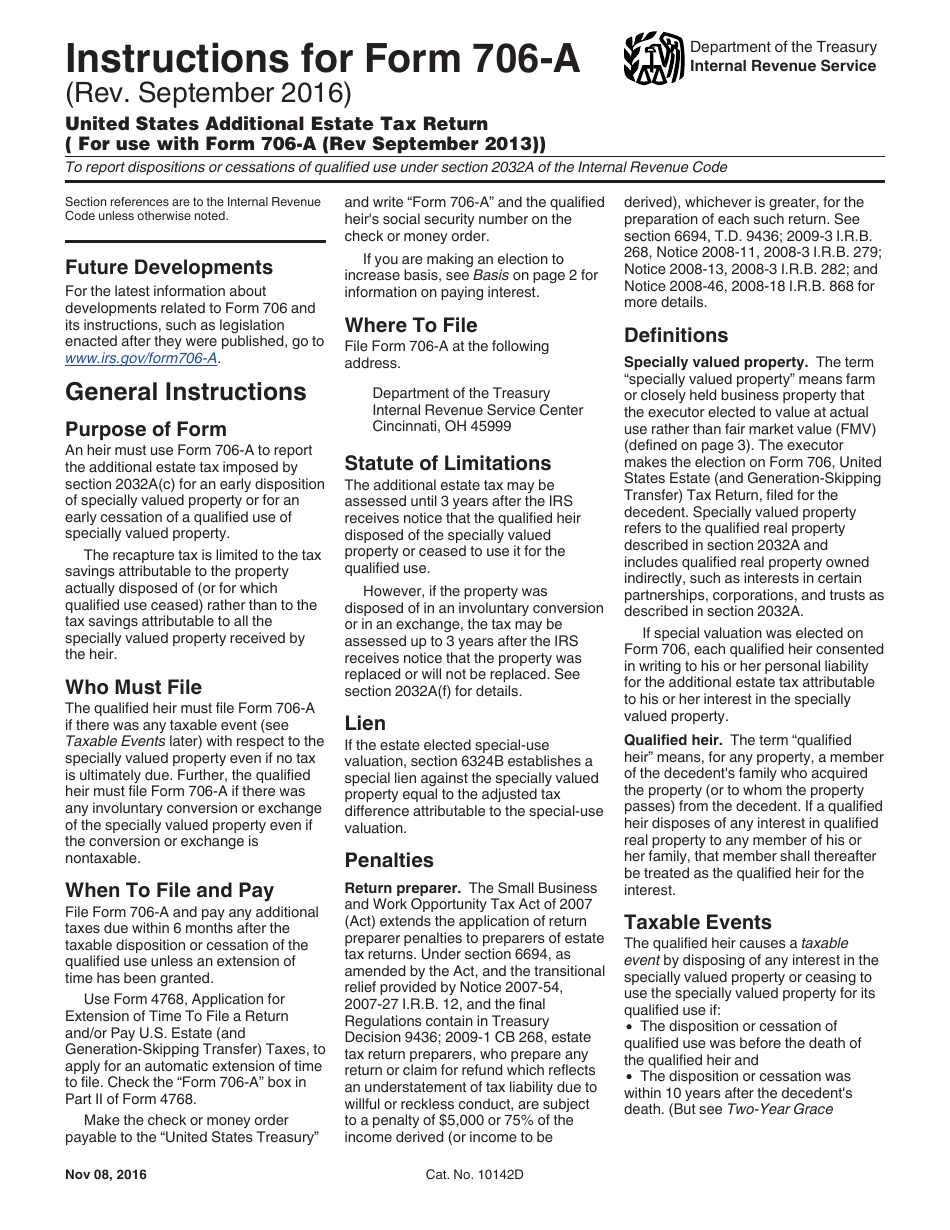

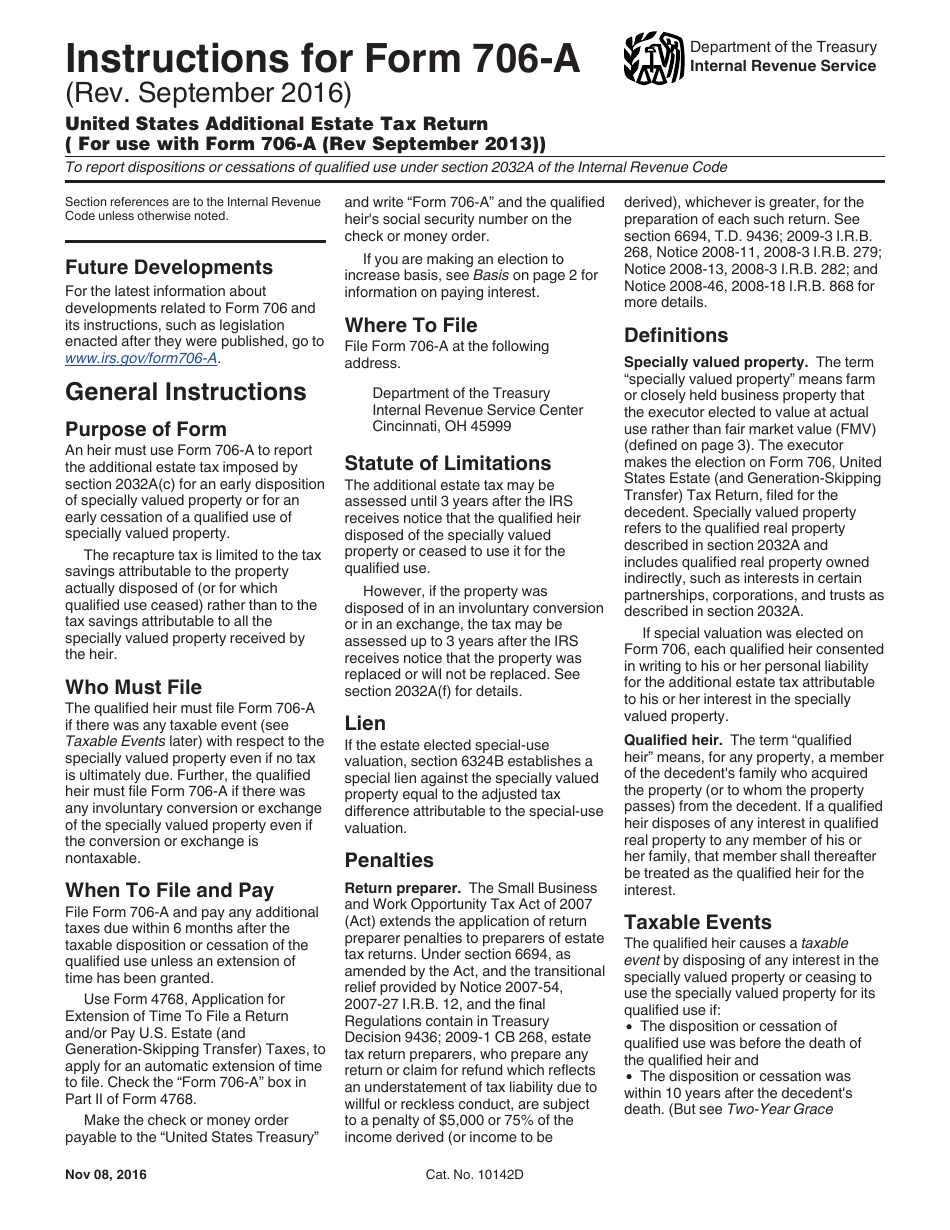

Download Instructions For IRS Form 706 A United States Additional

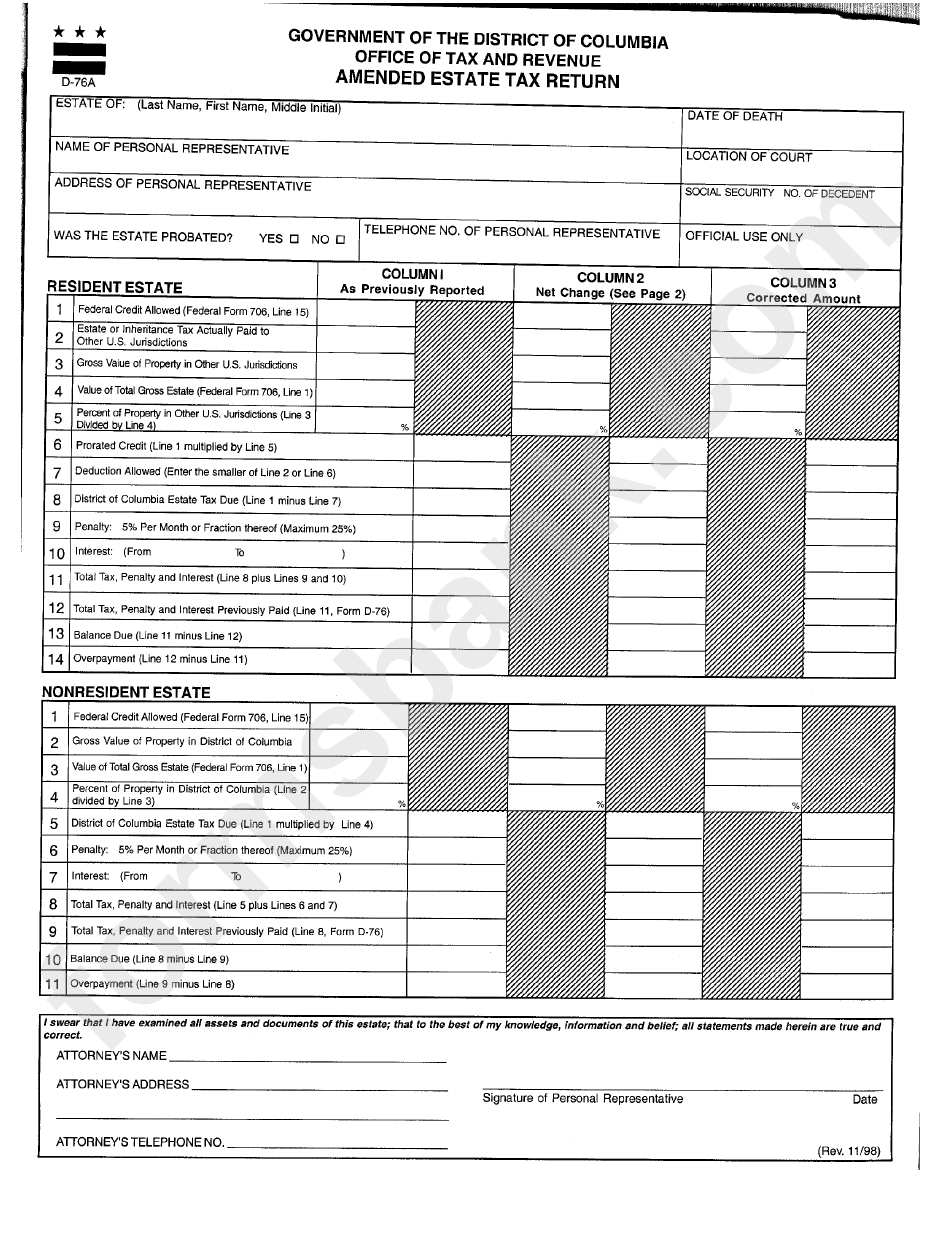

Form D 76a Amended Estate Tax Return Printable Pdf Download

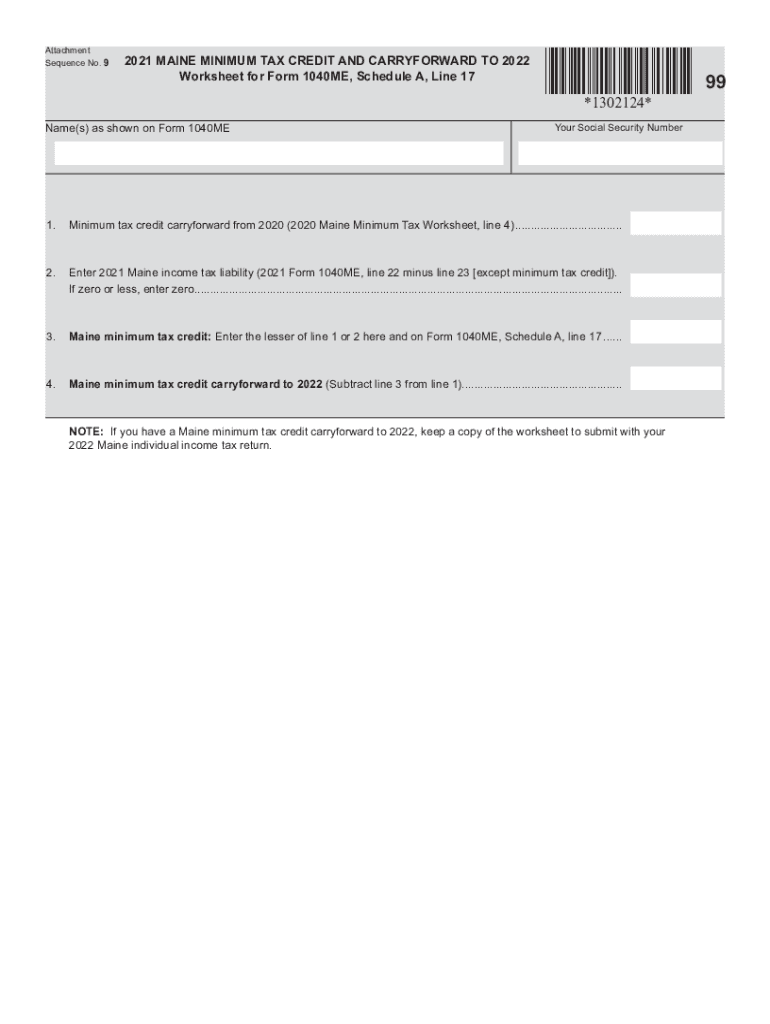

Maine Minimum Tax Fill Out And Sign Printable PDF Template SignNow

Printable New York State Tax Forms Printable Forms Free Online

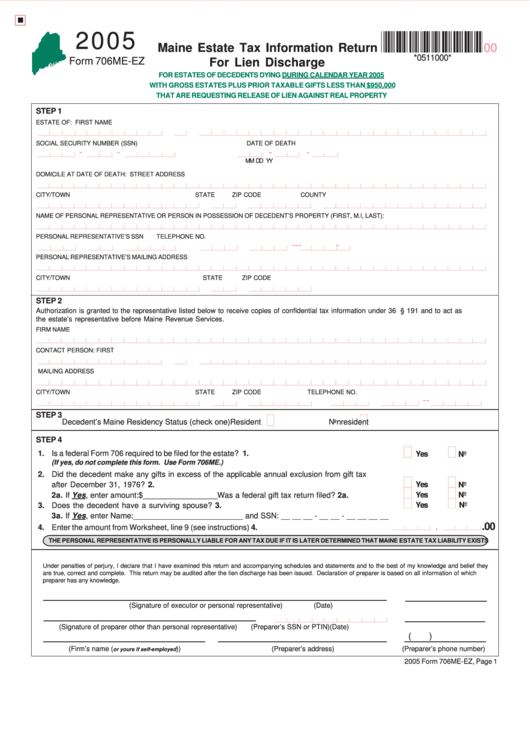

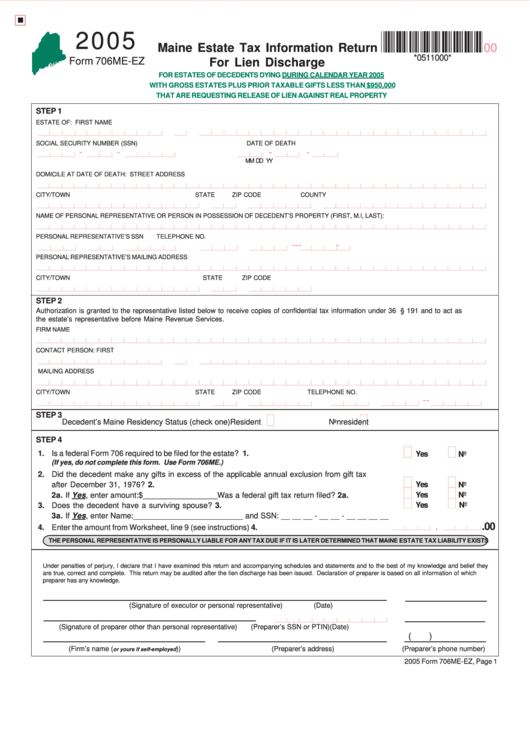

Form 706me Ez Maine Estate Tax Information Return For Lien Discharge

https://www.maine.gov/revenue/tax-return-forms/estate-tax-2021

INSTRUCTIONS FILE ONLINE 706ME PDF Maine Estate Tax Return Estate tax instructions PDF Maine Tax Portal 700 SOV PDF Estate Tax Statement of Value for Lien Discharge Included Maine Tax Portal

https://www1.maine.gov/.../estate_guidance_2019.pdf

A Maine estate tax return Form 706ME must be filed if the gross value of an estate plus adjusted taxable gifts made within one year of death plus Maine elective property is over the applicable Maine exclusion amount or if a federal estate tax return is required to be filed

INSTRUCTIONS FILE ONLINE 706ME PDF Maine Estate Tax Return Estate tax instructions PDF Maine Tax Portal 700 SOV PDF Estate Tax Statement of Value for Lien Discharge Included Maine Tax Portal

A Maine estate tax return Form 706ME must be filed if the gross value of an estate plus adjusted taxable gifts made within one year of death plus Maine elective property is over the applicable Maine exclusion amount or if a federal estate tax return is required to be filed

Maine Minimum Tax Fill Out And Sign Printable PDF Template SignNow

Download Instructions For IRS Form 706 A United States Additional

Printable New York State Tax Forms Printable Forms Free Online

Form 706me Ez Maine Estate Tax Information Return For Lien Discharge

Instructions For Maine Estate Tax Return 2013 Printable Pdf Download

Form 706me Maine Estate Tax Return Printable Pdf Download

Form 706me Maine Estate Tax Return Printable Pdf Download

Download Instructions For Form 706ME Maine Estate Tax Return PDF 2023