In the digital age, where screens have become the dominant feature of our lives, the charm of tangible printed items hasn't gone away. Whatever the reason, whether for education for creative projects, simply to add the personal touch to your space, Is Property Tax Deductible In Texas have become a valuable resource. Here, we'll take a dive through the vast world of "Is Property Tax Deductible In Texas," exploring what they are, where they are, and what they can do to improve different aspects of your lives.

Get Latest Is Property Tax Deductible In Texas Below

Is Property Tax Deductible In Texas

Is Property Tax Deductible In Texas - Is Property Tax Deductible In Texas, What Is Property Tax Relief In Texas, Are Property Taxes A Write Off In Texas, Property Tax Breaks In Texas, Property Tax Relief In Texas 2023, Can You Write Off Property Tax In Texas, Can Property Taxes Be Deducted In Texas

Taxes paid on rental or commercial property and on property not owned by the taxpayer can not be deducted Starting in 2018 the deduction for state and local taxes including property

Key Takeaways If you itemize your deductions you can deduct the property taxes you pay on your main residence and any other real estate you own The total amount of deductible state and local income taxes including

Is Property Tax Deductible In Texas provide a diverse range of printable, free material that is available online at no cost. The resources are offered in a variety kinds, including worksheets templates, coloring pages and much more. The value of Is Property Tax Deductible In Texas is in their variety and accessibility.

More of Is Property Tax Deductible In Texas

Ergeon How Your Fence Can Be Tax Deductible

Ergeon How Your Fence Can Be Tax Deductible

Annual payments of Public Improvement District assessments in Texas are frequently billed and collected by county tax offices along with the standard Texas property taxes However PIDs are not included in property tax amounts they re paid in addition to any assessed real estate taxes

Property tax in Texas is locally assessed and locally administered All real and tangible personal property in Texas is taxable in proportion to its appraised value unless the Texas Constitution authorizes an exemption

Print-friendly freebies have gained tremendous popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Customization: This allows you to modify print-ready templates to your specific requirements whether it's making invitations planning your schedule or even decorating your house.

-

Educational Value: Printing educational materials for no cost cater to learners of all ages, which makes them an essential resource for educators and parents.

-

Easy to use: Fast access numerous designs and templates cuts down on time and efforts.

Where to Find more Is Property Tax Deductible In Texas

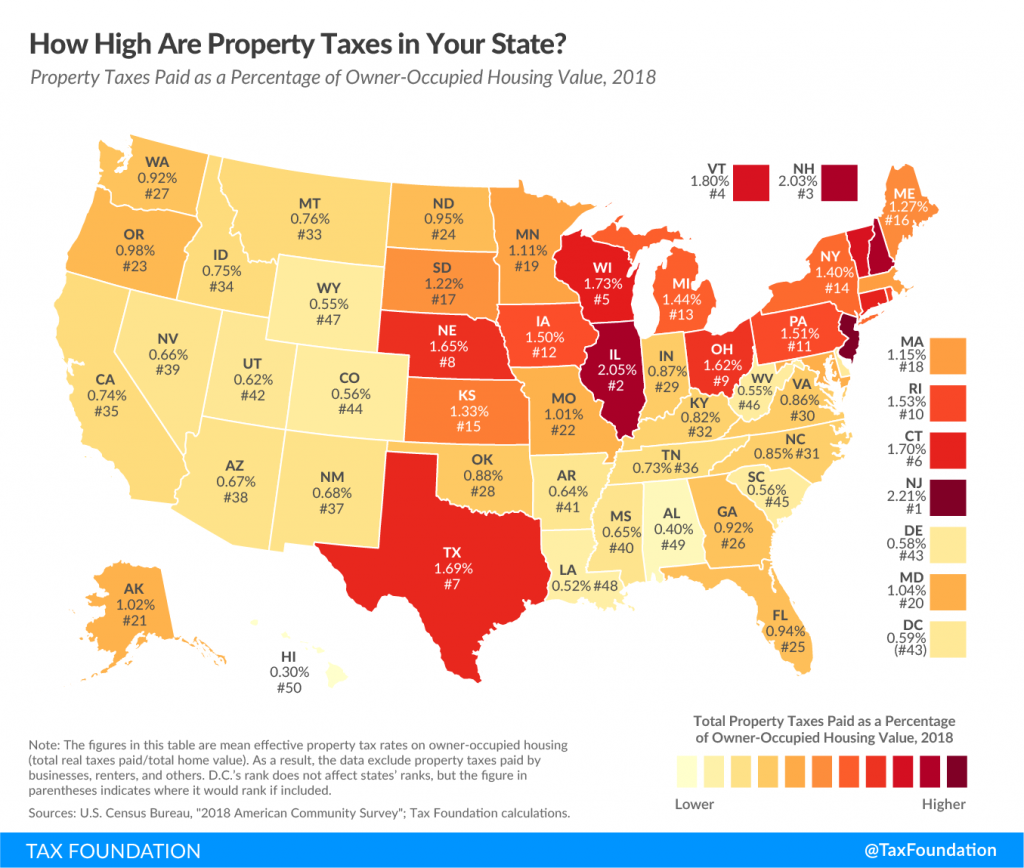

How High Are Property Taxes In Your State Tax Foundation

How High Are Property Taxes In Your State Tax Foundation

Taxes State tax Texas Property Tax Relief in 2024 Homeowners have started saving due to a Texas property tax relief package passed last year Here s a breakdown of the tax cuts

Real estate taxes are deductible if Based on the value of the property Levied uniformly throughout your community Used for a governmental or general community purpose Assessed and paid before the end of the tax year You can deduct up to 10 000 or 5 000 if married filing separately of state and local taxes including property taxes

If we've already piqued your interest in Is Property Tax Deductible In Texas Let's take a look at where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of Is Property Tax Deductible In Texas to suit a variety of reasons.

- Explore categories such as decorations for the home, education and organization, and crafts.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets, flashcards, and learning tools.

- The perfect resource for parents, teachers, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers provide their inventive designs as well as templates for free.

- These blogs cover a broad array of topics, ranging from DIY projects to planning a party.

Maximizing Is Property Tax Deductible In Texas

Here are some fresh ways in order to maximize the use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes or decorations for the holidays to beautify your living spaces.

2. Education

- Use printable worksheets from the internet to enhance learning at home also in the classes.

3. Event Planning

- Design invitations, banners and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable planners, to-do lists, and meal planners.

Conclusion

Is Property Tax Deductible In Texas are a treasure trove of practical and innovative resources for a variety of needs and hobbies. Their availability and versatility make them a wonderful addition to both professional and personal lives. Explore the wide world of Is Property Tax Deductible In Texas today to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Is Property Tax Deductible In Texas truly for free?

- Yes you can! You can print and download these tools for free.

-

Can I make use of free printables for commercial uses?

- It is contingent on the specific usage guidelines. Make sure you read the guidelines for the creator before utilizing their templates for commercial projects.

-

Do you have any copyright problems with Is Property Tax Deductible In Texas?

- Some printables may contain restrictions on their use. Be sure to check the conditions and terms of use provided by the designer.

-

How do I print Is Property Tax Deductible In Texas?

- Print them at home with printing equipment or visit a local print shop to purchase the highest quality prints.

-

What program do I need to run printables at no cost?

- The majority of printables are in PDF format, which can be opened with free programs like Adobe Reader.

Is Home Insurance Tax Deductible In Canada Surex

Is Home Insurance Tax Deductible In Canada Surex

Check more sample of Is Property Tax Deductible In Texas below

To What Extent Does Your State Rely On Property Taxes Tax Foundation

Tax Deductible Bricks R Us

Understanding Deductibles For Renters Insurance

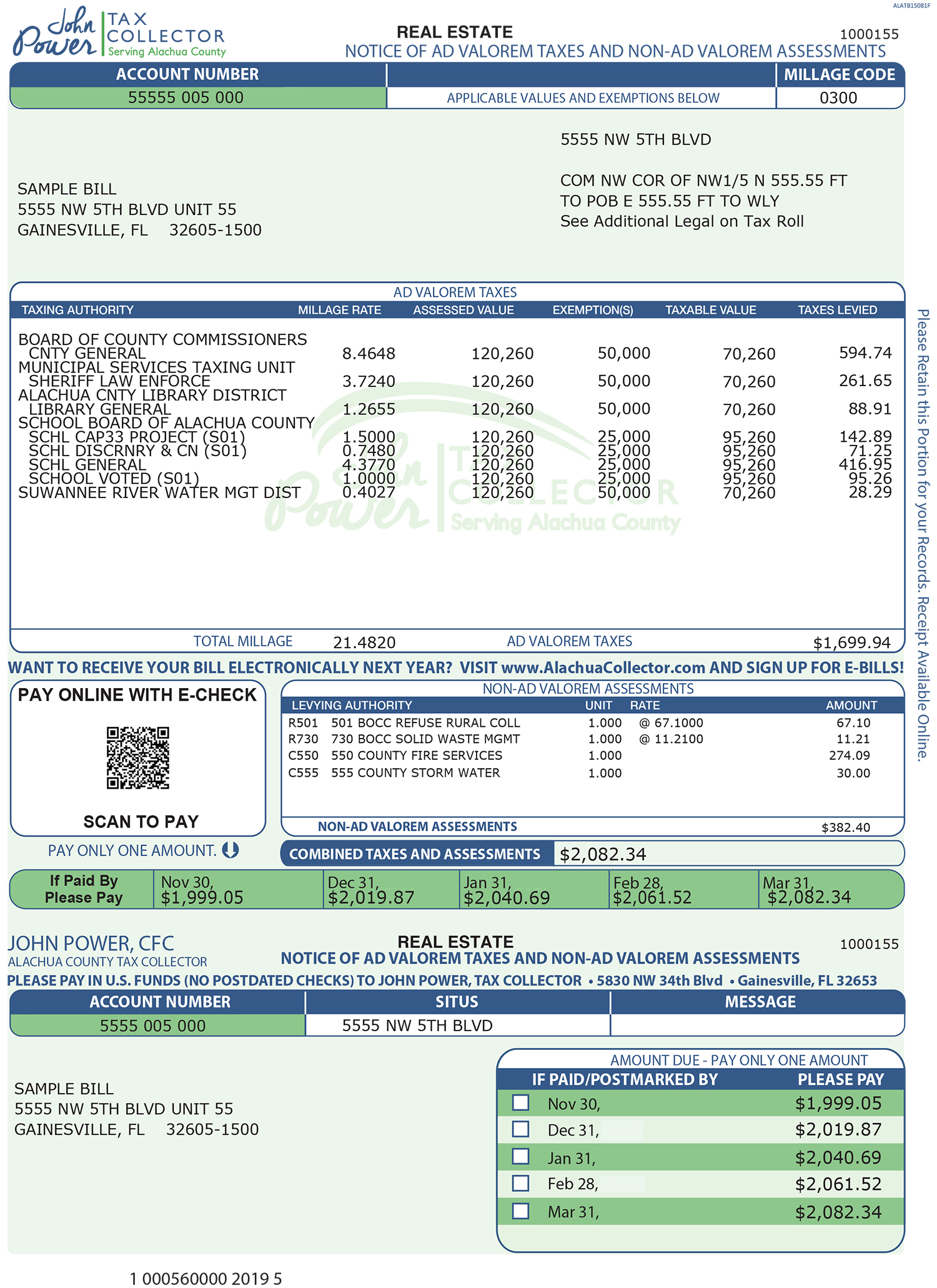

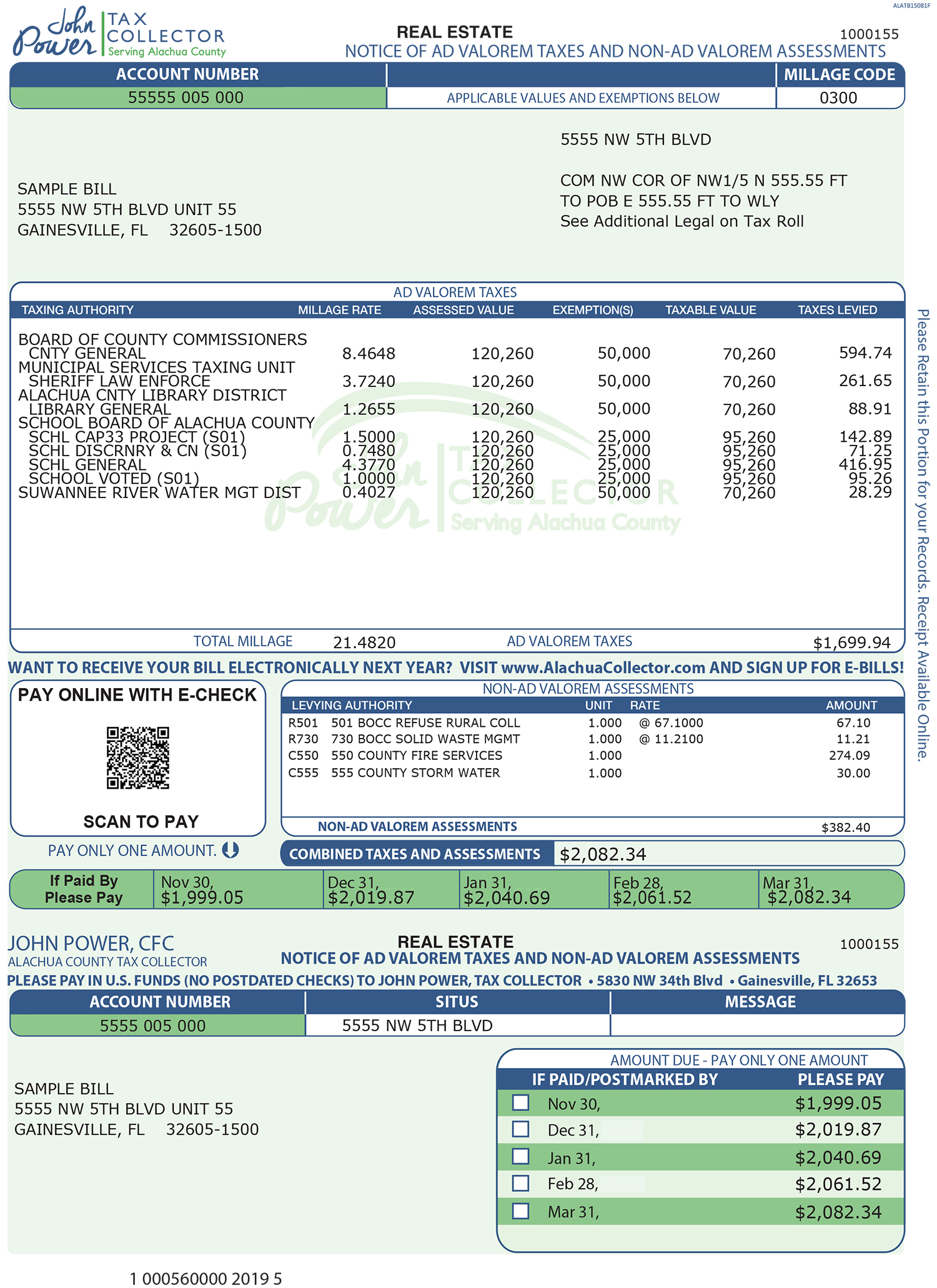

Deposit Your Due Property Tax Latest By 31st December 2019 Don T Ignore

Infographic Is My Move Tax Deductible Wheaton

School Supplies Are Tax Deductible Wfmynews2

https://turbotax.intuit.com/tax-tips/home-ownership/claiming...

Key Takeaways If you itemize your deductions you can deduct the property taxes you pay on your main residence and any other real estate you own The total amount of deductible state and local income taxes including

https://victorsteffen.com/guides/texas-property-tax-relief-bill...

The Texas Property Tax Relief Bill of 2023 aims to reduce the financial burden of property taxes on Texas homeowners As mentioned it raises the homestead exemption from 40 000 to 100 000 meaning homeowners can take a larger amount of money off the taxable value of their primary residence It also limits annual appraisal

Key Takeaways If you itemize your deductions you can deduct the property taxes you pay on your main residence and any other real estate you own The total amount of deductible state and local income taxes including

The Texas Property Tax Relief Bill of 2023 aims to reduce the financial burden of property taxes on Texas homeowners As mentioned it raises the homestead exemption from 40 000 to 100 000 meaning homeowners can take a larger amount of money off the taxable value of their primary residence It also limits annual appraisal

Deposit Your Due Property Tax Latest By 31st December 2019 Don T Ignore

Tax Deductible Bricks R Us

Infographic Is My Move Tax Deductible Wheaton

School Supplies Are Tax Deductible Wfmynews2

Investment Expenses What s Tax Deductible Charles Schwab

Property Tax 101 Real Estate Tax Cycle The Shoppers Weekly

Property Tax 101 Real Estate Tax Cycle The Shoppers Weekly

Are Any Legal Fees Tax Deductible PLOYMENT