In this age of technology, with screens dominating our lives, the charm of tangible printed objects isn't diminished. In the case of educational materials or creative projects, or simply adding some personal flair to your home, printables for free are now a useful resource. In this article, we'll dive into the world "Is Ny State Retirement Income Taxable," exploring what they are, how to locate them, and how they can be used to enhance different aspects of your daily life.

Get Latest Is Ny State Retirement Income Taxable Below

Is Ny State Retirement Income Taxable

Is Ny State Retirement Income Taxable -

New York allows you to subtract your pension received from New York State Local and Federal Governments as long as the income was included in your federal adjusted gross income Other taxable pensions not from NYS Local

Is New York tax friendly for retirees New York is moderately tax friendly for retirees It does not tax Social Security benefits and provides seniors a sizable deduction of 20 000 on other types of retirement income Retirees in New York should have relatively low income tax bills

The Is Ny State Retirement Income Taxable are a huge selection of printable and downloadable items that are available online at no cost. These printables come in different styles, from worksheets to coloring pages, templates and much more. The great thing about Is Ny State Retirement Income Taxable is their flexibility and accessibility.

More of Is Ny State Retirement Income Taxable

Is Disability Retirement Income Taxable

Is Disability Retirement Income Taxable

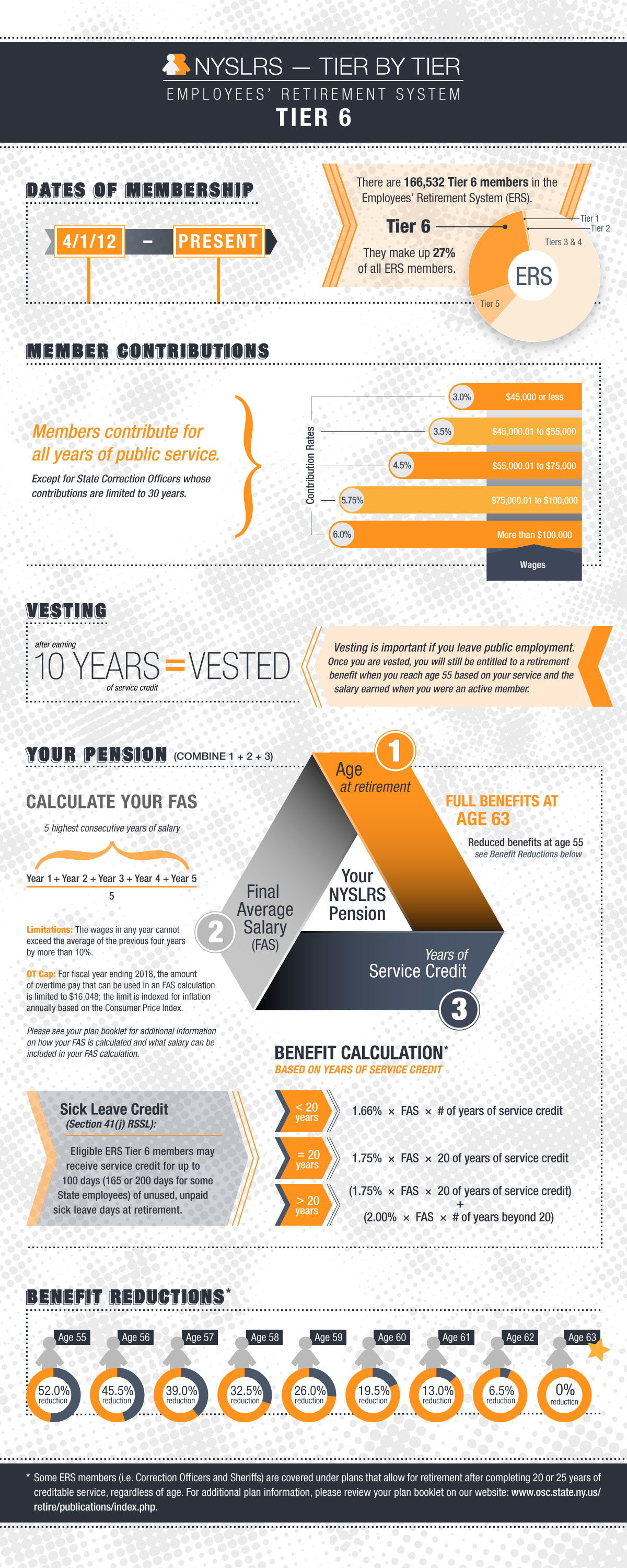

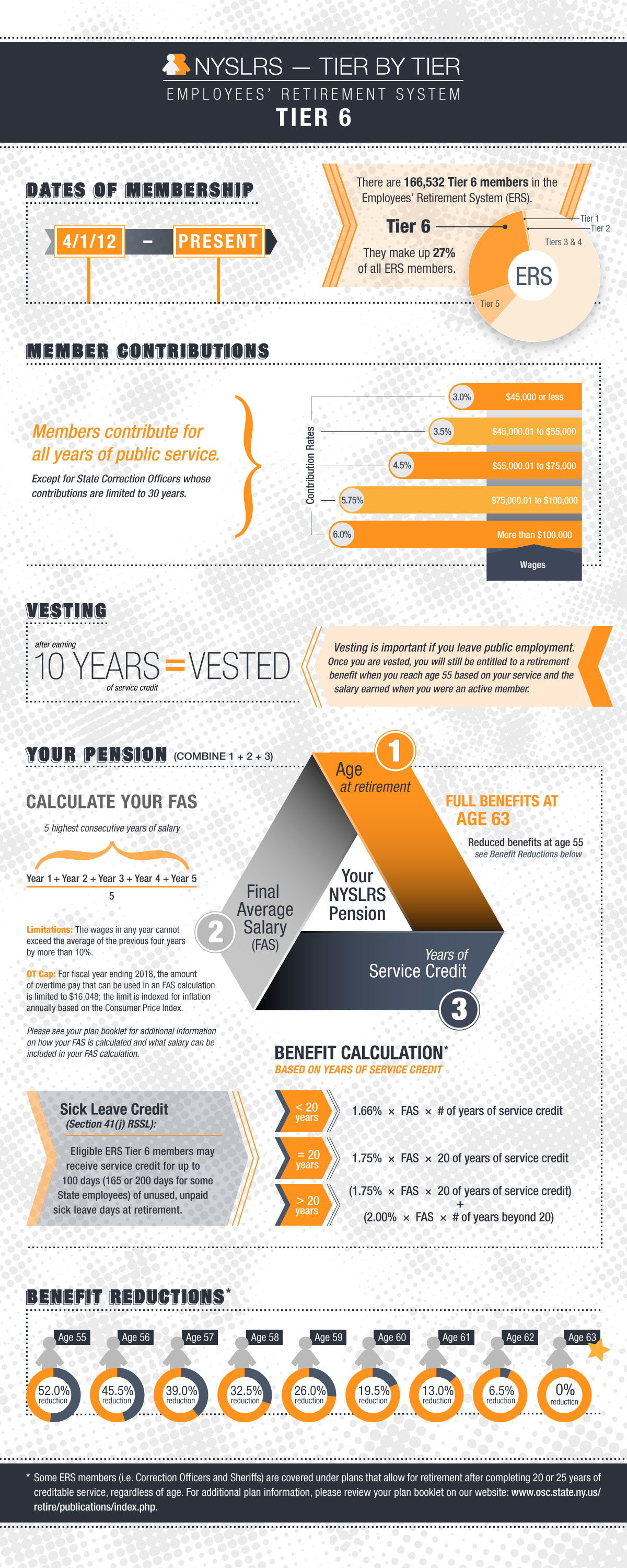

As a NYSLRS retiree your pension will not be subject to New York State or local income tax New York doesn t tax Social Security benefits either You may also get a tax break on any distributions from retirement savings such as deferred compensation and benefits from a private sector pension

The state of New York has a state income tax but residents benefit from an exemption on some of their retirement income that offers more favorable tax treatment than federal law

Is Ny State Retirement Income Taxable have gained a lot of popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or expensive software.

-

Individualization You can tailor printables to fit your particular needs, whether it's designing invitations or arranging your schedule or decorating your home.

-

Educational value: Free educational printables can be used by students of all ages, which makes them a useful device for teachers and parents.

-

Simple: Instant access to the vast array of design and templates is time-saving and saves effort.

Where to Find more Is Ny State Retirement Income Taxable

State Corporate Income Tax Rates And Brackets For 2020

State Corporate Income Tax Rates And Brackets For 2020

Are pensions or retirement income taxed in New York Yes money withdrawn from pensions and 401 k s 403 b s and IRAs are combined and taxed as regular income Tax rates run from 4 percent to 10 9 percent But federal and New York state pensions and military retirement pay are tax exempt

New York tax on retirement benefits New York does not tax Social Security benefits Additionally retirement income from the federal government New York state and local government

We hope we've stimulated your interest in Is Ny State Retirement Income Taxable, let's explore where you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection in Is Ny State Retirement Income Taxable for different motives.

- Explore categories such as decorations for the home, education and organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. materials.

- This is a great resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers post their original designs and templates for free.

- These blogs cover a broad variety of topics, including DIY projects to planning a party.

Maximizing Is Ny State Retirement Income Taxable

Here are some new ways of making the most of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print worksheets that are free for teaching at-home or in the classroom.

3. Event Planning

- Design invitations and banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep track of your schedule with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Is Ny State Retirement Income Taxable are an abundance of fun and practical tools catering to different needs and interest. Their availability and versatility make them an invaluable addition to both personal and professional life. Explore the vast world of Is Ny State Retirement Income Taxable to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly free?

- Yes you can! You can print and download these files for free.

-

Can I make use of free templates for commercial use?

- It's contingent upon the specific usage guidelines. Be sure to read the rules of the creator before utilizing their templates for commercial projects.

-

Are there any copyright problems with Is Ny State Retirement Income Taxable?

- Some printables could have limitations regarding their use. Be sure to read the conditions and terms of use provided by the author.

-

How do I print printables for free?

- You can print them at home with either a printer or go to a local print shop to purchase superior prints.

-

What program do I need to run Is Ny State Retirement Income Taxable?

- A majority of printed materials are in the format PDF. This can be opened with free software such as Adobe Reader.

2021 Nc Standard Deduction Standard Deduction 2021

NY State Pension Returns 9 5 In FY 2022 While NYC Pensions Lose 8 65

Check more sample of Is Ny State Retirement Income Taxable below

The Current State Of Retirement Income AB

Payroll Tax Withholding Calculator 2023 SallieJersey

The Most Common Sources Of Retirement Income SmartZone Finance

Pay Less Retirement Taxes

How To Use NY s 20G Exemption For Retirement Income Newsday

Where Do Americans Take Their Retirement Income Tax Foundation

https://smartasset.com/retirement/new-york-retirement-taxes

Is New York tax friendly for retirees New York is moderately tax friendly for retirees It does not tax Social Security benefits and provides seniors a sizable deduction of 20 000 on other types of retirement income Retirees in New York should have relatively low income tax bills

https://www.osc.ny.gov/retirement/retirees/taxes-and-your-pension

NYSLRS pensions are not subject to New York State or local income tax but if you move to another state that state may tax your pension Visit the Retired Public Employees Association website to see which states tax pensions Understanding Your

Is New York tax friendly for retirees New York is moderately tax friendly for retirees It does not tax Social Security benefits and provides seniors a sizable deduction of 20 000 on other types of retirement income Retirees in New York should have relatively low income tax bills

NYSLRS pensions are not subject to New York State or local income tax but if you move to another state that state may tax your pension Visit the Retired Public Employees Association website to see which states tax pensions Understanding Your

Pay Less Retirement Taxes

Payroll Tax Withholding Calculator 2023 SallieJersey

How To Use NY s 20G Exemption For Retirement Income Newsday

Where Do Americans Take Their Retirement Income Tax Foundation

Retirement Calculator Spreadsheet Template Spreadsheet Downloa

Ny state retirement tier 4 UPDATED

Ny state retirement tier 4 UPDATED

Retirement Income Planning In Pennsylvania Rolek Retirement Planning