In this day and age in which screens are the norm yet the appeal of tangible printed products hasn't decreased. Whatever the reason, whether for education project ideas, artistic or just adding a personal touch to your space, Is Military Retirement Subject To Federal Taxes have become an invaluable source. Through this post, we'll take a dive deeper into "Is Military Retirement Subject To Federal Taxes," exploring the benefits of them, where they are, and how they can improve various aspects of your lives.

Get Latest Is Military Retirement Subject To Federal Taxes Below

Is Military Retirement Subject To Federal Taxes

Is Military Retirement Subject To Federal Taxes - Is Military Retirement Subject To Federal Taxes, Is Military Pension Subject To Federal Taxes, Is Military Retirement Pay Subject To Federal Taxes, Are Military Pensions Subject To Federal Income Tax, Is Military Retirement Exempt From Federal Tax, Is Military Retirement Taxable Federal, Do You Have To Pay Federal Taxes On Military Retirement, Is Military Retirement Taxed Federally, Are Pensions Subject To Federal Taxes

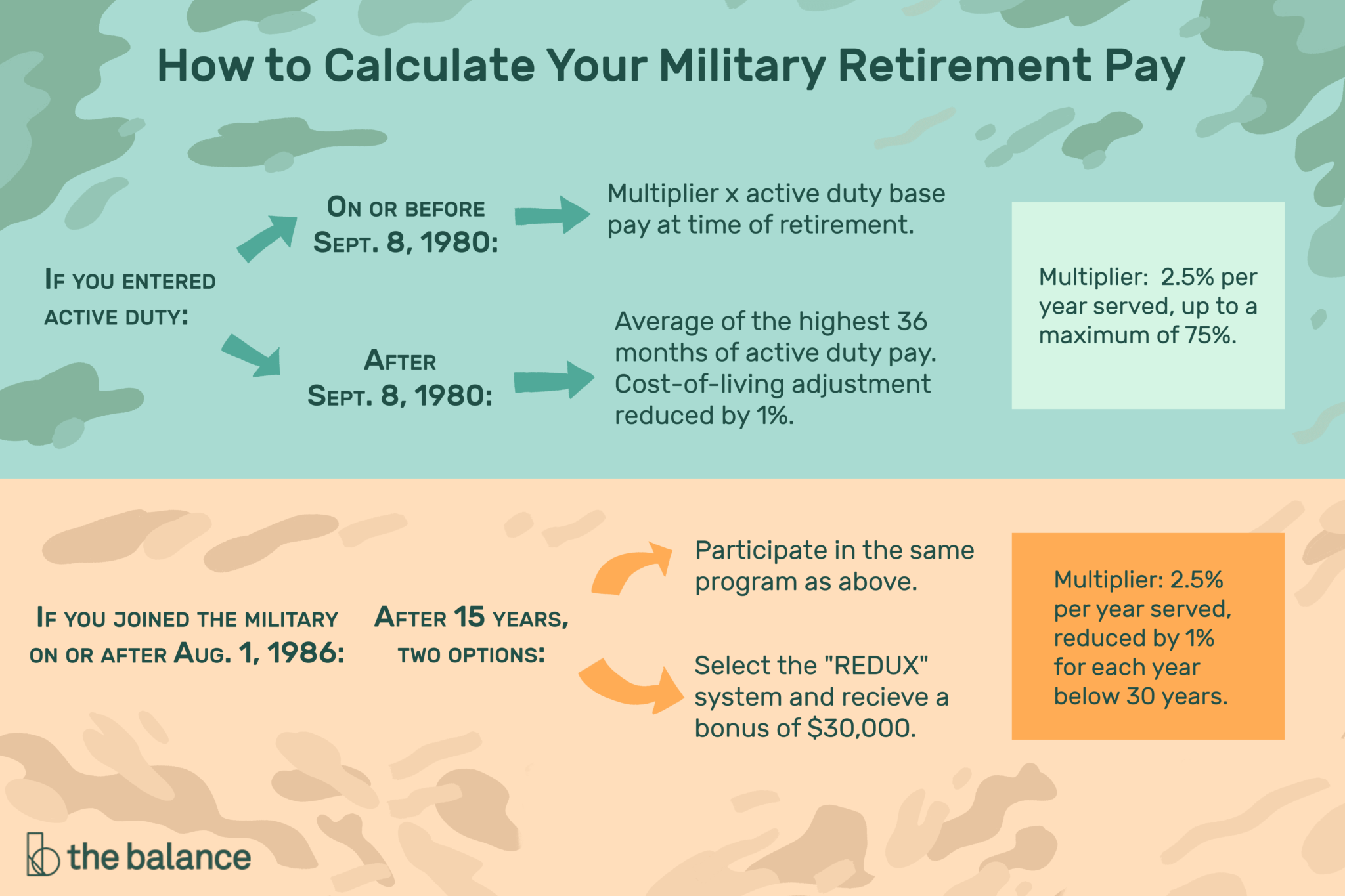

Yes military retirement pay is generally considered taxable at the federal level but exceptions exist for disability related benefits and retirees above the age of 62

Retired pay like other income is subject to Federal income taxation unless wholly or partially exempted by statute

Is Military Retirement Subject To Federal Taxes include a broad variety of printable, downloadable materials online, at no cost. They come in many styles, from worksheets to coloring pages, templates and many more. The beauty of Is Military Retirement Subject To Federal Taxes is their versatility and accessibility.

More of Is Military Retirement Subject To Federal Taxes

Average Federal Tax Rate On Military Retirement Pay Military Pay

Average Federal Tax Rate On Military Retirement Pay Military Pay

Payments you receive as a member of a military service generally are taxed as wages except for retirement pay which is taxed as a pension If your retirement pay is based

Military retirement pay based on age or length of service is considered taxable income for Federal income taxes However military disability retirement pay and Veterans benefits

Printables that are free have gained enormous recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the need to buy physical copies of the software or expensive hardware.

-

customization You can tailor the templates to meet your individual needs for invitations, whether that's creating them, organizing your schedule, or decorating your home.

-

Educational Benefits: These Is Military Retirement Subject To Federal Taxes provide for students of all ages, making them a vital source for educators and parents.

-

Accessibility: Access to the vast array of design and templates can save you time and energy.

Where to Find more Is Military Retirement Subject To Federal Taxes

Wait Is Military Retirement Pay Taxable Or Not Article The United

Wait Is Military Retirement Pay Taxable Or Not Article The United

Military retirement pay based on age or length of service is considered taxable income for Federal income taxes However military disability retirement pay and Veterans benefits

Military Retirement Pay The federal government taxes military retirement pay but many states have exempted it partly or entirely If you need to change your

If we've already piqued your interest in Is Military Retirement Subject To Federal Taxes and other printables, let's discover where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Is Military Retirement Subject To Federal Taxes suitable for many applications.

- Explore categories like decorating your home, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing, flashcards, and learning tools.

- The perfect resource for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates, which are free.

- These blogs cover a broad range of topics, that range from DIY projects to planning a party.

Maximizing Is Military Retirement Subject To Federal Taxes

Here are some creative ways how you could make the most use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or even seasonal decorations to decorate your living areas.

2. Education

- Print worksheets that are free to reinforce learning at home either in the schoolroom or at home.

3. Event Planning

- Create invitations, banners, and decorations for special events like weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars with to-do lists, planners, and meal planners.

Conclusion

Is Military Retirement Subject To Federal Taxes are a treasure trove of fun and practical tools catering to different needs and needs and. Their accessibility and versatility make them an invaluable addition to any professional or personal life. Explore the plethora of Is Military Retirement Subject To Federal Taxes now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly cost-free?

- Yes you can! You can print and download these items for free.

-

Does it allow me to use free printables to make commercial products?

- It's determined by the specific rules of usage. Always verify the guidelines provided by the creator before utilizing their templates for commercial projects.

-

Are there any copyright rights issues with Is Military Retirement Subject To Federal Taxes?

- Some printables could have limitations on their use. Always read the conditions and terms of use provided by the author.

-

How do I print Is Military Retirement Subject To Federal Taxes?

- You can print them at home using your printer or visit the local print shop for superior prints.

-

What software do I need to open Is Military Retirement Subject To Federal Taxes?

- Most printables come in PDF format. They is open with no cost software like Adobe Reader.

I Received Unemployment In 2021 Will It Be Tax free This Time

111 Retirement Email Subject Line Ideas Examples Branding Heights

Check more sample of Is Military Retirement Subject To Federal Taxes below

Retiring These States Won t Tax Your Distributions

How Is Interest Income Taxed

What Are The States That Don t Tax Military Retirement ClearMatch

Is Military Retirement Pay Tax Exempt USMilitary

Military Divorce The Process Challenges And Resources Tamara Like

An Overhaul Of The Military Retirement Program Fox Business

https://www.military.com/benefits/military-pay/...

Retired pay like other income is subject to Federal income taxation unless wholly or partially exempted by statute

https://www.military.com/benefits/military-pay/...

All non disability retired pay is subject to withholding of federal income taxes The amount withheld is dependent upon the taxpayer s amount of wages and the number of

Retired pay like other income is subject to Federal income taxation unless wholly or partially exempted by statute

All non disability retired pay is subject to withholding of federal income taxes The amount withheld is dependent upon the taxpayer s amount of wages and the number of

Is Military Retirement Pay Tax Exempt USMilitary

How Is Interest Income Taxed

Military Divorce The Process Challenges And Resources Tamara Like

An Overhaul Of The Military Retirement Program Fox Business

Dod Medical Retirement Calculator MeaghanRylee

Are Maryland State Pension Benefits Taxable Finance Zacks

Are Maryland State Pension Benefits Taxable Finance Zacks

Blog Archives Carstens Financial Group