In the digital age, in which screens are the norm and the appeal of physical printed material hasn't diminished. It doesn't matter if it's for educational reasons for creative projects, just adding some personal flair to your home, printables for free are a great source. For this piece, we'll dive into the world of "Is Cpp And Ei Income Tax," exploring what they are, how they can be found, and the ways that they can benefit different aspects of your life.

Get Latest Is Cpp And Ei Income Tax Below

Is Cpp And Ei Income Tax

Is Cpp And Ei Income Tax - Is Cpp And Ei Income Tax, Is Cpp And Ei Taxable Income, Is Cpp And Ei A Tax, Is Cpp And Ei Part Of Income Tax, Does Cpp And Ei Count As Income Tax Paid, Does Cpp And Ei Count As Income Tax Deductions, What Is Cpp And Ei Tax For 2023, Cpp Ei And Income Tax Deduction Tables, Are Cpp And Ei Taxable, Is Cpp And Ei Deducted From Taxable Income

Employers in Canada are responsible for deducting and matching employees CPP QPP and EI contributions Employers payroll obligations include withholding the correct amount of income tax from

All employers are required by law to deduct Canada Pension Plan CPP contributions and employment insurance EI premiums from most amounts they pay to their employees Employers must remit these amounts to the Canada Revenue Agency CRA along with their share of CPP contributions and EI premiums

Is Cpp And Ei Income Tax cover a large variety of printable, downloadable items that are available online at no cost. These resources come in many styles, from worksheets to coloring pages, templates and many more. The appeal of printables for free is their versatility and accessibility.

More of Is Cpp And Ei Income Tax

Self Employed Taxes In Canada How Much To Set Aside For CPP EI

Self Employed Taxes In Canada How Much To Set Aside For CPP EI

In the strictest sense of the word then CPP and EI aren t taxes They certainly feel like taxes when you pay them though and they are collected by Canada Revenue Agency through tax

When you file your tax return depending on your net income for the year you may need to repay some of your EI benefits This is called EI clawback As of October 2021 if your income was over 70 375 you will have to pay back 30 of the lesser of your net income in excess of 70 375 or the total regular benefits including regular fishing

Printables for free have gained immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to purchase physical copies or costly software.

-

The ability to customize: We can customize printed materials to meet your requirements whether you're designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational value: Educational printables that can be downloaded for free cater to learners of all ages, which makes them a valuable source for educators and parents.

-

Simple: You have instant access a myriad of designs as well as templates, which saves time as well as effort.

Where to Find more Is Cpp And Ei Income Tax

CPP And EI For 2022 Canadian Personal Finance Blog

CPP And EI For 2022 Canadian Personal Finance Blog

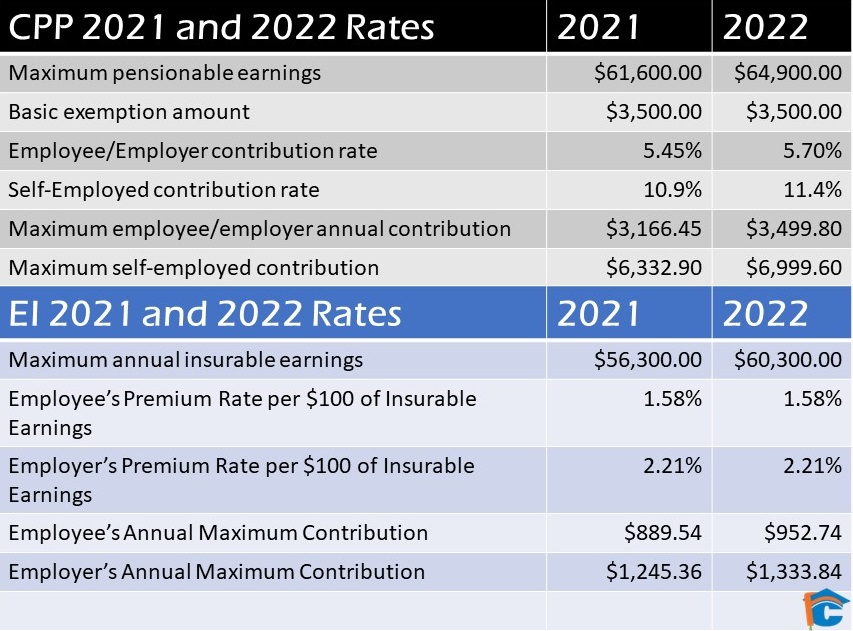

On November 1 2023 the Government of Canada announced changes to contributions for both Canada Pension Plan CPP and Employment Insurance EI for the 2024 calendar year The changes in how CPP is treated on a personal tax return which began in 2019 mean that of the 3 867 50 of normal max contribution 631 00 will be deductible on the

The federal government deducts federal income tax employment insurance and Canada Pension Plan CPP from your paycheck every pay period Actually your employer handles the deduction and forwards the money to the government I ll explain how the various deductions are calculated a bit later

After we've peaked your interest in Is Cpp And Ei Income Tax Let's find out where they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of Is Cpp And Ei Income Tax for various needs.

- Explore categories such as home decor, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free, flashcards, and learning tools.

- It is ideal for teachers, parents or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates at no cost.

- The blogs covered cover a wide range of interests, everything from DIY projects to party planning.

Maximizing Is Cpp And Ei Income Tax

Here are some ways create the maximum value of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Use these printable worksheets free of charge to reinforce learning at home as well as in the class.

3. Event Planning

- Design invitations and banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Be organized by using printable calendars as well as to-do lists and meal planners.

Conclusion

Is Cpp And Ei Income Tax are a treasure trove of creative and practical resources which cater to a wide range of needs and preferences. Their accessibility and versatility make them an essential part of both professional and personal lives. Explore the vast collection of Is Cpp And Ei Income Tax now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Is Cpp And Ei Income Tax truly completely free?

- Yes, they are! You can print and download these tools for free.

-

Does it allow me to use free templates for commercial use?

- It depends on the specific terms of use. Always check the creator's guidelines before utilizing their templates for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Some printables may come with restrictions regarding their use. Be sure to read the terms and conditions offered by the designer.

-

How do I print printables for free?

- You can print them at home with either a printer at home or in a local print shop to purchase more high-quality prints.

-

What program do I need to run printables free of charge?

- A majority of printed materials are in the PDF format, and can be opened using free programs like Adobe Reader.

Self Employed Taxes In Canada How Much To Set Aside For CPP EI

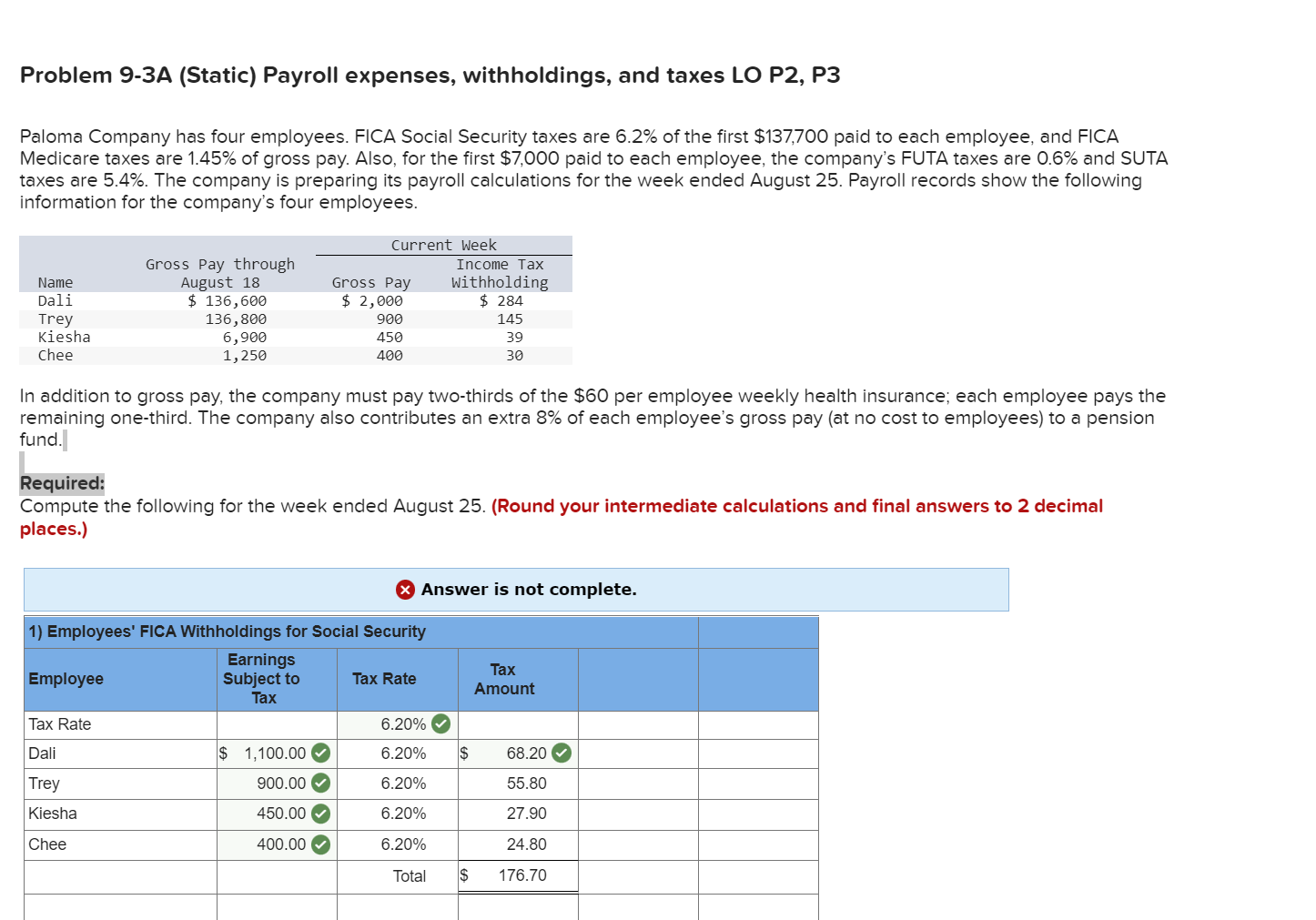

Solved Paloma Company Has Four Employees FICA Social Chegg

Check more sample of Is Cpp And Ei Income Tax below

CPP OAS Wealth Awesome

CPP And EI Contributions Snap Projections Support 1 888 758 7977

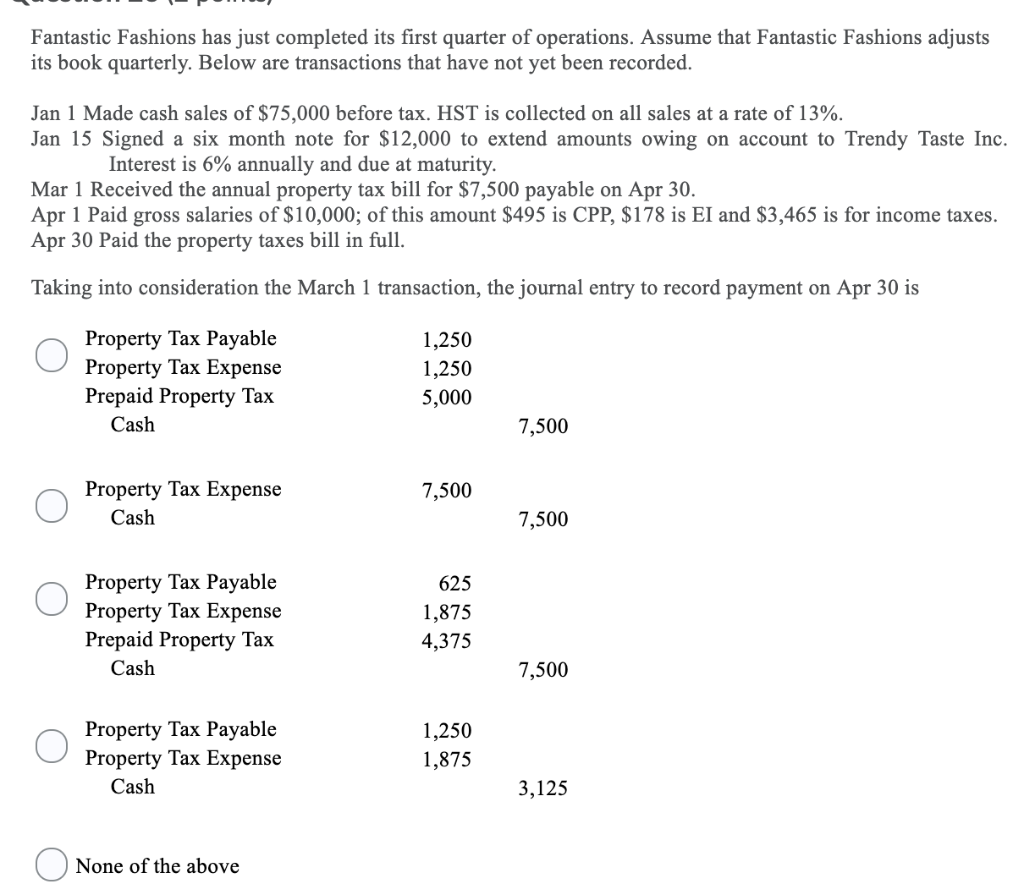

Solved Fantastic Fashions Has Just Completed Its First Chegg

Maximum Pensionable CPP And Insurable EI Earnings Changes Effective

Comprehensive Guide To Canada Pension Plan CPP 2024 Protect Your

![]()

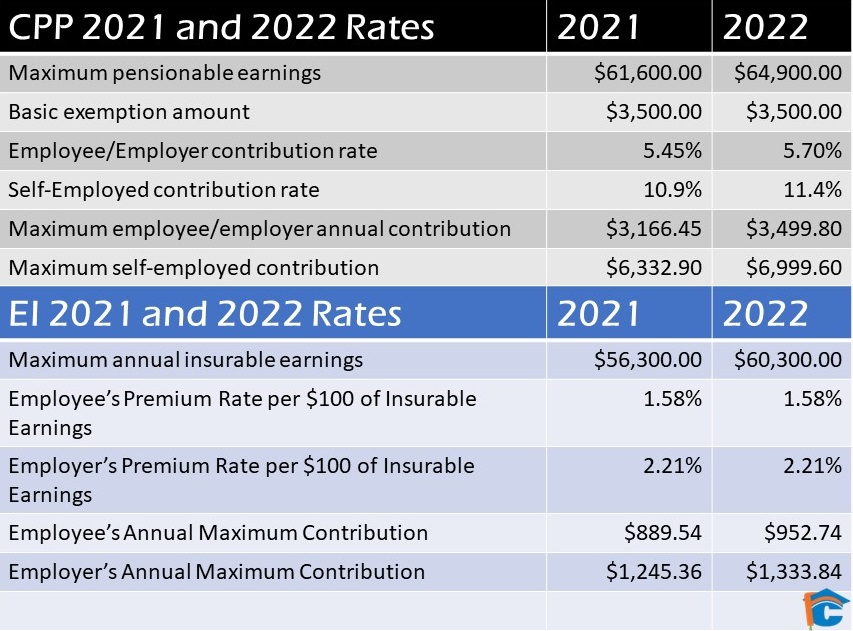

CPP EI Calculations 2021 And 2022 FinTech College Of Business And

https://www.canada.ca/en/revenue-agency/services/...

All employers are required by law to deduct Canada Pension Plan CPP contributions and employment insurance EI premiums from most amounts they pay to their employees Employers must remit these amounts to the Canada Revenue Agency CRA along with their share of CPP contributions and EI premiums

https://kpu.pressbooks.pub/cdntax/chapter/what-are...

Ex What would be the CPP and EI contribution for an employee with gross wages of 42 000 for 2023 What would be the tax credits for CPP and EI References and Resources Article CPP contribution rates maximums and exemptions Author Government of Canada Article CPP Retirement pension Author Government of

All employers are required by law to deduct Canada Pension Plan CPP contributions and employment insurance EI premiums from most amounts they pay to their employees Employers must remit these amounts to the Canada Revenue Agency CRA along with their share of CPP contributions and EI premiums

Ex What would be the CPP and EI contribution for an employee with gross wages of 42 000 for 2023 What would be the tax credits for CPP and EI References and Resources Article CPP contribution rates maximums and exemptions Author Government of Canada Article CPP Retirement pension Author Government of

Maximum Pensionable CPP And Insurable EI Earnings Changes Effective

CPP And EI Contributions Snap Projections Support 1 888 758 7977

Comprehensive Guide To Canada Pension Plan CPP 2024 Protect Your

CPP EI Calculations 2021 And 2022 FinTech College Of Business And

CPP EI Calculations 2022 And 2023 FinTech College Of Business And

Comprehensive Guide To Canada Pension Plan CPP 2023 Protect Your

Comprehensive Guide To Canada Pension Plan CPP 2023 Protect Your

New Changes CPP EI RATES For 2020 The New Canadians Canada Pension