In this age of technology, where screens have become the dominant feature of our lives it's no wonder that the appeal of tangible printed items hasn't gone away. No matter whether it's for educational uses project ideas, artistic or simply adding an extra personal touch to your space, Is Annuity Income Taxable In Pennsylvania are a great source. In this article, we'll take a dive into the sphere of "Is Annuity Income Taxable In Pennsylvania," exploring the benefits of them, where they are available, and how they can be used to enhance different aspects of your daily life.

Get Latest Is Annuity Income Taxable In Pennsylvania Below

Is Annuity Income Taxable In Pennsylvania

Is Annuity Income Taxable In Pennsylvania - Is Annuity Income Taxable In Pennsylvania, Is Annuity Income Taxed In Pa, Are Annuities Taxable In Pa, Are Annuity Distributions Taxable In Pa, Are Inherited Annuities Taxable In Pa

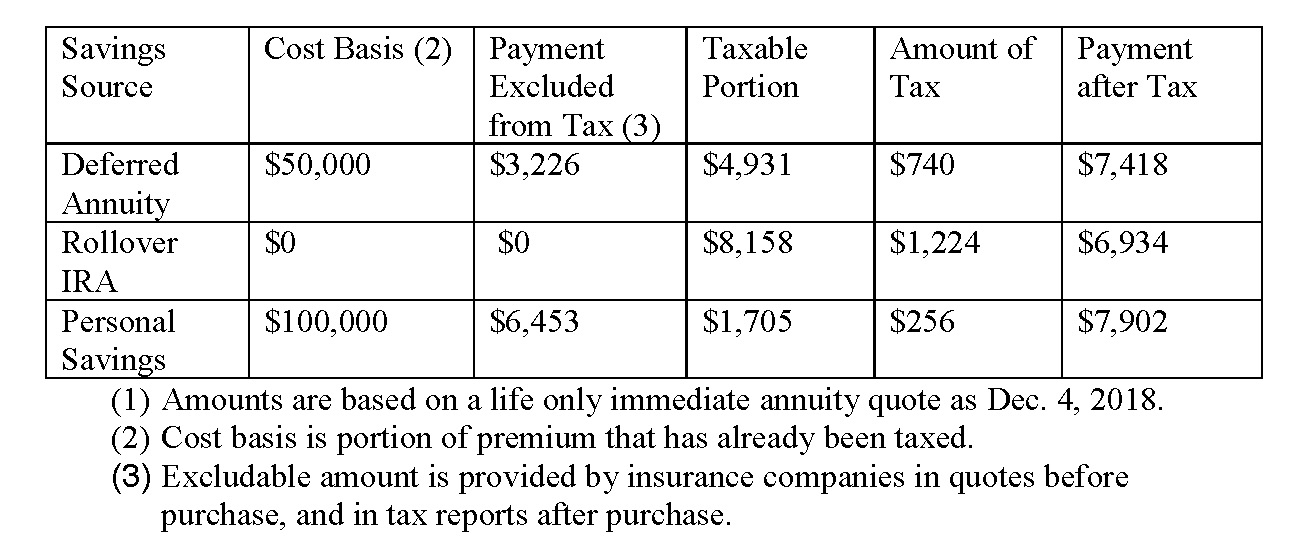

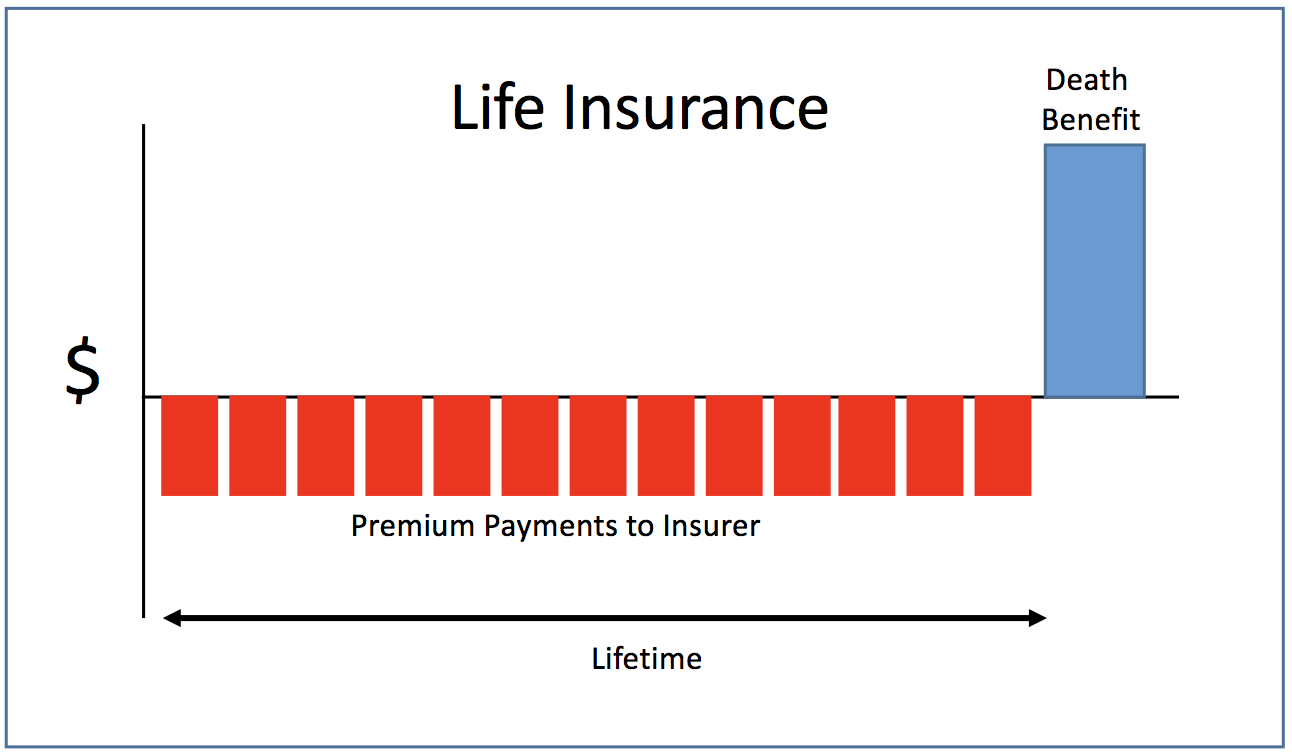

For Pennsylvania state income tax purposes once annuity benefits begin no tax is due while the sum of the annuity payments is less than the premiums paid during the accumulation phase of the annuity contract

The terms of the annuity provided for an initial lump sum premium deposit by Taxpayer and a guaranteed effective interest rate of 4 25 for five years The minimum guaranteed rate for the plan was 3 and was effective for the life of the policy

Printables for free include a vast assortment of printable content that can be downloaded from the internet at no cost. The resources are offered in a variety designs, including worksheets coloring pages, templates and more. The great thing about Is Annuity Income Taxable In Pennsylvania is their flexibility and accessibility.

More of Is Annuity Income Taxable In Pennsylvania

What Income Is Taxable Blog hubcfo

What Income Is Taxable Blog hubcfo

Once annuity benefits begin the interest part of each annuity payment will be taxed as ordinary income for federal income tax purposes For Pennsylvania state income tax purposes once annuity benefits begin no tax is due while the sum of the annuity payments is less than the

For taxable years beginning after Dec 31 2004 income received from a charitable gift annuity contract is taxable as interest income Any income from a charitable gift annuity that is taxable for federal income tax purposes is reported as interest income for Pennsylvania personal income tax purposes

Is Annuity Income Taxable In Pennsylvania have gained a lot of appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

Individualization There is the possibility of tailoring designs to suit your personal needs for invitations, whether that's creating them or arranging your schedule or decorating your home.

-

Educational Value Downloads of educational content for free offer a wide range of educational content for learners of all ages, making these printables a powerful source for educators and parents.

-

Easy to use: instant access many designs and templates cuts down on time and efforts.

Where to Find more Is Annuity Income Taxable In Pennsylvania

Is Disability Income Taxable In Canada Lionsgate Financial Group

Is Disability Income Taxable In Canada Lionsgate Financial Group

Unless the qualified annuity is a Roth annuity income tax must be paid on all of the money that s withdrawn the principal in the form of premiums that has contributed to the annuity along

Is Pennsylvania tax friendly for retirees Pennsylvania exempts all forms of retirement income from taxation for residents 60 and older That can mean thousands of dollars in annual savings as compared with other states in the

We hope we've stimulated your curiosity about Is Annuity Income Taxable In Pennsylvania, let's explore where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection and Is Annuity Income Taxable In Pennsylvania for a variety reasons.

- Explore categories like design, home decor, management, and craft.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets or flashcards as well as learning tools.

- Great for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their innovative designs as well as templates for free.

- The blogs are a vast spectrum of interests, starting from DIY projects to planning a party.

Maximizing Is Annuity Income Taxable In Pennsylvania

Here are some inventive ways that you can make use use of Is Annuity Income Taxable In Pennsylvania:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use free printable worksheets to enhance learning at home as well as in the class.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Is Annuity Income Taxable In Pennsylvania are an abundance filled with creative and practical information that meet a variety of needs and pursuits. Their availability and versatility make them a great addition to every aspect of your life, both professional and personal. Explore the vast collection of Is Annuity Income Taxable In Pennsylvania today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really are they free?

- Yes, they are! You can print and download these documents for free.

-

Do I have the right to use free templates for commercial use?

- It's based on specific terms of use. Always consult the author's guidelines prior to printing printables for commercial projects.

-

Are there any copyright concerns with Is Annuity Income Taxable In Pennsylvania?

- Certain printables may be subject to restrictions concerning their use. Always read the terms and conditions offered by the creator.

-

How can I print printables for free?

- Print them at home using either a printer at home or in a local print shop to purchase premium prints.

-

What software is required to open printables at no cost?

- The majority of printed documents are in the format PDF. This can be opened using free software, such as Adobe Reader.

What Income Is Not Taxable In Pennsylvania

What Income Is Subject To The 3 8 Medicare Tax

Check more sample of Is Annuity Income Taxable In Pennsylvania below

12 Non Taxable Compensation Of Government Employees 12 Non taxable

Solved Please Note That This Is Based On Philippine Tax System Please

Taxes Archives Jerry Golden On Retirement

Income Annuities Immediate And Deferred Seeking Alpha

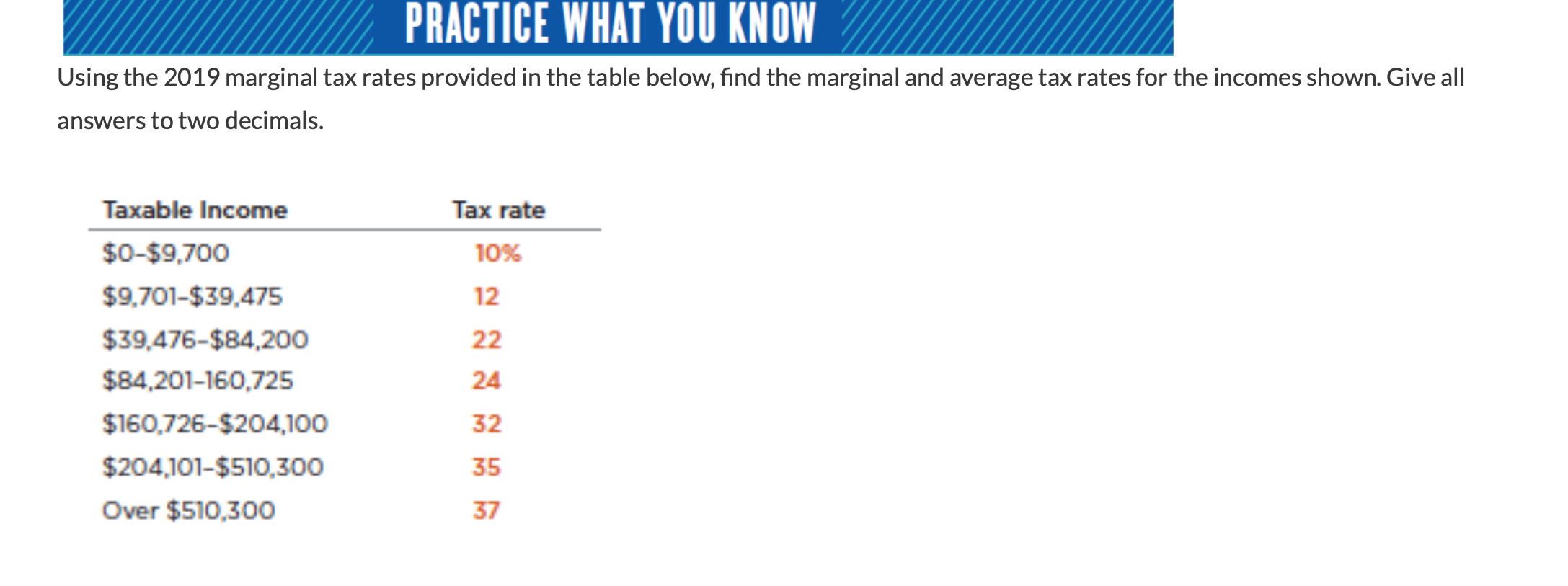

Solved What Would Be Your Federal Income Tax If Your Taxable Chegg

Don t Dread The IRS Three Part Guide To Tackle Your Taxes Financial

https://www.revenue.pa.gov/TaxLawPoliciesBulletins...

The terms of the annuity provided for an initial lump sum premium deposit by Taxpayer and a guaranteed effective interest rate of 4 25 for five years The minimum guaranteed rate for the plan was 3 and was effective for the life of the policy

https://revenue-pa.custhelp.com/app/answers/detail/a_id/1474

Regardless of whether the taxpayer is over or under age 59 1 2 the amount received from an annuity that is not part of an employer sponsored plan or a commonly recognized retirement program could be taxable for PA personal income tax purposes

The terms of the annuity provided for an initial lump sum premium deposit by Taxpayer and a guaranteed effective interest rate of 4 25 for five years The minimum guaranteed rate for the plan was 3 and was effective for the life of the policy

Regardless of whether the taxpayer is over or under age 59 1 2 the amount received from an annuity that is not part of an employer sponsored plan or a commonly recognized retirement program could be taxable for PA personal income tax purposes

Income Annuities Immediate And Deferred Seeking Alpha

Solved Please Note That This Is Based On Philippine Tax System Please

Solved What Would Be Your Federal Income Tax If Your Taxable Chegg

Don t Dread The IRS Three Part Guide To Tackle Your Taxes Financial

Annuities With Income Accelerators Carolina Family Estate Planning

What Is Taxable Income Explanation Importance Calculation Bizness

What Is Taxable Income Explanation Importance Calculation Bizness

Immediate Care How To Calculate Annuity Payments 8 Steps with