In the age of digital, where screens have become the dominant feature of our lives, the charm of tangible, printed materials hasn't diminished. Be it for educational use as well as creative projects or simply adding an individual touch to the home, printables for free are now a vital resource. For this piece, we'll dive to the depths of "Is Annuity Income Taxable In India," exploring what they are, how they are, and how they can enhance various aspects of your life.

Get Latest Is Annuity Income Taxable In India Below

Is Annuity Income Taxable In India

Is Annuity Income Taxable In India - Is Annuity Income Taxable In India, Is Pension Annuity Income Taxable In India, Is Annuity Income Taxable, Is Annuity Income Tax Free, Is Annuity Income Tax Exempt

Annuity which you will receive on a periodic basis in future will be taxable as an income under the head Salaries You will be eligible to claim standard deduction of Rs 40 000 from the said taxable Salary

An employee is entitled to claim standard deduction up to a maximum amount of 50 000 in a financial year against any income which is taxable under the head Salaries The standard

The Is Annuity Income Taxable In India are a huge assortment of printable, downloadable materials that are accessible online for free cost. These materials come in a variety of kinds, including worksheets templates, coloring pages, and many more. The benefit of Is Annuity Income Taxable In India is in their variety and accessibility.

More of Is Annuity Income Taxable In India

What Income Is Taxable Blog hubcfo

What Income Is Taxable Blog hubcfo

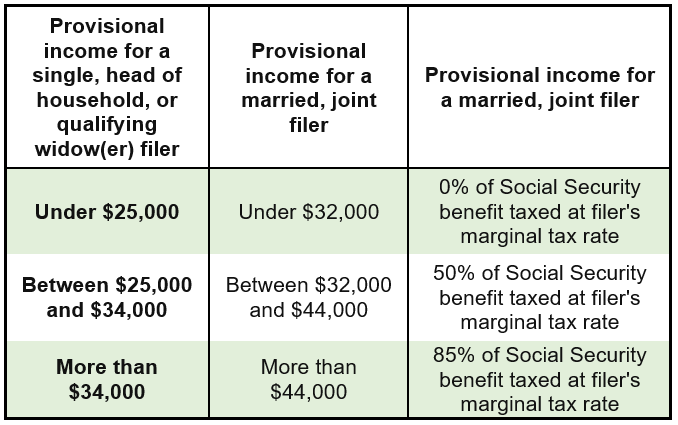

Depending on the type of annuity you buy and how you ve structured it some portions of your income may be subject to taxation at a higher rate than others For example suppose you purchase a fixed rate or capital one cd rates annuity with a guaranteed return

Contribution for an annuity plan is eligible for tax deductions under Section 80C 80CCC 80CCD of the Income Tax Act 1961 The specific section of the Income Tax Act allows individuals to claim a tax deduction for contributions made to pension funds

Is Annuity Income Taxable In India have gained immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or expensive software.

-

The ability to customize: It is possible to tailor designs to suit your personal needs, whether it's designing invitations for your guests, organizing your schedule or decorating your home.

-

Education Value Education-related printables at no charge offer a wide range of educational content for learners from all ages, making them a great device for teachers and parents.

-

Simple: immediate access a plethora of designs and templates, which saves time as well as effort.

Where to Find more Is Annuity Income Taxable In India

Is Income On Fixed Deposits Taxable In India

Is Income On Fixed Deposits Taxable In India

Under existing rules up to 60 of the NPS corpus withdrawn on maturity is tax free but the remaining 40 has to be compulsorily put in an annuity to earn a monthly pension that is taxed as income

Annuity issued on or after the 1st day of April 2012 shall be eligible for deduction only to the extent of 10 of the actual capital sum assured or actual premium paid whichever is less Where the policy issued on or after the 1st day of April 2013 is for insurance on life of any person

Now that we've piqued your interest in Is Annuity Income Taxable In India Let's look into where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of Is Annuity Income Taxable In India for various objectives.

- Explore categories like decorating your home, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free, flashcards, and learning materials.

- Ideal for parents, teachers or students in search of additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates, which are free.

- The blogs are a vast range of interests, including DIY projects to party planning.

Maximizing Is Annuity Income Taxable In India

Here are some ways of making the most use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or decorations for the holidays to beautify your living areas.

2. Education

- Print out free worksheets and activities for teaching at-home as well as in the class.

3. Event Planning

- Make invitations, banners and decorations for special events like weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Is Annuity Income Taxable In India are a treasure trove of useful and creative resources that can meet the needs of a variety of people and hobbies. Their access and versatility makes them a valuable addition to the professional and personal lives of both. Explore the wide world of Is Annuity Income Taxable In India today to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Is Annuity Income Taxable In India really free?

- Yes you can! You can download and print these tools for free.

-

Can I use the free printing templates for commercial purposes?

- It's contingent upon the specific usage guidelines. Make sure you read the guidelines for the creator before utilizing their templates for commercial projects.

-

Are there any copyright issues in printables that are free?

- Some printables could have limitations in their usage. Make sure you read the conditions and terms of use provided by the author.

-

How can I print Is Annuity Income Taxable In India?

- Print them at home using printing equipment or visit a local print shop for the highest quality prints.

-

What software do I require to open printables free of charge?

- Most PDF-based printables are available in PDF format. They can be opened with free software like Adobe Reader.

Solved Please Note That This Is Based On Philippine Tax System Please

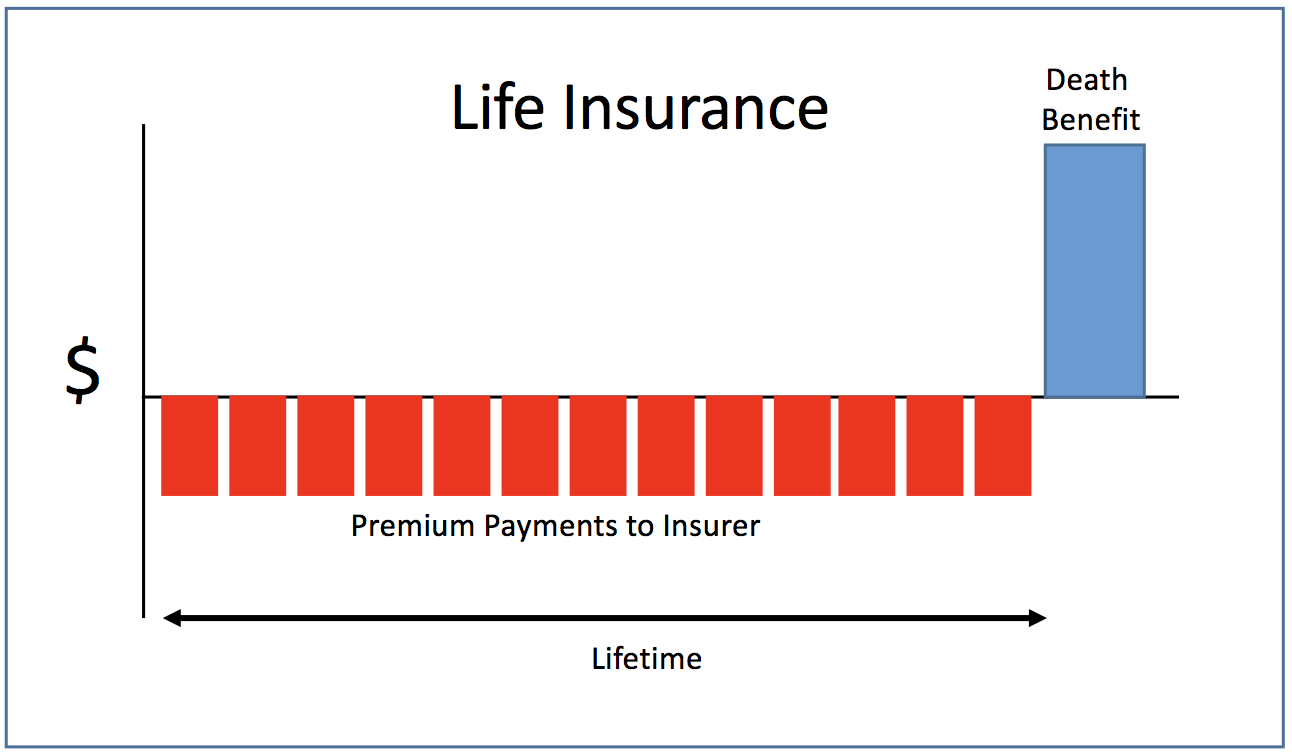

Income Annuities Immediate And Deferred Seeking Alpha

Check more sample of Is Annuity Income Taxable In India below

Taxable Income Calculator India

Budget 2022 Different Types Of Taxable Incomes Income Tax Slab Rates

What Is Taxable Income Explanation Importance Calculation Bizness

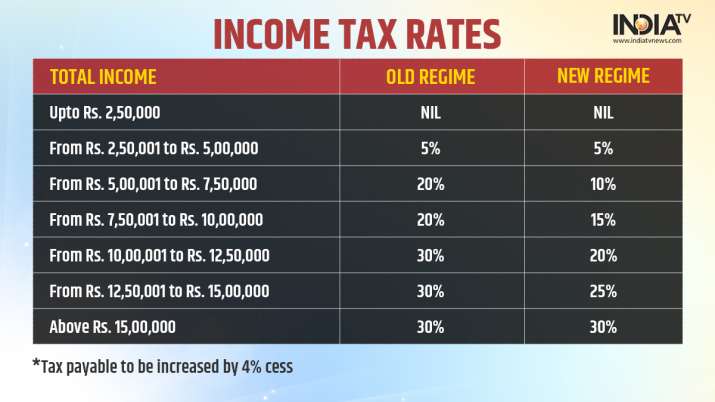

Income Tax Rates For FY 2021 22 How To Choose Between Old Regime And

Don t Dread The IRS Three Part Guide To Tackle Your Taxes Financial

Calculate My Income Tax SuellenGiorgio

https://www.livemint.com/money/personal-finance/income-tax-rules...

An employee is entitled to claim standard deduction up to a maximum amount of 50 000 in a financial year against any income which is taxable under the head Salaries The standard

https://www.hdfclife.com/.../annuity-meaning-and-types

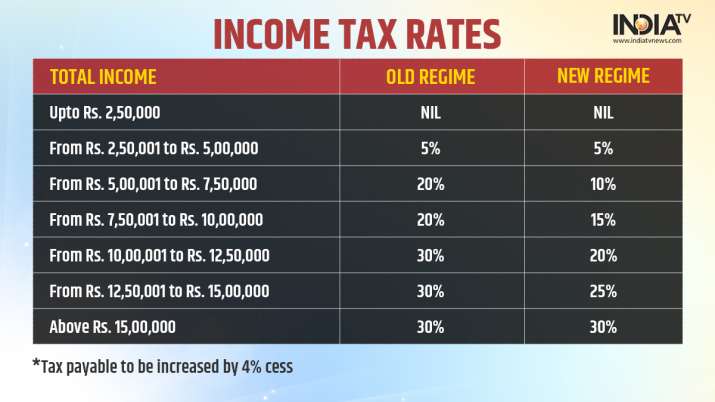

Since annuity is formulated to serve as a regular usually monthly pension income it is taxable as per various slabs governed by the existing taxation rules The taxation formats are listed below Up to an annual income of Rs 3 Lac no taxes are applicable for either the senior 60 80 years citizens or super senior more than 80 years

An employee is entitled to claim standard deduction up to a maximum amount of 50 000 in a financial year against any income which is taxable under the head Salaries The standard

Since annuity is formulated to serve as a regular usually monthly pension income it is taxable as per various slabs governed by the existing taxation rules The taxation formats are listed below Up to an annual income of Rs 3 Lac no taxes are applicable for either the senior 60 80 years citizens or super senior more than 80 years

Income Tax Rates For FY 2021 22 How To Choose Between Old Regime And

Budget 2022 Different Types Of Taxable Incomes Income Tax Slab Rates

Don t Dread The IRS Three Part Guide To Tackle Your Taxes Financial

Calculate My Income Tax SuellenGiorgio

Annuities With Income Accelerators Carolina Family Estate Planning

Immediate Care How To Calculate Annuity Payments 8 Steps with

Immediate Care How To Calculate Annuity Payments 8 Steps with

What Is Annuity Income Insurance Noon