Today, with screens dominating our lives it's no wonder that the appeal of tangible printed materials isn't diminishing. If it's to aid in education for creative projects, just adding the personal touch to your home, printables for free have proven to be a valuable source. Here, we'll dive deeper into "Is A Pension Tax Free Lump Sum Classed As Income," exploring what they are, how you can find them, and what they can do to improve different aspects of your life.

Get Latest Is A Pension Tax Free Lump Sum Classed As Income Below

Is A Pension Tax Free Lump Sum Classed As Income

Is A Pension Tax Free Lump Sum Classed As Income - Is A Pension Tax Free Lump Sum Classed As Income, Does Pension Tax Free Lump Sum Count As Income, Is A Pension Lump Sum Classed As Income, Is A Tax Free Lump Sum Classed As Income, Is Lump Sum Pension Considered Income

Most of the money you take out is subject to income tax but there s an exception the pension tax free lump sum It s a chunk of your pension that you take out completely tax free when you reach pension access age or at any point thereafter 25 of your pension value to be specific

Generally the first 25 of your pension lump sum is tax free The remaining 75 is taxable at the same rate as income tax The tax free lump sum does not affect your personal allowance In this post we will break down some of the details which will affect how much tax you pay on your lump sum

Is A Pension Tax Free Lump Sum Classed As Income include a broad assortment of printable materials available online at no cost. They are available in numerous types, like worksheets, templates, coloring pages and much more. The attraction of printables that are free lies in their versatility and accessibility.

More of Is A Pension Tax Free Lump Sum Classed As Income

Should You Take A Tax Free Lump Sum From Your Pension Beaufort Financial

Should You Take A Tax Free Lump Sum From Your Pension Beaufort Financial

If you take out smaller lump sums 25 of each will be tax free while the remaining 75 of each smaller lump sum will be taxed Most defined benefit pensions offer the option of taking a tax free lump sum as well as a guaranteed taxable income You should ask your scheme for details

Normally up to 25 of your overall pension fund can be taken entirely tax free benefits from the rest are classed as taxable income This is our guide to how the tax rules work for lump sums and the main options available to access your pension tax free lump sum

Print-friendly freebies have gained tremendous appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

Personalization The Customization feature lets you tailor the templates to meet your individual needs such as designing invitations, organizing your schedule, or even decorating your house.

-

Educational Value: These Is A Pension Tax Free Lump Sum Classed As Income provide for students of all ages. This makes them an invaluable device for teachers and parents.

-

The convenience of instant access numerous designs and templates saves time and effort.

Where to Find more Is A Pension Tax Free Lump Sum Classed As Income

Lump Sum Payment What It Is How It Works Pros Cons

Lump Sum Payment What It Is How It Works Pros Cons

Using these Pension lump sum tax calculators you can find out how much tax you re likely to pay on your lump sum Is a pension lump sum classed as income The first 25 you take from your pension is tax free but anything after that is classed as income

What is the tax free pension lump sum The pension commencement lump sum commonly known as tax free cash is the amount of money available tax free as a lump sum after the minimum pension age which is currently 55 rising to 57 in 2028

We've now piqued your curiosity about Is A Pension Tax Free Lump Sum Classed As Income Let's find out where you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Is A Pension Tax Free Lump Sum Classed As Income suitable for many motives.

- Explore categories like decorating your home, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing with flashcards and other teaching tools.

- Ideal for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers provide their inventive designs with templates and designs for free.

- These blogs cover a wide spectrum of interests, everything from DIY projects to party planning.

Maximizing Is A Pension Tax Free Lump Sum Classed As Income

Here are some creative ways that you can make use use of Is A Pension Tax Free Lump Sum Classed As Income:

1. Home Decor

- Print and frame beautiful artwork, quotes or seasonal decorations to adorn your living areas.

2. Education

- Use these printable worksheets free of charge to enhance your learning at home and in class.

3. Event Planning

- Design invitations, banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Be organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Is A Pension Tax Free Lump Sum Classed As Income are an abundance of useful and creative resources that cater to various needs and interest. Their accessibility and versatility make these printables a useful addition to your professional and personal life. Explore the plethora of Is A Pension Tax Free Lump Sum Classed As Income right now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Is A Pension Tax Free Lump Sum Classed As Income truly free?

- Yes, they are! You can download and print these items for free.

-

Can I make use of free templates for commercial use?

- It's determined by the specific rules of usage. Always verify the guidelines of the creator before using their printables for commercial projects.

-

Do you have any copyright problems with Is A Pension Tax Free Lump Sum Classed As Income?

- Certain printables may be subject to restrictions on their use. Always read the terms and conditions provided by the author.

-

How can I print printables for free?

- Print them at home with either a printer at home or in a local print shop for better quality prints.

-

What program will I need to access printables free of charge?

- The majority of PDF documents are provided with PDF formats, which is open with no cost software, such as Adobe Reader.

How Do I Calculate My Federal Pension Government Deal Funding

Lump Sum Tax What Is It Formula Calculation Example

Check more sample of Is A Pension Tax Free Lump Sum Classed As Income below

Should You Take A Tax free Lump Sum From Your Pension Mortgage

DB Tax Free Lump Sum T mobile

What Is Classed As Low Income For Council Tax Reduction The Money Edit

Why Taking Your Pension Tax free Lump Sum Could Leave You 1 000s Worse

Tax free Lump Sum On Death Hutt Professional Financial Planning

Call To Cap The 25 Pension Tax free Lump Sum At 100k Retirement

https://www.joslinrhodes.co.uk/pension-advice/is...

Generally the first 25 of your pension lump sum is tax free The remaining 75 is taxable at the same rate as income tax The tax free lump sum does not affect your personal allowance In this post we will break down some of the details which will affect how much tax you pay on your lump sum

https://www.nerdwallet.com/uk/pensions/pension-tax...

Pension tax free lump sum refers to the amount of your pension pot you re allowed to withdraw when you access your pension without needing to pay income tax

Generally the first 25 of your pension lump sum is tax free The remaining 75 is taxable at the same rate as income tax The tax free lump sum does not affect your personal allowance In this post we will break down some of the details which will affect how much tax you pay on your lump sum

Pension tax free lump sum refers to the amount of your pension pot you re allowed to withdraw when you access your pension without needing to pay income tax

Why Taking Your Pension Tax free Lump Sum Could Leave You 1 000s Worse

DB Tax Free Lump Sum T mobile

Tax free Lump Sum On Death Hutt Professional Financial Planning

Call To Cap The 25 Pension Tax free Lump Sum At 100k Retirement

Comparing Lump Sum Versus Payments Personal Finance Advice For Real

When Should You Take Out Your 25 Tax free Pension Lump Sum My

When Should You Take Out Your 25 Tax free Pension Lump Sum My

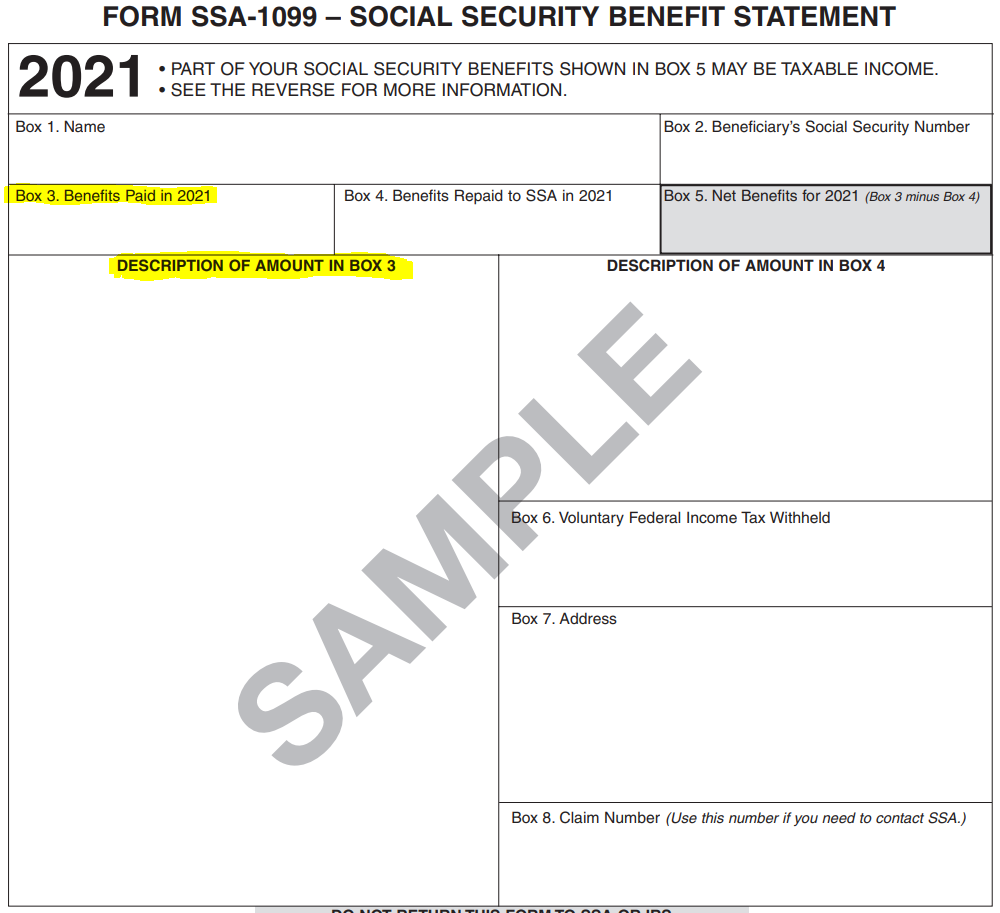

What Is A Lump Sum Payment SSA 1099 Support