In this age of technology, in which screens are the norm The appeal of tangible printed materials hasn't faded away. Whatever the reason, whether for education project ideas, artistic or simply adding a personal touch to your space, Inflation Reduction Act Ev Rebates are now an essential resource. Here, we'll dive into the sphere of "Inflation Reduction Act Ev Rebates," exploring what they are, how to locate them, and how they can add value to various aspects of your daily life.

Get Latest Inflation Reduction Act Ev Rebates Below

Inflation Reduction Act Ev Rebates

Inflation Reduction Act Ev Rebates - Inflation Reduction Act Ev Rebates, Inflation Reduction Act Ev Rebate Effective Date, Inflation Reduction Act Ev Charger Rebate, Inflation Reduction Act Ev Tax Credit Effective Date, Inflation Reduction Act Ev Charger Tax Credit, Inflation Reduction Act Ev Tax Credit Income Limit, Inflation Reduction Act Used Ev Tax Credit, Inflation Reduction Act Ev Tax Credit 2023, Inflation Reduction Act Ev Tax Credit Tesla, Irs Inflation Reduction Act Ev Tax Credit

Web 19 ao 251 t 2022 nbsp 0183 32 As a result these electric cars are ineligible for a credit under the new inflation law Chevrolet Bolt EV and EUV GMC Hummer Pickup and SUV and Tesla

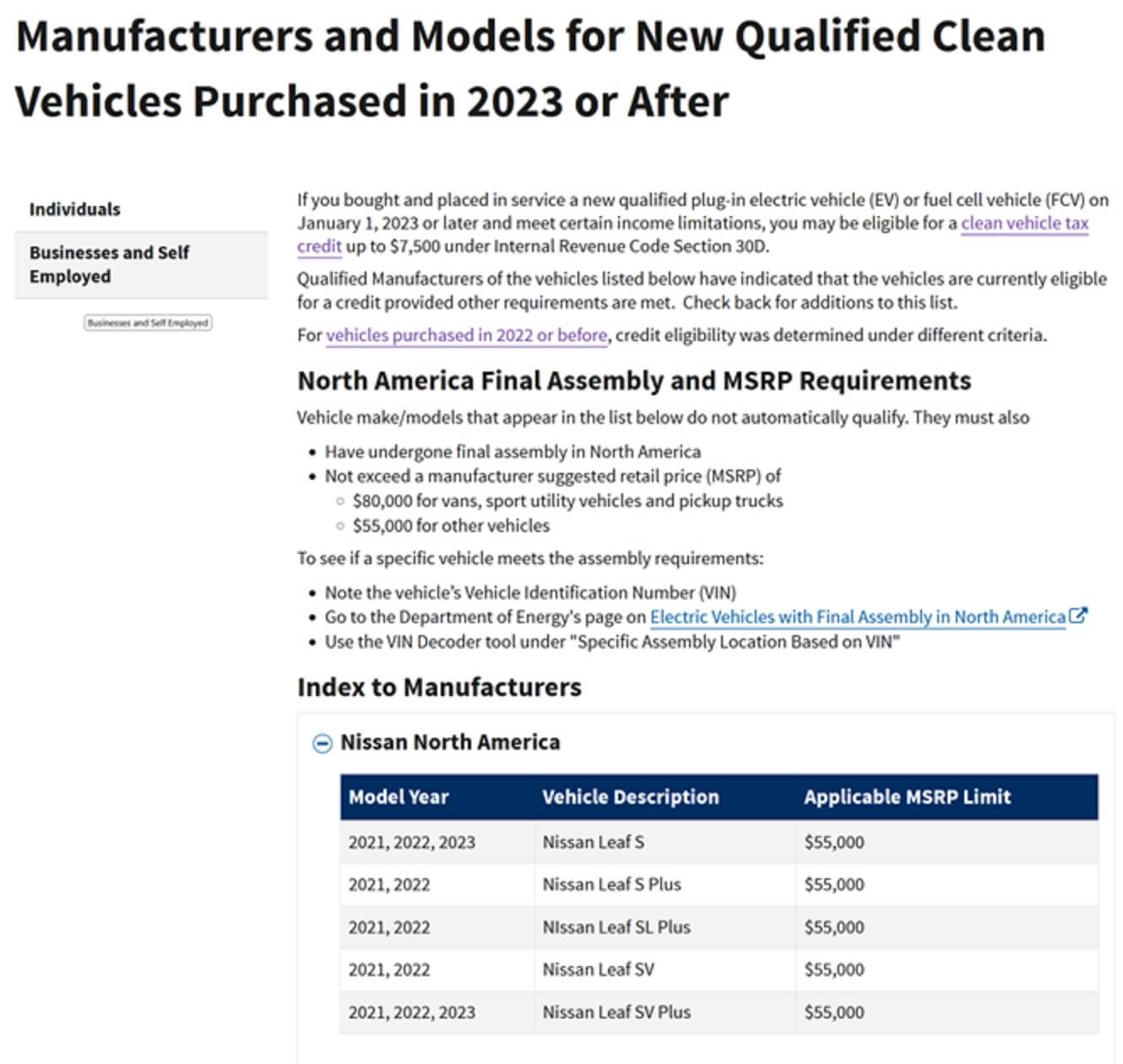

Web 17 ao 251 t 2022 nbsp 0183 32 Simply put the Inflation Reduction Act includes a 7 500 tax credit at the point of sale for new EVs and 4 000 for used EVs The

Printables for free cover a broad array of printable documents that can be downloaded online at no cost. The resources are offered in a variety styles, from worksheets to templates, coloring pages and more. The attraction of printables that are free is their versatility and accessibility.

More of Inflation Reduction Act Ev Rebates

Inflation Reduction Act Appliance Rebates Samsung US

Inflation Reduction Act Appliance Rebates Samsung US

Web the Inflation Reduction Act after August 16 2022 the tax credit is only available for qualifying electric vehicles for which final assembly occurred in North America Further

Web 10 ao 251 t 2022 nbsp 0183 32 Under the Inflation Reduction Act which received Senate approval on Sunday and is expected to clear the House this week a tax credit worth up to 7 500

Print-friendly freebies have gained tremendous popularity for several compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

customization Your HTML0 customization options allow you to customize printed materials to meet your requirements such as designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational Benefits: Downloads of educational content for free provide for students of all ages, which makes them a great aid for parents as well as educators.

-

The convenience of You have instant access numerous designs and templates helps save time and effort.

Where to Find more Inflation Reduction Act Ev Rebates

What s In The Inflation Reduction Act And What s Next For Its

What s In The Inflation Reduction Act And What s Next For Its

Web 29 juil 2022 nbsp 0183 32 The new Inflation Reduction Act promises major changes to the federal incentive program for electric cars and trucks 270639 no title EV rebates Inflation

Web The Inflation Reduction Act also extended the tax break for residential charging systems through 2032 and made it retroactive to Jan 1 2022 It s worth 1 000 or 30 of the

Now that we've ignited your interest in Inflation Reduction Act Ev Rebates Let's look into where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection with Inflation Reduction Act Ev Rebates for all applications.

- Explore categories like design, home decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets including flashcards, learning tools.

- Ideal for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates, which are free.

- The blogs are a vast array of topics, ranging including DIY projects to planning a party.

Maximizing Inflation Reduction Act Ev Rebates

Here are some innovative ways to make the most use of Inflation Reduction Act Ev Rebates:

1. Home Decor

- Print and frame gorgeous images, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Use printable worksheets from the internet to enhance learning at home (or in the learning environment).

3. Event Planning

- Design invitations for banners, invitations and decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars checklists for tasks, as well as meal planners.

Conclusion

Inflation Reduction Act Ev Rebates are an abundance of fun and practical tools that satisfy a wide range of requirements and needs and. Their access and versatility makes them a fantastic addition to your professional and personal life. Explore the many options of Inflation Reduction Act Ev Rebates right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Inflation Reduction Act Ev Rebates truly gratis?

- Yes they are! You can download and print these files for free.

-

Can I use free printables in commercial projects?

- It depends on the specific usage guidelines. Always verify the guidelines provided by the creator before utilizing their templates for commercial projects.

-

Do you have any copyright violations with Inflation Reduction Act Ev Rebates?

- Some printables may have restrictions on usage. You should read the terms and conditions set forth by the creator.

-

How can I print Inflation Reduction Act Ev Rebates?

- Print them at home using a printer or visit the local print shops for premium prints.

-

What software is required to open printables free of charge?

- Most PDF-based printables are available in PDF format. They is open with no cost software, such as Adobe Reader.

What The Inflation Reduction Act Could Mean For The Economy

Inflation Reduction Act Home Energy Rebate Program Moves Forward

Check more sample of Inflation Reduction Act Ev Rebates below

Inflation Reduction Act For Homeowners In 2022 Energy Retrofit

2022 Inflation Reduction Act News And Events For Air Inc Heating And

MSH PRESENTS HOW TO SAVE ENERGY WITH CREDITS REBATES FROM THE

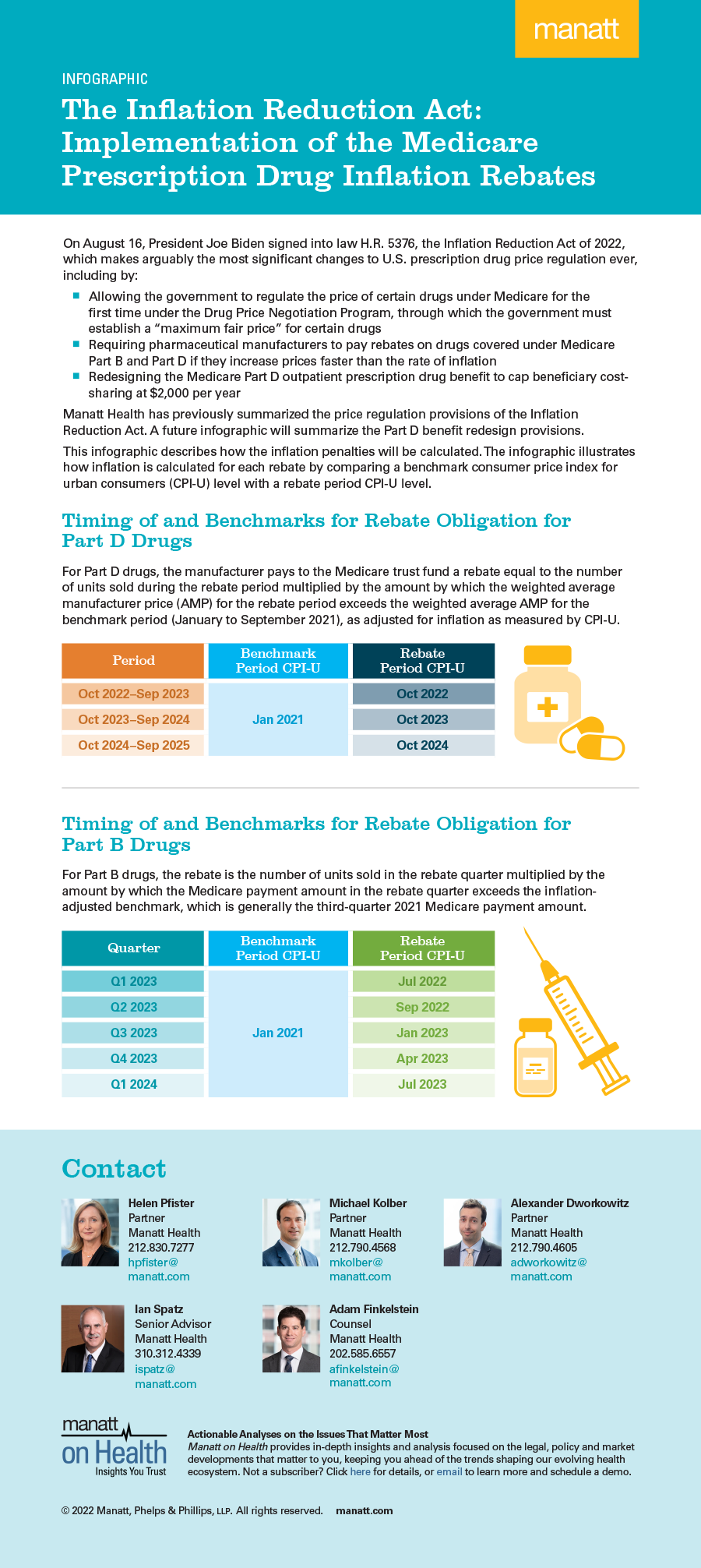

The Inflation Reduction Act Implementation Of The Medicare

Inflation Reduction Act Health Insurance Broker Raleigh

EVs Eligible For 7 500 EV Tax Credit In Inflation Reduction Act

https://www.theverge.com/23310457/inflatio…

Web 17 ao 251 t 2022 nbsp 0183 32 Simply put the Inflation Reduction Act includes a 7 500 tax credit at the point of sale for new EVs and 4 000 for used EVs The

https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles...

Web You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation

Web 17 ao 251 t 2022 nbsp 0183 32 Simply put the Inflation Reduction Act includes a 7 500 tax credit at the point of sale for new EVs and 4 000 for used EVs The

Web You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation

The Inflation Reduction Act Implementation Of The Medicare

2022 Inflation Reduction Act News And Events For Air Inc Heating And

Inflation Reduction Act Health Insurance Broker Raleigh

EVs Eligible For 7 500 EV Tax Credit In Inflation Reduction Act

Inflation Reduction Act Appliance Rebates Samsung US

Inflation Reduction Act Healthcare Provisions

Inflation Reduction Act Healthcare Provisions

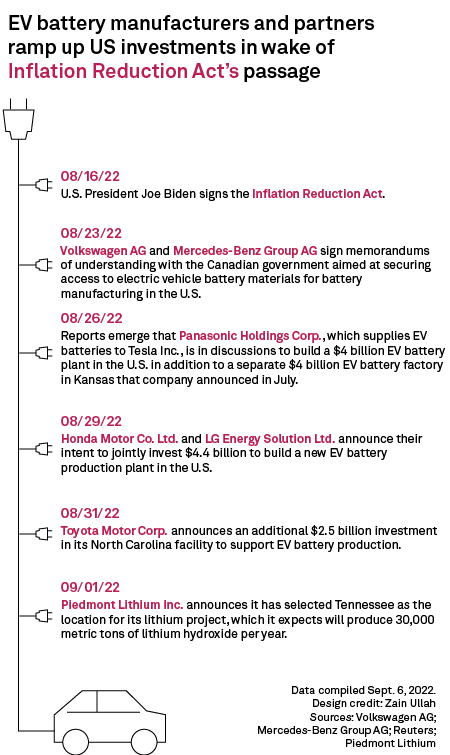

EV Announcements Snowballing Post Inflation Reduction Act S P Global