In this age of technology, where screens dominate our lives but the value of tangible, printed materials hasn't diminished. In the case of educational materials, creative projects, or just adding the personal touch to your area, Income Tax Rebate Under 80d are a great resource. In this article, we'll dive deep into the realm of "Income Tax Rebate Under 80d," exploring what they are, how they are, and what they can do to improve different aspects of your life.

Get Latest Income Tax Rebate Under 80d Below

Income Tax Rebate Under 80d

Income Tax Rebate Under 80d - Income Tax Rebate Under 80d, Income Tax Rebate Under 80dd, Income Tax Rebate Under 80ddb, Income Tax Benefit Under 80d, Income Tax Rebate Section 80d, Income Tax Rebate On 80dd, Income Tax Deduction U/s 80ddb, Income Tax Exemption U/s 80ddb, Income Tax Relief U/s 80d, What Is Section 80d In Income Tax

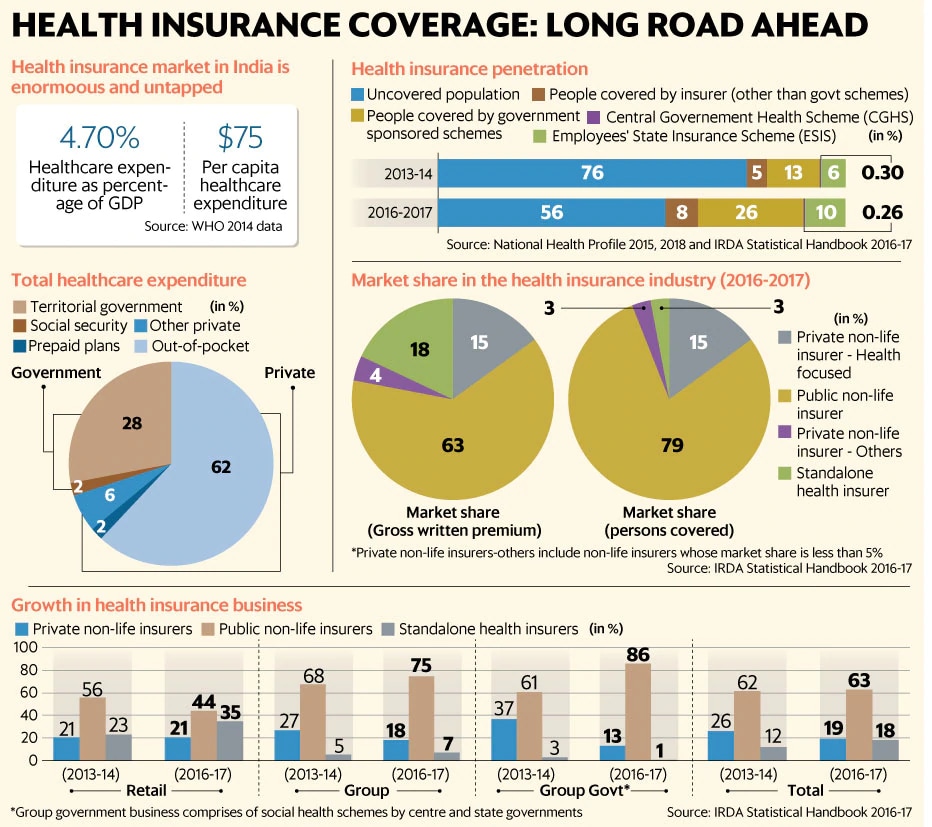

Web 9 mars 2023 nbsp 0183 32 The limits to claim tax deduction under Section 80D depends on who is included under the health insurance coverage Hence depending on the taxpayer s family situation the limit could be Rs 25 000 Rs 50 000 Rs 75 000 or Rs 1 lakh See Section

Web Income Tax Department gt Tax Tools gt Deduction under section 80D As amended upto Finance Act 2023 Deduction Under Section 80D Assessment Year Status Assessee Spouse amp dependent Children Assesee s parents Payment for medical insurance

Income Tax Rebate Under 80d encompass a wide collection of printable material that is available online at no cost. These resources come in many types, such as worksheets templates, coloring pages and much more. One of the advantages of Income Tax Rebate Under 80d is their flexibility and accessibility.

More of Income Tax Rebate Under 80d

80D Tax Deduction Under Section 80D On Medical Insurance

80D Tax Deduction Under Section 80D On Medical Insurance

Web 4 ao 251 t 2020 nbsp 0183 32 Section 80D provides that the single premium paid should be divided over the years for which the benefit of health insurance is available While filing the Income Tax Return ITR Arup Sahay

Web 1 f 233 vr 2023 nbsp 0183 32 As per the Income Tax provisions the tax assessees can claim a deduction under section 80D of the Income Tax for the premium paid towards a mediclaim insurance In this article we will discuss in

Income Tax Rebate Under 80d have gained a lot of popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Individualization They can make printables to your specific needs whether it's making invitations, organizing your schedule, or even decorating your house.

-

Educational Benefits: These Income Tax Rebate Under 80d are designed to appeal to students from all ages, making them an essential tool for teachers and parents.

-

Convenience: instant access an array of designs and templates can save you time and energy.

Where to Find more Income Tax Rebate Under 80d

Deduction For Health Insurance U s 80D Of Income Tax 91 7838904326

Deduction For Health Insurance U s 80D Of Income Tax 91 7838904326

Web Section 80D of the Income Tax Act 1961 offers tax deductions of up to Rs 25 000 on health insurance premiums paid in a financial year The tax deduction limit increases to Rs 50 000 per fiscal year for senior citizens aged 60 years and above

Web 8 juil 2020 nbsp 0183 32 Tax Deductions Available for Health Insurance under Section 80D The amount of deduction on health insurance premium paid ranges from 25 000 to a maximum of 1 00 000 deduction eligible if Self Senior Citizen and family includes senior Citizen

Now that we've piqued your interest in Income Tax Rebate Under 80d we'll explore the places you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of Income Tax Rebate Under 80d designed for a variety uses.

- Explore categories like furniture, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets for flashcards, lessons, and worksheets. materials.

- Great for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers post their original designs with templates and designs for free.

- The blogs covered cover a wide array of topics, ranging everything from DIY projects to planning a party.

Maximizing Income Tax Rebate Under 80d

Here are some inventive ways of making the most use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Utilize free printable worksheets to aid in learning at your home either in the schoolroom or at home.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Income Tax Rebate Under 80d are an abundance of useful and creative resources that meet a variety of needs and preferences. Their availability and versatility make them an essential part of any professional or personal life. Explore the vast collection of Income Tax Rebate Under 80d today to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually available for download?

- Yes they are! You can print and download these files for free.

-

Can I download free printables for commercial uses?

- It depends on the specific rules of usage. Always verify the guidelines of the creator before utilizing printables for commercial projects.

-

Do you have any copyright issues in printables that are free?

- Some printables may have restrictions on their use. Be sure to check the terms and regulations provided by the designer.

-

How do I print Income Tax Rebate Under 80d?

- You can print them at home with the printer, or go to a local print shop for top quality prints.

-

What software do I require to open Income Tax Rebate Under 80d?

- The majority of PDF documents are provided in the format PDF. This can be opened with free programs like Adobe Reader.

6 Tax Saving Tips And Tricks For Salaried Employees RTDS Blog

Section 80D Income Tax Deduction For Medical Insurance Preventive

Check more sample of Income Tax Rebate Under 80d below

How To Claim Health Insurance Under Section 80D From 2018 19

Income Tax Deductions FY 2016 17 AY 2017 18 Details

Income Tax Act 80D Deduction For Medical Expenditure INVESTIFY IN

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Top 5 Best Senior Citizen Health Insurance Plans 2020 21

Deduction Under Section 80D Of Income Tax For F Y 2018 19 A Y

https://incometaxindia.gov.in/Pages/tools/deduction-under-section-80d.a…

Web Income Tax Department gt Tax Tools gt Deduction under section 80D As amended upto Finance Act 2023 Deduction Under Section 80D Assessment Year Status Assessee Spouse amp dependent Children Assesee s parents Payment for medical insurance

https://www.forbes.com/advisor/in/tax/section …

Web How much can be saved under Section 80D The total tax deduction that can be claimed under Section 80D is based on members insured and

Web Income Tax Department gt Tax Tools gt Deduction under section 80D As amended upto Finance Act 2023 Deduction Under Section 80D Assessment Year Status Assessee Spouse amp dependent Children Assesee s parents Payment for medical insurance

Web How much can be saved under Section 80D The total tax deduction that can be claimed under Section 80D is based on members insured and

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Income Tax Deductions FY 2016 17 AY 2017 18 Details

Top 5 Best Senior Citizen Health Insurance Plans 2020 21

Deduction Under Section 80D Of Income Tax For F Y 2018 19 A Y

Section 80D Deduction In Respect Of Health Or Medical Insurance

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

IndiaNivesh Section 80 Deductions Income Tax Deductions Under