In the age of digital, with screens dominating our lives but the value of tangible printed objects isn't diminished. In the case of educational materials in creative or artistic projects, or simply adding the personal touch to your space, Income Tax Rebate On Housing Loan Interest are now an essential resource. This article will take a dive to the depths of "Income Tax Rebate On Housing Loan Interest," exploring what they are, how they are available, and how they can be used to enhance different aspects of your lives.

Get Latest Income Tax Rebate On Housing Loan Interest Below

Income Tax Rebate On Housing Loan Interest

Income Tax Rebate On Housing Loan Interest - Income Tax Rebate On Housing Loan Interest, Income Tax Rebate On Housing Loan Interest 2022-23, Income Tax Rebate On Housing Loan Interest 2021-22, Income Tax Rebate On Housing Loan Interest In India, Income Tax Rebate On Home Loan Interest Before Possession, Income Tax Rebate On Home Loan Interest And Principal, Income Tax Rebate On Home Loan Interest Amount, Income Tax Rebate On Home Loan Interest Under Construction, Income Tax Rebate On Home Loan Interest After Possession, Income Tax Benefit On Housing Loan Interest And Principal

Web 5 sept 2023 nbsp 0183 32 Under Section 80EEA of the Income Tax Act in India first time homebuyers investing in affordable property with the help of a home loans get Rs 1 50 lakh income

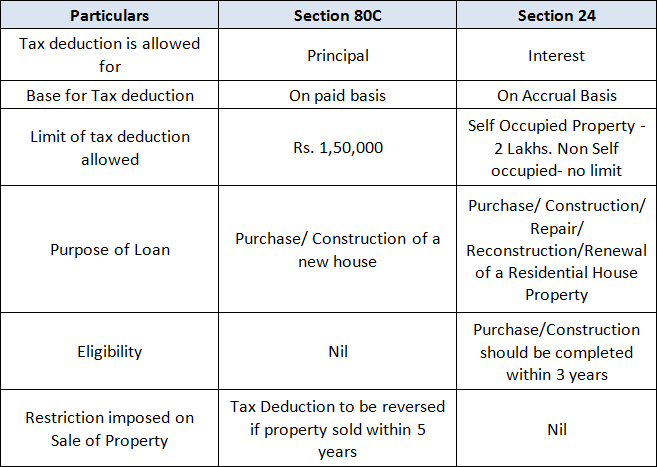

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Income Tax Rebate On Housing Loan Interest encompass a wide range of downloadable, printable resources available online for download at no cost. These resources come in many formats, such as worksheets, templates, coloring pages, and much more. The appeal of printables for free is in their versatility and accessibility.

More of Income Tax Rebate On Housing Loan Interest

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Web You can avail deduction on the interest paid on your home loan under section 24 b of the Income Tax Act For a self occupied house the maximum tax deduction of Rs 2 lakh

Web 7 janv 2023 nbsp 0183 32 The tax rebate on housing loan interest under Section 24 b needs to be hiked to at least Rs 5 lakh This will add momentum to housing demand particularly in the affordable segment said Anuj Puri

Printables for free have gained immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

Individualization They can make the design to meet your needs when it comes to designing invitations planning your schedule or decorating your home.

-

Educational Value: Printing educational materials for no cost are designed to appeal to students of all ages, which makes them a vital device for teachers and parents.

-

Accessibility: instant access a myriad of designs as well as templates, which saves time as well as effort.

Where to Find more Income Tax Rebate On Housing Loan Interest

Income Tax Benefits On Home Loan Loanfasttrack

Income Tax Benefits On Home Loan Loanfasttrack

Web The total claimed tax rebate is Rs 3 50 000 So the remaining amount is Rs 4 50 000 As we know there is no tax obligation for amount up to Rs 2 50 000 The taxable income

Web Income tax benefit on home loan is available under Section 80 EEA which provides income tax benefits of up to Rs 1 5 lakh on the home loan interests paid These home

After we've peaked your interest in Income Tax Rebate On Housing Loan Interest and other printables, let's discover where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection with Income Tax Rebate On Housing Loan Interest for all uses.

- Explore categories like decoration for your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free with flashcards and other teaching materials.

- Ideal for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs or templates for download.

- These blogs cover a wide array of topics, ranging from DIY projects to planning a party.

Maximizing Income Tax Rebate On Housing Loan Interest

Here are some innovative ways of making the most of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Utilize free printable worksheets to aid in learning at your home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners and other decorations for special occasions like weddings and birthdays.

4. Organization

- Be organized by using printable calendars or to-do lists. meal planners.

Conclusion

Income Tax Rebate On Housing Loan Interest are an abundance of creative and practical resources that meet a variety of needs and passions. Their accessibility and flexibility make them an invaluable addition to each day life. Explore the many options of Income Tax Rebate On Housing Loan Interest today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Income Tax Rebate On Housing Loan Interest really cost-free?

- Yes they are! You can print and download these materials for free.

-

Can I utilize free printouts for commercial usage?

- It's based on the terms of use. Be sure to read the rules of the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright issues with printables that are free?

- Some printables may come with restrictions concerning their use. Make sure you read the terms and conditions offered by the author.

-

How do I print printables for free?

- You can print them at home with a printer or visit an in-store print shop to get better quality prints.

-

What software is required to open printables that are free?

- The majority of PDF documents are provided in the PDF format, and can be opened with free software like Adobe Reader.

Latest Income Tax Rebate On Home Loan 2023

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Check more sample of Income Tax Rebate On Housing Loan Interest below

Latest Income Tax Rebate On Home Loan 2023

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

LHDN IRB Personal Income Tax Rebate 2022

Section 87A Tax Rebate Under Section 87A

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

https://cleartax.in/s/section-80ee-income-tax-deduction-for-interest...

Web 4 avr 2017 nbsp 0183 32 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You can claim a

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Web 4 avr 2017 nbsp 0183 32 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You can claim a

Section 87A Tax Rebate Under Section 87A

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

Union Budget 2023 Tax Rebate On Housing Loan Interest Expected To Hike

Housing Loan And Interest Paid Thereon For Construction Of Rented House

Housing Loan And Interest Paid Thereon For Construction Of Rented House

Tax Rebate Under Section 87A Investor Guruji Tax Planning