In the age of digital, where screens rule our lives The appeal of tangible, printed materials hasn't diminished. Be it for educational use for creative projects, just adding an element of personalization to your space, Income Tax Rebate On Home Loan And Hra are now a useful source. This article will take a dive into the world "Income Tax Rebate On Home Loan And Hra," exploring what they are, how they can be found, and how they can add value to various aspects of your life.

Get Latest Income Tax Rebate On Home Loan And Hra Below

Income Tax Rebate On Home Loan And Hra

Income Tax Rebate On Home Loan And Hra - Income Tax Deduction On Hra And Home Loan, Income Tax Rebate On House Rent, Tax Benefit On Home Loan And Hra Together, Can I Claim Hra And Deduction On Home Loan Interest As Well, Income Tax Rules For Hra And Home Loan

Web 30 juil 2022 nbsp 0183 32 ITR filing How to claim Home Loan tax benefit and HRA exemption together The Financial Express Sensex Web Stories NSE Top Losers Auranga Dist 232 75

Web 24 nov 2021 nbsp 0183 32 You may claim both HRA exemption and interest deduction on a home loan provided certain requirements as per the Income Tax Act 1961 the Act are met This

Printables for free cover a broad variety of printable, downloadable material that is available online at no cost. They are available in a variety of forms, like worksheets templates, coloring pages and much more. The beauty of Income Tax Rebate On Home Loan And Hra lies in their versatility as well as accessibility.

More of Income Tax Rebate On Home Loan And Hra

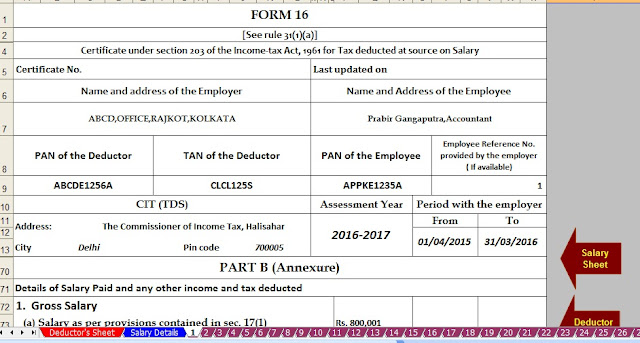

New Form 12BB For LTA HRA And Home Loan Interest Proofs To Be

New Form 12BB For LTA HRA And Home Loan Interest Proofs To Be

Web 13 mai 2019 nbsp 0183 32 As per Section 24 of the Income Tax Act home loan borrowers individually can claim tax benefit of up to Rs 2 lakh per financial year FY on the Home Loan

Web Actual rent paid 10 of salary Rs 12 000 10 of 30 000 0 12 000 3 000 Rs 9 000 Rs 9 000 being the least of the three amounts will be the exemption from HRA The balance HRA of Rs 6 000 15 000

Income Tax Rebate On Home Loan And Hra have gained a lot of popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

Personalization We can customize the design to meet your needs whether it's making invitations planning your schedule or decorating your home.

-

Educational Impact: Downloads of educational content for free are designed to appeal to students of all ages. This makes them a valuable tool for parents and teachers.

-

The convenience of Access to a variety of designs and templates is time-saving and saves effort.

Where to Find more Income Tax Rebate On Home Loan And Hra

Can I Claim Both Home Loan And HRA Tax Benefits

Can I Claim Both Home Loan And HRA Tax Benefits

Web 12 avr 2023 nbsp 0183 32 Actual rent paid 10 of basic salary DA HRA Calculator Use Now Can I Claim HRA and Deduction on Home Loan Interest Yes you may claim the HRA as it has no bearing on your home loan interest

Web 18 oct 2022 nbsp 0183 32 The Income Tax Act 1961 offers a home loan tax benefit on the repayment of a home loan by a taxpayer under several of its sections If you have made a principal

Since we've got your interest in Income Tax Rebate On Home Loan And Hra We'll take a look around to see where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Income Tax Rebate On Home Loan And Hra designed for a variety uses.

- Explore categories such as the home, decor, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free including flashcards, learning tools.

- This is a great resource for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their creative designs with templates and designs for free.

- These blogs cover a wide spectrum of interests, including DIY projects to planning a party.

Maximizing Income Tax Rebate On Home Loan And Hra

Here are some innovative ways how you could make the most of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Use printable worksheets for free to enhance your learning at home either in the schoolroom or at home.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions like weddings or birthdays.

4. Organization

- Be organized by using printable calendars or to-do lists. meal planners.

Conclusion

Income Tax Rebate On Home Loan And Hra are an abundance with useful and creative ideas that can meet the needs of a variety of people and preferences. Their accessibility and flexibility make they a beneficial addition to each day life. Explore the wide world of Income Tax Rebate On Home Loan And Hra today to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly available for download?

- Yes you can! You can download and print these tools for free.

-

Can I use the free printables to make commercial products?

- It's based on the rules of usage. Always review the terms of use for the creator before utilizing printables for commercial projects.

-

Do you have any copyright issues in Income Tax Rebate On Home Loan And Hra?

- Certain printables might have limitations on their use. You should read the terms and regulations provided by the designer.

-

How do I print printables for free?

- You can print them at home using the printer, or go to an area print shop for the highest quality prints.

-

What program do I require to view printables at no cost?

- Many printables are offered in the PDF format, and can be opened with free software, such as Adobe Reader.

Prepare At A Time 50 Employees Form 16 Part B For F Y 2016 17 With

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Check more sample of Income Tax Rebate On Home Loan And Hra below

How To Calculate Tax Rebate On Home Loan Grizzbye

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

Danpirellodesign Income Tax Rebate On Home Loan And Hra

Danpirellodesign Income Tax Rebate On Home Loan And Hra

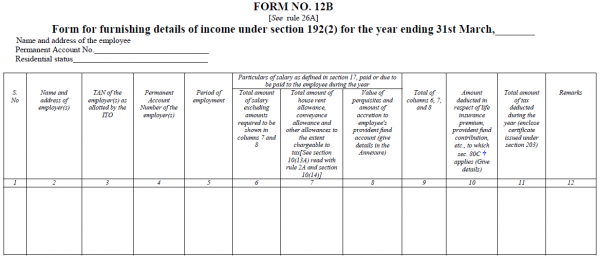

Form 12BB To Claim HRA Deduction By Salaried Employees

INCOME TAX REBATE ON HOME LOAN

https://tax2win.in/guide/claim-hra-deduction-home-loan-interest

Web 24 nov 2021 nbsp 0183 32 You may claim both HRA exemption and interest deduction on a home loan provided certain requirements as per the Income Tax Act 1961 the Act are met This

https://economictimes.indiatimes.com/wealth/t…

Web 6 juil 2022 nbsp 0183 32 Can such a person claim income tax benefit for both HRA and home loan repayment quot Yes if you are living on rent in your city of job and own house in another city then income tax benefit can be

Web 24 nov 2021 nbsp 0183 32 You may claim both HRA exemption and interest deduction on a home loan provided certain requirements as per the Income Tax Act 1961 the Act are met This

Web 6 juil 2022 nbsp 0183 32 Can such a person claim income tax benefit for both HRA and home loan repayment quot Yes if you are living on rent in your city of job and own house in another city then income tax benefit can be

Danpirellodesign Income Tax Rebate On Home Loan And Hra

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

Form 12BB To Claim HRA Deduction By Salaried Employees

INCOME TAX REBATE ON HOME LOAN

HRA House Rent Allowances Can You Claim Both HRA And Home Loan For

Claim Tax Benefit On HRA As Well As Tax Deduction On Home Loan

Claim Tax Benefit On HRA As Well As Tax Deduction On Home Loan

Home Loan Tax Benefits In India Important Facts